Hundreds of reverse mortgages taken out in southern Dallas over the last decade ended in foreclosure, the result of a nationwide trend in which lenders targeted sales pitches to low-income, predominately black neighborhoods, says a new investigation by USA Today.

The loans are designed to allow seniors to benefit from their home’s equity sooner than they’d otherwise be able. The Department of Housing and Urban Development cracked down on reverse mortgage lending five years ago, but USA Today reveals “a generation or families fell through the cracks and continue to suffer from reverse mortgage loans written a decade ago.”

These elderly homeowners were wooed into borrowing money through the special program by attractive sales pitches or a dire need for cash – or both. When they missed a paperwork deadline or fell behind on taxes or insurance, lenders moved swiftly to foreclose on the home. Those foreclosures wiped out hard-earned generational wealth built in the decades since the Fair Housing Act of 1968.

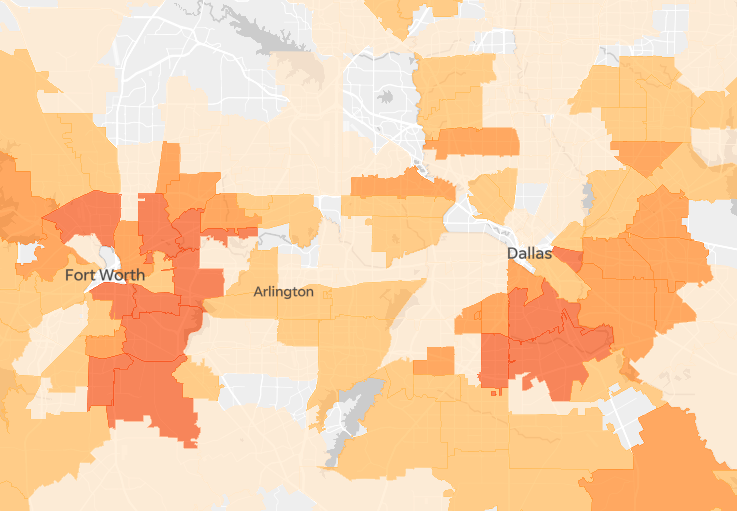

In addition to boots-on-the-ground reporting, USA Today mapped reverse mortgage foreclosures across the country from 2013 through 2017. This is where we get a sense of the costly local toll. You’ll see the map above this post, zoomed into Dallas-Fort Worth. The darkest red areas represent rates of at least six foreclosures per 1,000 senior residents.

There are dozens of foreclosures spread across the region, high concentrations in southern Dallas, and high rates across much of Fort Worth. The highest rate in North Texas belongs to southern Dallas’ 75216 zip code, where there were 108 total foreclosures—a rate of about 13 foreclosures per 1,000 seniors.

The map is embedded with the story. In addition to exploring our area, you’re able to zoom into the cities USA Today calls out as particularly hard hit by practices consumer advocates call predatory—Chicago, Detroit, Baltimore, Miami, Philadelphia, and Jacksonville. But doing so only serves to underscore that there were plenty of these foreclosures in our own backyard, as well.