IT HAPPENS TO all of us.

You’ve just finished the first draft of your tax return. Having added a little pad here, a flourish there, a dash of creativity throughout, you are looking at a nice, fat refund. But the pleasure fades rapidly as a stern little voice inside whispers: “AUDIT!”

Few words elicit a response like this one. Panic, terror and unmanageable guilt rush into your paralyzed brain.

“Will they get me?”

Well, they might. But it pays to know something about audits in order to understand the ways in which you can lower your risk of having to go through one.

Less than 2 percent of the 2.6 million individual returns filed in the Dallas district will be audited. The statute of limitations on your tax return is generally three years from the filing date. Since the Internal Revenue Service needs to open and close your case within this time frame, an audit will generally be initiated within six months to two years after filing. So, you can at least breathe easy now about your 1981 return. The earliest you could hear about 1983 returns being audited is August 1984.

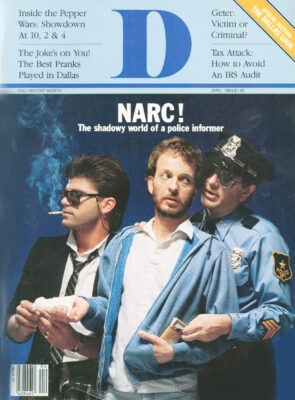

There are several ways in which your return might be selected by the IRS. These include such screaming headliners as being arrested for a crime-say selling illegal drugs-which generally involves lots of cash; being informed upon (so be careful whom you antagonize-the person who tips off the IRS that you might owe more taxes may be able to collect 10 percent of what you owe); or being caught up in the trail of an audit of your ex-spouse, employer, partner or even tax preparer. Some people not only refuse to pay taxes, they shout their intentions to the IRS by sending in blank forms or scrawling “unconstitutional” all over their return. Not subtle. Definitely an audit.

More likely, the initial selection will be done not by a jealous lover or an IRS Colum-bo, but by a quiet, dispassionate computer. The computer can select you in one of two ways.

The first is the one-in-2,000 killer known as the Taxpayer Compliance Measurement Program (TCMP). Every two to five years, about 40,000 unlucky souls are chosen for the bureaucratic equivalent of root canal surgery. The TCMP audit chooses a so-called stratified random sample (a variety of returns representing different income brackets, geographic locations and professions) in order to get a detailed profile of all types of taxpayers.

These returns are scrutinized line by line, and you are the one who’s got to prove every number leading to every total on every line of your return-right down to the last dollar.

If you’re chosen by the computer for the TCMP audit, you will be audited, period. Ulcer victims and other high-level worriers beware: 1982 was a TCMP year. Fifteen hundred unlikely Dallasites will be involved, and local returns are still being selected.

Uncle Sam, however, is only moderately interested in collecting back taxes from the TCMP. He’s really out for something far more important: information. Having dissected these 40,000 returns, he now knows that the average veterinarian in Boise, Idaho, who earns $50,000, is likely to have $15,000 in office expenses and that the average hotel waiter is likely to neglect reporting $5,000 in tips each year, etc. Uncle Sam now knows about you.

This extensive information on “average/ normal” expenses and typical mistakes is broken down into 12 categories of individual returns. By the time your return hits the big computer in West Virginia (which it will), the computer will be ready and waiting with the DIF.

The DIF (Discriminate Functions System) is really at the heart of the IRS’ audit activities. More than 75 percent of the IRS’ audit work is generated by it. Here’s how it works: The IRS’ profiles from the detailed TCMP data now have scores attached. Your return will be “graded,” and this is one time you don’t want a high score. The actual DIF data is, of course, a heavily guarded secret. You can get a high score when a lot of deductions and expense items are slightly above average for your tax group or for one or two whoppers. The more complex your return is, the more scheaules you fill out, the more likely it is that some or all of those items may be above average. This isn’t to say that you shouldn’t take all allowable deductions, expenses and credits, but if they’re high, you’ll likely have to explain them in person.

Once the computer kicks out your return along with other high DIFs as having a “high probability of error,” it’s looked at by a classifier, a seasoned Solomon-type who examines the return for its audit potential. If the standout items seem to be explained by other factors, the return will not be audited. (For example, high medical expenses on elderly persons’ returns or high casualty losses claimed during a year when a disaster struck a particular area are probable reasons for high deductions.) If the standout items simply seem “out of balance,” the classifier will identify those for audit. Frequently, one large “out of balance” item is more likely to be chosen than a lot of slightly high ones. You will be sent a letter and asked to document those items to an IRS examiner.

Classifiers seem to know their job well. Last year in the Dallas district, more than 90 percent of the more than 36,000 individual returns audited resulted in additional taxes paid. The system is geared to a high-change potential.

Which items or combinations are the most likely to get you snared by the computer? Generally, high scores are given to any large deductions, but those items that require legal or financial expertise to be deducted properly are more heavily weighed. These include casualty losses, contributions of goods or cash, business travel and entertainment, auto expenses, home office, bad debts, depreciation and rental property. And the higher your income, the more likely you are to be audited. In 1983, for example, 5 percent of the returns of $50,000-plus incomes were audited, while lower income brackets had less than a 1 percent chance.

Safer deductions tend to be those that are easiest to document, such as IRAs, sales tax from the tax table, medical expenses, your personal exemptions, interest expense or very small-dollar items such as professional dues and journals or business use of home telephones. Be advised, however, if your score is high and your return is selected, the classifier can select any item for inspection.

Some “hot for audit” issues vary from year to year. Each year has its own “exam plan.” According to Larry J. LeGrand, assistant chief of the exam division in the Dallas district, there are three areas that will guarantee an audit. 1983 is the IRS year of the “abusive” tax shelter. An abusive tax shelter, explains LeGrand, is one in which the shelter promotes reductions in U.S taxes as its main object, without a legitimate business function. Such shelters routinely use non-recourse loans or high property appraisals to increase depreciation, investment tax credits and other non-cash expenses. The IRS is currently seeking out such schemes “up front” at the promoter level long before any returns are filed. The IRS now has the power to pre-notify both the promoter and the investor of abuse and to penalize the promoter. The agency will be looking at all partnership operations very closely. If it sounds too good to be true, it probably is.

Tax protests, donating all your income to a non-profit family trust or taking clergy-related deductions based on mail-order ordination are other ways to draw unwanted attention. Business and other financial ventures and tax havens (such as the Bahamas) as well as tip income not reported by waiters are other “high non-compliance areas” that have been identified for 1983.

Extra attention will also be paid to matching your reported wage and interest income with the W-2 and 1099 information sent to the IRS by your employers and banks on magnetic tapes (no more paper shuffling here). Amended returns (changes made on a return originally filed several years ago) are always examined by a classifier but not always audited. Returns requesting a refund of over $200,000 are automatically audited.

If you’re audited, take a deep breath, collect your records and hope for the best. Whatever you do, cautions Kenneth Walker, assistant director for the IRS in Houston, “Don’t ignore the letter. The IRS will adjust your return without your evidence. And don’t be scared. Our mission is voluntary compliance. Anything that is correct is safe. The U.S. has a very high rate of voluntary compliance. Ninety-seven percent of taxpayers file their return, albeit with occasional human errors.” (Estimates indicate that of the total population, 92 percent of the returns filed are correct, 5 percent have errors, and 3 percent are fraudulent or non-filed.)

Factors not affecting the likelihood of being audited, according to Walker and Le-Grand, include filing with the pre-printedlabel, filing early, filing on April 15th, filing on paper other than the IRS forms or filing late with an extension. Says Walker: “Ifit’s late, we’ll wait for you.”

Get our weekly recap

Brings new meaning to the phrase Sunday Funday. No spam, ever.

Related Articles

Arts & Entertainment

DIFF Documentary City of Hate Reframes JFK’s Assassination Alongside Modern Dallas

Documentarian Quin Mathews revisited the topic in the wake of a number of tragedies that shared North Texas as their center.

By Austin Zook

Business

How Plug and Play in Frisco and McKinney Is Connecting DFW to a Global Innovation Circuit

The global innovation platform headquartered in Silicon Valley has launched accelerator programs in North Texas focused on sports tech, fintech and AI.

Arts & Entertainment

‘The Trouble is You Think You Have Time’: Paul Levatino on Bastards of Soul

A Q&A with the music-industry veteran and first-time feature director about his new documentary and the loss of a friend.

By Zac Crain