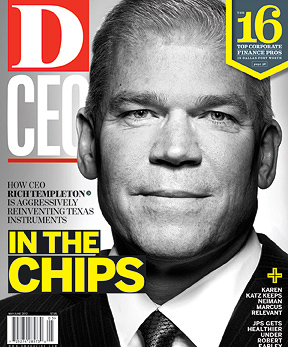

Rich Templeton isn’t much one to talk about himself. But unleash him in front of Congress on the topic of American innovation, or at the latest Goldman Sachs investor conference for a technology presentation, and he’s in his element.

Learning of my quest to find out more about the man who leads Texas Instruments Inc., he adjusts his sport coat at his Dallas headquarters and jokes that the Goldman talk in January was “easy stuff” compared to this.

It’s not that Templeton isn’t personable, or knowledgeable, or that he has anything to hide. In fact his dry wit and easygoing demeanor make him instantly likeable, and he can explain the significance of semiconductors so clearly that even a child could understand. The truth is that Templeton, 53, is a savvy businessman and engineer all in one unique package. But he’d rather roll up his sleeves and get to work than talk about it.

“He’s the real deal,” says Brian Toohey, president of the Washington, D.C.-based Semiconductor Industry Association, where Templeton serves on the board. “He’s an incredible executive, incredible communicator, and he has a terrific no-nonsense, straightforward way of explaining complicated technology issues to policymakers and to anyone. He’s just an extraordinary mix of leadership and knowledge, but a terrific, humble person.”

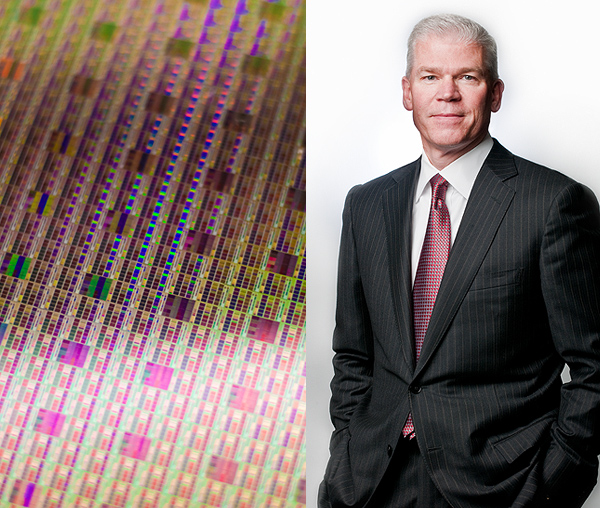

Thoughtful and carefully spoken, Templeton has spent his entire 32-year career at TI, the past eight as president and CEO. Since taking the helm he has been steadily reshaping the semiconductor manufacturer, moving it away from other technologies to focus on analog and embedded-processing growth, all while repositioning its wireless business in the smartphone market. Under Templeton, TI has bet the farm on analog chips, which process and convert “real world” signals—sound, temperature, electricity—into the 1’s and 0’s of the digital world.

The company has its work cut out for it. On average, 13 analog chips per person are sold each year for devices found in places like your car, kitchen appliances, air conditioner, notebook, and smartphone. The chips can make medical devices like ultrasounds portable. They’re being used in intelligent thermostats that adjust to user habits and patterns, and they have vast applications for cloud computing and energy efficiencies not seen before.

The possibilities, Templeton says, seem endless. “Literally every piece of electronic equipment you have at work or home has at least one, if not multiple, analog chips,” he says. “We have a chance to sell something to every customer in the world. The number of companies that can say that are pretty limited.”

Aggressive Moves

The shift in focus represents a giant leap for a company that began selling tricked-out calculators 45 years ago. That segment, which remains important because of its impact on education, accounted for less than 4 percent of the company’s $13.7 billion in revenue last year. With the $6.5 billion acquisition of Santa Clara, Calif.-based National Semiconductor in September, nearly half of TI’s business now is in the analog space.

Some critics say TI paid too much for the struggling company—a whopping 78 percent premium per-share over the closing day’s stock price. But others say if the integration of 5,600 employees and 12,000 analog products goes smoothly, TI could come to dominate the $309 billion analog market. It currently ranks third, behind Intel Corp. and Samsung Electronics Co.

Templeton says that although the final chapter on the National Semiconductor deal has yet to be written, it was a “bold, correct move” given the economy, the opportunity, and his vision for the company.

“There’s some confidence behind that,” he says. “We’re not afraid to make aggressive moves in down economies, while everybody is kind of scared and waiting out the fear of, ‘Is the sun ever going to come up again?’ We learned the lesson over time: Don’t be afraid to make moves when they make sense.

“We saw an opportunity with National Semiconductor and it was absolutely in line with this vision of the world that we have, and we thought the numbers could work. As a result, so far, so good. We’re pleased with the way the customers have responded, and pleased with the team out in California. We’re going to be focused on converting that into great results.”

Templeton isn’t alone in his optimistic outlook. Betsy Van Hees, an analyst at Wedbush Securities, likes TI over all other big companies in the semiconductor sector. The Dallas firm is well-positioned to grow starting in the second quarter, she says, because of its market-share gains in analog and the increasing silicon content in mobile devices.

“We view the consolidation of the analog sector as a considerable positive for the industry,” Van Hees says. “We believe TI made the right decision in acquiring National Semiconductor, because it increases TI’s market share, manufacturing, and sales, as well as provides TI with a greater footprint across several end markets, particularly industrials, where National has been particularly strong.”

Under Templeton and his predecessor, TI has taken an aggressive approach to buying or selling companies that don’t fit in with its emphasis on analog and embedded processors. Since 1996, TI has acquired 33 companies and divested at least 18—from defense to liquid-crystal-display operations—that were not central to this razor focus. (See story on page 53.) Many of those sales and acquisitions were completed during Tom Engibous’ tenure, which ran from 1996 to 2004. But Templeton, who served first as semiconductor group president and later as COO, shared a similar mindset with his mentor and colleague.

“Tom and I worked together well, and we really had a common view and very broad strokes of, ‘Let’s get our company into better businesses, which are analog and embedded processing today,’ ” he says. “We benefited from a great market that discovered us back in the ‘90s in the wireless business, and from not being afraid to make tradeoffs to get into better businesses.”

MoneyGram CEO Pam Patsley, who has served on TI’s board since 2004, says Templeton is willing to take measured risks based on many different perspectives—and a lot of data.

“It has been rewarding to see how he has continued to lead TI through some really challenging economic times,” she says. “He’s not afraid to make some hard decisions, but his sense of balance and fairness is right where it should be.”

Although it might seem unusual that Templeton has spent three decades at TI, he says it’s common for TI’ers (as the employees are called) to stick around for awhile. “It really is a case of a unique culture where we keep challenging people with more,” he says. “The next thing you know it’s 32 years later and you’ve enjoyed what you’ve worked on and who you’ve been able to work with.”

CEO’S Impact

It didn’t take Templeton long after finishing his schooling to join that “unique culture.” One week after graduating with an electrical engineering degree from Union College in Schenectady, N.Y., in 1980, he moved to Texas to take a sales job in the semiconductor business at TI.

Growing up in a city outside Poughkeepsie, N.Y., the athletically inclined son of an IBM engineer and schoolteacher says he declared his major on “the first day of showing up” at Union College. It was there that Templeton met his future wife, Mary, a computer-science major. They lived on the same floor, became friends, and he helped her with calculus, she remembers. After they married, the couple settled down in Parker, a sprawling Collin County suburb, where they raised two sons and a daughter.

The early 1980s were a challenging time under then-chairman Mark Shepherd Jr. and president J. Fred Bucy, who was called abrasive and autocratic. TI recorded its first-ever revenue loss of $145 million in 1983, due, in part, to the recession and an unforecasted slump in demand for its home computer. The company was deemed the de facto seller of home computers, even hitting the 1 million mark in sales, but competition was heating up and, eventually, TI exited the business.

Some analysts call those the darker days for TI. But things brightened up in 1985, when Jerry Junkins was named president and CEO. Junkins is credited with loosening up the corporate culture and encouraging innovation, while helping reposition the company to better compete in the 1990s.

“We’ve learned, without exception, that whatever the CEO is like, it drifts incredibly quickly through the whole company,” says KRLD business analyst David Johnson, who has followed TI for nearly three decades. “The personality of the CEO quickly permeates the company. Junkins did an overnight turnaround. This is the group that Templeton came from, the new wave. They had a laser-like focus on [digital signal processors]; that was going to be the great new thing, and they sold all of this great technology. That’s the mold that Templeton came from.”

Junkins died of a heart attack on a business trip in 1996, quickly thrusting Engibous, a 20-year TI veteran already serving in an executive role, into the spotlight as CEO. Another TI vet, Jim Adams, was tapped as chairman.

During “those transitions when faced with such emergencies, these guys did a terrific job,” Templeton says. “The board made some wise decisions about the direction of the company and the choice of leaders.”

For 15 years Templeton worked with Engibous, who’s credited with transforming the company from a broad-based conglomerate to a semiconductor company focused on making chips for the signal-processing markets that have fed the wireless and Internet revolutions.

After years of grooming, Templeton stepped into the president and CEO roles in 2004, and was named board chairman in 2008.

It seems fitting that Templeton’s name may someday adorn a Dallas building or two, much like TI founders Cecil H. Green, Patrick E. Haggerty, John Erik Jonsson, and Eugene McDermott. For now, however, his ambitions lie elsewhere.

“It all comes down to, how well is TI run?” Templeton says. “There is no greater assessment of how well you’ve done than, ‘Do you leave the place stronger?’ A lot of my time and energy and passion goes to that. The same philosophy carries into what you do in your personal life or organizations and groups that you’re affiliated with. If you’re going to invest the time and effort, do you leave it stronger than when you arrived?”

Setting the Tone

Clearly, Templeton practices what he preaches. It isn’t every day, for example, that a CEO leads an internal United Way campaign. But Templeton has quietly taken on that role at TI for the last 10 years, garnering employee support and helping raise millions of dollars for the nonprofit. “Investing in the community that you operate in doesn’t just make sense emotionally, but there’s some pretty sound logic to it,” he says.