As 2020 comes to a welcome end, the North Central Texas land market has seen significant influences modifying its prior three years of sales and absorption activity. To some surprise, the effects of COVID 19, an agonizing political competition, a profound market disruption in retail, entertainment, and hospitality have not had a serious impact on land pricing and activity. In reviewing last year’s report, only a few observations have changed.

For many years, our Investments/Land Group, a division of Younger Partners, has produced a report designed to help investors review the viability of acquiring for investment undeveloped land for medium and long-term positive returns. Since our 2019 report was distributed, DFW has experienced continued active growth in specific commercial and residential product types and distinct devaluations in others. However, total transaction volume has held steady for both user and investment product for all residential and industrial uses and lessened for office and retail uses.

Absorption of residential, developed, undeveloped (land without access to infrastructure permitting immediate use), and underutilized land has progressed at an ascending rate over 2019. That increased activity has offset the decrease in the less active product segments. The trend continues as increased, aggressive; new vertical development has left even fewer desirable infill sites remaining for the desired uses with much less desirable site uses seeking zoning changes.

Recent infill development site purchases have been at record sales prices per square foot for industrial and all residential (SF, MF, and SF for rent). More peripheral sites see increased activity, with employers still competing for employees who desire a shorter commuting distance despite the COVID 19 flight to home office.

Before the 1950s, DFW had hardly been noticed by the east and west coast’s industrialized areas and the belt between Chicago and NY. It certainly held no appeal for any major investment despite its central location and climate. Insurance and oil and gas formed the Texas asset-based economy and were the major regional employers. Texas had a law that requires any insurance company doing business in Texas had to be headquartered in Texas. Thus, while Houston became the state’s center for oil and gas activity, DFW became the state’s insurance and banking capital. Livestock and agricultural products still reigned as the major income producer and employer.

It wasn’t until the mid-1950s that DFW began to emerge as a recognizable economic entity.

A severe drought in 1955 and 1956 served to set back growth and to serve as a wake-up call. The need to prepare inadequate infrastructure had to be addressed should there be any hope for growth. Fortunately, DFW leadership stepped up to the task.

Men like Trammell Crow, the Stemmons Brothers, Amon Carter, and the Bass Family formed partnerships, some reluctantly, to plan for reservoir and highway construction to meet new growth. More importantly, they saw the projects through to completion, most of which are still current today. Unhampered by physical restrictions, DFW could and did expand, continuing to this day, in all directions because of the infrastructure these farsighted philanthropists created. (Dallas-Fort Worth Commercial Real Estate, Hall of Fame, The Book, 2018)

While few deny that our extended period of strong economic growth has proven vulnerable, actual project starts and announcements of pending projects have maintained their 2019 pace, arguably fueled by industrial and multifamily.

While few deny that our extended period of strong economic growth has proven vulnerable, actual project starts and announcements of pending projects have maintained their 2019 pace, arguably fueled by industrial and multifamily.

Although being partially filled by extensive inbound migration and rapidly increasing construction costs, the continuing low unemployment rate seems not to have a major influence on developers’ positive personalities. Wisely, projects are being valued on a long-term basis, assuming a negative period within their ten-year hold expectations. A common belief within the investment community holds that DFW is well-positioned to absorb even a relatively strong readjustment and has emerged as a top-five national investment market.

Despite sale prices at a multiple of replacement cost and static retail demand, income-producing investments have maintained their active volume due largely to the need to invest 1031 trade equity and lack of competition with alternative investments, which has kept capitalization rates at record historical lows.

Despite sale prices at a multiple of replacement cost and static retail demand, income-producing investments have maintained their active volume due largely to the need to invest 1031 trade equity and lack of competition with alternative investments, which has kept capitalization rates at record historical lows.

Excessive competition to acquire cash flow assets providing even the smallest yields produces increased vulnerability to market corrections. A cyclical downturn in the national economy would have a dour, negative impact, and threaten or eliminate positive cash flows. Inherently, land investment differs greatly from other types of real estate products generally because of its inability to produce interim cash flow and its considerably more sensitive vulnerability to recurring cycles. While becoming more sophisticated over the last two cycles, the criteria used to determine potential land opportunities remains principally in implementing basic strategies.

Perhaps the most important of these is the ability to project and fund ownership long term. Positive liquidity, the ability to sell for an acceptable profit at the optimum market time, can be highly speculative. When an investor is placed in an imposed forced sale position or loses confidence in the future of the investment, returns are jeopardized and most frequently result in a significant loss.

Like most types of investments, real estate is cyclical. Investment success or failure can often solely depend on where the cycle is when the purchase is made in conjunction with the investor’s ability to determine the true state of the cycle. Buying at various points in a cycle, cost averaging, can provide some security. There has yet to be a final cycle; thus, the ability to hold long term may affect the yield but does offer some degree of safety. With access to historical data, projecting long term value, while still speculative, is much more achievable.

Like most types of investments, real estate is cyclical. Investment success or failure can often solely depend on where the cycle is when the purchase is made in conjunction with the investor’s ability to determine the true state of the cycle. Buying at various points in a cycle, cost averaging, can provide some security. There has yet to be a final cycle; thus, the ability to hold long term may affect the yield but does offer some degree of safety. With access to historical data, projecting long term value, while still speculative, is much more achievable.

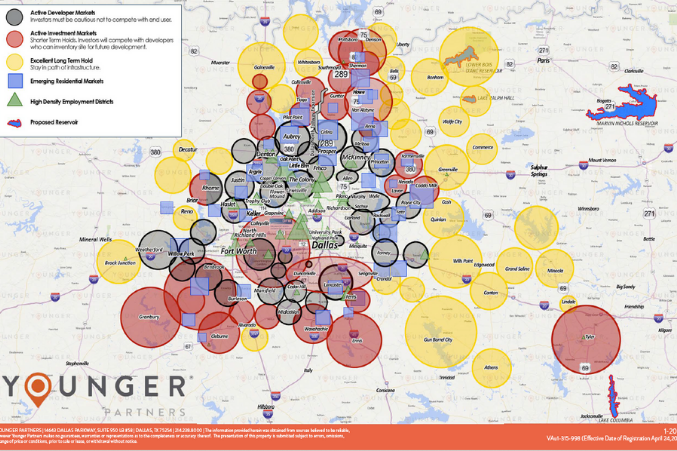

Our report includes our Land Absorption Map, which sets out the various types of 2020 commercial real estate land activity in specific geographic areas. Actual sales, current listings, and announcements of pending projects are the basic criteria used and benchmarked annually to complete the current year’s map.

Not difficult to understand, the progression from active to long term generally follows the current infrastructure and newer expanding utility systems. Land currently available for vertical construction will bring significantly higher value over those that must wait for services.

Over the twenty-plus years of presenting the map, it is interesting to note that, while the circles have limited movement, the colors have many changes and generally move out from the core in concentric circles.

Younger Partners is a member of the highly respected North Texas Land Council (NTLC), a group comprised of 50 of the most active, knowledgeable, and talented land brokers in DFW. Believing that activity generates more activity, the North Texas Land Council freely shares information with its competing members, and the market in general, on a level of professionalism unusual within similar organizations. As such, the organization is a benefit to all clients and to those anticipating a land investment. Much of the projected activity displayed on the Younger Land Absorption Map (YLAM) reflects the activities of the NTLC.

Through 2019, the market today continued to see record prices for infill, readily developable sites possessing available infrastructure, permitted anticipated uses, and increased demand for products. Because of the many increased cost factors, single-family new home prices have increased fifty percent in six years, making affordability more difficult.

However, historically low long-term interest rates have dramatically increased single-family affordability. Less obvious are the increases in completed per square foot costs in all commercial sectors. The surprisingly strong national economy, despite interruptions, as well as strong continued inbound relocations have provided record employment and income, despite a pandemic.

Short-term projections are difficult, long-term less so. Perhaps one of the strongest influences softening the impact of a correction is the enormous amount of uncommitted cash held by investors awaiting their perception of pending opportunities. That cash will be quickly reinvested, steading prices in the event of a devaluation, by investors not wishing to miss their perceived value. A suspect stock market and weak oil and gas prices also has contributed to the attractiveness of real estate.

Our continuing extended analysis, as displayed on the “Younger Land Absorption Map” (revised December 2020), is principally based on extensive historical data collected utilizing over 150 years of market experience possessed by Younger associates, members of the NTLC, and reliable future projections from sources that have traditionally displayed accurate information.

Our market demographic information was provided by Steve Triolet, director of Younger Research. Depending on which source one chooses to use, the DFW market still expects to absorb an additional expansion of over 30,000 acres over the next fifteen to twenty years.

In conclusion, the principles of sophisticated investment must utilize primary criteria, some of which are outlined above. Reviewing the many years of land abortion maps provides distinct, valuable growth trends applicable to intelligent investing. Access to infrastructure, most importantly water, the admirable effort by our past Dallas Mayor to utilize available land in our southern corridor, absorption of the remaining few infill sites, high suburban infill land costs, and the migration of employment centers will all play significant roles in prudent land investment decisions. Utilized in the investment process, the only remaining elements are sound financial strength and patience.

Robert Grunnah is a Member of Younger Partners.