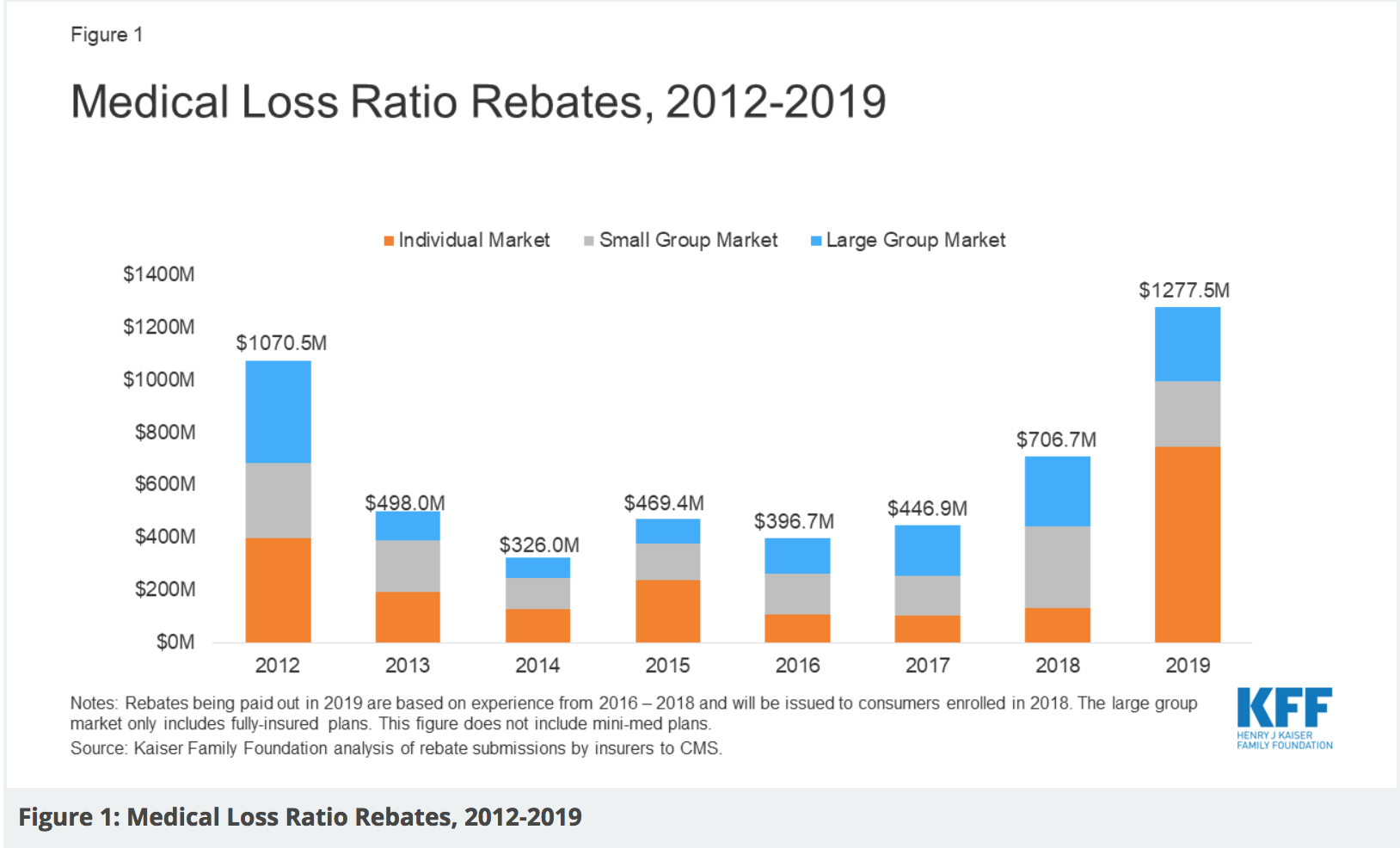

Private insurers will pay a record of around $1.3 billion in rebates to consumers this year for excessive premiums relative to health care expenses, surpassing the record high of $1.1 billion in 2012, according to a Kaiser Family Foundation report. Rebates may either be paid out in the form of a premium credit or as a lump sum, though lump sum is more common.

Rebates are the result of insurance companies not meeting the Affordable Care Act’s medical loss ratio threshold, which requires insurers to spend at least 80 percent of premium revenues (85% for large group plans) on health care claims or quality improvement, limiting the portion of premium dollars health insurers may use for administration, marketing, and profits.

The report says that total rebates were just under $1.3 billion, but the majority of the rebates ($743.3 million) were for those in the individual market. 2012 saw a previous high of nearly $1.1 billion, but rebates hovered between $700 million and $300 million for the past six years. This year saw rebates nearly double, with most of the rebates coming from the individual market. The states with the largest expected rebates in total include Virginia ($149.6 million), Pennsylvania ($130 million) and Florida ($107.4 million).

The insurer Centene ($216.9M) owes especially large rebates. Other insurers issuing large rebates include Sentara ($98.9 M), Health Care Services Corporation ($78.5 M), Cigna ($55.9 M), and Highmark ($50.8 M). These insurers tend to have high enrollment and participate in a number of states. HCSC is the parent company of Blue Cross Blue Shield of Texas. Each individual member who purchased HCSC insurance in the individual market will receive a $180 rebate. Individual market plan holders in Virginia who purchased insurance with Sentara/Optima will receive $1,850 in rebates, according to the report.

Rebates span all three private insurance markets- the individual market, the small group market and the large group market. Rebates in the small and large group insurance markets are more similar to past years, at $250 million and $284 million, respectively, while individual market insurers owe expected rebate payments of at least $743.3 million, their highest ever. In the individual market alone, Texas ($80.4 million) is estimated to be third-most rebated after Virginia ($111.3 million) and Arizona ($92.3 million), the report says.

Currently, MLR calculations are based on a 3-year average, meaning 2019 rebates were based on insurer’s financial data in 2016-2018. Insurers in the insurance market were operating with significant losses in 2016, but by 2017 financial performance had begun to stabilize as premiums rose. Insurers in 2018 were highly profitable and arguably overpriced, which has pulled up the rebates despite 2016 and 2017 being less favorable.

The report estimated that it is likely that individual market insurers will continue to own large rebates next year, in September 2020, as the rebate calculation at that time will be based on 2017, 2018, and 2019, and will no longer include a year with significant losses.

Read the entire report here.