Gary Wojtaszek was ready for the open road. In early 2020, before coronavirus slammed the brakes on everything, Wojtaszek (pronounced Wo-ta-sik, or in traditional Polish, Voy-ta-shek; he’s called Wojo by his friends) and his wife Wendy bought an Airstream camper in Florida. They brought it back to Dallas before saddling up for a 10,000-mile, cross-country camping excursion.

Wojtaszek hadn’t taken an extended vacation in years. A decade earlier, in May of 2010, he was promoted to his first CEO post. He had been chief financial officer of Cincinnati Bell at the time and helped steer the company through a $525 million acquisition of Houston-based data center provider CyrusOne. As part of the deal, Wojtaszek was put in charge of CyrusOne. In the decade that followed, the company’s CAGR grew by at least 25 percent every year. In 2013, Wojtaszek led CyrusOne through an IPO at $19 a share, resulting in an initial market value of about $1.18 billion. “It was a rocket ship,” he says. Eight years later, in November 2021, investment giants KKR and Global Infrastructure Partners inked a deal to acquire the company for $15 billion. It was the largest data center M&A deal in history. But Wojtaszek was no longer captain for that transaction; he resigned from his leadership post at Cyrus-One in February 2020. And that’s when his getaway was about to begin.

As Wojtaszek drove the RV closer to his University Park home, he remembered that neighborhood rules wouldn’t allow him to park his new vehicle on his street. So, he started calling storage facilities—only to discover there wasn’t a single open RV parking space across North Texas. A spot eventually became available, but for a while, Wojtaszek thought he was going to have to stash the oversized vehicle in a CyrusOne data center parking lot.

He and his wife soon were ready to hit the road and embarked on a journey through as many national parks as the couple could handle. (They have visited 34 to date.) Seeing the country from different campsites, Wojtaszek fixated not on the mountains. Nor the prairies. Nor the oceans. He was captivated by the countless boat and RV storage facilities he encountered along the way. Many were just grass or gravel lots with covered parking or rundown metal shelters. After returning to Dallas after the long excursion, Wojtaszek began digging into the economics of these assets. At the same time, he was receiving offers to run large data center companies, but he turned down each opportunity.

“I wanted to do something entirely different,” he says. “And that was really my wife’s inspiration. She said, ‘Hey, how about you explore this RV storage facility thing?’ And I know she was saying it from the perspective that this could be a small, family business thing that could keep me busy. And believe me—there was no intention of building another big, public company again. But I just couldn’t help myself.”

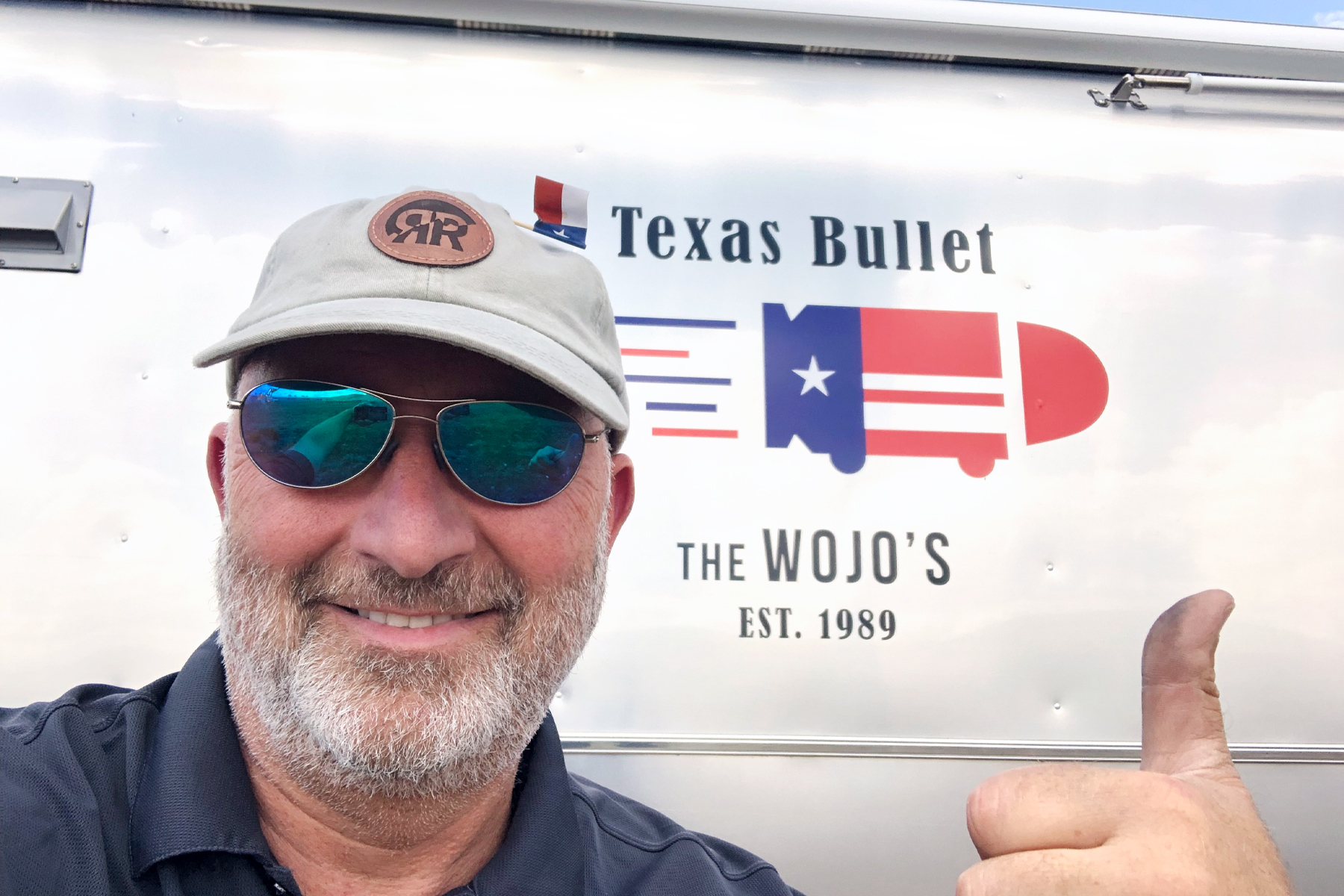

His wife was right about several things. Wojtaszek’s new business is family-run. He convinced all four of his children to join him in the venture. (See sidebar on page 35.) And the company is keeping Wojtaszek busy. But what started as a road trip reverie is now RecNation. The Wylie-based company has raised $800 million in capital (and deployed $400 million of it), has more than 70 employees, and a portfolio that includes 53 assets in six states. Two years in, there’s nothing small about it. The company—which calls a collection of four vintage Airstreams repurposed into mini offices its corporate headquarters—is still private. But Wojtaszek says there is just something about an IPO he cannot help but be tempted by. “We’re structured in anticipation as a REIT, where we can take it public,” he says.

Wojo’s Family Recipe

Gary Wojtaszek convinced all four of his children to leave their careers behind and join the burgeoning family business. Here’s how:

The pandemic was the perfect opportunity for Gary Wojtaszek to convince his four kids to come home and work for the family startup. “They were all bored,” he says with a laugh—except maybe for Kaitlyn, who was the chief of staff for Q.ai, Forbes’ AI startup. “My daughter, by far, was the hardest to convince,” he says. So, what moved the needle for RecNation’s director of business development? “Leaving the world behind that I knew was daunting,” Kaitlyn says. “But now, I’m one of the biggest advocates for RecNation, and joining the business was the best decision I’ve ever made.” Christian, who has been there from the start, admits things didn’t begin as smoothly as anticipated. “I was taking a risk to start a business,” the director of revenue management says. “It’s not the natural progression, but I can’t quantify how rewarding it is. When we started in October 2020, we didn’t have any processes in place, and we purchased a facility with 600 customers. We didn’t know how to turn them over to our system; we had all these outdated processes, so it was a little bit of a nightmare.” Wojtaszek’s son Matt is a senior financial analyst and Ryan, his youngest, serves as a financial analyst. “The culture my dad has built is such a breath of fresh air,” Kaitlyn says. “We have Taco Tuesdays, we have barbecues, and we play in a bowling league—I love coming in every day because of that culture.”

After graduating from Rutgers University in the mid-1990s, Wojtaszek took a job with General Motors doing corporate finance work. After about a year in New York, he operated out of Belgium before leaving in 1998 to join Delphi Automotive, a $28.4 billion automotive products and technology supplies arm of GM. As a regional treasurer, Wojtaszek worked out of Paris, France, and played an instrumental role in setting up new processes in Europe following Delphi’s split—via a lucrative IPO—from GM in 1998. Three years later, Wojtaszek joined communication semiconductor company Agere Systems as chief accounting officer and VP of finance. One of his first tasks was to help the company restructure after a $3.6 billion IPO; ultimately, in 2007, the company went through a $4 billion all-stock merger with LSI Logic Corp.

After Agere’s sale, Wojtaszek was recruited by Laureate Education, the world’s largest for-profit education company, to step in as CAO and treasurer. There, he executed his first leveraged buyout to take the company private. After the $3.1 billion transaction, Cincinnati Bell came calling.

The phone company approached him with one objective. “They asked me, ‘How do we strategically reposition this company?’” Wojtaszek recalls. He took the prompt and helped lead Cincinnati Bell—which was getting into the data center market in Cincinnati with four assets—through its acquisition of CyrusOne. At the time, Cincinnati Bell was generating about $1.2 billion in annual revenue. Wojtaszek then led CyrusOne’s 2013 IPO; by 2016, he engineered a way to buy back Cincinnati Bell’s remaining stake in CyrusOne.

Internally, Wojtaszek was building a people-first culture. Mike Schwartz, former VP of finance at CyrusOne who now serves as RecNation’s CFO and COO, says it wasn’t just talk. “Before Gary recruited me to CyrusOne, I used to always hear people say things like, ‘I really love my job,’ and I used to think they were full of shit,” Schwartz says. “I knew nothing about data centers but when I first joined, the culture was so strong, and people genuinely loved working there. He created a culture like I had never seen before.”

Kim Doan, former director of training and culture at CyrusOne, admits she had misperceptions about Wojtaszek before she met him. “[At Cincinnati Bell,] Wojo was the CFO, so I just figured he was going to be a boring numbers guy,” she says. “But he was interested in people, and he truly was open for feedback. When he became CEO of CyrusOne, he surrounded himself with people of all skill sets and always made sure to give people the empowerment and autonomy to succeed.”

“Believe me, there was no intention of building another big, public company again. But I just couldn’t help myself.”

Gary Wojtaszek

Doan ran new hire orientation for CyrusOne and says Wojtaszek attended each session. He showed up undercover and unassuming, mingling with others in the room, and striking up conversations. “He would sit right next to new hires and get to know them,” Doan says. “At the end of the orientation, he got up on stage to close and told everybody he was the CEO. People always looked around shocked. He’d always say, ‘If any of you want to leave, no questions asked, I will give you a check for $5,000!’ In all that time, nobody ever left. They liked our culture and most important, they liked Wojo.”

By the start of 2019, CyrusOne’s portfolio was up to 50 global data centers, many of which cost $300 million to build. Wojtaszek started positioning Cyrus-One for a leveraged buyout at $70 a share—a 368 percent increase over its 2013 IPO. “But someone started leaking that we were selling, and the stock rode up to $90,” he says. “So, at that figure, no one could come in with that kind of offer.”

In January 2020, Wojtaszek was forced to cut 12 percent of the CyrusOne staff. “Pricing in data centers was on a continual decline for a decade,” he says. “Unlike other industries, where prices go up—particularly because of inflation—we were constantly fighting the headwinds. And we were overcoming this through continued growth. But there came a point where I just didn’t see enough demand. And so, we needed to make cuts to ensure profitability. It was anything but fun, but I had a job to do to ensure profitability, and we delivered our numbers.”Doan was one of the employees Wojtaszek had to lay off. “But to this day, Wojo is someone I’d invite into my house for a beer or a coffee,” she says.

A month after the news of the layoffs got out, Wojtaszek submitted his resignation; the job was getting monotonous. “I was just ready to go,” he admits. “After the LBO didn’t happen, I realized how burnt out I was. I had aspirations to reposition Cyrus-One, to take it private, then bring it back to market as this reincarnation effort, but I lost my motivation to want to achieve big, big things.”

Through its $15 billion sale, CyrusOne, for the time being, is private. And a roadmap that’s similar to what Wojtaszek envisioned is seemingly being explored by the new guard.

On Wojtaszek’s new map, thousands of X’s mark the spots for opportunity in the U.S. There is currently about 11,000 facilities—including self storage—that offer boat and RV storage units. According to McKinsey, from 2019 through the pandemic’s height, sales of recreational products surged by more than 30 percent. The RV market—currently valued at $48 billion—is expected to expand at a 4 percent CAGR between 2023 and 2035, reaching more than $80 billion by the end of 2035, according to GlobeNewswire. And Wojtaszek is capitalizing, having acquired 53 storage assets; by 2028 he plans to own as many as 350. RecNation has no plans for ground-up builds, but each acquisition is given a significant facelift. “We will buy a facility—and it could just be a grass parking lot—then we will go in and put in fencing, security cameras, gravel, and blacktop. Then, we put in a structure—either a canopy or closed units—on it,” Wojtaszek says. “We reserve about 15 to 20 percent of our capital for that.”

After he returned from his national parks trip, Wojtaszek founded the company in October 2020 with his oldest son Christian, who was just starting his career at PwC. Together, the father-son duo bought three assets in a short span of time. “I had to ask Christian: ‘Are you going to be an actuary, or do you want to do something fun?’”

Christian hopped on board full-time and, eventually, so did Wojtaszek’s three other kids—Kaitlyn, Matt, and Ryan—as did Wojtaszek’s nephew Danny. In the first year or so, RecNation acquired six properties in the fragmented asset class and was doing everything from the comfort of the family’s University Park home—running scale efficiency models and automation efforts, putting together legal structures, and operating a makeshift call center. All the while, RecNation achieved profitability. “When you take underperforming assets and just clean them up and put formal processes and procedures in place to focus on the right things, you can really make a big difference quickly,” Wojtaszek says. “We’ve been profitable since that first year.”

Around Christmas 2021, Wojtaszek secured a $300 million equity investment from private investment firm Centerbridge Partners. “If I’m going to recruit my kids to give up their careers, we’re going to go build something big,” Wojtaszek says. “I want them to look back in 10 years and say, ‘Oh, man, look at what we built and look at what I learned.’ All these kids at the end of this should be able to start their own companies.”

With the capital in place, Wojtaszek accelerated his recruiting efforts beyond his own home and built out an executive team for RecNation consisting entirely of former CyrusOne executives. “After Gary left CyrusOne I told him, ‘Call me when you’re ready to do your next thing, and I’ll leave to join you,’” Schwartz says. “However, to be honest, when he told me about RecNation, it was difficult for me to get my arms around the whole thing.” But Wojtaszek sold Schwartz, and he joined. Now, like his boss, Schwartz is dreaming big. “I’d like to take the company public,” Schwartz says. “Taking this company from a startup, putting all the systems in place, getting our first audits done, to going public jazzes me up.”

By December 2022, Wojtaszek was ready for a significant debt raise. As of May 2023, he had pulled together $500 million from Goldman Sachs, Morgan Stanley, Raymond James, Key Bank, Royal Bank of Canada, TBK, Truist, and Citizens Bank.

“When Gary came to Truist, we were all thinking small scale,” says Matt Wyatt, a senior vice president at the bank. “But Gary knew where RecNation was headed—and keep in mind, especially for real estate debt, this has been the toughest market in more than a decade.” Truist is currently RecNation’s lead bank and helped it increase the lending group to seven other banks. “Our deal just got off the ground, and next thing you know, instead of talking about tens of millions of dollars, we’re talking about hundreds of millions dollars to raise,” Wyatt says. “The sky’s the limit for this company.”

RecNation is diversifying its revenue through various other streams, including the launch of an RV rental business, RecRental. Through a partnership with the largest RV rental company in the U.S., RVShare, RecNation is piloting the rental program in DFW. RecNation has also launched an RV cleaning and minor repair business, RecRepair, and Wojtaszek recently received approval from the state on its fourth revenue stream to become an RV dealer. “Those businesses are all monetizing other parts of the business that we’ve made,” he says. “So, it’s all just yield enhancers; it’s additional cash flow with no additional capital—we just have to work on the business model. Once we get it down, we’re going to go around the country, and we’ll copy and paste it in each of the major metro areas.”

Many possibilities abound. “In real estate, there are a lot of folks who are good at acquiring assets but not particularly focused on building an operating business,” Wojtaszek says. “And that’s what makes us unique—actually, to the point now where we’re getting requests from other companies developing boat and RV facilities asking us if we would [handle management], which is exactly what the big public storage rooms do. We have an opportunity to be like a CubeSmart or Public Storage and manage these assets, and companies can pay us a fee off the top.”

Another equity raise is planned for next year. Wojtaszek aims to operate at a debt-to-equity ratio of 1:1 (with allowance for 3:2). RecNation is targeting assets in the Sunbelt and Mountain States for the next 18 months, and the company is hoping its latest $500 million debt raise will fuel expansion in 20 to 25 states. While scaling to 350 assets, Wojtaszek expects the company’s headcount to grow by 200 percent. For the next five years, he anticipates revenue to grow by 30 percent on a continual annual growth rate. “RecNation has the same mojo that CyrusOne had for years, but ironically, I’ve grown RecNation faster in the first two years than I did at CyrusOne,” Wojtaszek says. “We’ve got that small, startup, scrappy mentality, and I have no doubt we’ll be able to produce big growth numbers for a long time.”

Author