To say the least, Dallas’ Trammell Crow and the Teamsters make an odd couple. Nevertheless, the Teamsters’ giant pension fund is in need of a little real estate counseling. So after a visit to Crow’s offices by union president Frank Fitzsimmons, the Teamsters hired Crow, one of the nation’s most prestigious real estate developers, to give them advice. Crow’s staff will have plenty of fodder – as of January 1, 1976, the Teamsters’ Central States Pension Fund held $866 million in real estate mortgages, of which a sizable portion is either in foreclosure or behind on payments.

The fund is in so much trouble that the Internal Revenue Service has temporarily revoked the fund’s tax-exempt status. IRS is using the threat to force some much needed reform in the fund’s management, which IRS contends hasn’t been looking out for the best interests of the 424,000 active Teamsters and 60,000 retired Teamsters who have a stake in the fund’s $1.42 billion in assets. Hiring Crow should help considerably, because 61 percent of the fund’s assets are in real estate – an unusually high percentage for pension funds, which generally are invested quite conservatively. It’s also worth noting that in picking Crow not only did the Teamsters select a first-rate real estate counselor, they picked a well-connected Republican booster, who once threw a fundraiser at his house with President Ford as guest of honor.

Many of the fund’s major investments are in the nation’s most populous states, especially California and Illinois. There are some major loans in Texas, including a handful in Dallas. Most of the Dallas loans have had topsy-turvy histories of foreclosures and loan renegotiations. Along with a look at two major Teamster loans in Dallas that have been paid off, here’s an update on the more than $5 million in Teamster pension funds remaining in Dallas.

The Central States Pension Fund’s smallest Dallas loan is with an evangelical foundation which runs an Oak Cliff Bible school, named Christ for the Nations Institute. The foundation owns 40 acres of land around the convergence of Thornton and Love freeways, near the Sheraton Inn-Oak Cliff.

The Teamsters originally loaned $550,000 in 1964 on a three-acre tract, owned by 67 Properties. Within 16 months the Teamsters foreclosed, holding the land a few months before selling it to a partnership called Dallas Associates. That loan was foreclosed in 1971, and after three more sales in four years, the land was sold to Christ for the Nations. The foundation bought the property in 1975, for $478,000, and assumed personal liability to pay off the Teamster note.

Christ for the Nations has 16 buildings on its property, and is about to break ground on a million dollar gymnasium-classroom-lounge complex, located just across Love Freeway from the Teamster – financed land.

Located on Stemmons Freeway, just north of downtown, the Hyatt has a colorful financial history. It was developed in the early Sixties by Jay Sarno, who today works in Las Vegas, where he has used Teamster money to develop hotels like Caesar’s Palace and Circus Circus.

In 1963 the Central States Pension Fund made a $3.6 million mortgage loan on the Cabana, as the hotel was then known. Originally the Cabana had 11 owners, including singer Doris Day and her late husband, Marty Melcher. Several years later Day and Melcher bought out most of the other investors, but it wasn’t long before they realized what a nightmarish property they had purchased.

The Cabana began missing mortgage payments, so in 1968, just before the pension fund foreclosed on the hotel, the Cabana filed for bankruptcy. The Cabana’s problems were investigated by a court-appointed receiver who reported outrageous practices ranging from free-bie luxury suites for friends of management to charging $14 in the restaurant for a 59-cent Cornish hen.

The Hyatt chain agreed to buy the Cabana, which it did after a tortuous six years in bankruptcy proceedings. Hyatt owned the hotel from 1974 to 1976, then walked away last winter, taking millions in losses.

Today the hotel is owned by Holders Capital, which owns several other hotel properties. The Teamster mortgage stands at about $2 million, and until the hotel proves itself profitable, there’s little chance that the Teamster Pension Fund can get out of the deal. The hotel has recently been renamed DuPont Plaza, to avoid confusion with the Hyatt Hotel under construction at ReUnion.

This loan was paid off quite recently – October 1, 1976. Its story is relatively simple, beginning in 1965 when the Central States Pension Fund lent real estate promoter Jack Isaminger Jr. $2 million to develop 23 1/2 acres behind Union Terminal. Isaminger announced plans for a huge development, including a domed sports complex. Isaminger’s plans fell through. The $2 million was due in 1970, which proved to be an unfortunate year for Isaminger. In June, the National Bank of Commerce, Tulsa, secured a $348,000 judgement against him, and several weeks later the Teamsters foreclosed on the Union Terminal property.

The Teamsters held the property for two years before Hunt Investment, whose principal is developer Ray Hunt, came along and bought the land. Now the Union Terminal property is being developed into ReUnion, a $210 million complex, which is currently under construction. The Hunt mortgage originally stood at $2.6 million, which was to have been paid out by 1997. On October 1, 1976, Hunt Investment terminated the Teamster relationship by borrowing $2.25 million from First National Bank in Dallas and repaying the outstanding balance of the Teamster loan.

The Executive Inn, located on Mockingbird, directly across from the Love Field entrance, is another of those Teamster motel loans which has had a turbulent history. The Executive Inn opened in 1961, and for five years was financed by local bank money, mainly from Mercantile. In 1966 the motel’s owner, Tower Contracting, took out a $3.8 million mortgage from the Central States Pension Fund.

Tower Contracting fell into trouble almost immediately. In 1967 Tower had one federal tax lien placed against it and two state tax liens. In 1968 Tower borrowed another $139,000 from the Teamsters and in 1970 was assessed a judgment for back taxes. In 1972, Tower borrowed $400,000 from Justice Mortgage of Dallas, then in 1973 had another state tax lien placed against the company. In 1974, two more tax judgements, then the Teamsters finally gave up and foreclosed.

Last summer the Fund sold the Executive Inn to Ronald Walters Jr., an officer of the corporation which had been operating the Executive Inn for Tower Contracting. The mortgage terms are very generous – calling for a one-year respite from payments on the $3 million note. The Central States Fund originally expected to be out of the Executive Inn deal by 1968, but now the note has been extended to the year 2001. If the Executive Inn lasts that long, it will be celebrating its 40th birthday.

Get our weekly recap

Brings new meaning to the phrase Sunday Funday. No spam, ever.

Related Articles

Local News

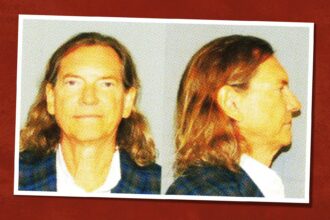

Bill Hutchinson Pleads Guilty to Misdemeanor Sex Crime

The Dallas real estate fun-guy will serve time under home confinement and have to register as a sex offender.

By Tim Rogers

Restaurants & Bars

The Best Japanese Restaurants in Dallas

The quality and availability of Japanese cuisine in Dallas-Fort Worth has come a long way since the 1990s.

By Nataly Keomoungkhoun and Brian Reinhart

Home & Garden

One Editor’s Musings on Love and Letting Go (Of Stuff, That Is)

Memories are fickle. Stuff is forever. Space is limited.

By Jessica Otte