It was 2012 when I relocated to DFW from back east. Over my time here, the one thing that has stood out to me as a commercial real estate professional is how amazingly dynamic our market has been.

Our DFW growth story has been told often. In fact, it is kind of a simple story – our lost cost of doing business and our pro-business “can-do” approach to most things has created an environment that allows existing companies to expand and attracts new companies from other areas. I know that its more complex than that, but at its core these are the basics.

While almost everyone is familiar with the phenomenal job gains we’ve seen over the last decade and how much we’ve recovered since the pandemic-related economic slowdown, there are currents that flow under the surface that often surprise me. Things like DFW being one of the most significant video gaming hubs in the US or the significant number of tech-related patents originating here speak to the drivers of our future.

Recently, Dallas Innovates did a story on venture capital (VC) in DFW. I highly recommend it. The story is especially important because VC dollars are the fuel that will drive our economy and help it evolve over the years ahead.

As I looked deeper into the topic, I was again surprised by how significant the trend really is and, in many ways, taking place quietly behind the scenes. In looking at total VC funding flowing into DFW, the numbers are incredible

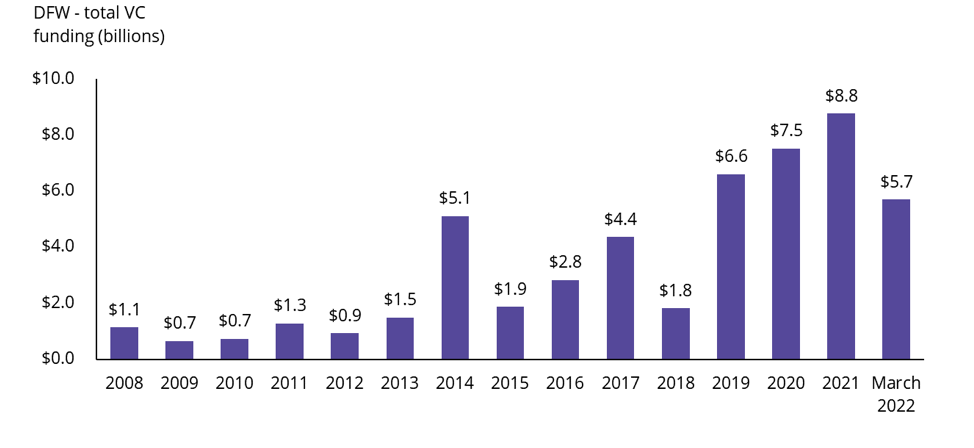

Our investment metrics we compile from “Crunchbase” and visualize through our AVANT platform, dramatically illustrate that DFW’s VC funding is up. But being “up” doesn’t quite capture the scale of how fast it has risen. Last year, it totaled $8.8 billion. This is an increase of more than 3-fold since the 2015 to 2018 period. And, when looking at the period before that in 2008 to 2013, DFW only garnered barely a billion annually. Importantly, data through March show that 2022 should be another strong showing for DFW funding rounds.

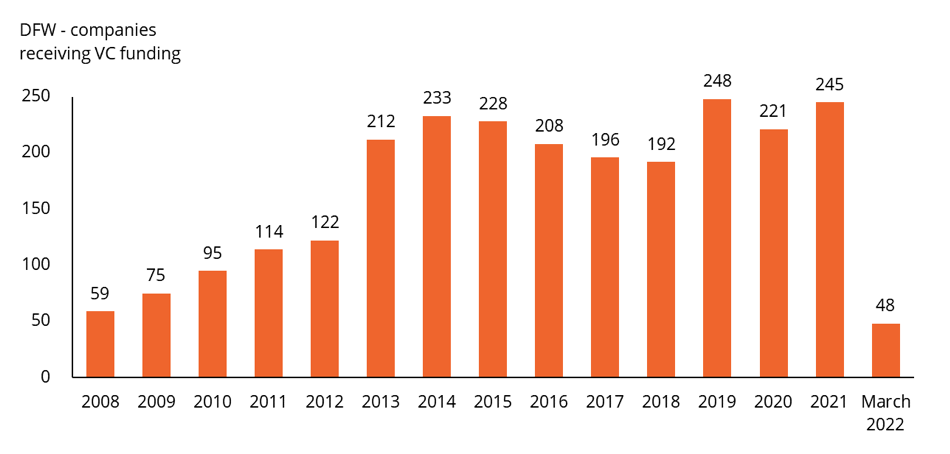

Likewise, the number of companies receiving VC dollars has more than doubled. Back in the 2008 to 2012 timeframe, maybe 100 companies received allocations annually. Now, that number is closer to 250.

Another important distinction here is how these dollars will be used. When most people hear VC, they immediately think of “angel | seed” money. This is the part where investors provide financial backing for small start-ups or entrepreneurs to help the business get off the ground or an injection of funds to support a company through its difficult early stages.

VC dollars, actually come in a variety of forms. Investments can range from debt and equity to dollars earmarked to support an IPO, to early and late stage investments for companies that have a track record.

In the case of DFW, since 2020, 76% of VC funding has been for debt and equity to established companies, with about 6% to 8% going toward IPO, early stage, and late stage investments. In comparison, over the period 2008 to 2015, debt and equity accounted for 52%, with almost 30% for late stage investments. Importantly, with the rapid rise in overall funding levels, these recent investment percentages are even more dramatic, with 2020 to 2022 debt and equity bringing in $16.8 billion versus $6.9 billion total over the 8-year period of 2008 to 2015.

| Type of VC investment | 2020-2022 | 2008-2015 |

| Debt/Equity | 76% | 52% |

| IPO | 8% | 10% |

| Early stage | 8% | 7% |

| Late stage | 6% | 29% |

| Angel/Seed | 1% | 2% |

| Other/Undisclosed | 1% | 0% |

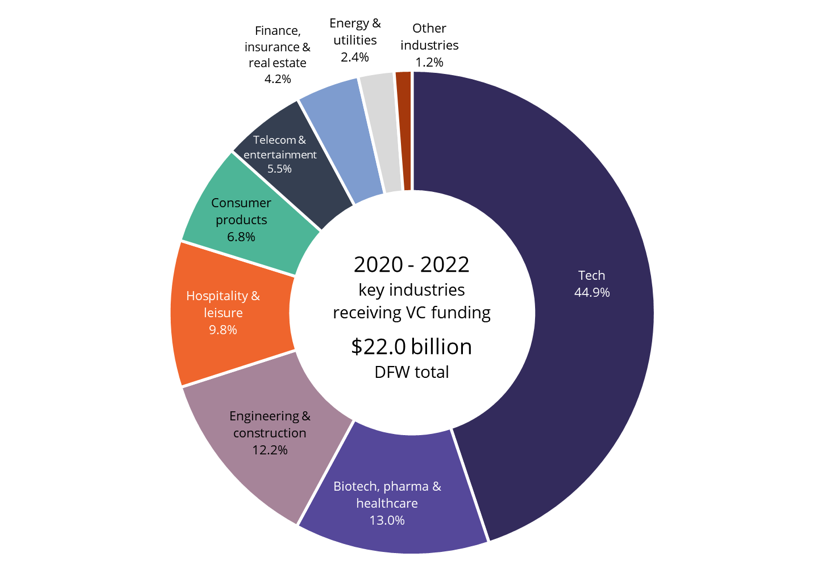

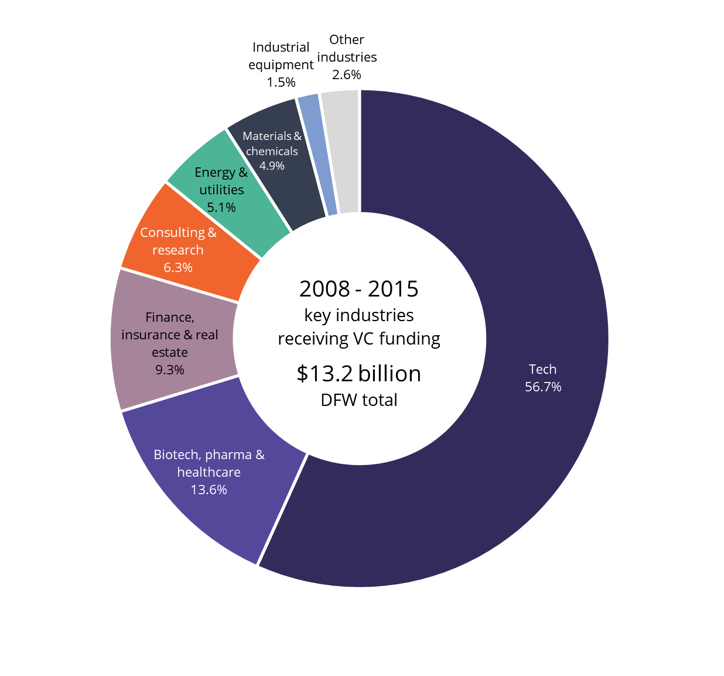

Another fascinating twist is where this money has gone. Again, when most think about VC investments, they think “tech”. That is undoubtedly the case, especially in the major US tech hubs like the Bay Area.

For DFW, however, the mix is quite different. Based on our review, tech currently comprises about 45% of funding. This compares to over 55% back in 2008 to 2015. What is important is not that “tech” has declined in its share – after all, it has increased in actual dollars funded from $7.5 billion over 8 years to $9.9 billion since 2020. Rather, it is the significant diversity in where the other investment dollars are flowing. As a point of comparison, 82% of all recent VC investment in the Bay Area has gone into tech or biotech, with 14% going to energy or finance.

This is, perhaps, my biggest takeaway from the VC topic in DFW! The level of diversity where funding is going in industry, as well as companies, astounded me. We all know that our economic diversity is a unique regional strength compared to most markets. It serves as a stabilizing influence as the national economy runs through its cycles over the long-term. As we’ve seen over the last few downturns, our diversity helped us rebound faster than many areas – almost always leading to an enviable economic growth outlook. In essence, as one sector may wane, another often sees outsized gains. That’s DFW’s special ingredient – we are predictably stable and always with an edge toward ongoing future growth.

Looking at these venture capital investments, you see many of the companies written about in the news every week. Whether they are from tech or telecom & entertainment, finance or consumer goods, and manufacturing or biotech (which comes in #2, winning $2.9 billion and 13% of the funding since 2020), these are the companies and industries that will fuel DFW’s growth and lead the region into its prosperous future.

Walt Bialas is a senior insight analyst at Avison Young.