I’m seeing a lot of hand-wringing, kvetching, and task force creating around the issue of affordability in Dallas. I, however, have yet to see anybody beyond Councilman Griggs and Brandon Formby at the DMN, hitting on some of the critical local issues. In my spare time this week, I’ll be working on some data sets to begin triangulating some of these issues so that we’re more acutely attuned to the challenges we face and the opportunities present to correct market inefficiencies and general disempowerment of the not- or not-yet-upwardly mobile. It should go without saying that our issues are much, much different than San Francisco or New York’s affordability issues. Therefore, the conclusions and recommendations are probably going to look much different.

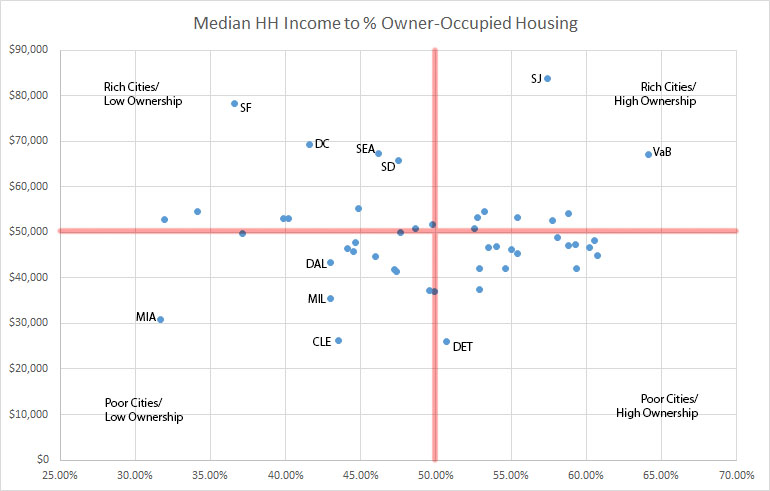

For now, I’ll begin by leaving you with this chart which shows the latest and greatest ACS data on household income and owner-occupied housing. I show this because I find too many people reflexively suggest homeownership is the cure to all ills (which is one of the deeper reasons we tend to hit housing bubbles every so often. Regs get relaxed to increase homeownership, in an ends justify the means way).

The real question is what is our goal? Is it merely homeownership? The generalized opinion is that homeownership creates wealth. We know for a fact that isn’t often the case as over time housing prices are pegged to income. Home create wealth when they’re in truly improving areas or are passed down between generations. But they don’t immediately create wealth on their own.

Cities exist in all four quadrants. There are very wealthy cities with less homeownership than Dallas. There are very poor cities with greater ownership than Dallas. In other words, there is little correlation between income and homeownership. Nor does it appear much relationship between cost of housing and homeownership. We have to look deeper and establish goals and priorities.

I suspect, based on where the cities lie on the chart, that density correlates with high renters. Density allows for lower transportation costs, which means cost savings from a different annual budgetary expense. I expect cities that are low density, low ownership are in the worst situation and that’s where Dallas finds itself. Disempowerment at two levels.

Further, if our incomes are too low we may be trapping people in place. That’s the opposite of what we should be doing. Renters by choice do so because often times they can generate greater returns with their income elsewhere, not tied up in real estate and can be more liquid. They also may not be interested in all the auxiliary costs of homeownership, like maintenance, fees, etc.

What we’re really talking about, whether it’s people suggesting homeownership or renters-by-choice is empowerment. Empowerment doesn’t necessarily mean homeownership. It may. In an area like Bishop Arts, it means property owners who may have sold their home for 10x (or more!) what they paid for it twenty years ago. In that case, the empowerment of ownership allows for diversification. Not all will sell, but some will if it is in their best interest allowing for an area to not simply be ‘white-washed,’ but will diversify naturally.

It’s empowerment that is a critical component to the gentrification issue. One way to define gentrification is the displacement by the empowered and upwardly mobile of the disempowered that results in a lesser outcome for the disempowered. They don’t have enough say and thus not an equal footing in the transaction. Reasons for this include, not just homeownership, but income levels, educational attainment, and general engagement in the neighborhood (which can be caused physically or via language barriers).

To solve this issue means to empower and that’s more complex than homeownership or inclusionary housing programs. It means improved education and skills training (human capital), engagement, and plans for anybody that does get displaced via rising tides that their outcome (new neighborhood wherever that might be) is a place of empowerment with access to opportunities via walkability and transit.

I’ll be adding other data points such as rent-to-income ratios, median rents, median home values, wealth disparity, and some others in order to better define local housing market inefficiencies, which by nature are rooted in the desirability of place.