Cities and economies are always under the pressure of “growth,” whether that be in economic activity, productivity, or physical expansion. The last of which is what twists the meaning and understanding of the inherent need for improvement. Perhaps “improvement” is the preferred terminology. Either way, it is first necessary to understand that this is the way we are wired. Second, we must put in some brain damage to minimize misteps

If we’re to apply the colonization habits of the honey bee, it is that they are on constant lookout for new nectar, new manufacturing opportunities for their very specific industry. The workers look for new territory and return to the nest “marketing” their finds. Other bees follow in order to “test” these finds based on the prospector bee’s marketing abilities.

Obviously, marketing can only get a colony so far, as the new lands actually have to prove productive, useful. The way of testing these new finds for their utility is the colony expands outward to the new finds much the way outward growth from a city does, testing the temporary value of the land to the needs of the day. As some prove more valuable than others, the shape and size of the colony follows the ability of the land to support it. Some expand, some recede.

With that, we are finding that much of our recent suburban growth (that of the last 20 years) is proving to lack resilience, importance, and usefulness. In fact, the things holding them up are largely due to temporary inertia based on population as it exists today, not in how it will exist in the future. For example, good schools are largely considered to be in the suburbs. But, as countless examples show, good schools follow population much the way a Whole Foods or a Target might.

Because of this constant testing and shape shifting, I wish to challenge the tautology of a few points of conventional wisdom and offer some ideas for underserved markets as to where the next areas of growth will be as we shift from an expansionist growth economy or an extroverted to an introverted one where we find value within our existing parameters.

I think each of these will be worth deeper introspection, but for now I’ll just provide a brief synopsis. Following the internet rules of 3s and 5s for the attention deficit’d, I’ll leave the list at three and provide pretty colors:

UNDERVALUED OPPORTUNITIES

In many ways, all of these are related. They represent markets or land that is less than its potential based on physical characteristics of constant urban dynamics, those being the patterns that are evident throughout the history of civilization but perhaps not today. The presumption being that because of rampant and often profligate change throughout the last fifty years disappearing such consistencies represents only a temporary one.

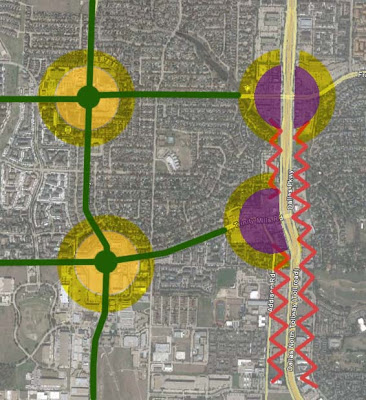

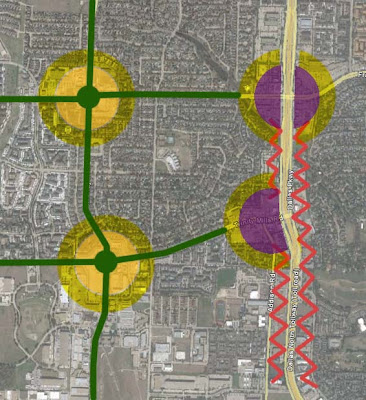

Arterials and Intersections

(Green represents improved multi-modal corridors, purple is commercial node, orange is neighborhood centers, yellow is neighborhood transition, and red is overvalued highway frontage)

This land is in contrast to the overvalued “highway frontage.” Similar to strip style development (that also plagues arterials), highway frontage is 1) difficult to get to and 2) is impossible to build the critical mass around the sites to have a proper “ecology” of varying uses and frameworks holding together and providing resiliency.

Development always goes hand in hand with transportation design. Bad transportation design, in this case car-oriented concrete deserts (arterials) begets bad development. With the shift from car-only transportation, to one that allows and designs for choice, arterials have the opportunity to be redesigned as multi-modal corridors that attract people rather than repel them. This is merely a matter of design.

Furthermore, many are over-retailed (as is the entire country) because retail had to disperse in proportion to the residential population. What resulted was a landscape full of empty big boxes and derelict buildings as there was always some new store, or mall, or strip center where retail tried to appropriately cluster (but often has done so poorly).

Arterials are poised for economic development as they are redesigned to function as both conduit AND place. They carry the most traffic, but unlike highways can actually support people-friendly development with the right people-friendly design. Density of Movement + People-friendly design = Demand for Developmental Density.

Cities should be focusing on repositioning their arterials from linear strips of repulsion to points of attraction and Developers should be eyeing properties along them in coordination to maximize positive momentum. See this article about the densification of one strip retail intersection in North Dallas.

Affordably Long Tail of Housing

I mentioned this the other day in my half-baked idea about mid- or high-rise cohousing or what might represent something similar to Single-Room Occupancy units. The fundamental issue is that we have to date provided very little choice in type or format of housing. Single family are nearly all the same, as are townhomes, as are multi-family buildings.

In order to meet the market that demands in-town walkable urban housing (supply of ~3%, demand of ~40%) while accounting for higher land costs, developments must maximize efficiency of space and development and find new prototypical niches to differentiate your project.

There are lots of ways to do all of the above, some of which have been done before in other cities, some have yet to be tried. The key is to understanding people, the market, and demographics, particularly the two biggest population bubbles in American history, retiring boomers and graduating Millennials.

Around Downtown

I came to the realization a few months ago after long discussions with a few colleagues and clients that the opportunity didn’t lie in downtown so much as it did in the bombed out areas immediately around downtown, they became the moated wasteland around a 9-to-5 castle. What is now known as uptown was once this way as well twenty-plus years ago, but benefited from being within the “favored quarter” or the direction of initial expansion.

I came to the realization after studying Leinberger’s favored quarter concept that it only applies in younger cities, ie American cities. As cities age, they eventually recenter around the primary center of gravity (those defined by transportation hubs or places of the greatest degree of convergence). These nearly always are downtowns. Eventually, investment begins to encircle downtown and North-South, East-West balance is restored as pioneers and investors seek cheap deals near to hubs of activity. Furthermore, more mature cities often relegate all industry or noxious uses aka LULUs (Locally Undesirable Land Uses) to a singular “quarter.”

That brings me to downtown Dallas and its adjacent neighborhoods or once-were and soon-to-be neighborhoods. Already we are seeing signs of positive momentum in Bishop Arts, Deep Ellum, the Design District, and some parts of Ross/Live Oak (albeit chaotic here).

Applying the transect, these areas want to be of medium- to high-density similar to what uptown Dallas has become, but many of these have more history, more potential for unique character than uptown (ie Bishop Arts, Lakewood, Deep Ellum). However, some of these areas are more encumbered by barriers, ie highways than others. Cedars for example is an island whereas Near East connects all the way to East Dallas without interruption or break in the fabric until White Rock Lake.

Furthermore, all of these areas fall within the 1- to 3-mile radius of downtown that modern streetcar and bikes serve very well, two pieces of the transportation hierarchy rising in demand and cultural consciousness. Similar to the Arterials section, new kinds of transportation will yield new development by repositioning a barrier (the arterials) through design and repositioning the neighborhood through provision.

You might say, why streetcar and bikes? The answer is that to support the natural amount of density that the land and sites can support, there have to be alternative modes of transportation 1) to support a variety of market segments that may not want to have a car and 2) you can’t provide infrastructure for high amounts of car use AND the framework for density, which should be nothing more than a product of desirability, uninhibited by barriers.

Lastly, the kind of density that is demanded in these areas (but held back by a number of reasons, some unique to each “quarter”) will eventually result in increased vibrancy and that means drinking establishments. Do we really want all of our bars to be only served by car?

Furthermore, with that kind of density, parking requirements (which are nothing more than poor substitutes for mobility) are less necessary because the parking is replaced by nearby rooftops (where people can walk or bike to the store or office, etc.) and large supplies of parking often interrupt the latticework of interconnected walkable urbanism (not to mention are cost prohibitive).

By limiting parking and providing new hierarchy of transportation alternatives, areas adjacent to downtown offer the perfect setting for creative, affordable housing infill.