Step Three: Ignore Analysts

J.C. Penney got into the drugstore business back in the ’60s, with a regional chain called Thrift Drug. In the ’90s, the company acquired Kerr’s, Fay’s, some Rite-Aid stores, some Revco outlets, the Genovese chain, and Eckerd. With 2,600 locations, Eckerd is now the fourth-largest drugstore chain in the country. But when Questrom took over, analysts wanted—and expected—him to sell off the Eckerd stores. According to accepted wisdom, J.C. Penney had no business being in the drugstore business.

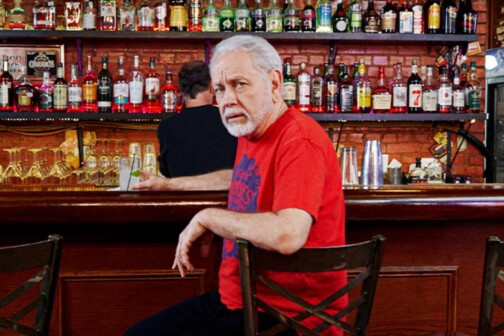

Where analysts saw liability, Questrom saw possibility. “I’m not going to give away a business that has been badly run,” Questrom told them, “when I know the business in front of me is going to triple the value to my shareholder.”

He saw pharmaceuticals as a growth industry. People live longer, and when they do, they typically need more drugs. Questrom also recognized that drugstores were no longer merely drugstores; they were like specialized supermarkets, where grandparents could get their arthritis medication and, on the way out of the store, spend money on their grandkids.

Questrom hired J. Wayne Harris, another outsider, to be chairman and CEO of Eckerd. Together, they reconfigured the management of the stores and the stores themselves (you may have noticed a more circuitous route from the pharmacy area to the exit door). They repositioned Eckerd as a convenience store that happened to refill prescriptions—rather than a drugstore that happened to sell greeting cards.

Merrill Lynch analysts, who say a spin-off of Eckerd could happen as early as spring 2003, recently computed a break-up value for J.C. Penney and put Eckerd at roughly $20 a share, compared to about $15 for the store and catalog combined.

Step Four: The Catalog is Key

The catalog division of J.C. Penney, which shipped its first volume some 40 years ago, is the nation’s largest. In 2000, revenues topped $3.8 billion. That same year, Penney’s web site was the largest online retailer of apparel and home furnishings, according to Nielsen/Net Ratings. The site had 1.3 million unique visitors a month, and an industry-high 18 percent of those visitors bought something.

Dot-com start-ups had catchy names and cheap prices but ran into hurdles when it came to filling the onslaught of orders. With its experience in catalogs, though, J.C. Penney has the infrastructure to handle high volume. The company’s five fulfillment centers across the country process orders from both the old-school catalog and new Internet. The 45-acre center in Lenexa, Kan., can ship 8 million items in two to three days.

But even though Penney’s web site was popular, it wasn’t profitable. “It’s a very costly way to do business,” Questrom said, citing that the company lost $40 million in 2000. Because the catalog and web site are two sides of the same coin, Questrom combined the two operations. And because no one in the company had the kind of experience he thought was needed to run the division, he brought in two managers he’d worked with before who had financial, operations, marketing, and merchandising backgrounds.

Step Five: Make Some Noise

J.C. Penney is in the process of renovating its existing stores across the country with wider aisles, fewer walls, and new floors, paint, and lighting. New stores, like the one at Stonebriar Centre in Frisco, feature televisions and electronic kiosks. The new look has already impressed the investment houses.

“After a store tour of a freshly laid-out prototype,” said Merrill Lynch analysts as part of a recent upgrade, “we believe that the new, centrally managed store layout does a significantly better job of displaying the much improved merchandise assortment, through improved signage, fixturing, and a focus on product adjacencies.” In other words, the new stores look pretty.

But analysts, as it turns out, don’t buy clothes when they tour prototypes. Questrom needed to get the word out to consumers. So he added $100 million to the marketing budget. “You cannot survive today as a national company without being in the face of your customer on a regular basis,” Questrom said.

Now that J.C. Penney has a centralized purchasing system, it can take a centralized approach to its marketing. National television ads can feature clothing lines that you can find at your local J.C. Penney, whether you live in Pittsburgh or Peoria.

…And Don’t Rest on Your Laurels

Questrom has said that getting J.C. Penney back on its feet would take two to five years. “One should not, because we’re going to have a few good months of sales, [assume] that we’ve made the turn,” he cautioned last April. Investors seem to like what he’s done so far: in 2001, the company’s stock rose 147 percent, making it the fifth-best performer on the S&P 500 that year.

If he stays true to form, Questrom will leave J.C. Penney once he’s convinced the ship has been righted. He’ll probably take a little well-deserved R & R—until the next board of directors comes calling, looking to lure the old pro out of retirement.