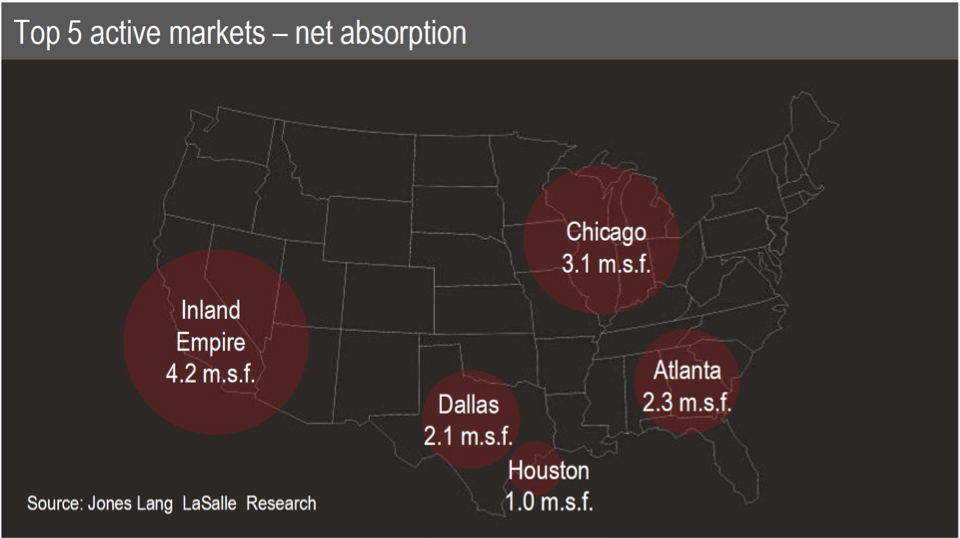

The industrial sector in North Texas is heating up. In fact, when comparing net absorption rates, Dallas is among the most active markets across the United States. Here’s how the markets currently stack up:

But there’s more to understanding how the sector is going to perform than simply analyzing net absorption. Here’s what you can expect from the North Texas industrial market going forward.

Market Conditions

• Dallas-Fort Worth recorded 2.1 million square feet of positive net absorption in the first quarter, which is a normal, healthy level by historical standards, but below the pace set over the past two years.

• In third and fourth quarter of 2012, about 4 million square feet of build-to-suit deals were signed, but stats won’t reflect the deliveries until tenants take occupancy of the completed properties.

• Leasing activity has been high in recent quarters.

• Average asking rates have been flat over the past few quarters, again largely due to limited new product being completed in recent years. However, effective lease rates have risen seven to eight percent with reductions of free rent and other incentives.

• Almost 50 percent to 60 percent of the absorption and build-to-suit activity in DFW is a result of inbound companies.

Investment Opportunity

• Because DFW is a top five industrial market in the U.S., there is a strong demand for investment opportunities within the market.

• The average price per-square-foot on investment grade properties has trended upward over the past quarter, but the volume of sales has remained low. The average price per-square-foot currently stands at $48, while the average cap rate is 7 percent.

• It has been reported that national industrial portfolios have been trading at a premium in comparison to one-off investment grade assets.

Outlook

• The construction pipeline continues to be only a fraction of what is the historic norm and almost all of the construction currently underway is built-to-suit projects. Currently there’s a little more than 2 million square feet of speculative construction under way, only a fraction of the normal level typically under way.

• Over the past few quarters there has been over 5 million square feet of built-to-suit deals that have been signed. Additional spec development is expected to begin in 2013, but the forecast for new construction is still expected to remain below the historic norm for at least the next year.

• Once spec construction begins to hit the market, the average asking rate is expected to increase, as the weighted average rate right now is currently skewed by older, functionally challenged properties that do not command state-of-art rates.

• Retooled supply chains and population growth bode well for DFW now and in the future.

As managing director, Terry Darrow leads Jones Lang LaSalle’s Dallas-Fort Worth industrial group. Contact him at [email protected].