It’s been a decade now. Ever since 2012, one hot housing market has followed another. At the start of this year, the hotness went from habanero to ghost pepper level. In the entire Dallas area, prices were up 22 percent this spring over the same time in 2021. In Collin County, prices surged even higher, increasing 32.7 percent from April 2021. The median price for a home there now is an eye-popping $550,000.

But you can put your eyes back in your head. They say it’s all over now for surging prices. That’s because the Federal Reserve is throwing cold water on the hot housing market. It has signaled steady increases for much of this year in its fed funds rate, which, in turn, is making borrowing more expensive for homebuyers.

For instance, last spring that $550,000 Collin County home would have cost $1,846 per month if purchased with the prevailing rate of 2.96 percent on a 30-year fixed interest loan with 20 percent down. With the same terms today, and with rates at something like 5.275 percent, those monthly payments would be $2,464. That’s $222,480 more over the lifetime of the loan.

That’s a lot. Too much, they say. It’ll drive people out of the market. It’ll chill prices. It’ll end the boom all over the country.

Except it won’t. Or, at least, it won’t here. “The expectations have been that two hammers will fall,” says Jim Gaines, a research economist at the Texas A&M Real Estate Research Center. “You’d have the hammer of higher interest rates and the other hammer of a lack of available housing for sale. Those would both hit and slow down the rate of sales and the pace of sales increases in Dallas-Fort Worth. But so far, that hasn’t happened.”

Indeed, it hasn’t. That’s why local real estate agents are saying something different than what “they” have been saying. Agents I spoke to (both on and off the record) told me that, sure, increasing mortgage rates might change how some buyers approach the market and might even lead a small number of potential buyers to drop out altogether. But the agents still see no end in sight to sales appreciation in the Dallas area. There are two main reasons for that, both of which are simple economic concepts with a lot of complexity behind them when it comes to home prices. They are supply and demand.

Demand: It might slow, but it won’t stop as long as the people keep coming.

Wall Street has been buzzing about a possible recession that could run headlong into the highest inflation rate in 40 years and cause a worst-case scenario of stagnant growth and high prices, aka stagflation. That kind of environment does threaten housing markets, including the local market. But stagflation might never arrive. And for now, there’s nothing stagnant about local economic growth.

Employment is still growing robustly here. More than 275,000 jobs were added to the local economy from February 2021 to February 2022, a gain of 7.4 percent—well above the national 4.9 percent increase in employment. As has been the case during the entire decade-long run of the current housing boom, many of the new jobs being created are being filled by people moving to the area from out of state. It seems many employers plan to feed that trend.

Take Goldman Sachs, for instance. After a hiring and relocation spree that brought 2,000 workers to the Dallas area beginning in 2021, that company now employs almost 4,000 people here. Dallas is now its biggest workplace outside of Manhattan, and the City Council recently approved tax breaks on a new tower in Victory Park that will grow its total employees here to 5,000.

Harrison Polsky, principal of The Polsky Messer Team at Douglas Elliman Real Estate in Dallas, recently took one of Goldman’s relocating New Yorkers around to various high-end homes here. They looked in Preston Hollow and in Highland Park and in other tony parts of town. “Every house we went to already had two to three offers on it,” Polsky says.

But stagflation might never arrive. And for now, there’s nothing stagnant about local economic growth.

That’s not what “they” have been saying. But it’s not surprising, either. The hottest-selling home categories in the area are properties priced over $500,000. Sales closures on homes priced from $800,000 to $900,000 were up 91 percent in early 2022 over early 2021. Sales of homes priced at more than $1 million were up 21 percent.

The way Polsky figures it, buyers looking at properties with high price tags aren’t going to be stopped by a few additional percentage points on a mortgage. That’s why his Goldman client wasn’t fazed by the multiple offers on the high-end homes that piqued his interest. “My Goldman guy understands that’s just what’s going to continue to go on in this market as long as people keep moving here,” Polsky says. “He’s ready to go into that battle.”

The Californians who are still moving here after a decade-long wave of relocation come especially equipped for that battle, with many coming from markets that are far more expensive than Dallas, even after the recent price spikes here. Southern California’s median price is now $735,000, or almost twice as much as the Dallas-area median, and real estate agents I spoke to told me they think Californians buying here have little sensitivity to mortgage rate hikes. “They’re coming with cash,” says Jackie Dorbritz, an agent with Compass, “because they can sell their California homes for so much more.”

Surprisingly, what some of today’s Californian buyers aren’t coming here with is a job in Texas. “I’m starting to see buyers coming in from California that now are able to work remotely full time,” Dorbritz says. “But they’re interested in doing that remote work out of Texas because they can get more for their money in a home here while paying less in taxes. Even as prices go up here, I think that’s still going to be the case.”

Dorbritz also runs a site called DallasGolfHomes.com and says several recent buyers have been from California. They’re snapping up properties like the one she’s listed on Discovery Bay Drive in Frisco—a three-bed, three-bath home on a golf course, with a lake view and a $775,000 price tag that is likely to sell for more than that regardless of rising mortgage rates.

Still, Dorbritz and other agents say they’re starting to see a little less frenzy in the local market, likely because of the combination of higher prices and higher mortgage rates. “Basically,” Dorbritz says, “instead of 39 offers on every house, we may only see five. But all five are still exponentially over asking price.”

Supply: There’s not enough, and there are no easy ways to make more.

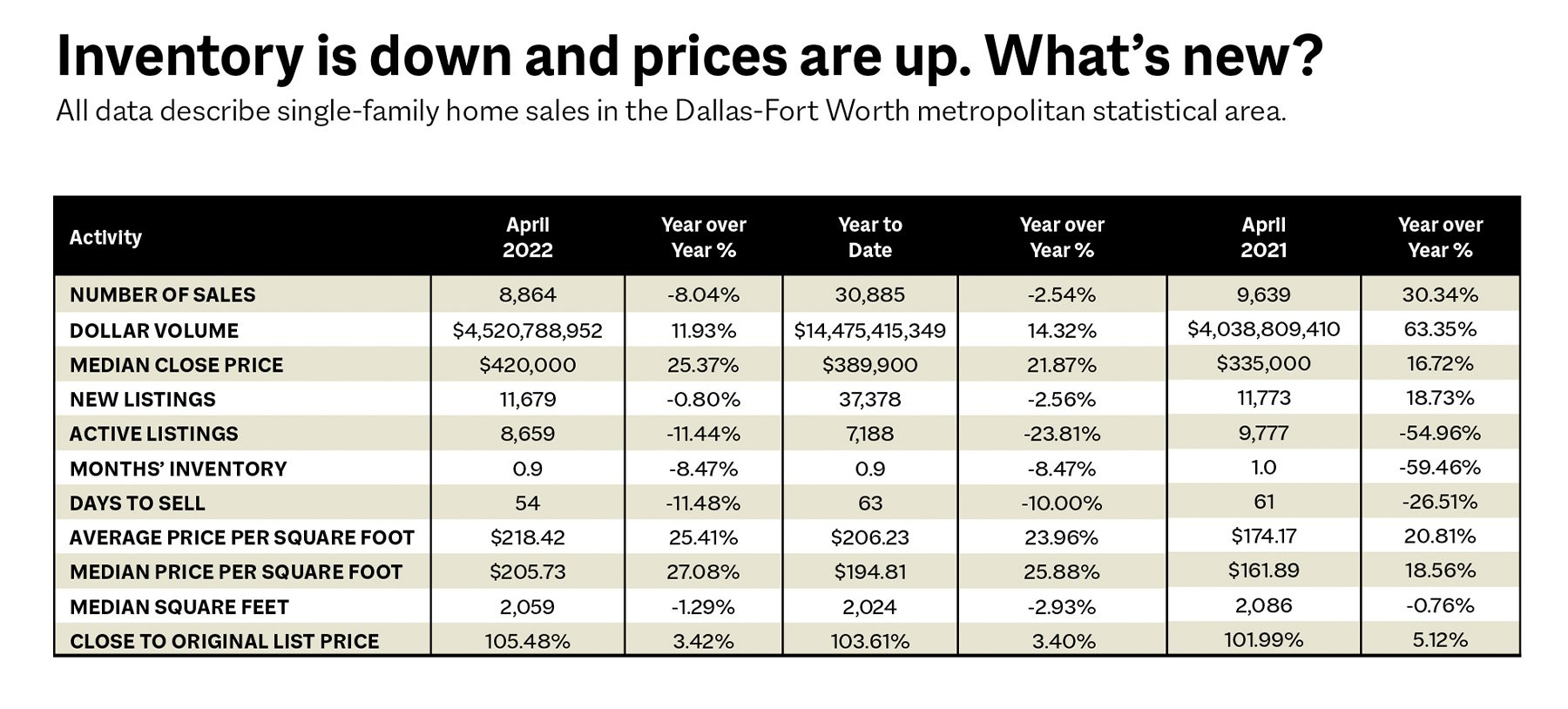

Housing supply is measured in a quirky stat called “months of inventory.” In the Dallas area in March, there was just 7/10th of a month’s worth of supply. Meaning that if the market froze in place on March 31 and no new homes were listed for sale after that, everything that was on the market on the last day of March would be sold within about three weeks, and then there would be no more homes to buy. That’s an exceedingly tight level of supply. It should take more like five or six months to sell through all the inventory. That kind of market would be in equilibrium between buyers and sellers, and price pressures would be minimal.

To get closer to that state of equilibrium, thousands of homes need to come on the market. But there are plenty of reasons that won’t happen. One key reason is that existing homeowners may not want to sell. “A seller has to turn around and become a buyer in this market,” says an agent who mainly sells in Coppell and other northwestern suburbs. “And a lot of people who could cash in don’t want the hassle of looking for something new.”

Homeowners also have a financial incentive to stay put. Attom Data Solutions, a “curator of real estate data nationwide,” reported this spring that, as prices have ballooned, existing Texas homeowners have gotten “equity rich.” More than half of all homeowners in Texas have outstanding home loans that are 50 percent or less of their home’s estimated market value. So, even though Attom also says the average home seller in the Dallas area made more than $112,000 in profit for homes sold in the first quarter of this year, if prices continue to rise, homeowners who don’t sell could continue to get equity richer while also avoiding becoming one of today’s harried home hunters.

The inventory of homes for sale could also increase if builders put up more new homes. And right now they’re swinging all the hammers they can find. Polsky, who also runs a high-end homebuilding company called Catēna Homes that works both on new construction in Dallas and in emerging suburbs like Anna, says he expects new home construction to set records for the next several years, as builders like him try to plug the inventory gap.

As prices have ballooned, existing Texas homeowners have gotten “equity rich.” More than half of all homeowners in Texas have outstanding home loans that are 50 percent or less of their home’s estimated market value.

Even though the industry has struggled with labor shortages and a dearth of materials such as concrete and wiring, and pandemic-elongated inspection timelines, more single-family construction permits were issued in the Dallas area than in any other metropolitan area in the country in the first quarter of this year, except for Houston. Work began on almost 16,000 new homes in the first quarter of 2022, a 4.5 percent jump from the first quarter of 2021. In fact, builders in the Dallas area will likely set a record this year for the number of new homes under construction, according to the Texas A&M real estate experts.

But that still won’t be enough to fill the 20 percent gap in active listings from 2021. Think about it this way: out in rapidly growing Melissa, which is just north of McKinney, Meritage Homes expects to finish 456 new homes this year. They’ll be built in three different developments with adorable names: Bryant Farms, Wolf Creek Farms, the Quarry at Stoneridge. They’ll have from three to five bedrooms, and they’ll start at a popular price point of $463,000. Fill them all, and Melissa’s population swells by 16 percent.

Now consider this: in March, there were just under 7,000 homes actively listed on the entire Dallas area market. That is 0.7 of a month’s worth of inventory. To get to a state of price equilibrium—five months’ inventory—solely through new construction would take more than five times that number of listings. That’s about 75 developments equal in size to the three going up now in Melissa.

“It’s tough to imagine us getting from where we are now to having five months of housing inventory in the next year or year and a half,” Gaines says. “It’ll take something really dire, like a deep recession that takes a lot of people out of the market, for that to happen. And a recession is not at all the way you want to balance your market.”

This story originally appeared in the July issue of D Magazine under the headline, “The Boom That Won’t Go Bust.” Email [email protected].