Dallas is one of the most expensive places to receive healthcare in the country. Combined with Texas’ lack of regulatory oversight of business and high entrepreneurial drive, it is a city that is great for business, but when that business has to pay for healthcare for its employees, it creates a number of challenges.

Identifying high value providers, bundling payments, and forming direct contracts are all ways that employers are avoiding unnecessary medical care for their employees, and the costs that come with them. Last month, the Hilton Anatole played host to the Employee Health, Benefits, and Well-Being Congress, where speakers from around the country described how employers large and small are making wise decisions about the healthcare they provide their employees.

Making sure providers deliver value was a consistent talking point. Jason Parrott, the Senior Manager of Global Healthcare and Well Being Strategy for Boeing, highlighted one example. He said their data showed that for OBGYN physicians, the highest value doctors performed C-sections just 14 percent of the time, while the doctors on the other end of the spectrum performed C-sections 49 percent of the time. “One out of two births are C-sections in the metroplex. Why is it that way?” he said.

A C-section costs about 50 percent more than a natural birth, and with today’s fee-for-service model of healthcare, there are perverse incentives for physicians to provide too much healthcare, whether that is lab work or procedures. Experts at the panel emphasized finding providers who had great results without breaking the bank with unnecessary care.

Direct Contracts

Many employers are attempting to take much of the negotiating away from insurance companies through direct contracts, where the employer works directly with a provider to negotiate prices for a basket of healthcare needs, and incentivizes its employees to use that provider in an attempt to reduce price without sacrificing quality.

Direct contracts not only allow employers to bank on a consistent price for common surgeries and procedures, they allow businesses to focus on providers who only provide the right amount of care, if they can get the data to determine who is high value. A UnitedHealth brief earlier this year said that if all the U.S. physicians who treat Medicare fee-for-service patients were to meet quality and cost-efficiency criteria, Medicare would save $286.8 billion between 2020 and 2029. The same idea applies to healthcare provided by employers.

Olivia Ross is the associate director for employers centers of excellence at the Pacific Group on Health, and described how even some of the largest employers are worried that they can have enough buying power to arrange a direct contract. They also worry that they won’t be able to find the highest value provider. But when these employers find the right provider, there are dividends. Employers want to find “health systems that are dedicated to only perform surgery if necessary,” she said. Health groups like hers and other analytics companies make it possible for employers to identify these high value providers.

But Andy Ziskind, Senior Executive Officer of Southwestern Health Resources, said that Dallas provides unique hurdles to controlling costs for businesses. He said Dallas has one of the highest utilization rates in the country, which along with some of the highest costs, a lack of standardization of care pathways, and a large number of physician owned clinics, means employers have to be disciplined and work hard to find savings, as costs are quite variable. “It truly is the wild west,” he said.

Direct contracts often include paying for employees to travel to the providers in the contract, a cost that pays for itself if the provider can avoid expensive unnecessary treatment. Contracts tend to focus on high volume, high cost, highly variable procedures like musculoskeletal, bariatric, and maternity care. Employers can use available technology to aggregate data for their own employees, or join a group like the Pacific Group on Health to help negotiate the contracts en masse with other employers.

Mick Rogers, who is an Employee Benefits Consultant at Axial Benefits Group, described how direct contracts and similar organizations like Amazon, Berkshire Hathaway, and JP Morgan Chase’s Haven healthcare entity is changing the way healthcare is delivered, and starting to cut out the large insurers with direct contracts. “If you look at what they have built, are in process of, own, or have a vision for, it completely takes out the carriers.”

Centers of Excellence

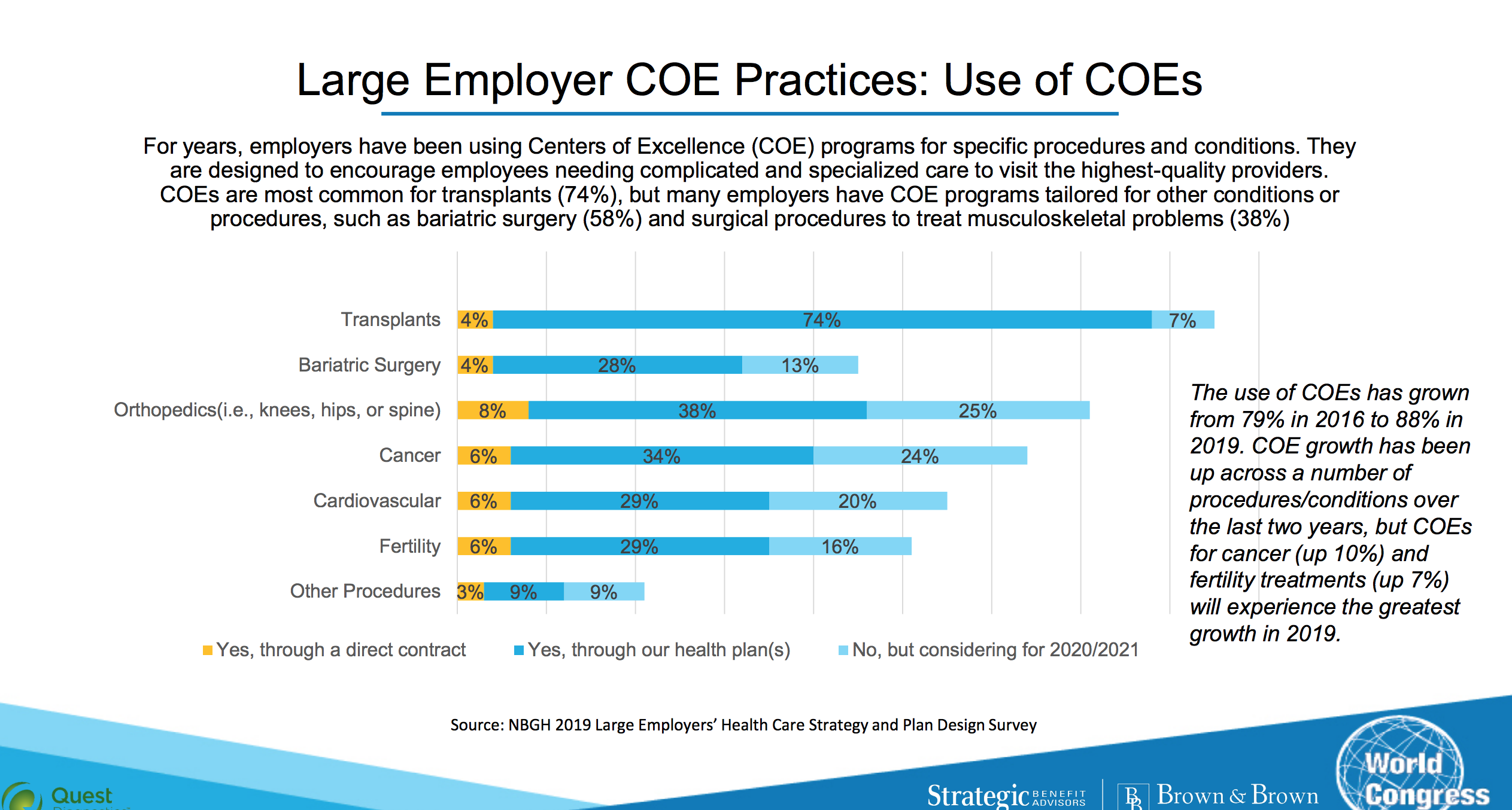

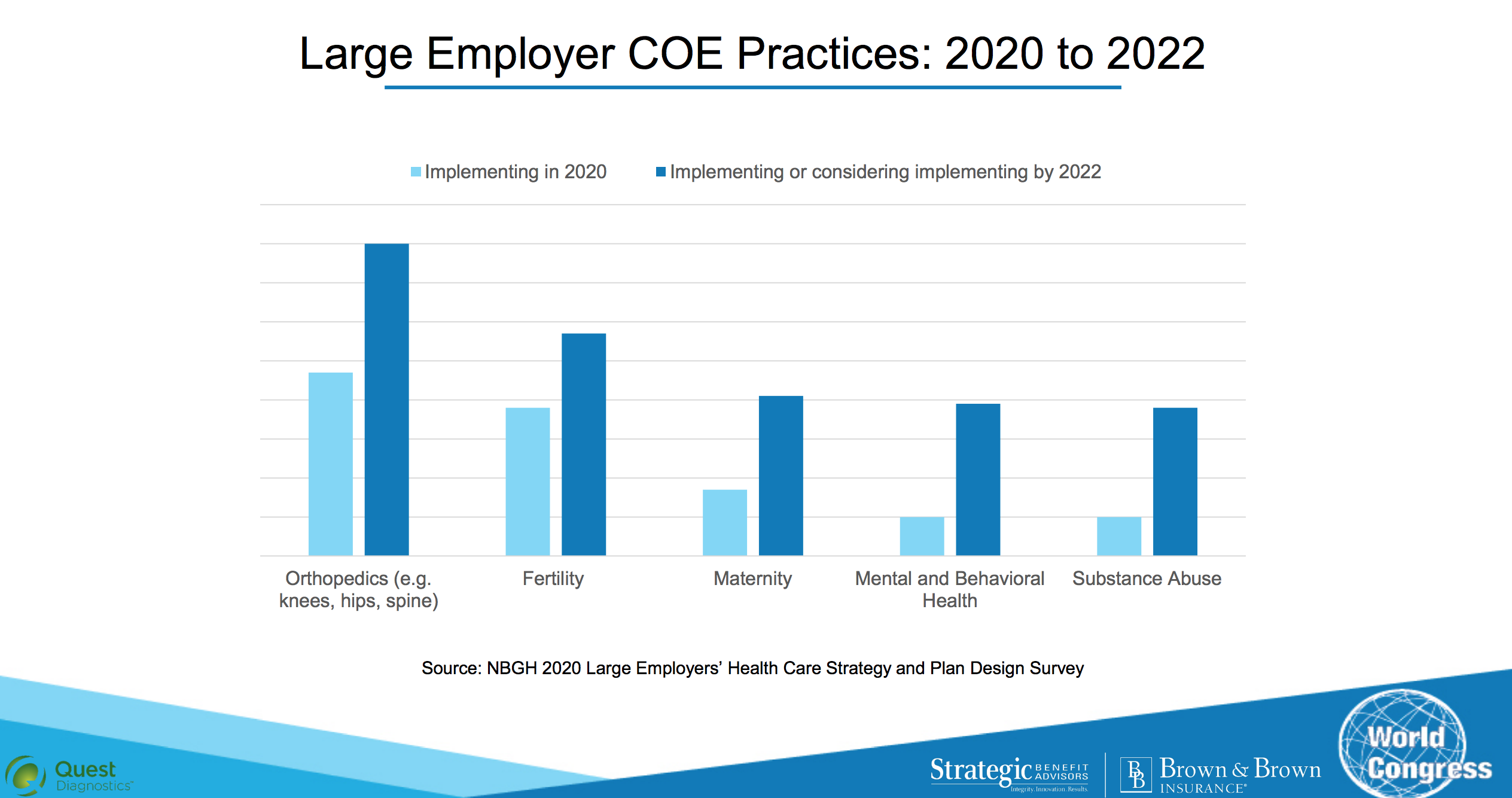

Centers of Excellence are a growing trend among employers because they often provide better quality, improved efficiency, and a great patient experience. Employers incentivize employees to utilize these centers, which can be part of a large health system, an independent surgery facility, or anything in between. Centers of Excellence are often used for transplant surgery, but orthopedic, bariatric, cancer, and fertility treatment is growing at the centers as well.

Employers are also seeing the value of behavioral health centers of excellence targeting mental health and substance abuse. Because these centers are high quality and low cost, employers can take their savings and improve the treatment experience, paying for travel and lodging if employees need to travel to the center and often times covering the entire cost if the employee uses the center of excellence.

A panel zoomed in on Quest Diagnostics’ use of centers for excellence. The medical lab giant has 30,000 subscribers covering 60,000 lives on its health plan, and spends $360 million annually on healthcare. Through the use of centers of excellence, it lowered the per-member costs of healthcare overall and for employees for the first time in a decade, after annual 5-6 percent increases. For employees, the total out-of-pocket cost went down three percent over the last two years, significantly improving employee feedback about the health benefits along the way.

For employers, these solutions can improve relationships with providers and for employees, speakers said. “It is not fun to say I am happy with a 5 percent annual increase,” said Tom Sondergeld, Vice President of HRIS and Global Benefits and Mobility for Walgreens Boots Alliance. “If a salesperson did that they would be fired. We get to do that every year.” Maybe one day they won’t have to.