I recall being in a meeting with an institutional investor in the summer of 2010. This investor was absolutely convinced that multifamily assets were at their peak and that values would surely decrease over the next year or so. This was based on their predictions that 1) interest rates were going to rise dramatically, 2) the availability of Fannie Mae and Freddie Mac debt was going to be significantly reduced, 3) there was going to be significant cap-rate expansion in the near term, and 4) that revenue growth would never be able to overcome the anticipated expansion in cap rates. Their basic feeling was, “Get out now.”

All of us in the business now realize that the predictions this institutional investor was acting upon are “predictions gone wrong.” The current rate on the 10-year T-bill is 1.25 percent lower than the summer of 2010 (1.25 percentage points, or something like 30 percent). Fannie Mae and Freddie Mac provided $44.7 billion in multifamily debt financing in 2011, versus $31.9 billion in 2010. Multifamily cap rates have compressed since 2010, and multifamily properties have generated strong effective rent growth in that period.

I find solace in realizing that very smart, well-informed people sometimes rely on and act on bad predictions. The imperfection of relying on bad predictions does not discriminate; it knows no boundaries and it is not reserved for a single class of investor. This imperfection will touch all of us who are involved in the business of making and managing investments.

At the foundation of these predictions gone wrong, however, are fundamental questions that will determine the success or failure of all real estate investments. Predictably, these external determinants are the future direction of interest rates and the corresponding movement in cap rates, the availability and cost of debt, and what type of rental increases will we be achieved during the holding period. Although there is not a crystal ball to predict these variables, one can use his or her best judgment and mental reasoning to assess and bracket these risks.

Given the low interest rate environment that the multifamily sector is currently operating in, coupled with the compressed cap rates being paid for multifamily assets, one has to consider what type of rent growth must be recognized to offset potentially rising interest rates. Conventional wisdom still leads one to believe that interest rates will increase over the coming years and that cap rates will correspondingly adjust to reflect these increases in borrowing costs.

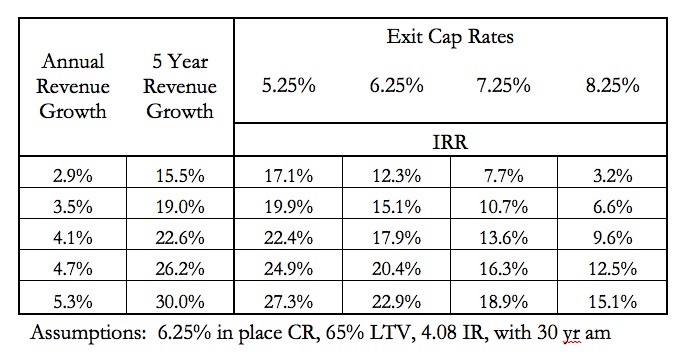

On a five-year hold, assuming revenue grows at a constant rate, an investment will lose in excess of 4 percent of its IRR for every 1 percent increase in cap rate. Therefore, the Goliath all of us have to slay as we analyze real estate investments is what are cap rates going to do, and how much revenue growth will be recognized during our holding period? The following chart illustrates this point (click on image for larger view):

At times it is hard to understand how investors are justifying the prices that are currently being paid for multifamily assets. It is clear that they’re underwriting strong revenue growth in their projections, with verifiable justification. However, the assumption that the residual cap rate will be 25 basis points higher than the going in cap rate may be unrealistic.

There is also no reason not to believe that the multifamily rental market will continue to be strong for the foreseeable future. I assume the Goliath in the investments being made today will be the residual cap rate. Given the aggressive nature of the multifamily investment space, investors are hoping that their residual cap rate prediction does not come to be known as a “prediction gone wrong.”