A software development company has been preparing to move for nearly a year. As the project unfolds, they regularly miss critical dates because the decision-maker will not delegate even minor design decisions. The project labors, then the move is postponed because he fails to pick between brushed aluminum or enamel painted bathroom partitions. The delay costs him two times his regular monthly rent.

Oh, stop your snickering.

According to Jim Collins, author of Good to Great: Why Some Companies Make the Leap … and Others Don’t, before making important decisions, great corporate leaders “dive into the brutal facts like pigs in slop.” Lesser decision-makers, “tend to just act.” The key is: important decisions. Smart leaders don’t pig-out over things that don’t matter.

How does one know if something is important? Ask these questions first:

• What problem am I trying to solve?

• What need am I trying to fill?

• What kind of money is at stake?

• What measurable results am I looking for?

• What is the penalty for a bad decision?

• What is the penalty for inaction?

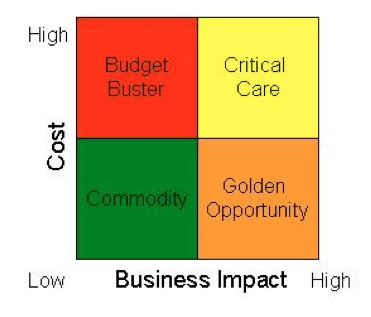

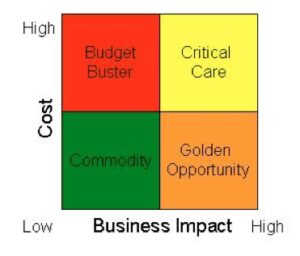

This exhibit shows a framework when approaching decisions. The horizontal axis shows the Business Impact of a decision.

This exhibit shows a framework when approaching decisions. The horizontal axis shows the Business Impact of a decision.

The range can be wide and varied: what’s important to some may not be to others. Elements that can define Business Impact are the degree to which a decision leads to greater profit margins, to better employee retention, to higher quality products, to longer shelf life, to increased differentiation, and to more efficient operations.

The vertical axis represents the Dollar Amount, or potential cost, a decision represents. So what are the four quadrants? Read on.

The worst of all worlds: high cost and low business impact (think the platinum hammers the Pentagon is so famous for). Handling Budget Busters: Why handle them? Would well-educated, rational people spend time dealing with items that are high cost and have a low business impact? Here’s a hint: no, they would not.

Commodities

Commodities are cheap, widely available, and have a number of replacements with no differentiation between them. Why then do we always hear the following during baseball season: “Left-handed, power-hitting third basemen are a rare commodity in the big leagues.” How could a commodity be rare? Handling Commodities: Make a choice and move on.

Golden Opportunities

Low-cost goods or services with a high business impact. Now that’s the ticket! But Golden Opportunities are rare. They don’t hang out on street corners waiting for some executive to offer them a ride.

Handling Golden Opportunities: Do so frequently! How does one unearth them? Start by plowing the ground in the final quadrant.

Critical Care (aka: Consultantland)

Critical Care (aka: Consultantland)

These are really expensive things that have a high business impact. Think risk.

But what is Consultantland? Why it’s is a magical place where, if one chooses poorly, a house (or maybe a pink slip) falls on you and you lose your ruby slippers, the key to the executive washroom, and the parking spot with your name on it. Mistakes here can cripple a business and ruin a career (remember the New Coke guy? Nobody else does either. Get it?).

Handling Critical Care items: Wise decision-makers will invest in specialized help to guide them through the acquisition process in this quadrant. The consultants they hire often have specialized training, unique knowledge, and have probably helped others move decisions from Critical Care to Golden Opportunities before.

Now, to make sure you have been paying attention, I have prepared the following exercise: Acquire an overhead paging system installed.

What quadrant does this fall into? Take a minute to think while I run to the bathroom.

OK. I’m back. The right answer is, of course: “It depends.”

An overhead paging system involves speakers cut into ceiling tiles, a simple control panel, electrical power, and someone’s labor. So about now, you’re thinking Quadrant II (the Commodity quadrant for those of you with short-term). If this decision involves a single big-box retail store, I agree. If the paging system fails, sure there is a little disruption, but it wouldn’t close the store.

What if the business in question is a new municipal baseball stadium? Does the Business Impact of a good quality, high-reliability system creep up some?

What about a paging system for a hospital? What happens if a patient dies because the paging system failed? Sound like a trip to Consultantland is in order?

Bottom line: There are no hard fast rules for Commodities or Critical Care or anything. Instead, business decisions will vary based on the type of business, the size of the organization, and the risk and dollars involved. All you need to do is spend a little time thinking about it and then plot your acquisition strategy accordingly.

Randy Thompson is the managing director within Cushman & Wakefield’s corporate occupier and investor services group. Contact him at [email protected].