A couple of weeks ago, I took a look at the financials of the Dallas Convention Center, prompted by Philip Jones’ announcement that he planned to borrow a quarter billion dollars in public money to expand the facility. To summarize, I discovered:

- The city of Dallas is currently subsidizing the facility to the tune of roughly $53 million per annum; and

- Three years and $500 million later, the construction of the adjacent convention center hotel hasn’t had any discernable impact on the convention center’s bottom line.

Today, I’m taking a look at the financial performance of the convention center hotel itself. Back in January, city staff presented a fairly glowing review of the hotel’s performance, which prompted council members Jennifer Staubach Gates, Philip Kingston, and Lee Kleinman to suggest selling the property. In contrast, council member Jerry Allen said that we should hold out until “the timing is right,” and Tennell Atkins said we need to spend another $27 million to build a restaurant & parking complex, first, to make it truly desirable (for some reason, no one bothered to mention prior to construction). More recently, the Dallas Morning News ran a curiously timed article touting the Omni’s 2014 success. Evidently, the news was so pressing the paper’s editors decided they couldn’t wait until the end of the year to inform readers of this important development. Zac Crain shed some light on possible motivations.

So, is it successful or not? Let’s take a look.

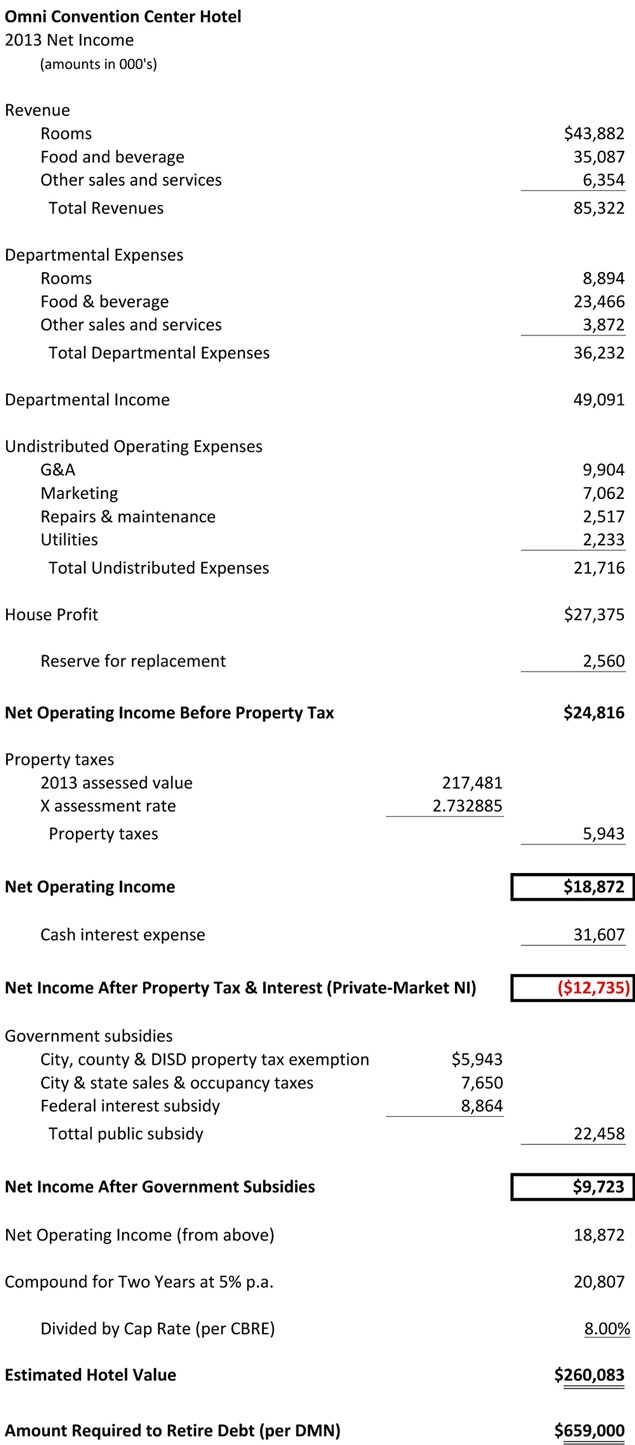

As indicated in the table below, the property’s 2013 income statement reveals a house profit (“property net income before debt”) of $24.8 million, exclusive of depreciation, but inclusive of a 3 percent “reserve for replacement” noted in the original market study. So far, so good. Then, however, we have to address property taxes & debt service. To determine property taxes, I used the 2013 DCAD-assessed value of $217.5 million and applied 2013 assessment rates against that value, resulting in $5.9 million in estimated city, county & DISD property taxes. The resulting property net operating income is thus determined to be $18.9 million, before interest, after making provision for property taxes.

As noted on the balance sheet, the hotel is encumbered by $489.6 million in total debt. Servicing this debt required cash interest payments of $31.6 million in 2013. After deducting interest and making proper allowance of property taxes, the property appears to be losing $12.7 million per year.

Let’s see, did I mention that this is a government-owned hotel, just like Havana’s Hotel Nacional, Tripoli’s Bab Al Bah Hotel, and Pyongyang’s Yanggakdo Hotel?

I was purposefully overlooking this key factor to suggest that the Omni is operating at a loss. The hotel is owned by the city of Dallas, and being owned by the city brings many benefits. First of all, it’s exempt from all property taxes, resulting in an estimated $5.9 million savings per annum by shorting DISD, Parkland, the city of Dallas and Dallas County. Second, unlike other Dallas hotels, the Omni is allowed to pocket all of the sales and hotel occupancy taxes it collects, resulting in $7.7 million in additional revenue. Finally, the Federal government reimburses the city for a portion of the interest expense it incurs on the hotel, resulting in an additional $8.9 million in annual revenues.

All told, the hotel received $22.5 million in taxpayer subsidies in 2013. Once those subsidies are factored in, the hotel shows a $9.7 million profit. “Success“ at last!

In other words, take a 100% leveraged, money-losing hotel investment, sprinkle liberally with taxpayer largesse, and it doesn’t look half bad, for the time being. Of course, hotels are notoriously risky investments with highly volatile income streams, and debt payments are scheduled to escalate sharply over the next several years (the project’s financial structure features bond payments that step up sharply over time, allowing those who originally structured this deal sufficient time to put a fair amount of space between themselves and the deal; some hapless future mayor or city manager can take the fall, if necessary). But those are tomorrow’s problems, unless we sell this “successful” investment, following in Houston’s footsteps as former Mayor Leppert had suggested.

So what about this idea — raised back in January — of selling the property to a private investor?

To assess the value to a private investor, we need to look at the 2013 “Net Operating Income” of $18.9 million, because a private investor wouldn’t be able to pocket the sales taxes and Federal interest rate subsidies that the city collects, but would be liable for property taxes. Then, we adjust that upwards by taking the city claim that profits will be up 10 percent this year at face value. That gives us an estimated net operating income of $20.8 million. To determine value, we need an income capitalization rate, and CBRE suggests that 8 percent is probably a safe number for a full-service hotel located in Dallas.

Dividing $20.8 million by 8 percent gives us an estimated value for the hotel of $260 million, and this is where things start getting sticky. As noted previously, the city owes $489.6 million on the hotel, and even factoring in cash reserves, we are still over $100 million in the hole on this thing. But wait, it gets worse. According to the DMN article referenced earlier, we would actually have to pay out a whopping $659 million to pay off the hotel’s debt, an amount that appears to be well in excess of double the property’s value.

So the Omni is consuming more than $22 million per year in city, state, and federal taxpayer subsidies, and the only way to stop the hemorrhaging is for the city to cut a check of several hundred million to make up the shortfall between the hotel’s market value and the much larger amount required to clear the associated debt. Oh, did I forget to mention that the property’s debt service payments begin to escalate sharply within the next five years? In other words, there will be no early checkout of this speculative investment for city taxpayers.

And now, taxpayers are being primed to fund another quarter-billion dollars to expand and renovate the convention center, because of additional demand coming from the hotel, or something.