The premier office towers that make up the Dallas skyline boast—by far—the most expensive rents, according to JLL’s 2015 Skyline Review, a study that tracks 47 urban markets across North America.

In the first quarter of 2015, lease rates for trophy assets in Uptown and downtown Dallas averaged $29.94 per square foot, compared to $21.68 per square foot in non-trophy buildings. Across the country, average rents have reached a record high of $42.30 per square foot, up 20.1 percent since bottoming in 2010.

“The DFW economy is booming, and it’s creating a vibrant urban core that now stretches between the central business district and Uptown submarkets, said Walt Bialas, research director for JLL.“We are predicting the area will go through a recalibrating phase where capital improvements at vintage buildings can bridge the gap between Class A and trophy assets.”

Favorable market conditions have triggered new construction projects that will deliver in late 2015 and 2016, but tenants can expect little relief in rates once that happens. That’s because preleasing is strong, and major tenants are paying as much as a 30 percent premium in Dallas. Nearly 75 percent of the new development is concentrated in only nine cities, which means most tenants will have little leverage in negotiating their office agreements.

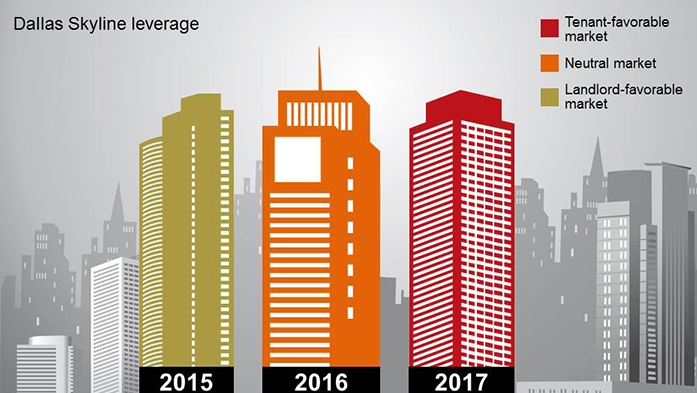

That’s not to say conditions will persist. Although current conditions favor landlords, the Dallas market could begin to see a shift in leverage by 2017, JLL reports.

Tenants Seeking Alternatives

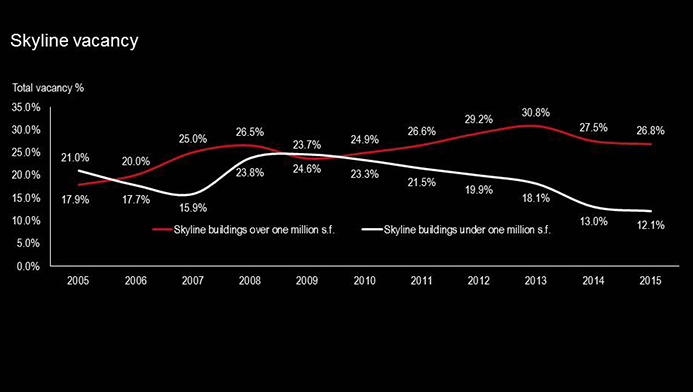

The vacancy rate at smaller urban properties in Dallas has dropped from 18 percent to 12 percent over the past two years, with tenants flocking to new buildings in Uptown. Larger tenants are exploring alternatives. Examples of this include Santander relocating to Thanksgiving Tower and Omnitracs leasing space at the former KPMG building.

That trend could be helped by the fact that Uptown and downtown Dallas are beginning to merge in the eyes of tenants, said Jeff Eckert, managing director of JLL’s agency leasing and property management group.

“With the completion of the Dallas Arts District and Klyde Warren Park, it’s now seen as a seamless submarket that provides a highly desirable urban environment that meets the area’s multi-generational needs,” he said. “Companies are paying rent premiums for a location that provides the kind of urban environment employees desire, where the choice of walkable amenities is endless.”

Recent notable transactions fitting this trend include Tenet Healthcare’s 214,000-square-foot renewal and expansion at Fountain Place, EnLink Midstream’s 159,996-square-foot headquarters relocation to One Arts Plaza, and Gardere Wynne Sewell’s 107,000-square-foot lease at McKinney & Olive.

Foreign Buyers Targeting U.S. Trophies

From a capital markets perspective, economic growth, business expansion, and improving market fundamentals have resulted in a second consecutive year of pricing gains.

The sheer volume of foreign capital chasing office deals is having a major impact on as well. Of the $35.3 billion transacted over the past five quarters across the United States, 34.6 percent was driven by international buyers.

In Houston and Seattle, every office deal transacted during this time period had a foreign buyer, while in Washington, D.C., Boston, and New York, offshore capital led more than 50 percent of office purchases. Just last year, Canada-based Olymbec purchased 1700 Pacific in Dallas.

“High occupancy rates in the urban core are driving a long-term ownership perspective,” said Evan Stone, managing director with JLL’s Capital Markets. “We’re seeing institutional investors considering buildings that would benefit from property and amenity enhancements, such as parking–which has been a struggle we’ve faced for a long time.”

For detailed information on more than 25 significant office buildings in Uptown and downtown Dallas, click here.