Even the New York Times has taken note. According to Mayor Rawlings, the City of Dallas is “walking into the fan blades” of municipal bankruptcy. Everyone is acting surprised, like the tunnel was dark, our noise canceling headphones were in, and we thought the ever-increasing breeze just meant we were getting closer to the beach. In reality, we are face-to-face with the sharp, spinning metal. Our uniformed officers are asking for $1.1 billion so they can turn off the fan. But that’s not even for good—that’s just for now.

It all feels very complicated, and we’re busy trying to wrap our heads around an election that the President-elect can’t even wrap his head around (I mean, if your New York sheets are softer, why should you move?), and our family members just missed their Thanksgiving flight to Dallas, which means we’re now going to have to drive to DFW at rush hour. Yet the sun is shining and it’s a beautiful fall day. So let’s just look at some pretty pictures. Because, it turns out, the State Pension Review Board has been having hearings and making charts for years.

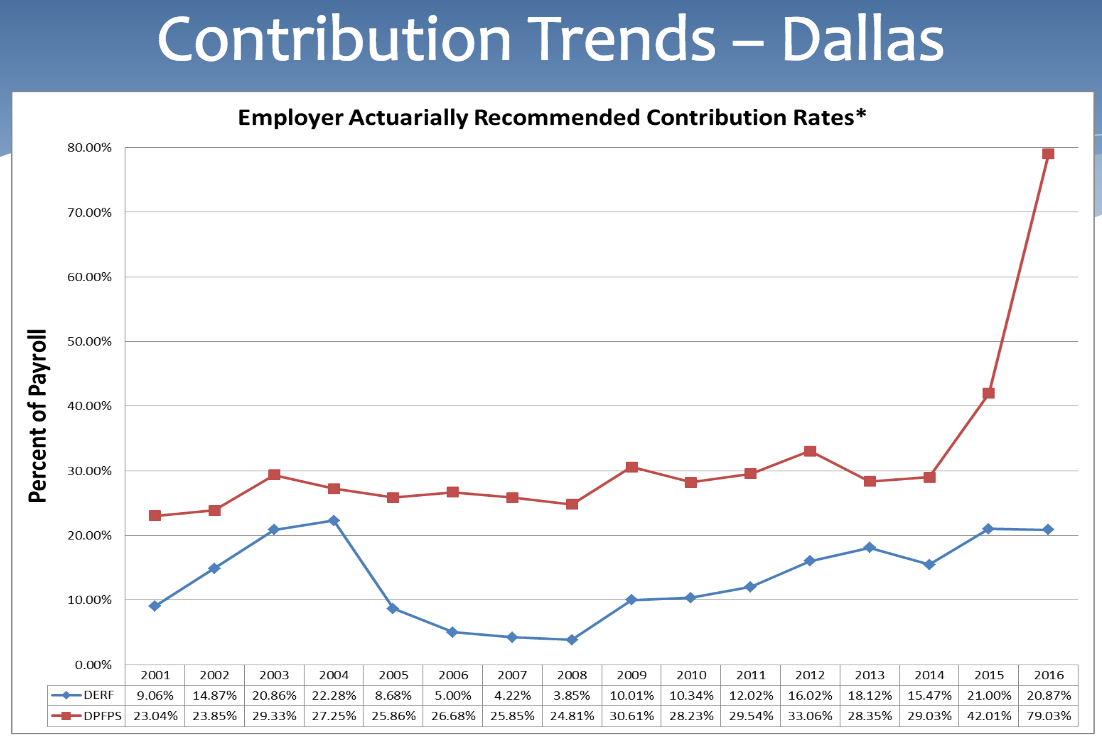

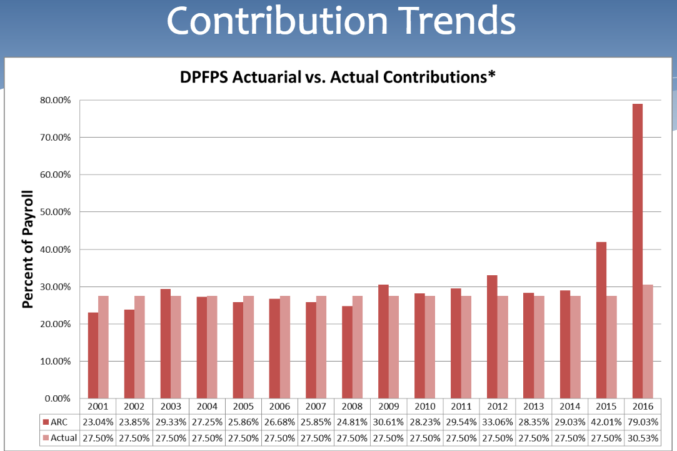

This is my favorite chart. Because it is ridiculous. The lazy river of a blue line? That’s the Dallas Employee Retirement Fund, which needs the city to contribute 20 percent or so of the payroll to stay alive. That crazy Six Flags Elevator ride of a red line? That’s the recent escalation of the Dallas Police and Fire Pension System, which now, according to the Pension Review Board for the State of Texas, needs the city to contribute a whopping 80 percent to stay solvent.

This is my favorite chart. Because it is ridiculous. The lazy river of a blue line? That’s the Dallas Employee Retirement Fund, which needs the city to contribute 20 percent or so of the payroll to stay alive. That crazy Six Flags Elevator ride of a red line? That’s the recent escalation of the Dallas Police and Fire Pension System, which now, according to the Pension Review Board for the State of Texas, needs the city to contribute a whopping 80 percent to stay solvent.

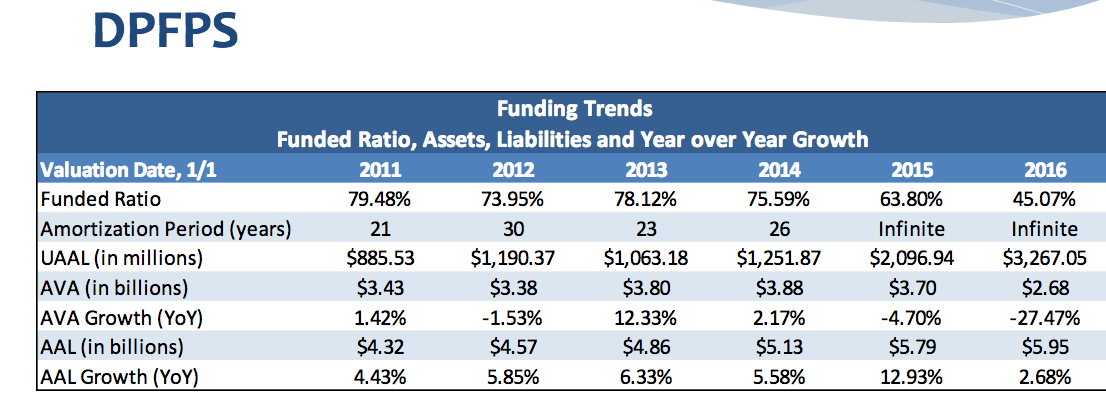

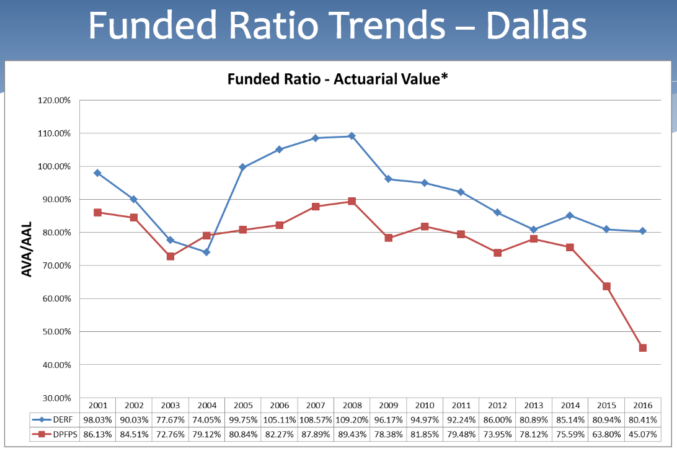

Here, the focus is on the fact that as of January 1, 2016, the DPFPS is only 45.07 percent funded.

Here, the focus is on the fact that as of January 1, 2016, the DPFPS is only 45.07 percent funded.

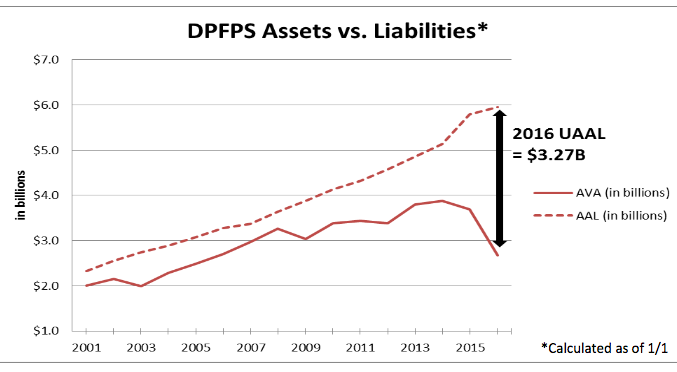

Note the dotted line going up (that’s what we owe to future retirees) and the red line taking a steep dive (that’s what we’ve got). The gap of unfunded accrued liability exceeds $3 billion.

Note the dotted line going up (that’s what we owe to future retirees) and the red line taking a steep dive (that’s what we’ve got). The gap of unfunded accrued liability exceeds $3 billion.

Pink line is what is being put in. Red line is what’s needed.

Pink line is what is being put in. Red line is what’s needed.

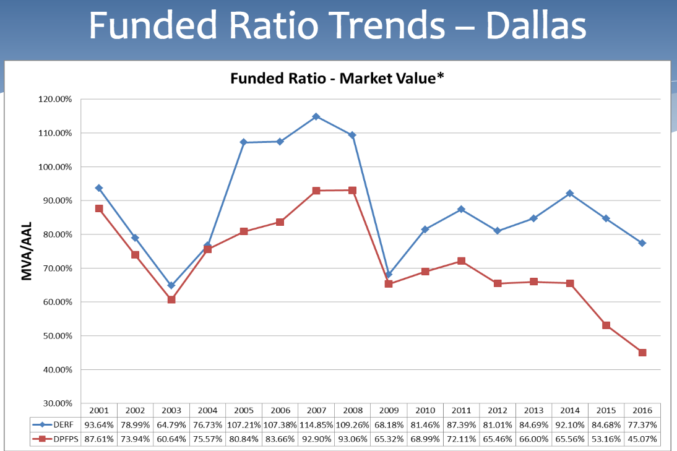

I don’t know the difference between actuarial and market values. I think one has to do with current (potentially crazy) market conditions, and the other looks at longer term trends. In either case, the red line is falling.

I don’t know the difference between actuarial and market values. I think one has to do with current (potentially crazy) market conditions, and the other looks at longer term trends. In either case, the red line is falling.

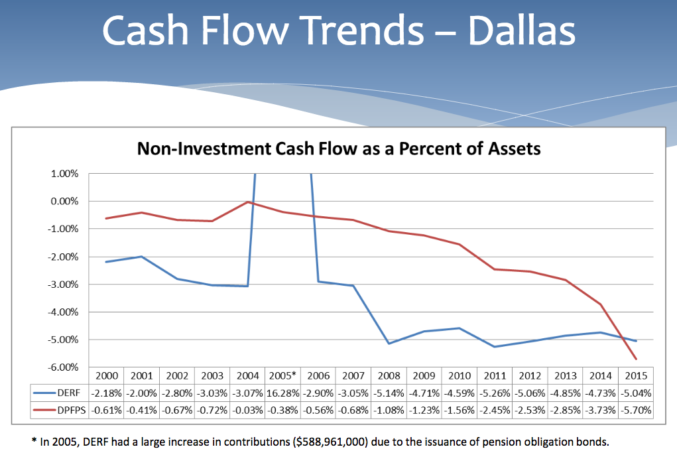

The blue line is, literally, off the chart. (I figured you needed a chuckle about now, and I don’t exactly know what this one means.)

The blue line is, literally, off the chart. (I figured you needed a chuckle about now, and I don’t exactly know what this one means.)

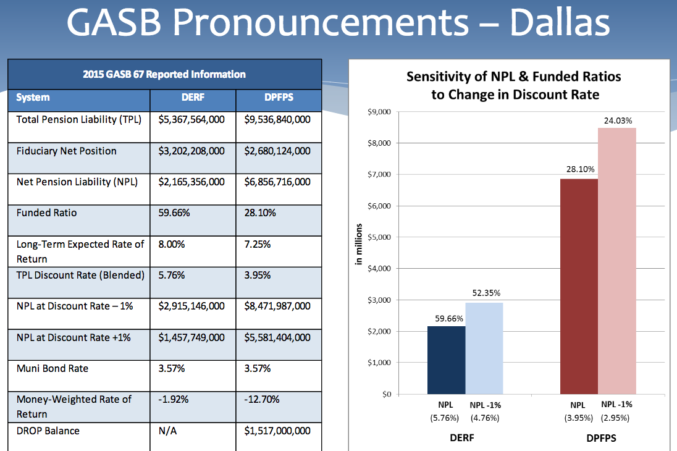

$9.5 billion in total pension liability, with 28 percent of that funded.

It’s time to start paying attention.