In my last column, I went over the background for and basics of the proposed lease accounting changes by the Financial Accounting Standards Board (the governing body in the United States) and the International Accounting Standards Board (the governing body for G20 companies and U.S. companies whose financial statements are being used outside of America). On May 19, the FASB and the IASB met again and—almost!—finalized the proposed changes.

Unfortunately, the kinder, gentler approach many firms and consultants have been assuring us about has about has gone by the wayside. (Good thing we ignored those e-mails.)

As of the date of this blog, here’s where the proposed rules stand on lessee accounting. (We will cover lessor accounting in Part III.) This is going to get a little dry and technical, but it’s important knowledge for all associated with a company, whether a stockholder, manager, executive, client, or adviser.

Changes for Lessees

Under current guidelines, a lessee only recognizes one year’s rent obligation in its financial statements. Any subsequent years or other lease expenses are just footnotes. The proposed new guidelines will change all of that:

• Lessees must now recognize a “right of use asset” and a corresponding liability on their balance sheets. Because a lease gives a lessee the “right to use” an asset for a period of time in exchange for payment, the reasoning behind this new guideline is that the lessee has both a new asset and a new liability when the lessee signs a lease.

• The asset and corresponding liability will be equal to the “Net Present Value” of the lease payments—rent only, not any other portions of the lease (i.e. operating expenses for real estate)—at the interest rate in the lease. If the lease does not include an interest rate, as most don’t, the lessee will use its incremental borrowing rate (the “IBR”), the rate of return on the property included in the lease, or the implicit rate in the lease. If more than one of these is determinable, the implicit rate will be used. (See below on how to determine the term of the lease.)

• We’ll cover how to determine the term of the lease later in this blog.

• The right of use asset will be depreciated on a straight-line basis. Interest expense on the liability will be calculated as it would be on any loan and amortized accordingly. The effect of the straight-line depreciation PLUS the front-loaded interest will be a decrease to earnings in the first half of the lease and an increase to earnings in the second half of the lease. Similarly, in the first half of the lease, debt-to-equity ratios and interest coverage ratios will be negatively impacted. In the second half of the lease, these same ratios will be positively impacted.

To illustrate this accounting treatment, what follows is an actual example I did for a publicly traded company on the New York Stock Exchange earlier this year.

Example: Lessee Accounting

ABC Co. signs a new lease for its corporate headquarters. For purposes of this example, the lease is very simple—a flat rate, net of any operating expenses (a “triple net” lease)—for 10 years. The annual lease payment is $5.5 million. The lease does not state an interest rate, and the building’s owner has not disclosed a rate of return on the property. So, ABC Co. will use its incremental borrowing rate of 7.5 percent. The calculated Net Present Value is $38.6 million.

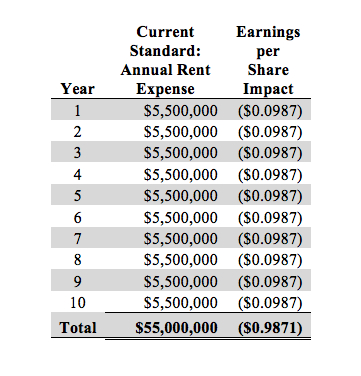

Under current accounting rules, here’s what ABC Co.’s expenses look like:

But under the new accounting rules, here’s what the expenses would look like:

But under the new accounting rules, here’s what the expenses would look like:

As you can see, the new standard creates a “front loaded” earnings impact for the lessee—in effect penalizing earnings for the first half of the lease. In the second half of the lease, the effect on earnings is accretive—a “bonus” effect, as it were, to the company’s P&L statement. In the written comments received by the FASB, many writers criticized this methodology because of the front-loaded negative effect on earnings.

Here is the effect on earnings per share and yearly expenses under both current and proposed guidelines in graphical form: (Click on image for larger version.)

Don’t forget that the debt to equity ratios and interest coverage ratios are also negatively impacted in the first half of the lease. In this real example, the debt-to-equity ratio increased from 30 percent to 32 percent—more than enough to potentially violate existing debt covenants—and the interest coverage ratio fell from 15.5 to 14.5.

Frequently Asked Questions

Q. I’ve heard the lessee’s obligation also has to include any renewal options if there is a greater than likely chance the lessee will renew. Is this true?

A. Not anymore. The Exposure Draft in August 2010 suggested this treatment, but the FASB has since revised the treatment of renewal options to an “economic incentive” standard. That is, if the lessee has a “significant economic incentive” to renew its lease, the renewal term should be included in the initial lease term. Specifically excepted from a significant economic incentive is a change in market lease rates during the initial term of the lease. Examples of significant economic incentive might be a cash “bonus” if the lease is renewed, a remodeling allowance contingent upon renewal, or a bargain renewal at stated discounted rates or a discounted percentage of market rates.

Q. What about termination options?

A. The treatment for termination options is the same as the one for renewal options. In other words, if there is a significant economic penalty to terminate, it should be assumed the lessee will not terminate the lease and the initial term should assume no termination. Likewise, the opposite also applies.

Q. What about variable or percentage rents? How are those treated?

A. They’re supposed to be estimated and included in the lessee’s right-of-use asset and liability based on some sort of “reliable measurement threshold,” which is not specifically defined in any of the extant materials. Fortunately, in this latest round, if they are not estimable or if the estimates are incorrect, any adjustments can be made on a year-by-year basis (in other words, the entire calculation does not have to be redone). My guess is the final guidelines will include more guidance, and eventually auditors will develop measurement standards they can support in company’s financial statements.

Q. What’s the timing on all of this? Should my clients or my company be getting ready?

A. The final guidelines will be released sometime in 2011. The final implementation date has not been decided, but experts are saying it will be anytime from 2012 to 2014. Remember, though, that companies have to have a three- to five-year history in place the day the guidelines go into effect. In other words, yes, get ready.

Q. My company’s lease payment includes individual components for operating expenses for the multitenant building we occupy. Do I need to include the operating expense portion of the rent in the new accounting treatment?

A. In general, no. As long as the costs are observable—i.e., obtainable, even though they’re quoted inside the rental rate—lessees are allowed to back them out of the lease rate and do not have to include them.

Q. I’ve heard this applies to ALL leases, even short-term ones, and there is no grandfathering of existing leases.

A. On May 19, the FASB specifically exempted leases with less than 12 months remaining on the term, or leases with only 12 months on the initial term, from the proposed guidelines. There is no grandfathering, however, of existing leases with more than 12 months remaining, including renewal terms.

For more details and the latest information on lessee accounting, see www. FASB.org. Be watching for Part III of this series, which will cover lessor accounting.

As managing director at Transwestern, Karra Guess leads the office tenant advisory team for the company’s Central region. Contact her at [email protected].