COVID-19 continues to dominate the headlines, and its massive influence on healthcare will extend throughout 2022. At the same time, longstanding issues demand attention. CommerceHealthcare® recently completed its annual market scan and analysis of leading issues in finance and revenue cycle management (RCM). Healthcare Finance Trends for 2022 detail eleven trends that carry significant implications for the economic and operational wellbeing of health systems, hospitals, and physician practices.

Another Year of Financial Recovery

The trajectory of the COVID-19 crisis suggests a long-tailed recovery. The latest financial data reveals the ongoing challenges.

- Margin/Profitability. More than a third of hospitals maintained negative operating margins during 2021. Estimated total industry net income loss was $54 billion and median margin 11% below pre-pandemic levels.1 Hospitals paid an additional $24 billion for clinical labor during the year, $17 million for the average 500-bed hospital.2 Medical practices have suffered as well. Under 30% of surveyed primary care practices reported being financially healthy.3

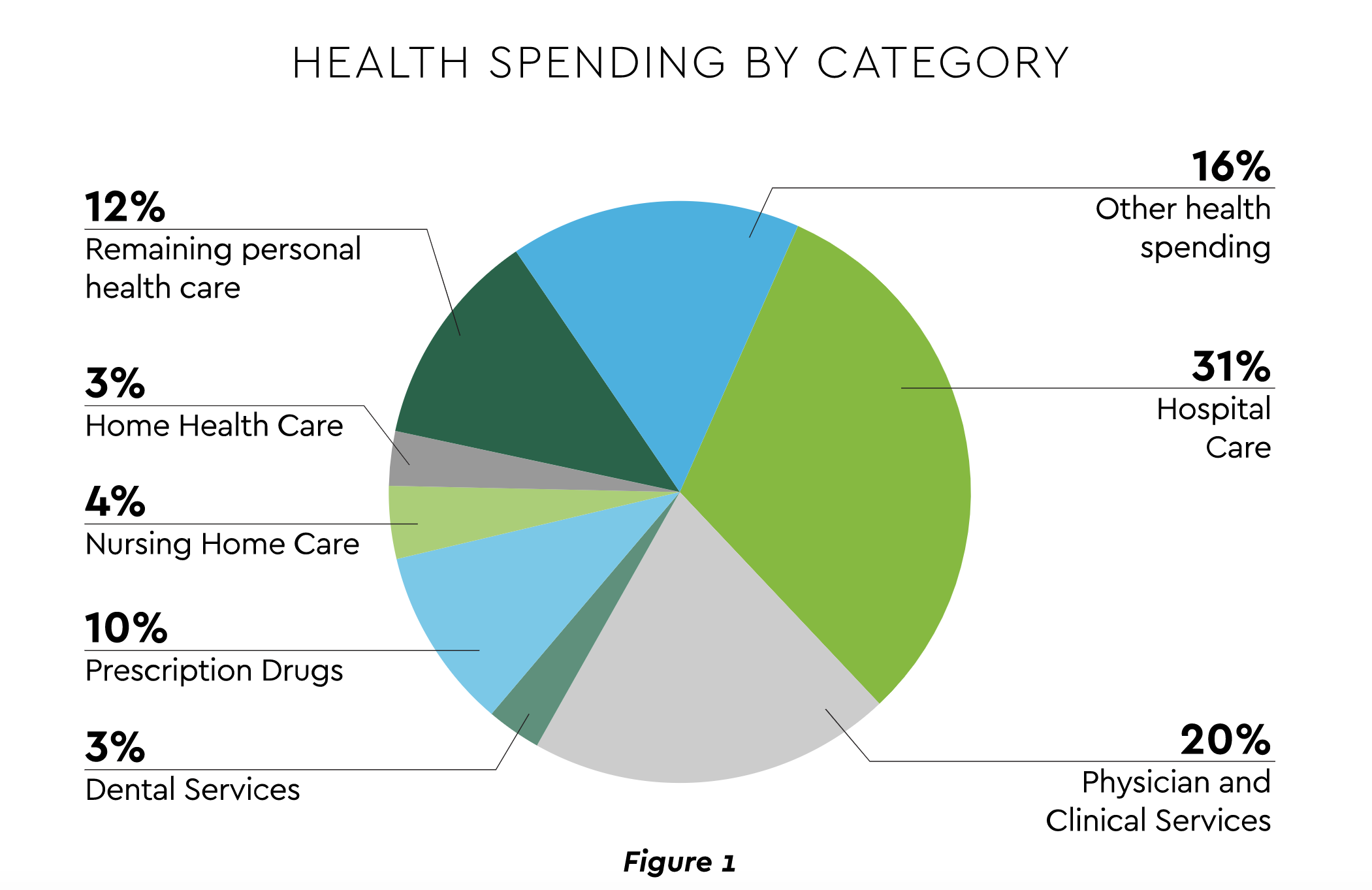

- Revenue and Volume. An encouraging but decidedly mixed picture emerges on the demand side. Through August 2021, overall healthcare spending was 7.2% higher than the previous year, distributed as displayed in Figure 1.4 Spending has lagged GDP growth. Hospital revenue grew, but volume of overall discharges and emergency department (ED) visits remains depressed from 2019 and flat for OR minutes.5 The longer-term utilization outlook sees inpatient volume decreasing 1% through the end of the decade, outpatient rising 14% and ED growing 5% for emergent and falling 15% for urgent.6

- Cash/Liquidity. This metric was bolstered by COVID-19 government subsidies and expedited insurance reimbursements. Disciplined cash management will be required as these supports are removed. In fact, a recent article detailed an emerging liquidity challenge. Major insurers are behind on billions of dollars in payments for various reasons.7

- Medical Cost Trend. Another closely watched indicator is growth in employer medical costs. Forecasts for 2022 include:

- PwC: 6.5%8

- Willis Towers: 5.2%9

- Aon: 4.8%10

Several 2022 implications arise from the data. Effective scheduling and resource management remain essential to optimizing elective procedures. Many will diversify revenue, exploring sources such as new reimbursement models, office space leasing, and service line expansion. Cost management will be a constant. Leaders will look outside for help. A recent survey found 92% of hospital respondents are intensively considering more outsourcing vendors to drive down both clinical and nonclinical costs.11

Mounting Patient Financial Pressures a Growth Inhibitor

Recovery hinges to a significant degree on patients proceeding with elective and routine care. But like providers, patients are challenged financially, both from the effects of the pandemic and from accelerating patient payment obligation. Statistics delineate the current state of consumer healthcare finances.

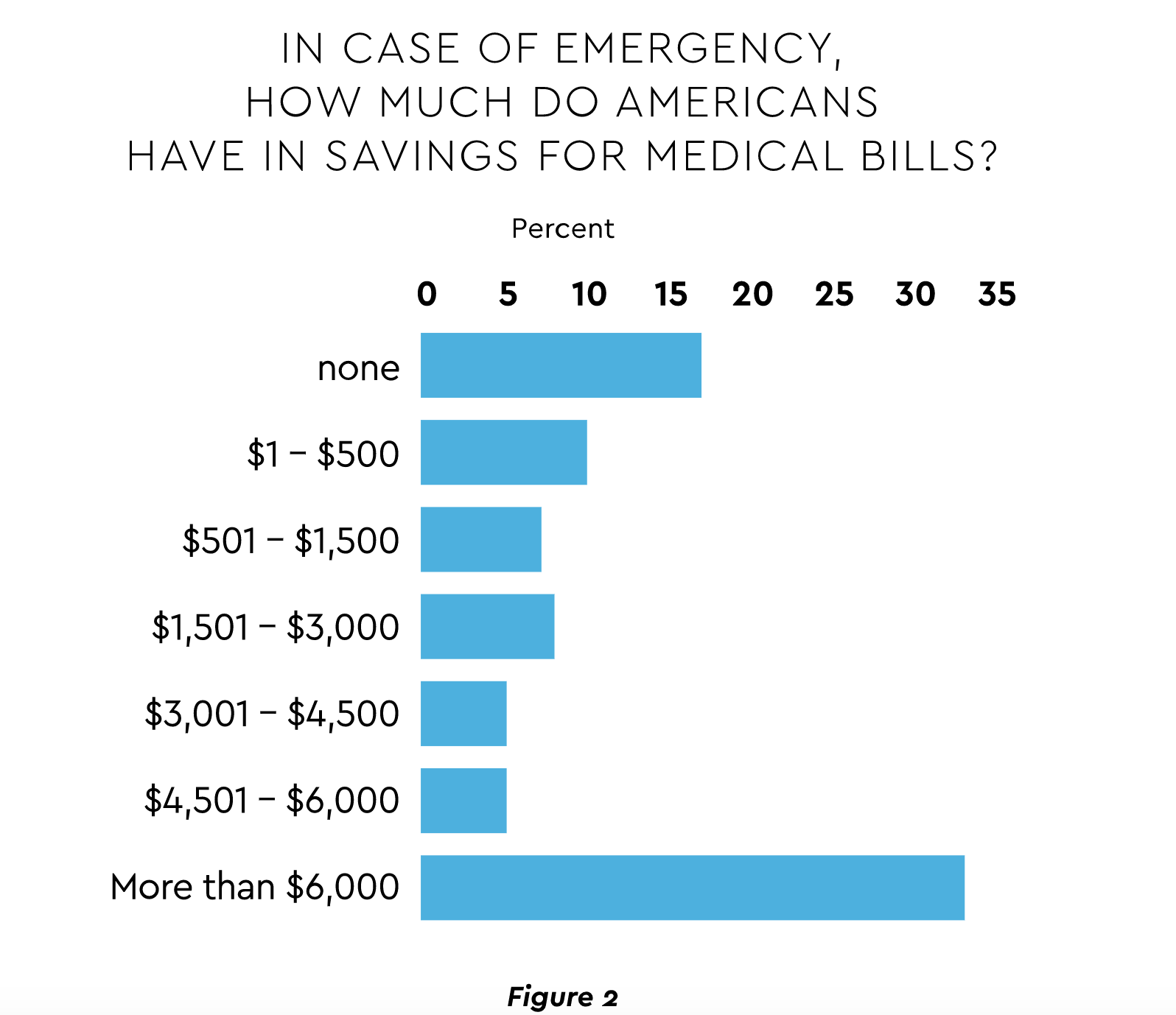

- Rising out-of-pocket expenses and insurance coverage gaps. For many years, the trend in patient expense obligation has marched steadily upward. Growth of personal outlays is projected to rise 9.9% annually through 2026.12 Moreover, 10% of adults under 65 were uninsured in the first half of 2021.13 Many lack required resources. A study of Americans over age 65 found 27% possess under $500 available for medical bills.14 (Figure 2)

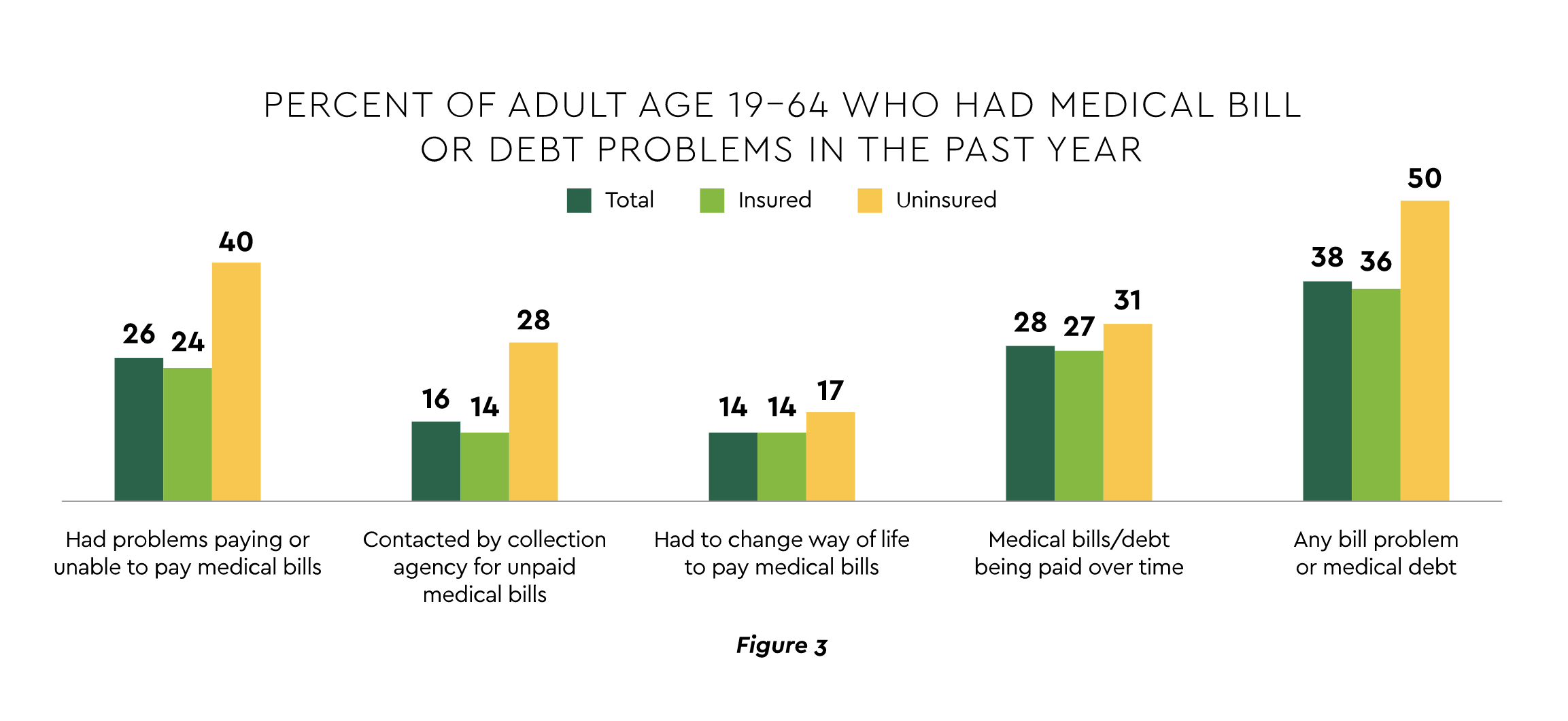

Consumers struggling to manage care finances. A Commonwealth Fund study found that over one-third of patients — both insured and uninsured — encounter some billing problem or medical debt.15 (Figure 3) Another survey estimated almost 18% of individuals carry medical debt, with a mean amount of $429.16

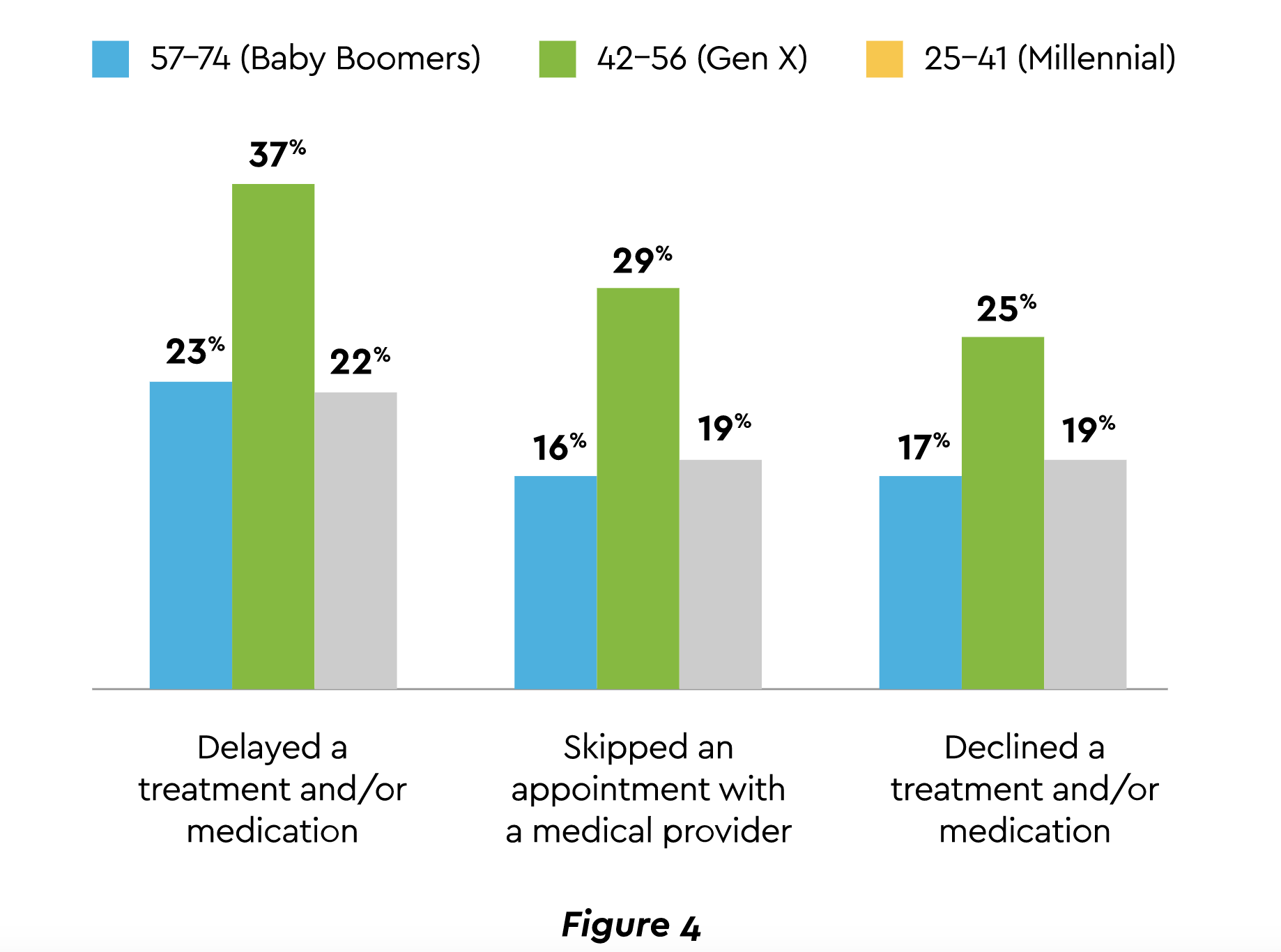

The result is lost or deferred revenue for care providers. During the past year, 18% of households had a member unable to access care for a serious condition, even though 78% carried insurance.17 Yet another affordability survey in mid-2021 discovered the percentages shown in Figure 4 of those who delayed, skipped, or declined treatment.18

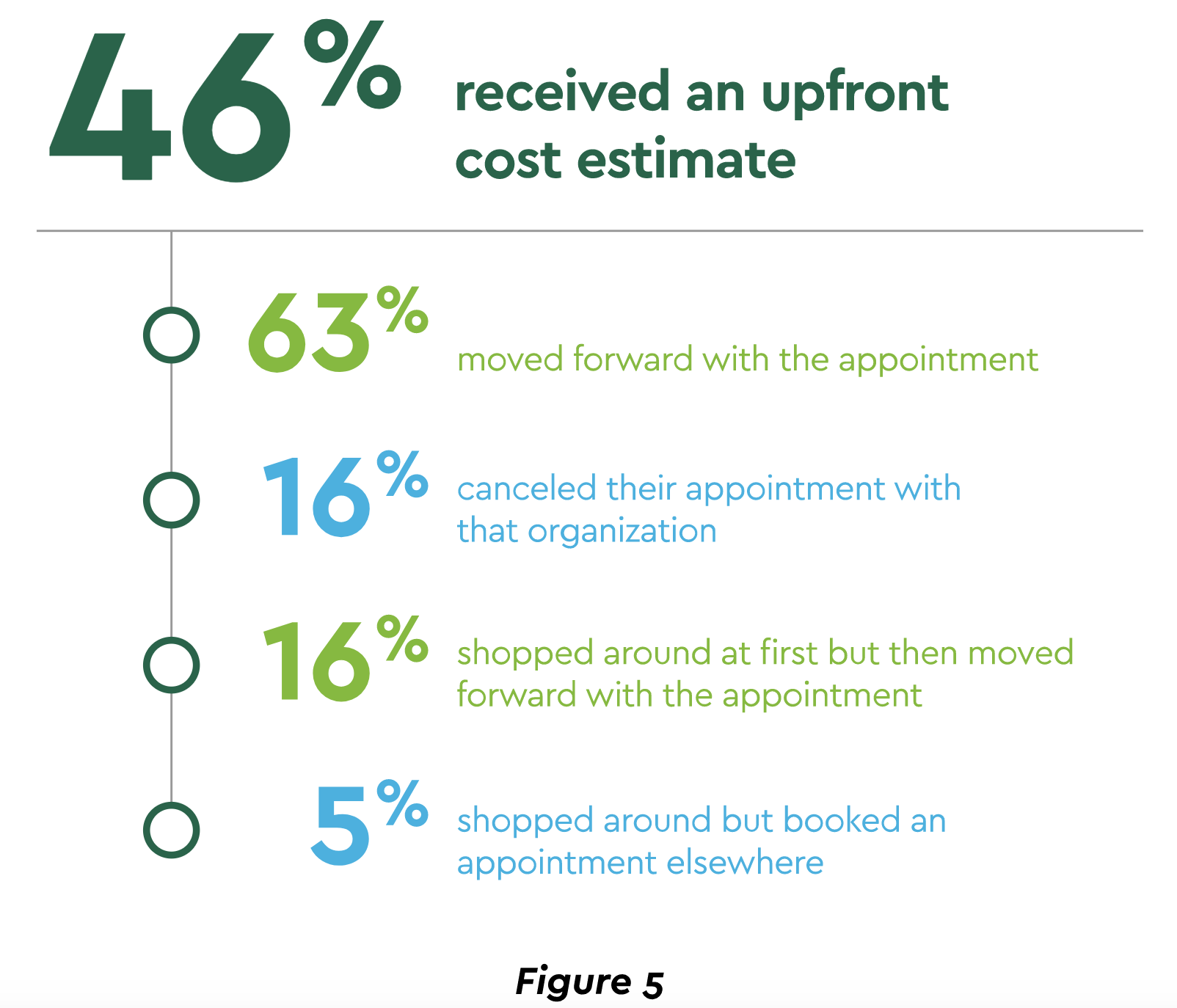

Financial status may get more precarious for many as the national pause in student loans and rent obligations end. Providers will be expected to offer more financing as well as respond to the growing consumer preference for obtaining upfront out-of-pocket cost estimates. A recent survey noted that nearly half of patients obtained an estimate, and the effect on volume was largely positive.19 (Figure 5) These expanded financing steps can go beyond improved satisfaction to building patient loyalty. That effort is critical to long-term provider health and is much needed in an environment in which 36% of consumers register indifference to health system brands.20

Supply Chain Bottlenecks a Major Pressure Point

Another factor impeding recovery is a global supply chain breakdown. Nearly all hospitals and health systems are experiencing supply chain problems with 80% enduring shortages and scrambling to find additional vendors.21 The scope of affected supplies is broad:

- Drugs. Pharmacy inventories are low for a number of important medications, from cancer drugs to anesthetics to inhalers. Even outages of medication containers have been reported.

- Medical technology. Semiconductor chip shortages have created an acute, industry-wide issue for manufacturers of a host of devices including ventilators, glucose and other monitors, imaging machines and many more.22

- Supplies. Availability of numerous high-volume items remains limited, and some providers have issued appeals for donated crutches and other medical supplies. COVID-19 case surges have also produced shortages of oxygen.

The ramifications are significant. Extended lead times for critical supplies can force delays in procedures. Costs are increasing as some goods become more expensive to procure or workarounds are pursued. Productivity also suffers as staff devote more time to overcoming supply chain challenges, including managing more suppliers. Not the least of the impacts is the risk to patient care and safety. Unfortunately, the forecasts are not positive. IHS Markit projects that global supply chain disruptions will persist throughout 2022 and even into 2023.23

Providers are taking several actions to ameliorate current pressures and strengthen the supply chain long-term:

- Drive greater efficiency. Finance and procurement need to be nimble, efficient and able to maintain close relationships with an expanding array of vendors. Removing paper-based processes and streamlining through automation supports all these objectives.

- Data analysis. In a highly constrained environment, providers must stay on top of their supply needs, usage and projections. Sharing data with suppliers can be very helpful.

- Refine budget and cash flow analysis. Higher cash levels are likely to be committed to inventory, and cost pressures mean that investment management of short-term funds will need to be optimized.

- Pursue additional best practices. Gartner recently evaluated the top health systems for supply chain management excellence and highlighted two approaches they take to manage the current difficult scenario. One is concentrating on risk and resiliency with some even creating resiliency positions to lead the effort. Second, a deep commitment to collaboration with vendors is maintained. This partnering can span everything from placing an efficient order to visibility and transparency of where products are manufactured.24 Finance and Revenue Cycle Management (RCM) must be prepared for such teamwork.

Pricing, Data Requirements, Consolidation Headline Political and Regulatory Concerns

Legislative and regulatory considerations are paramount in healthcare planning. Three major topics deserve particular emphasis for their impact on finances and growth:

- Pricing-related regulations. Drug pricing and provider price transparency are the two focal points here. Spending on drugs is expected to reach $380–$400 billion by 2025.25 Government estimates suggest that translates to $1,500 per person. The most substantial — and controversial — action being considered is allowing Medicare to negotiate drug prices. This move, along with other administrative steps, could generate substantial provider cost reductions. Hospital noncompliance with rules calling for clear disclosure of actual procedure charges has been a big issue. Centers for Medicare & Medicaid Services (CMS) has increased penalties that could reach $5,500 per day.

- Information system integration. Interoperability rules are designed to facilitate effective system integration and information exchange at national scale. Mandates and standards include definition of core data sets, accelerated use of application programming interfaces (APIs) for system integration and rules preventing “information blocking” by technology vendors. This major interoperability push demonstrates regulators’ recognition that integration and data fluidity are vital to achieving important administrative and clinical goals.

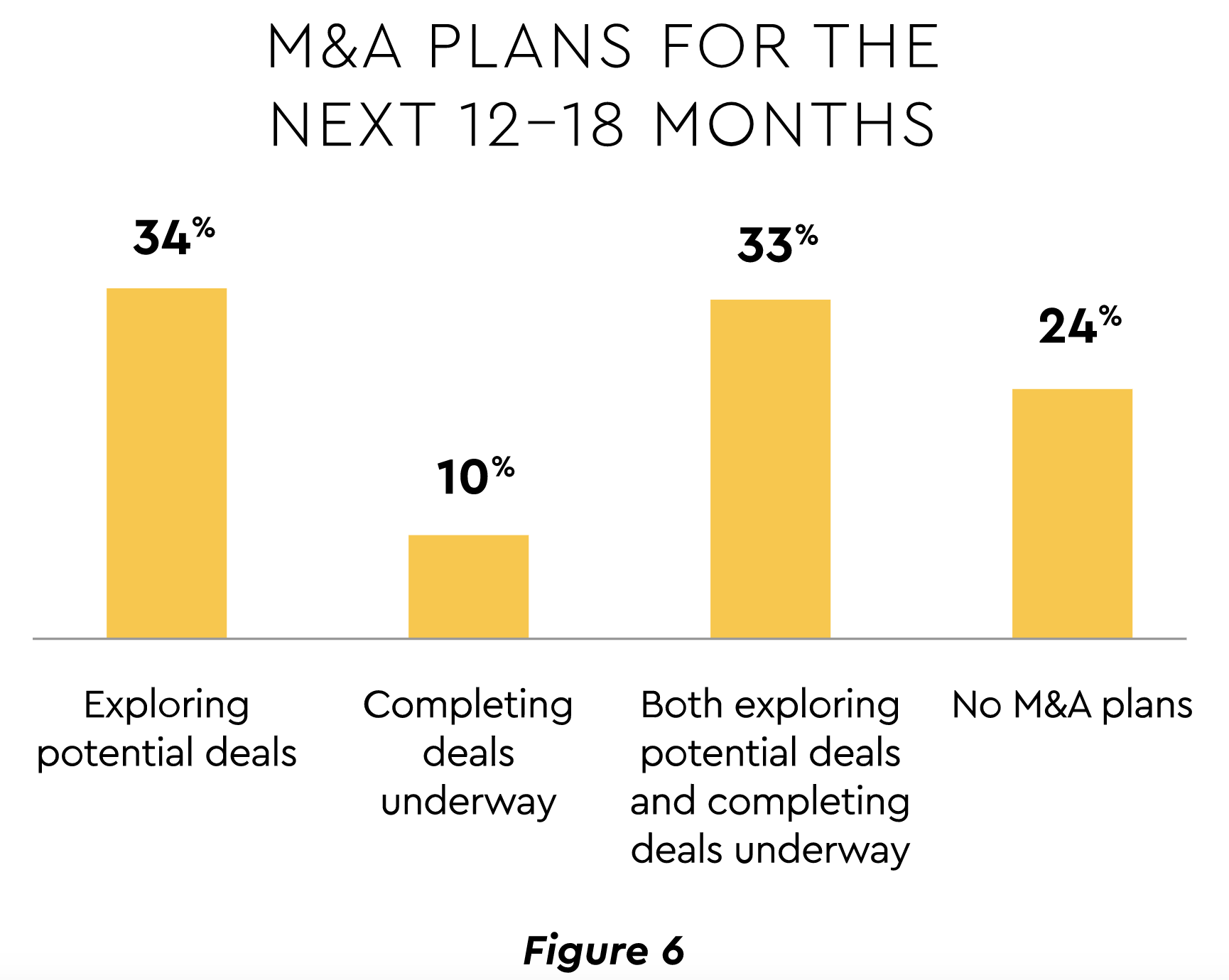

- Anti-competitive behavior. The Federal Trade Commission (FTC) and Congress are showing interest in increased enforcement of anticompetitive pricing activity as part of a growing debate about the merits of the industry’s consolidation wave. Merger and Acquisition (M&A) activity is expected to remain robust in the near-term (Figure 6).26

The government perceives that increased prices and diminished services are frequent post-merger outcomes. Small and rural hospitals are especially vulnerable. Payers are weighing in as well, contending that hospital consolidation has produced average premium rates 5% higher than in more competitive regions.27

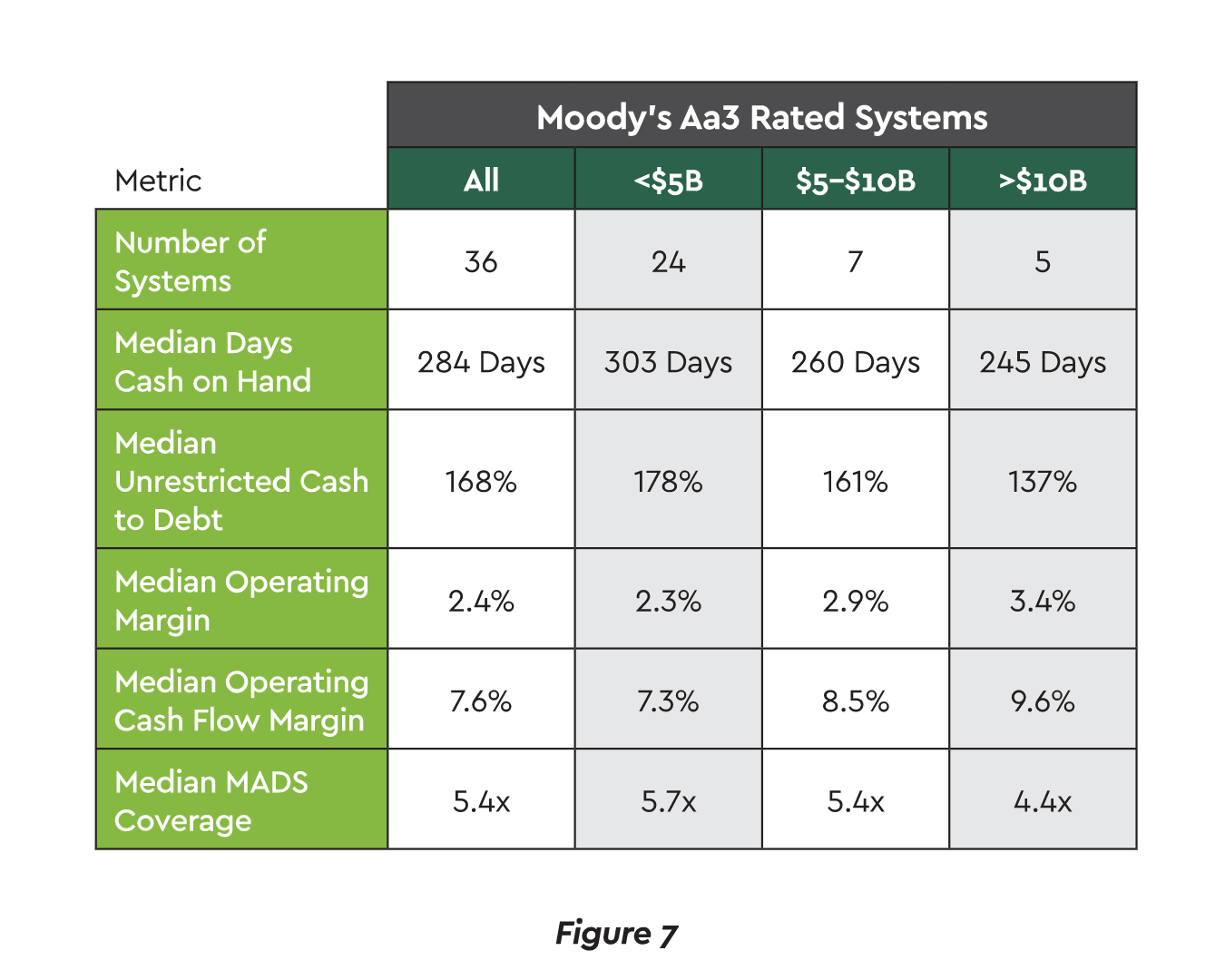

The counterargument holds that M&A helps providers combat shrinking margins, pursue growth and cost control through vertical integration and scale to compete against large and non-traditional companies.28 The scale benefits are borne out in the data. Larger health systems appear better positioned coming out of COVID-19 and can maintain less cash on hand while also achieving superior margins.29 (See Figure 7.)

Bringing the Technology Strategy Together

The pandemic added fresh impetus to healthcare’s substantial multi-year investment in digital transformation. Stimulated by the crisis, 60% of providers undertook new digital projects.30 The focus for 2022 will be on integrating the technology pieces into a coherent, comprehensive whole. Many will formulate a digital roadmap to guide investment and sequence implementation of several high-profile technologies:

- Digital front door. Providers are unifying disparate systems, apps and workflows into a single-entry pathway that enables patients to navigate their care with maximum convenience and efficiency. IDC believes that by 2023, 65% of patients will be accessing services through a digital front door.31 Progress is already evident in the proliferation of online appointment scheduling and bill pay tools.

- Remote/virtual care. While telehealth’s surge during the crisis has abated, usage is poised to grow. Over half (56%) of hospital and health system leaders expect increased telemedicine investment during the next two years.32 Additional research calculates that 40% of the pandemic-related virtual care will remain.33

Further embedding telehealth into the landscape carries two key 2022 dependencies. The first is reimbursement alignment. Providers and industry groups are strongly urging CMS to extend the public health emergency declaration that broadened coverage eligibility during COVID-19. The agency has proposed doing so through 2023. The second dependency is platform redesign. Much telehealth workflow was put in place rapidly and now must mature for long-term optimization. - Connected Health. Remote monitoring devices, mobile apps and artificial intelligence are opening a new frontier of personalized care and enabling movements such as hospital at home.

Several hurdles must be jumped to execute digital transformation. A study of CFOs across industries identified the two leading barriers to effective technology deployment in finance as high investment cost (26%) and inadequate internal staff skill sets (23%).34 Clearly health systems, hospitals, and physician practices will need to find ways to budget appropriately.

Cybersecurity Will Consume Major Leadership Attention

Cybersecurity is a top leadership concern. A handful of data points show why:

- 642 breaches of 500 or more records in 2020 affecting 30 million individuals. With 487 breaches through September 2021, activity remains high.35

- Over two-thirds of care organizations reported ransomware strikes, and 33% have had two or more.36 Total downtime cost is almost $21 billion.37

- Finance is also battling payments fraud and theft. Cross-industry tracking reveals that business email compromise is the biggest root cause, with the locus of attacks falling heavily on Accounts Payable (61%) and secondarily on Treasury (13%).38

Prime vulnerabilities identified in a recent federal healthcare report are phishing, out-of-date software patches, unsupported software and operating systems, and poorly configured internet access ports.39 Vendors need to share responsibility. A security specialist recently accessed more than 4 million patient and clinician records through third-party apps and APIs to major EHR systems.40

Defenses must be shored up. A survey found that 61% of healthcare executives expressed little to no confidence in their organizational capability to mitigate ransomware risks.41 Just 11% of hospital IT leaders believe that cybersecurity is a high budgetary priority.42

Major Advancement Opportunity for RCM/Finance Automation

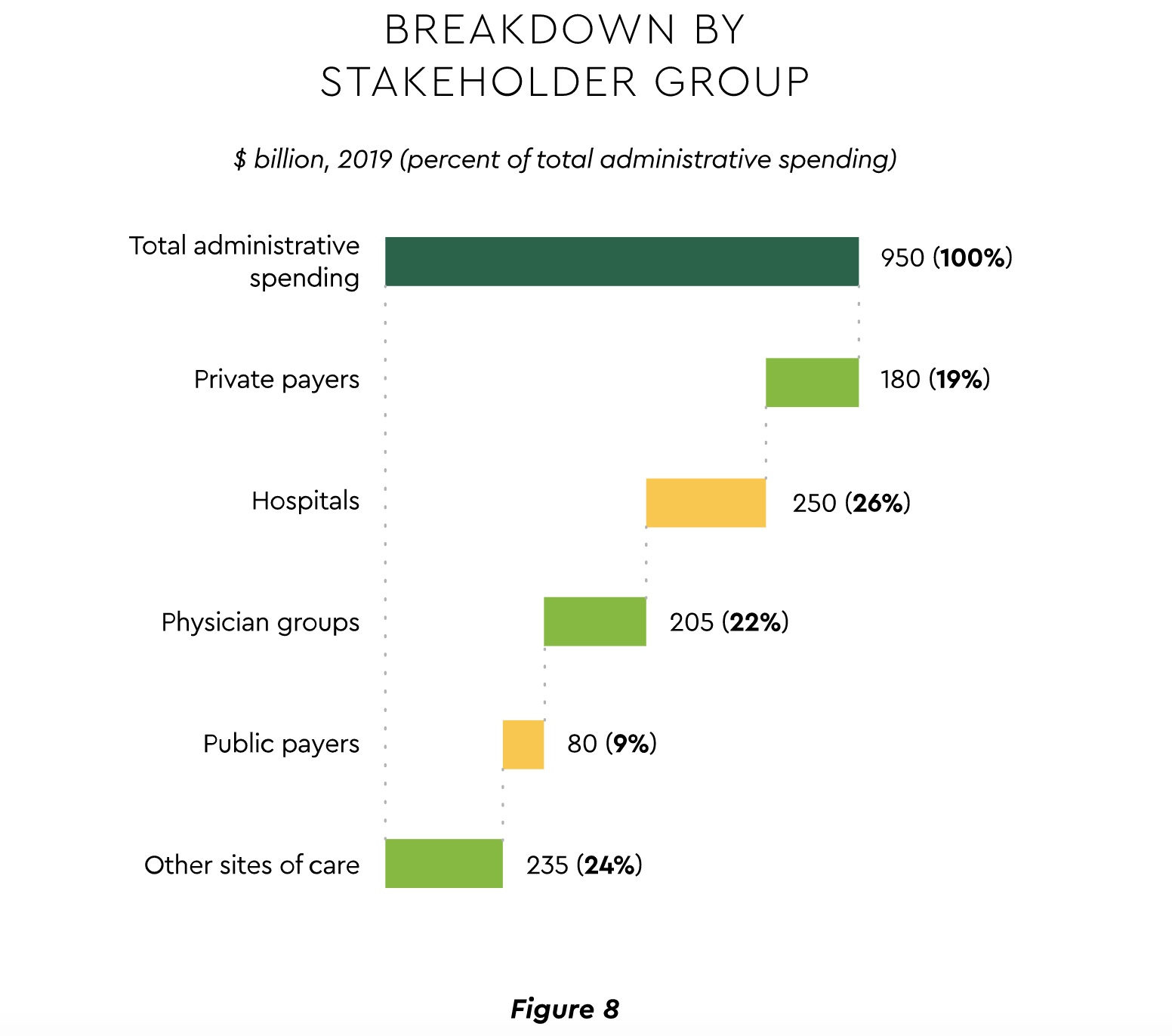

The pandemic’s workflow disruptions spotlighted the desirability of expanding automation of manual processes in the revenue cycle and financial departments. The potential is substantial. McKinsey recently took a fresh look at administrative spending and calculated a 2019 total of $950 billion.43 The sector breakdown is shown in Figure 8. The analysis attributes fully 21% of that total to the financial transaction ecosystem, providing a sizeable target to find savings.

CAQH’s latest annual study asserts that the industry could save over $13 billion if it implemented full electronic transactions.44 As one example, $426 million yearly could be realized via electronic claims transactions. According to the survey, 82% of finance executives stated their organizations are implementing significant automation, but only 19% report positive results to date.45 Implementation snags are still prevalent and impede the acceleration of automation efforts for many providers. A premium will increasingly be placed on selecting outside partners who can manage training and ongoing support effectively to reduce risk and produce speed-to-value.

Financial automation could have a banner year in 2022 driven by several forces:

- Lingering staffing issues. Automation adds significant RCM staff bandwidth, freeing them from rote work to concentrate on more complex situations.

- Inaction becoming more costly. CAQH and others affirm a widening cost gap between ever more efficient electronic transactions and manual/partially automated ones. For providers whose payment or invoice processes were not automated, average Days Sales Outstanding (DSO) jumped 17% (42 to 49 days) during the pandemic, according to one analysis.46

- Need to feed growing analytics efforts. Electronic processes help ensure consistent, timely and accurate data flows that are the lifeblood of analytics.

Drive for Convenience Fuels Digital Payments Adoption

A variety of digital payment modes are gaining wider acceptance. Growth is being propelled by convenience, efficiencies, cash management, and health safety and is uniform across a range of payment rails, including:

- Real time payments (RTP). This mode forms a $13.5 billion worldwide market, expanding at an annual clip of 33% through 2028.47 Real time healthcare bill payments and disbursements are projected to reach over 70 million in 2022.48

- Electronic Funds Transfers (EFT). Healthcare processed 108 million EFTs in the second quarter of 2021, up almost 36% from the same 2020 period.49

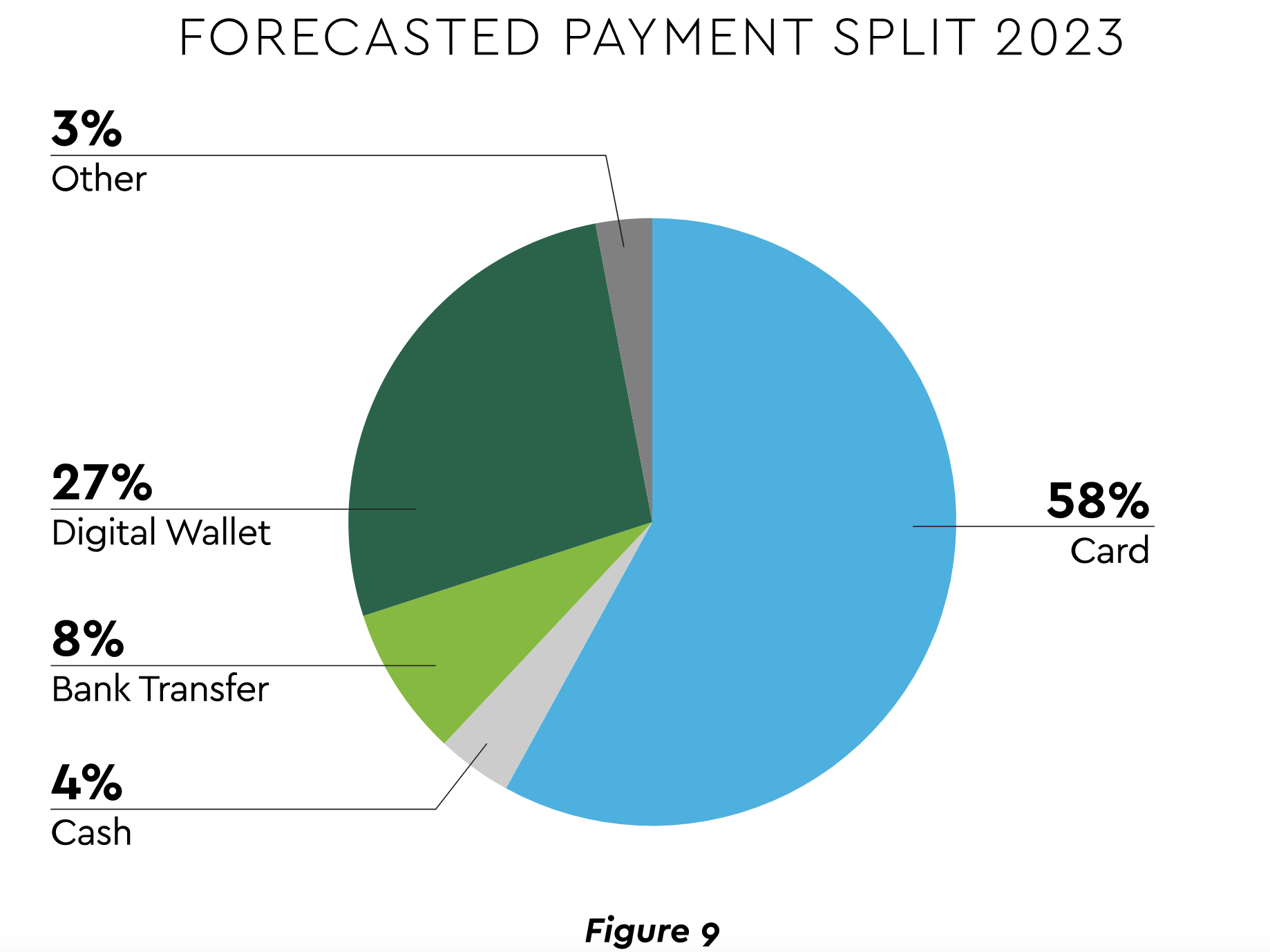

- Mobile wallets. This facilitator of RTP is likewise surging. New mobile wallet users are projected to come onstream at a rate of 6.5 million per year between 2021 and 2025, with average spending reaching $4,064 annually per user.50 Wallets are also becoming a force in all e-commerce as the forecast in Figure 9 displays.51

Digital payments should expand in 2022 as part of the e-commerce protocols necessary to support telehealth. COVID-19 concerns will provide further stimulus.

Related technologies to keep on the planning radar:

- Biometric authentication. Security is paramount in electronic payments, and research suggests that consumers prefer voice, fingerprint and other biometrics.

- Open banking APIs. These tools allow strong integration between bank and provider systems to provide patients a more seamless payment experience.

- Cryptocurrency. The future remains cloudy for this mode, but it is already being used for a number of consumer transactions.

It is important to note that effective payments innovation is about more than just processing digital payments. A closed-loop system is needed that unites payments and data to permit complete reconciliation and tracking of fund flows.

Pandemic Changes Will Reorient Workforce Management

Entering 2022, providers face acute workforce issues. There are several workforce management challenges facing the industry, including:

- Shortages. Nursing is a major flashpoint. A mid-year study saw fully 84% of respondents claiming continued challenges with nursing workforce coverage.52 Though not tracked as precisely, RCM and other administrative areas are experiencing short staffing as well. This predicament may unleash problems when the previously mentioned backlog of payer reimbursements begins to flow.

- Turnover. Clinician turnover is notably on the rise. Record highs in Emergency, ICU and Nursing have been reported with rates increasing from 18% to 30%.53

- Competitive talent market. Struggling with personal decisions forced by COVID-19, a meaningful segment of the administrative workforce is reluctant to commit to full-time positions or is willing to switch jobs to secure scheduling flexibility. Recruitment becomes highly competitive in this environment. RCM executives report that the advent of virtual work means competition for talent on a nationwide rather than just local basis.54

These issues create the context for strategic decisions on long-term hybrid work. Forecasts vary on the extent to which remote work will persist. One suggested that 34% plan to blend in-person, hybrid, and remote.55 Another said 66% expect their administrative staff remote/on-site mix to continue at pandemic levels.56

The decisions are difficult because virtual work is a two-edged sword. Employees are attracted to the flexibility and work-life balance. Conversely, inter-departmental communication and collaboration are complicated with a dispersed staff. Leaders document other hybrid model problems that range from impact on revenue (29%) to concerns about treating off-site workers differently (32%) to underutilization of office space (24%).57 Achieving the right strategy will necessitate adroit change management on the part of the C-suite, middle management, and clinicians. Many commentators suggest that the pandemic’s effects have only reinforced that healthcare must also rely more heavily on outside partners to effect lasting change.

Payer-Provider Ecosystem Evolving Rapidly

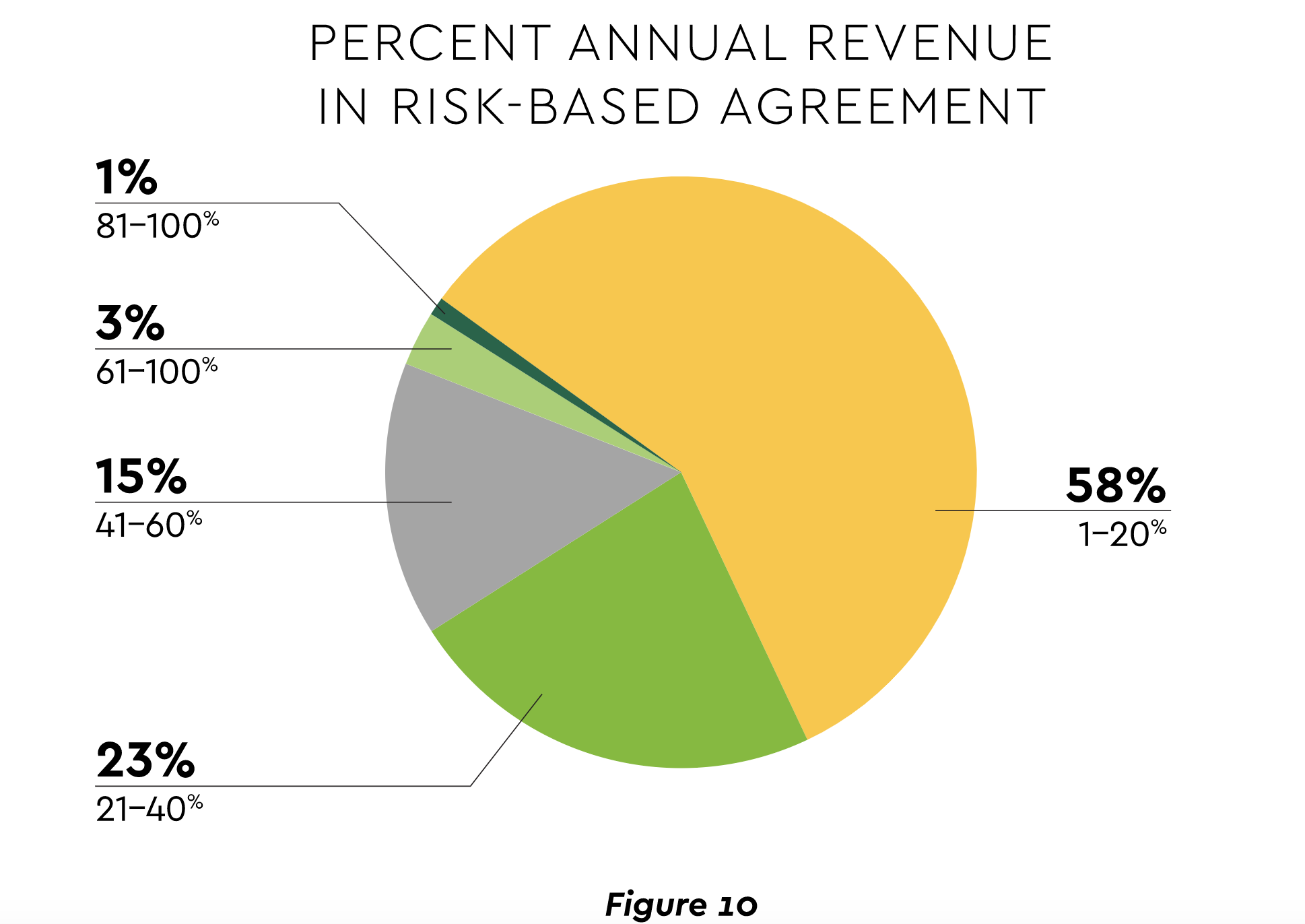

The pandemic is contributing to a tectonic shift in the ecosystem of payers, employers, and providers. The latter witnessed their financial exposure from reliance on fee-for-service. Value-based approaches gained renewed interest, though adoption still lags. Most health systems, hospitals, and physician practices have under 20% of revenue exposed to upside or downside reimbursement risk.58 (See Figure 10.)

All parties are motivated to expand value-based programs. Providers need to diversify their revenue streams and respond to payers encroaching on their care delivery space. Advancements in artificial intelligence promise better risk management capabilities. For their part, payers are striving for new ways to drive down care costs and alter engrained reimbursement structures. Employers have reacted to the COVID-19 crisis with urgency to rein in burgeoning healthcare costs and foster workforce wellbeing.

The following emerging relationships should see growth in 2022:

- Captive health plans. Health plans launched by providers are growing. Captive insurance offers a predictable revenue stream and a potentially more controllable path to value than structures such as ACOs.

- Corporate partnerships. More companies are forming extensive partnerships with providers. Opening an on-site, near-office or virtual dedicated healthcare center for employees is of interest to 79% of employers.59

- Payviders. The so-called payvider union of insurance company and provider offers strong vertical integration. Payviders can be created by acquisition, internal development or through partnership, which some argue best creates balanced incentives to pursue value-based care.

Providers Become Partners in Public Health

The COVID-19 crisis exposed serious weaknesses in the nation’s public health infrastructure. Interest is high in strengthening preparedness through closer provider-government partnership. Investment priorities for 2022 include:

- Data gathering and exchange. Comprehensive information at scale is vital. Data gaps hampered pandemic containment efforts, and the problem has been longstanding. In 2018-2019, 50% of hospitals reported constraints on ability to exchange information electronically with public health agencies, while 70% said they have faced one or more public health reporting challenges.60 On the government side, experts assert that the Centers for Disease Control and Prevention (CDC) has debilitating deficiencies in data management tools, advanced analytics and integration with electronic health records.61

- Physical capacity. Health systems, hospitals and physician practices are evaluating supplies policies, moving from just-in-time inventory management to what is being referred to as just-in-case. Hospitals are devising plans for facility flexibility and surge staffing.

- Population health management. COVID-19 underscored the strong role social determinants play in care access and quality. The crisis likewise offered evidence that population health efforts and community-based care buttress pandemic response.

Operational efficiency built on process automation is central to producing the cost structure, investment capacity, and management efficacy to scale public health initiatives and maximize readiness. With the pandemic still at the forefront, 2022 should be a year of national progress toward these crucial goals.

Conclusion

Many believe the aftershocks of COVID-19 will reverberate throughout healthcare for years. As the eleven trends in this report attest, leaders face mandates to achieve financial recovery, boost financial help to patients and expand RCM automation, digital payments, and other technologies that breed no-longer-optional efficiencies and convenience. The year promises to bring significant progress on adopting value-based reimbursement and advancing readiness for future public health emergencies. Balancing the demands and investments analyzed in Healthcare Finance Trends for 2022 will not be easy. The report’s analysis should aid executive decision-making. CommerceHealthcare® will stay committed to providing innovative solutions and to active market surveillance.

CommerceHealthcare® by Commerce Bank offers solutions that are tailored for healthcare that help improve cash flow and create a better patient experience. Our team of healthcare and banking professionals understand the business of healthcare and the needs of patients and can help you find a better approach to healthcare finance that delivers measurable results. Learn more at commercehealthcare.com.

Resources

- American Hospital Association and Kaufman Hall, Financial Effects of COVID-19: Hospital Outlook for the Remainder of 2021, September 2021.

- Premier, Inc., “PINC AI Data Shows Hospitals Paying $24B More for Labor Amid COVID-19 Pandemic,” blog post, October 6, 2021.

- Primary Care Collaborative and the Larry A. Green Center, Quick COVID-19 Primary Care Survey, Series 30, September 2021.

- Altarum Center for Value in Health Care, “Insights from Monthly National Health Spending Data through August 2021,” Spending Brief, October 19, 2021.

- Kaufman Hall, National Hospital Flash Report, October 2021.

- Sg2, 2021 Impact of Change® Forecast Highlights: COVID-19 Recovery and Impact on Future Utilization, June 2, 2021.

- J. Hancock, “Major Insurers Running Billions of Dollars Behind on Payments to Hospitals and Doctors,” Kaiser Health News, October 6, 2021.

- PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022, June 2021.

- P. Minemyer, “Willis Towers Watson: Employers Expect Health Costs to Rise by 5% in 2022,” Fierce Healthcare, October 6, 2021.

- Aon, 2022 Global Medical Trend Rates Report, 2021.

- Black Book Research, “Labor and Supply Shortages Fuel Surge in Hospital Outsourcing Partnerships, Black Book 2021 Survey Results,” press release, September 30, 2021.

- Kalorama, Out-of-Pocket Healthcare Expenditures in the United States, 5th Edition, July 12, 2021.

- S. Collins, G. Aboulafia, M. Gunja, “As the Pandemic Eases, What is the State of Health Care Coverage and Affordability in the U.S.? Findings from the Commonwealth Fund Health Care Coverage and

COVID-19 Survey, March–June 2021,” Commonwealth Fund Issue Briefs, July 2021. - D. Grunebaum, “One in Four Seniors Lack $500 for Medical Bills: Survey,” MedicareGuide blog post, October 19, 2021.

- S. Collins, G. Aboulafia, M. Gunja, “As the Pandemic Eases, What is the State of Health Care Coverage and Affordability in the U.S.? Findings from the Commonwealth Fund Health Care Coverage and

COVID-19 Survey, March–June 2021.” - N. Eddy, “Medical Debt Soars To $140 Billion and is Examined as a Social Determinant by JAMA,” Healthcare Finance, July 21, 2021.

- NPR, Robert Wood Johnson Foundation, and Harvard T.H. Chan School of Public Health, Household Experiences in America During the Delta Variant Outbreak, October 2021.

- Accenture, “Digital Adoption in Healthcare: Reaction or Revolution?” 2021 Accenture Health and Life Sciences Experience Survey–US Findings, August 2021.

- Waystar, Consumer Attitudes Toward Medical Bills and the Price Transparency Rule, 2021.

- T. Macgibbon, “Why Patient Loyalty in Health Care Matters: Why Now and How to Get Started,” MedCity News, August 23, 2021.

- D. Thompson, “Supply Chain Issues Bring Shortages of Drugs, Devices to U.S. Hospitals,” HealthDay News, November 4, 2021.

- B. Murray and S. Bradley, “The Semiconductor Chip Shortage Hits MedTech: Strategies to Rebuild Resilient Supply Chains,” Advanced Medical Technology Association blog, September 23, 2021.

- C. Bustos, “Supply Chain Delays Will Spread Well Into 2022 and Possibly 2023,” Yahoo Finance, September 2, 2021.

- Gartner, Inc., “Gartner Announces Rankings of the Gartner Healthcare Supply Chain Top 25 for 2021,” press release, November 10, 2021.

- S. McGrail, “Prescription Drug Spending Expected to Reach $400B in 2025,” PharmaNews Intelligence, June 7, 2021.

- HealthLeaders, No Drop-Off for M&A Post Pandemic, July-August 2021.

- D. Weldon, “Health System Mergers Drive Higher Healthcare Costs, Says Trade Association,” HealthLeaders, October 7, 2021.

- D. Weldon, “Are Mergers And Acquisitions the Cure For Shrinking Hospital Margins?” HealthLeaders, September 22, 2021.

- Kaufman Hall, Partnerships, Mergers, and Acquisitions Can Provide Benefits to Certain Hospitals and Communities, October 2021.

- BDO, 2021 Healthcare Digital Transformation Survey, 2021.

- IDC, Futurescape: Worldwide Health Industry Predictions, 2021.

- B. Siwicki, “Most Provider Organizations Boosting Telehealth Investments, Survey Finds,” HealthcareIT News, September 30, 2021.

- Oliver Wyman, “Five Things to Know about Consumer Sentiment and Virtual Care Adoption,” blog post, August 25, 2021.

- McKinsey & Company, Mastering Change: The New CFO Mandate, October 2021.

- HIPAA Journal, Healthcare Data Breach Statistics, 2021.

- J. Wider, “Ponemon Institute: 67 Percent of Healthcare Organizations Hit By Ransomware,” Healthcare Innovation, September 29, 2021.

- B. Horowitz, “2020 Offered a ‘Perfect Storm’ for Cybercriminals with Ransomware Attacks Costing the Industry $21B,” Fierce Healthcare, March 26, 2021.

- Association for Financial Professionals, 2021 Payments Fraud and Control Survey Report: Key Highlights, April 2020.

- S. Chapman, “CISA Report Sounds the Alarm on Cyber Threats,” For the Record, September/October 2021.

- “Hack the Aggregator,” STAT Healthtech newsletter, October 19, 2021.

- J. Wider, “Ponemon Institute: 67 Percent of Healthcare Organizations Hit By Ransomware.”

- J. McKeon, “Cybersecurity, Vulnerabilities Not Priorities for Most Hospitals,” HealthIT Security, August 12, 2021.

- McKinsey & Company, Administrative Simplification: How to Save a Quarter-Trillion Dollars in US Healthcare, October 2021.

- CAQH, 2020 CAQH Index, 2021.

- Healthcare Financial Management Association, “Survey: Hospitals And Health Systems Prioritize Automation,” August 2021.

- PYMNTS.com, B2B Payments Innovation Readiness Playbook, February 2021.

- Grandview Research, Real-Time Payments Market Size, Share & Trends Analysis Report, January 2021.

- PYMNTS.com, “Deep Dive: Giving Healthcare Payments a Real-Time Upgrade,” blog post, November 20, 2019.

- Nacha, 2Q 2021 ACH Network Volume Totals Infographic, 2021.

- eMarketer Insider Intelligence, “U.S. Payment Users Will Surpass 100 Million This Year,” blog post, March 30, 2021.

- J.P. Morgan, 2020 E-commerce Payments Trends Report: US, 2020.

- McKinsey & Company, Increased Workforce Turnover and Pressures Straining Provider Operations, August 2021.

- Premier, Inc., “PINC AI Data Shows Hospitals Paying $24B More for Labor Amid COVID-19 Pandemic.”

- S. Morse, “Revenue Cycle Directors Deal with a Competitive Market for Staff as Elective Care Returns,” Healthcare Finance, June 21, 2021.

- PwC, US Pulse Survey: Next in Work, September 2021.

- M. Hagland, “Kaufman Hall Report: Pandemic Continues to Rock Hospitals on All Levels,” Healthcare Innovation, October 19, 2021.

- PwC, US Pulse Survey.

- Numeroff & Associates, The State of Population Health: Sixth Annual Numerof Survey Report, August 2021.

- Marathon Health, Employee & Employer Healthcare Survey, June 2021.

- C. Richwine, C. Marshall, C. Johnson, V. Patel, “Challenges to Public Health Reporting Experienced by Non-Federal Acute Care Hospitals, 2019,” ONC Data Brief, September 2021.

- S. Gottlieb, Uncontrolled Spread, 2021.

Signup for D Exclusive

Author