It’s not because they didn’t turn a profit. Thanks to a marked decline in fuel prices, in fact, they posted a record profit. But American Airlines Group is one of 27 profitable companies in the S&P 500 not to pay any income taxes in 2015.

How’d they manage that trick, despite finishing $7.6 billion in the black for the year? Why through the dark arts standard practices of corporate accounting, of course.

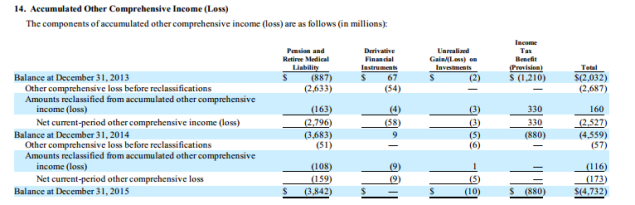

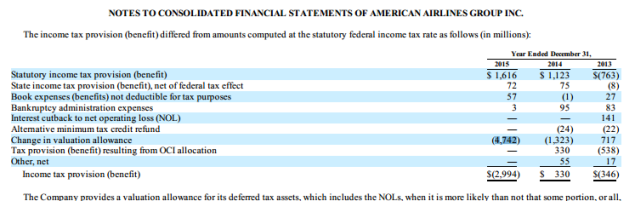

According to the company’s annual report, AAG claimed a “valuation allowance” of $4.742 billion because of accumulated income losses over the last three years due primarily to its pension and retiree medical liabilities (totaling $3.842 billion).

That, which results in a reduction in this year’s taxes to make up for those losses, meant their bottom-line tax obligation for the year 2015 was -$2.994 billion. The minus sign on that number could well mean AAG can carry that amount over to further reduce next year’s bill from Uncle Sam too.

Which has got to be nice to have, given the unpredictable volatility of oil prices and the outsized effect those can have on an air carrier’s business.