…or how many co-opted French words can I fit into a title.

(Old image, but I wanted to show its location and every rendering seems to conveniently ignore its context in favor of the shimmery skin.)

There are two pieces of news in this article at the DMN: first, is that like Frankenstein, the Museum Tower is ALIVE. IT’S ALIVE! And that it is funded by the respective pensions of the Dallas Police and Fire departments. The second bit is that the House by Starck and Yoo is a whopping 10% sold and the Ritz is full to the kind of ambiguity you expect from leasing/sales agents at 1/3rd of the units.

——————————————

Side note: my guess is that very few are first homes for the buyers either. Some by foolish investors, others bought as 3rd, 5th, or 12th homes by the uber-rich to have a pad in Dallas. The problem of all of the above is that those “residents” add very little to the street scene and livelihood of the urban experience.

——————————————

Let’s start from the beginning shall we? Dallas (and downtown in particular) needs investment and residents; density and tax base in proper relation to infrastructure so, ya know, we can afford our City once again. As Mike Davis of Dallas Progress points out via tweet, Museum Tower can mean up to $7 million in tax base for the City of Dallas. All good right?

While that is good from a City perspective, I immediately turn and look at it from an investors perspective through the filter of knowledge and understanding of cities. I see product delivery, more supply and no demand. What we don’t need is silly mindless investment ignorant of context and urbanism that is doomed to lose money and potentially scare away investment in downtown long into the future.

Investment in Downtown Dallas already missed the market once aiming for uptown level returns fueled by two things: a demand for walkable urbanism and an overheated housing/lending market. Barriers inherent in downtown Dallas required a lower level market (at least a mix), but land costs drove the market back up to the high end.

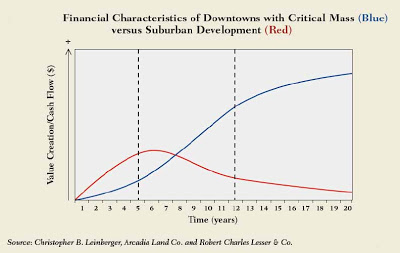

A few months back, sitting around a desk with some fellow financial and urban minds, we discussed the potential of pensions as an ideal source of investment for high quality urbanism because of the long-term and consistent returns of real estate that is part of an interconnected whole, aka urbanism.

Apparently, we’re confusing location and density alone in a vacuum as somehow “urban” and a good investment. Which is why I get the feeling that someone is getting “took.”

The same way we did with high end projects like the House (10% full) and the Ritz hovering slightly above that.

That 10% number apparently didn’t scare away the developers or the investors for some reason. Why? My guess is that they are merely assuming this was another hum drum bubble and business as usual can begin after a couple years laying in the economic cut.

Eventually, all that leasable space will 1) magically be absorbed, 2) we time the market rebound with the grand opening (as if they’re the only ones doing this suggesting they will “have the market to themselves.” Every developer I’ve talked to is trying to time the exact same thing.), and 3) profit.

That’s how it works kids.

And that would be fine if the only problem was timing a saturated high end condo market when we desire to add more to that supply.

Never mind the fundamental flaws in buildings/developments like the Ritz, Museum Tower, or all of Victory in that they provide no connection, participation, or interaction with their surroundings. They are anti-urban density, cul-de-sacs in the sky. And thus, the value is less than what went into the development, otherwise known as precisely the reason they aren’t selling for what they are priced.

In a luxury condo, in a downtown urban setting, people are paying for the location, the vitality and activity of the area. Value is driven by what is outside the walls. Outside of the museum tower, what can you walk to?

You might say, “but that’s not what they’re paying for?” Oh yeah professor? Than why build it there? Build it in Allen and it will do just as well.

At first blush one might think the site demands high end: the Arts District, Woodall Rogers Park, etc. However, I would argue (for the time being) that unlike the Transformers there is far less than meets the eye. There is no urbanism, no relationship of buildings to streets and buildings to each other.

Those kinds of places quickly get boring and when the rich get bored, even they move out, often to areas colonized by artists and creative types who are busy pioneering into Deep Ellum and Bishop Arts, making them fun, safe, interesting, AND more valuable. When the wealthy move into those “hip” places, then everybody screams GENTRIFICATION! Welcome to how city’s work.

Walkability means value. Not for some esoteric notion of holding hands and happily skipping down the street, but rather proximity. The distance to things you can walk to, the density, and mix creating synergies that drive the variety and real estate value of said destinations. The mix of all that creates the increased incremental value of urbanism where the whole is greater than the sum of parts rather than less.

(Here is a picture of the Upper East Side to drive home the point about necessary ingredients for determining valuable places. The height/density is a direct response or outgrowth of the demand to be in the area.)

The stuff inside of a building or unit, ie quality of counter tops and fixtures, etc are well and good, but those are the fine-grained adjustments to the real estate microscope. Location and proximity, or propinquity, is the big knob.

The problem of the Arts District is its clustering of the venues so tightly that any potential vitality is suffocated by an over abundance of simple boxes. Sure the architecture might be complex but that is only skin deep. Value is driven by complexity. And real complexity is created by the mixture of types, uses, buildings and the interconnection of a walkable urban fabric. The point of walkable urbanism is the value of having your daily destinations within a safe, pleasant walking distance.

This is still Henry Ford assembly line urbanism when we need the technology of the 21st century of smart, interconnected systems thinking with the ability to learn and adapt populating our approach to urbanism and development. Simplicity vs. Complexity.

It is the difference between Wrigley Field and Fenway Park being so loved and “stadium districts” getting, well, torn down every twenty or thirty years. Which was the smarter investment? I’ll answer my own question, it is the development that is the cherry on top, the culmination of the messy mix of its urban neighborhood.

Of course, I just spent a thousand words talking about the investment going into the Museum Tower and the only real problem is the clover leaf strangulating it. If that was my pension money, I’d be putting a little extra into protecting my investment and getting rid of that thing so the tower and its residents actually can participate in the City around them.

Underestimate highway engineering’s negative effect on real estate value at the peril of your investment.