In my opinion, the best way to get started and build a practice as an industrial real estate adviser in a major market is through submarket specialization. This is how I began my career and this is how the majority of my colleagues and competitors started out as well. While my service model has evolved, the majority of the people I know in this business have worked inside a couple of zip codes their entire careers and have made a hell of a living. Most importantly, they are true market experts. It is an art form.

My business today is built on partnering with submarket specialists around the globe to implement and execute world class real estate strategies on behalf of our clients. I will not work on a transaction without partnering with a submarket specialist. Even if I get an assignment in Dallas (where I have lived for almost 40 years), I will bring in a partner to help me implement; this optimizes value for my clients and maximizes overall process efficiencies.

Focus and specialization is key. In major markets like Dallas-Fort Worth, Los Angeles, New York, Atlanta, Chicago, Toronto, to name a few—focusing on a submarket is the fastest and most effective way to quickly learn about the commercial real estate business and truly become an expert in a fairly short amount of time. Being a true expert is the only way that you are going to be able to add value to a commercial real estate transaction. Our clients are buying a unique commodity that is an expensive, long term, relatively illiquid obligation. Sophisticated clients recognize and value the importance of a partner that is a bona fide expert.

Like most things in life, the process of becoming a submarket specialist is fairly simple, yet not necessarily easy—to succeed requires optimism, patience, consistency, discipline, and persistence.

Here are the basic steps needed to accomplish this feat. If you actually follow these simple steps, I will be shocked if you aren’t pulling down six figures within a few years.

Step 1: Find a Mentor

Get hired by a reputable company and find a senior level broker who has time and interest to mentor you. My door is always open for new candidates, so you can start by calling me. If we don’t turn out to be a decent match, I can introduce you to plenty of other folks that will be happy to meet with you. Finding a strong company and a good mentor is huge and will help you out tremendously.

Step 2: Identify Your Submarket

Pick specific geographic boundaries and stick to them. It is very easy to get excited and start chasing potential opportunities all over the place. Don’t be that guy. Specialize. Specialize. Specialize. Have I made this clear? As it relates to DFW, we have eight industrial submarkets. Different folks may cut them up in different ways, but this is how I break them down:

- DFW Airport

- North Stemmons

- South Stemmons

- Great Southwest

- South Dallas

- East Dallas

- Northeast Dallas

- Fort Worth

Step 3: Database All Properties, Property Owners, And Tenants In Your Submarket

First, you need to choose a database system. Some companies provide a database for you, but surprisingly, most do not. Similar to health insurance and benefits, even giant publicly traded companies do not provide database systems for their brokers. My team uses ACT. I have also been trying out Apto, but I am switching back to ACT when my one year with Apto expires. Let’s just say that Apto has great advertising. If you or your company can’t afford to invest in a real database, just use an Excel spreadsheet to get started and you will be fine.

Begin by “databasing” every building in your submarket. I would typically limit this list to include distribution and manufacturing buildings that are 50,000 square feet and greater, but it really depends on the city and the submarket.

Once you have identified the buildings and input them all into your database, go back through and identify and record the following:

- Tenants/Building Occupiers

- Landlords/Building Owners (Sometimes the building owner is the also the occupier.)

Most commercial real estate companies have invested in technology to help gathering information (we use Zoom Info, Costar, and Business Wise) but if not, just use the appraisal district website and Google.

This process should take about 2-3 months. You shouldn’t do anything else for the first 2-3 months other than get organized.

Step 4: Cold Call Property Owners And Tenants In Your Submarket

Make 50 in-person cold calls per week to the owners and the tenants in your submarket and record the information that you gather through this process. I am working on my cold calling blog post but for the time being, here is a good approach that you can feel free to try out:

“Hi, my name is Ward Richmond with Colliers International. I specialize in representing companies in this submarket with their real estate needs. My goal is to help our clients maximize value and improve efficiencies related to the commercial real estate process. Do you currently have any commercial real estate challenges that you are dealing with that I may be able to discuss with you?”

I highly recommend starting out with in-person calls so that you have the opportunity to actually see the buildings, potentially tour the properties, and learn the area.

The purpose of these calls is to achieve the following:

- Identify the real estate decision maker. This is the guy or gal who hires the real estate broker and runs the real estate process. Sometimes this is the CEO or CFO, sometimes it is the local branch manager. The ability to identify the true decision maker is an art form in itself and takes time.

- Identify opportunities to assist the real estate decision maker with their commercial real estate needs. Here are a few examples of opportunities you may find:

- Tenant wants to move

- Tenant needs to downsize or expand

- Tenant has a pending lease expiration

- Tenant needs to negotiate a lease renewal

- Tenant needs to sublease

- Owner has a vacant building they need to lease

- Owner has a building they want to sell

- Develop a comprehensive understanding of what is going on within your submarket. Find out:

- Who needs more space?

- Who needs less space?

- Which owners will consider selling?

- Which tenants are considering moving? etc. etc.

If you stick to the plan and call 50 people per week, you will have knocked on 1,200 doors within your first six months and you are well on your way to becoming a submarket expert.

Step 5: Repeat Step 4

This is the toughest part—and your ability to consistently prospect, meet with key real estate decision makers, and gather market intel—is the key to becoming a submarket specialist and a true expert. Go get ‘em!

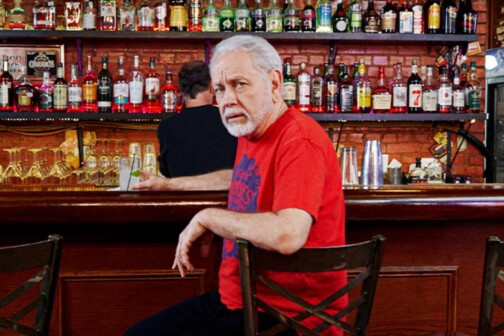

Ward Richmond is a senior vice president in the industrial practice group at Colliers International.