For years, our investments/land division has produced a report designed to aid investors in determining the viability of acquiring undeveloped land for medium- and long-term positive returns. Since last year’s report, North Texas has experienced substantial growth in virtually every commercial and residential product type. Absorption of undeveloped and underutilized land has been unprecedented. Aggressive, vertical development has left few desirable infill sites remaining, producing ever-increasing activity further out from current job markets and increasing commuter distance demands.

We are consistently asked how long this activity can continue in the current cycle. Our observation is economically based. As long as we have continued job growth, inbound population increases, low interest rates, and a sound local economy, there is no reason for a reverse cycle. However, should any one of those standards collapse, the effect will be telling on all.

Inherently, land investment differs greatly from other types of real estate products, generally by its inability to produce interim cash flow and its vulnerability to recurring cycles. The criteria used to determine potential land opportunities, while becoming considerably more sophisticated over the last two cycles, remains principally in implementing four basic strategies.

Perhaps the most important of these is the ability to project and fund ownership long-term. Positive liquidity, the ability to sell for an acceptable profit at the optimum market time, can be highly speculative. When the investor is placed in an imposed forced sale position, returns are jeopardized and the investment frequently results in a loss.

We have all learned that real estate is “local” in character. No two markets possess the same dynamics. Location will ultimately best determine value. Values of similar properties will vary greatly in specific submarkets and in different geographical locations. Public perception, while an intangible, plays a large role. Real estate visionary Craig Hall built a 250,000-square-foot building fronting the then North Dallas Toll Road service road in Frisco (there was no main road) without a lease in hand against the advice of many sophisticated developers. Six months after completion, it was fully leased in what could be considered a mediocre market. Hall Park now has 16 leased buildings and new construction in process. In retrospect, Mr. Hall chose location, path of growth, pending infrastructure, a welcoming and supportive municipal entity (Frisco EDC), and an expanding local economy—all ingredients for predictable, yet risky, success. His timing was perfect, and has led to what economic development officials now are calling the city’s “$5 Billion Mile.”

More “Bubbles” in the Future

Anticipated use governed by demand, zoning, proximity to infrastructure, interim use, historical absorption, publicly perceived location, and the municipal political climate, are but a few of the investment points to be considered. Current investment and development activity by informed entities and verifiable market comparables are equally important.

Like many types of investments, real estate is cyclical. Investment success or failure can often solely depend on where the cycle is at the time the purchase is made and the investor’s ability to determine the true state of the cycle. The cliché, “quick to follow, slow to lead,” can prove costly. There has yet to be a final cycle—thus, the ability to hold long -term may affect the yield but does offer security. Although the ability to use historical data to project long-term value as set out above is logical, many down cycles have been created by artificial, non-real estate related influences that were difficult to anticipate. For example, in the late 1980s, tax law changes and deregulation destroyed the market. In the late 2000s, the subprime collapse did the same. It is reasonable to assume there will be more fragile “bubbles” in the future.

The DFW market today continues to see record prices for infill, readily developable sites possessing available infrastructure, permitted anticipated uses, and demand for product. Fueled by extensive population and employment growth, new construction remains at a record pace which is anticipated to continue at least through 2018. Increased land, labor, and materials cost will, however, inevitably have a negative impact.

Construction in process and fully financed new projects pending ground-breaking will fuel the real estate market for at least 18 months. Increased activity for pure, longer-term investment sites has begun to extend to the outer lying, concentric circle tracts, considered “pure investment tracts,” which until recently remained fairly benign in sales activity and price fluctuation. It appears that such specific investments are becoming more attractive than competing investments such as oil and gas (price fluctuation), a pending bear stock and bond market, and the tech world, which have offered a more equitable vehicle to the less patient investor. Additionally, local investors (the heretofore most active group of land speculators) are being out bid by more patient national and foreign investors. Yet, historically, and perhaps ironically, a large number of the most successful, wealthiest investors have made their patient fortunes in land by simply applying these basic techniques.

Access to Infrastructure Key

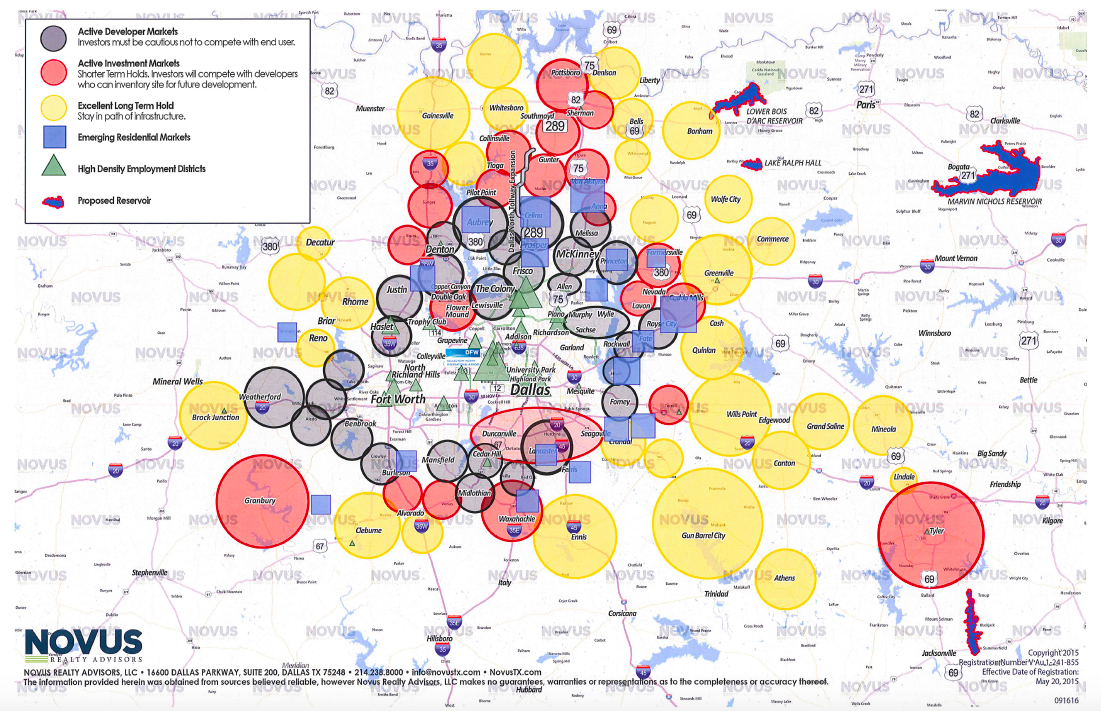

Novus Realty Advisors is a member of the North Texas Land Council (NTLC), a highly respected group comprised of 50 of the most active land brokers in our area. Believing that activity generates more activity, the NTLC freely shares information with its competing members, and the market in general. Much of the projected activity displayed on the “Novus Land Absorption Map” reflects the activities of the NTLC.

Our analysis, as displayed on the map (revised in October and available upon request) is principally based on extensive historical data collected over 100 years of market experience possessed by NRA’s associates, members of the NTLC, and reliable future projections from sources that have traditionally displayed accurate demographic data. Depending on which source one desires to use, the DFW market will absorb an additional 1.6 million to 2.5 million residents over the next 15 years. Success in real estate investment will lie in determining where that growth will locate.

History has taught us that product will be made available and priced based on economics. The cost to provide available product to meet demand will depend on the availability of affordable infrastructure (sewer, water, roads, proximity to employment centers, service commercial, schools, political climate, etc.). Land prices will fluctuate according to such availability. Investing in the right product will produce exceptional rewards. Some estimate that it requires approximately 12,000 to 15,000 acres of raw land to accommodate 1 million people in a reasonably confined, socially acceptable, service-provided environment. Two million people can’t fit into Frisco.

We are extremely fortunate to have had an extended period of significant activity, which can at least be partially credited to our aggressive political structure (both local and state), our sophisticated and informed developers and engineers, and our incredibly competent and equally aggressive EDCs. Of equal depth are the well-educated, hard-working, and professional “under 40” group of brokers, administrators, and managers who have emerged during this cycle. They may well be the first group exiting a positive cycle who have learned from and benefited from the experience of their predecessors. They may not need a disaster to stay solvent.

In conclusion, the principals of sophisticated investment must utilize primary criteria, some of which is outlined above. Access to infrastructure (most importantly water), the continued effort by our current Dallas mayor to utilize available land in our southern corridor, absorption of the remaining few infill sites, high suburban infill land costs, and the migration of employment centers will all play significant roles in prudent investment decisions. Utilized in the investment process, the only remaining element is patience.