Retail and shopping continue to make headline news. A large part of those discussions center around the impact of e-commerce on bricks and mortar. With the International Council of Shopping Centers (ICSC) conference coming to town and the holidays just around the corner, we will likely be hearing more about that. But, is that the whole story?

It is clear that e-commerce has changed the way we shop. Consider your own shopping patterns and the retailers you have patronized in the past and today. Commodity items like books, household goods, and certain furnishings and apparel items have quickly moved online. Let’s face it, it is easy to shop for these items and shipping has become fast.

I think a largely underscored factor here that is affecting retailers are the debt loads many have taken on over the last years. As you look at the companies closing stores or having filed for bankruptcy, one common factor is high debt. I am amazed when I find that debt is often in the billions and, if not in billions, exceed their assets by wide degrees. The reasons for racking up this debt are complex—but the common denominator is that the debt came at a sometimes hidden price—much like a “corporate” pay-day loan.

Companies making the news are places we have all shopped. One of the most recent is Toys R Us. While toys have become an online commodity, is it the loss of sales or the reported $7.9 billion in debt against $6.6 billion in assets that is causing the pressure? Likewise, Neiman Marcus and Macy’s both carry $5 billion in debt, with Payless at $2.3 billion emerging from bankruptcy a few months ago, and Sports Authority at $1.1 billion shuttering its stores last year. Or Sears, which reportedly may not make it to the holidays due to struggles with high costs. There are other examples, as well, of smaller companies that have suffocated under debt, like The Limited and BCBG Max Azria.

The impact of online has been analyzed by groups like the ICSC. Generally, they have shown that online sales are modest at about 10 percent of total retail—although increasing. It is not only online, though—it is also the split between omni-channel and pure play online retail. To keep it simple, omni-channel includes retailers that have both a strong bricks and mortar presence and online presence—think of the companies where we all shop in person and online like Target, Walmart, Bed Bath & Beyond, etc. Pure play are companies with only an online presence.

In terms of that 10 percent of retail sales going online, perhaps 4 percent is flowing to the pure play retailers. The remainder is being captured by omni-channel. So here is my question—does omni-channel really matter? Of course there is internal accounting of where the dollars flow in a company and a difference in cost of goods sold, but essentially whether an item is purchased online or in a physical store, an omni-channel retailer wining the sale is all that matters.

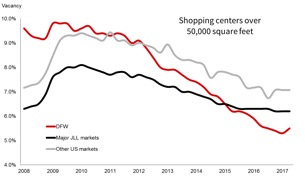

If we look at shopping centers across the U.S., their performance has been pretty strong. In terms of vacancy, the industry is in better shape now than it has been in many years. As noted in our chart, there is almost no vacancy in DFW, a fast growth market. Even in the larger markets we track, vacancy is vastly improved from the recession. At these levels, limited space exists for retailer expansion or growth. Yet, the news persists of how impacted the industry has been.

What is the outlook? Again, it is complex—and much more than just e-commerce. On the one hand, debt has been relatively cheap, at least less expensive than raising capital. Unfortunately, sales growth at the retailers we have shopped at may have not ramped up quickly enough to balance the debt. Instead, eCommerce took away some of that growth and now these companies are looking at an environment where interest rates may be on the upswing (we been talking about that for a couple of years now).

Clearly, this topic demands more work. As I close out this blog, I have scheduled some time to dig into this topic further, so stay tuned for more from our team at JLL.

Walter Bialas is a vice president and director of research at JLL in Dallas.