I have a smart friend. She can do math. She can also probably beat me at singles, although I have very purposely not given her the chance. I can, however, beat her at poker, which drives her nuts.

All of that is beside the point. The other night she was out having a drink in Plano with a fellow oil company employee, without me, and they got into a debate about post-election taxes. Apparently, after she sobered up, she went home and did the math. And, of course, made an Excel spreadsheet to show off her findings to me, the one who wasn’t there for the fun part. What she confirmed was that most of us will be paying more taxes under the President-elect’s plan. Meaning less money for booze. Unless you’re American Airlines, which, perhaps similarly to Donald Trump, didn’t pay any taxes last year despite pre-tax profits.

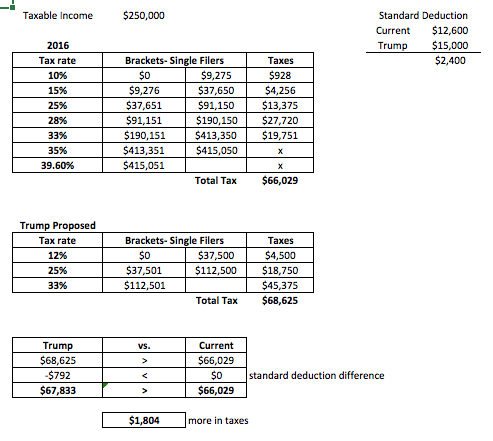

For those who need some ‘splaining: If your taxable income as an individual is $250,000 (with no spouse, no kids, and no mortgage deduction), a healthy sum, you would currently pay $66,029 in taxes. Under Trump’s proposal, you’ll pay $68,625—an increase of $2,596. Even with Trump’s increased standard deduction, you’d be paying $67,833 as opposed to $66,029, an increase of $1,804.

Please correct me if her math is wrong. I would like to tell her so.

In terms of local taxes, Dallas County Judge Clay Jenkins fought the good fight to get our property taxes reduced this year. One of his proposals was to cap property tax increases at the county’s budgeted 7.5 percent, based on the fact that middle-class homeowners need the most relief because their home appraisal values are increasing at an insane rate of more than 12 percent. (Homeowners with homes valued at $1 million or more only saw an increase of 6.7 percent.) But Jenkins’ efforts were foiled because Dallas County Commissioners wanted to use the windfall from increased property values to raise the salaries of county employees.

The county’s small concession was to reduce the tax for Parkland Memorial Hospital from 28.6 cents per $100 valuation to 27.94 cents. So if you have a home appraised at $250,000, you’ll save $16.50. Check me on that, but I think that’s right. That’s the price of a Pumpkin Old-Fashioned at the Mansion Bar, with a really skimpy tip.

I believe Eric Celeste is on the better track, arguing that we need to make the price of real estate sales public, so that we can base our property valuations on actual market values and middle class homeowners won’t continue to pay a disproportionate share of the county tax burden.

Anyhoo, I’m a patriotic citizen, happy to pay my fair share to participate in this great nation. Especially if paying an extra $2,500 (-$16.50) means I get to stay gay married, among other things. Because that’s part of the deal, right?