Having a financial emergency without the means to solve it is a situation many have experienced. It becomes more frustrating if you have a bad credit score because many lenders won’t consider your application. A traditional financial institution will spend considerable time vetting your information and still deny your loan request.

Fortunately, these days, getting turned down for personal loans is not a deal breaker because there are tons of other options to choose from. Online bad credit loan sites are the go-to source for a loan for bad credit scores borrowers. And you can get an approval immediately. Read further to know the best-unsecured loan sites you can patronize with bad credit scores.

Best Bad Credit Personal Loans Guaranteed Approval

- MoneyMutual: Overall Best Bad Credit Loans Guaranteed Approval

- BadCreditLoans: Popular Online Lenders Offering Bad Credit Loans Online

- Money-Wise: Top Same Day Payday Loan Company With Instant Loan Approval

- RadCred: Get Quick Online Loans For Bad Credit No Credit Check

- CashUSA: Trusted Financial Institution Providing Fast Cash Loans

- Personal Loans: Get Personal Loans With No Credit Check From Best Loan Services

#1. MoneyMutual: Overall Best Bad Credit Loans Guaranteed Approval

Pros

- Their service is free

- Multiple lenders to choose from

- Guaranteed 24 hours instant approval

- Flexible lending interest rates and repayments

- They lend to individuals with minimum credit scores

Cons

- Limited loan amount to borrow

- Only available to US citizens and residents

MoneyMutual offers a secure and safe platform for borrowers to lend upto $5000 to solve their emergency. They connect borrowers to many lenders but do not have a hand in the lender’s rate. It takes minutes to fill out their application form, and if you meet their eligibility criteria, you will be connected to a lender.

What To Expect From MoneyMutual

Fast Funds Transfer

Lenders on the platform will fund your preferred checking account within 24 hours of you accepting their interest rate. Bad credit scores are not a deterrent to loan approval. However, it will have a hand in the lender’s interest rate.

Credit Repair

Lenders on the platform are likely to help repair your credit score if you repay the bad credit loan early. They will send your information to major credit bureaus, helping to turn around the state of your scores.

Ease of Use

The site is user-friendly; you don’t have to be a tech guru to understand its features. They provide information to guide their site’s visitors; every heading is self-explanatory.

⇒ Visit the Official Website of MoneyMutual

#2. BadCreditLoans: Popular Online Lenders Offering Bad Credit Loans Online

Pros

- You can request a loan of upto $10000

- They offer loans for any purpose

- No pressure to sign with lenders

- Topnotch data protection policy and security

- They provide other loan services

Cons

- Limits to the loan amount you can access with bad credit

Bad Credit Loan will provide options for debt relief and credit repair if they can’t find a loan for you. You will have to complete a three-step online application to access a loan from $500 to & 10,000. They also have multiple lenders willing to give loans for bad credit to individuals without checking their credit scores.

What To Expect From Bad Credit Loan

Variety of Loan Options

You can access a loan for any purpose, from medical emergencies to going on vacation, planning a wedding, debt consolidation, paying credit card bills, rentals, etc. Lenders will provide you with their APR and other fees in their loan agreement. You’re not obligated to sign after reading the terms. The contract is only valid after you append your signature.

Scam Education

They provide numerous information on scams on their website to help keep people abreast with fraudulent situations online. It will help to go through them to best know how to protect yourself against online fraud.

Great Customer Reviews

Bad Credit Loans has amassed a great following, catering to over 750,000 borrowers. They have positive reviews from people that attest to the legibility of their service. Also, many review sites have good things to say about them.

⇒ Visit the Official Website of BadCreditLoans

#3. Money-Wise: Top Same Day Payday Loan Company With Instant Loan Approval

Pros

- Guaranteed installment loans for bad credit loans

- No credit history check loans

- No charges for exploring their site

- Accredited by the better business bureau

- Part of the online lender’s alliance (OLA)

Cons

- Lenders only transfer funds during business days

Money-Wise is another site that will offer you a bad credit loan faster than your bank. They do not request paperwork to apply for a loan, and their lenders provide one of the best interest rates for payday loans for bad credit. Also, you do not have to worry about your credit score getting lower if a lender rejects your application.

What To Expect From Money-Wise

Customer Service

They have excellent customer service that will respond to your inquiries professionally. They are open from Monday to Friday with weekends off. You can also send them an email with your questions.

Money Transfer to Your Preferred Account

The lenders will send the money electronically or to your personal bank account. You’re required to have an active bank account before transactions proceed. Also, they can write you a paper check and mail it to your home address.

⇒ Visit the Official Website of Money-Wise

#4. RadCred: Get Quick Online Loans For Bad Credit No Credit Check

Pros

- They provide certified lenders with cheap APR

- Partners with other top financial companies

- It’s easy to land a lender

- Your vital information is not shared with lenders unless it’s necessary

- No limitation on loan usage

Cons

- You might not access substantial loan amounts with a bad credit score

RadCred is a platform that aims to make your loan journey easy and fast. They use their algorithm to match you with lenders likely to accept your payday loan application. They have credible lenders who will send you their loan terms with no hidden charges or excessive penalty fees.

What To Expect From RadCred

Negotiate Interest Rates

They have multiple lenders, and you can negotiate the interest rate till you arrive at a term that suits you. Also, you can arrange the repayment plan to be in monthly payments to avoid burdening your income.

Informative Blog

They have a blog section on their platform offering news and articles that will enlighten you on finances. You can access their platform’s information by clicking on the blog section at the top.

Easy To Meet Criteria

The criteria to meet are easy and seamless. You will not be required to mortgage your property for the loan. All you have to do is go through a lender’s rate to know their interest rate and penalty for defaulting on repayment.

⇒ Visit the Official Website of RadCred

#5. CashUSA: Trusted Financial Institution Providing Fast Cash Loans

Pros

- They offer loans for debt consolidation

- Secured and effortless application

- You can pay back in installments

- Access upto $10,000

- They provide short-term loans

Cons

- They might share your information with third-party lenders

CashUSA requires you to earn above $1000 to be eligible for unsecured personal loans on their platform. And you don’t have to exert yourself for loan repayment. The lenders automatically withdraw the loan from your account on the scheduled date.

What to Expect From CashUSA

Third-party Lenders

CashUSA will send your information to third-party lenders if you cannot land a lender on their platform. This might be a problem for people that seek data privacy. However, CashUSA verifies their third-party lenders, so your information is safe. The third-party lenders will offer you credit repairs, debt relief, or consolidation.

Possibility of an Extension

If you’re going to miss your payment, you can inquire about the possibility of an extension. Many lenders will offer extensions to borrowers for a fee, and many will do so free of charge, so it doesnt damage their credit.

Soft Credit Check

Some lenders on the platform will perform a soft credit pull when you submit your application to determine your eligibility. However, soft credit checks will not damage your credit score. But if you do not repay timely, lenders might report your default to one or more credit reporting agencies, which will lower your score.

⇒ Visit the Official Website of CashUSA

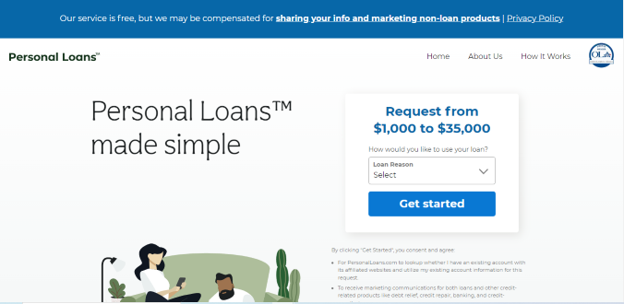

#6. Personal Loans: Get Personal Loans With No Credit Check From Best Loan Services

Pros

- You can access up to $35,000

- They do not ask for collateral

- Straightforward loan transactions, you can request for any time in the day

- All information on their website is easy to understand

- They offer access to an extended lending network

Cons

- Bad credit restricts the minimum loan amounts you’re eligible for

PersonalLoan is one of the oldest loan platforms you can count on for granting instant loans with bad credit scores. They have eligibility criteria you must meet to access loans like your age, US citizenship, and income level. The site offers guidance on avoiding scam platforms and displays a rough chart of loan rates and how much you will ultimately pay.

What To Expect From PersonalLoans

Transparency

The PersonalLoan platform is transparent with information on its website. They are not ambiguous with their word choice, so anyone can easily understand the information they provide. Their lenders also offer bad credit loan terms with no hidden charges.

Great Repayment Plan

Lenders on the platform loans feature repayment terms depending on your loan amount and fico score. You can get a loan repayment deal from a minimum of 3 months to a maximum of 72 months.

⇒ Visit the Official Website of PersonalLoans

Factors To Consider Before Choosing a Bad Credit Loans Guaranteed Approval

Do not settle for just about any online bad credit loan platform in your haste to have cash for your emergency. You might fall victim to fraudulent online sites offering cheap rates to lure in people. Although they are credible sites providing online bad credit loans guaranteed approval, you must do due diligence to know them. Here are some factors you should consider

- Privacy and Security

Seek bad credit loan brands that offer top-notch privacy and data security to ensure you will not become a victim of identity fraud. Read customer and blog reviews to know which bad credit loan companies they consider credible. Or you can go for the sites reviewed in this article.

- Interest Rates

Online loan & bad credit loan platforms usually have hundreds of online lenders with different terms and rates. Some lend strictly to borrowers with good credit, and some offer personal loans for bad credit borrowers. Ensure that the brand gives personal loans for bad credit borrowers before applying. That aside, read the bad credit loan terms thoroughly to grasp what it entails before signing. Discard the lender if the terms do not sit well with you. Lenders’ terms usually have origination fees, prepayment penalties, and a monthly payment schedule.

- Eligibility

Check the site’s eligibility criteria before going any further. Usually, the standard eligibility criteria are you have to be 18 years and above and have a stable income. Also, you have to provide proof of citizenship, or permanent residence in the united states and have a live checking account, email, and home address.

- Guaranteed Approval

Determine if the lenders on the platform will forward the funds to your account within 24 hours. You need to know how fast they are with their fund transfer to ensure you cater to your emergency fast. Also, determine if the site is easy to use with an effortless application process before proceeding.

Alternatives To Online Loans For Bad Credit

If you fail to land a online lender with any platform, consider one of these methods as a way of obtaining a bad credit loan for your emergency:

- Pawn Shops

Numerous pawn shops will offer you cash in place of any valuables. However, regardless of the value you place on the item, the pawnbroker will likely price it at half the price. You can only get a fair bargain if you’re great at bargaining.

- Borrow From Family or Friends

You can borrow funds from your family and friends to pay back on your next payday. They will likely understand your emergency and come to your aid. And unless they tell you to forget about the bad credit loan, ensure to pay them back on the scheduled day to avoid causing a rift.

- Auto Title

Auto title loans are secured loans in which the borrower puts up their automobile as collateral. They are also known as car title loans, and for the loan to be viable, the car has to belong to the owner and not be mortgaged. Note the lender can repossess your car if you do not pay back in time.

- Credit Card Cash Advance

You can request a credit cash advance if you own a credit card. The beauty of this system is you can withdraw cash in place of purchasing items or making payments with the card and cater to your emergency. However, you’re likely to accrue high-interest fees for the transaction. So key that into your plan.

- Credit Unions

Credit unions will offer you a bad credit loan to cater to your emergency. But you have to be a member for them to consider your application. They have a personalized customer service approach for their members. And credit unions might charge you high-interest rates due to your bad credit score.

FAQ’s: Bad Credit Loans

Q1. Can unemployed individuals get bad credit loans?

Yes, lenders can still loan unemployed individuals, provided they offer a payment method. This is because they are borrowers that possibly own trust funds, benefactors, or come from families that give them monthly stipends. They will grant them a bad credit loan if the borrower can prove without any shadow of a doubt that they have a means of repayment.

Q2. What happens if I don’t make payments on time?

You must repay the loan timely to avoid incurring penalties. Lenders state their penalty charges in the loan terms, so go through the terms thoroughly before signing. Ask questions if any statement confuses you and ask if you can get extensions and possible credit score improvement in case of timely repayment.

Q3. How costly is it to obtain a bad credit score?

Having a bad credit score puts you at a disadvantage. You will get high-interest rates from lenders, which makes the loan expensive. Lenders fix their rates depending on the amount you borrow and how long it will take for you to repay the loan. Additionally, if you don’t repay the loan, the penalty charges will add to the overall cost of the loan, making it expensive.

Q4. Will lenders approve loans with no credit history check?

Yes, you can get approved for Instant payday loans online guaranteed approval and receive funds in your bank account without the lender pulling your credit score. However, bad credit loans guaranteed approval like this usually have high-interest rates and minimum loan amounts.

Q5. How do I identify bad credit loan fraud sites?

Having an emergency might cloud your mind in your haste to get fast cash to solve your crisis. And bad credit borrowers are easy targets for scammers since they have fewer options. That’s why it’s important to research before deciding on a platform.

Fraudulent sites lack reviews or stage reviews to get borrowers. They might choose the names of popular financial institutions, tweaking them to deceive bad credit score borrowers. Another sure way of knowing a fraudulent site is if the lenders ask you to pay fees before getting the bad credit loan. Or if they do not disclose their fees before you apply.

Concluding On The Best Online Loans For Bad Credit Online

Check your credit report to know why you have low credit scores and determine how to fix it. Bad credit loan companies will help you solve your emergency. However, compare online bad credit loan lenders and choose the site that benefits you more.