From stinking rich to just plain rich: one man’s tale of survival.

“Millionaires’ ranks thinned in 2002 for the first time in a decade. The reason? Falling stock prices.”

—World Wealth Report, December 2002, Merrill Lynch & Co.

I MET A FRIEND FOR A DRINK THE OTHER night at the Mansion bar. He’s a trial lawyer at a top downtown firm and a man accustomed to the hunter green of that particular setting. “I’ll have a Scotch and water,” he told the bartender. “Johnny Walker.”

The bartender: “Blue, sir?”

My friend: “Uh, Black will be fine, thank you.” He then turned to me and said, “I hate being broke!”

Then there was this, not a week later, from a senior executive of a local software company, at a dinner party in Highland Park: “We’ve simply had to stop collecting. This winter we were in Santa Fe at one of our favorite galleries, and we saw a little piece that was smashing. And only $8,000! But knowing that framing it would add another two grand, my wife and I looked at each other and mouthed our new mantra—’We’re broke’—and passed. It absolutely killed us.”

It’s killing us alright, because we used to be rich. Bubble rich. Bubble rich in Dallas. Sure, New York has always been rich. Old-money rich. Wall Street rich. And LA, too. Movie-star, pro-athlete, rock-star rich. Dallas has been rich before, of course, but that was ranch rich, oil rich, real estate rich. But bubble rich? That was something else altogether. No smoke-belching, sooty manufacturing plants for us. No big cargo ships in the harbor. No butchering cows or throwing up buildings. We got rich out of thin air. We were magicians. Presto-stock options, abracadabra-I.P.O.

And we were rich like only Dallas can be rich. Not a “Golly, gee, we won the lottery!” rich. Not a “This is somewhat sudden and undeserved, and we really should be humbly grateful” rich. Heck no! The rich part was understood. It was the minimum criterion for membership in the fraternity. To really sport the Brooks Brothers rep tie, you needed to affect the right tone: a casual, above-it-all, had-it-for-years attitude with a just-so, dismissive “It’s such a bother” grimace.

There was a shared sense of hassle to all the matters we had to “deal with.” Ice tinkling in our $40 tumblers of Johnny Walker Blues, our eyes wet and sparkly in the low bar lights, we would complain about our insolent contractors. Gripe that the marble in our foyers cost more than we paid for our first townhouses. Bitch about how much it cost to keep two houses going at once and the outrageous storage fees at Delivery Limited for all the antiques we had bought, naively believing that our mansions would be finished in less than two years.

We would agree indignantly that the lowering standards for Platinum membership meant that we had to share the first-class express check-in line with the vulgar, off-the-rack masses. The exasperation was all the more ironic—and ironically meant—because we all knew that in a few more years we would be flying in our private jets, and the crush of the hoi polloi would be merely a distasteful memory, something we could “remember when” with each other as we vacationed together in pampered seclusion in Nevis or the Amanjena in Marrakech.

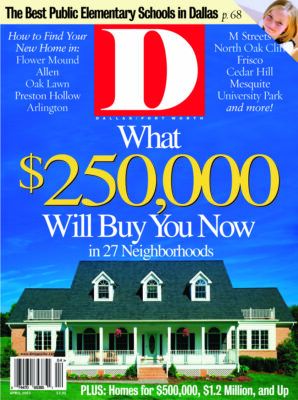

That was the best part: we were all rich together. Gliding through the endless black-tie fundraisers and catered dinner parties, we would take passionate sides over the supremacy of the Bali Four Seasons in the mountains versus the one on the beach (referring to them, of course, simply as Sayan and Jimbaran). Express surprise at the relative cheapness of auto insurance for a $250,000 Ferrari. (“They never get stolen. That’s why.”) Backslap the poor sap who lost at credit-card roulette for a table of 12 at Javier’s where the bill topped three grand with tip—and hand him a conciliatory $60 Partagas 150 as we staggered back to the bar.

But you know what happened next. The pain was unimaginable, like giving birth to a piano. But twins. And it didn’t have the decency to happen fast. Not the sweet singing quickness of the guillotine’s blade, but a thousand tiny cuts of endless fools’ rallies and buying-on-the-dips madness. Margin calls. Underwater options. Down rounds. Cram-downs.

We were broke.

One friend: “I lost more in six months than my dad made in his entire life.” Another: “It’s like a house disappeared from my brokerage statement from January to March. And those were only my accounts at Goldman!”

And the defining statement signaling the end of the bubble: “You know, suddenly a million bucks is a million bucks again.”

We were completely lost. The thing that had bound us together, the glue of our tight friendships, was gone. The thing that had defined our identity, the thing that had provided the very basis for our culture, had evaporated into thin air. Just like it came.

But, of course, not totally. Not all of us. The old rich, the insulated rich, were untouched, and they continued to entertain and travel and live their lives as they always had, without us. We, the paper rich, were now … less rich. Unrich, actually. Broke. Not broke broke. More along the lines of faded-British-empire broke. We still have the house and cars and country-club memberships, but we can’t quite afford them.

But we’re a resilient crew. That’s how we got rich in the first place. So, after the initial shock, we blinked into the glare of the new reality, struggled to our feet, and brushed ourselves off. The private-jet expectations were put on indefinite hold, but we weren’t exactly working the check-out counter at the Container Store, either.

It took about a year, but we embraced our new brokeness with the same brio as we had accepted our richness. Broke as a fashion statement. The new broke chic. We could still brag, but in a minor key: “I fired my pool man. Turns out that I was paying him a hundred and twenty bucks a week to come out and empty my skimmers. I can empty my own damn skimmers.”

“Yeah, we switched from Lambert’s to a little guy with his own truck and three Mexicans. He works the leaf blower while they mow and bag. Lambert’s was costing us fifteen hundred a month. He’s less than half and does a better job.”

“I’m going to bail out of my hedge fund, right? And suddenly Robert gets all technical on me. Says the docs I signed require 45 days written notice—before the end of a calendar quarter! Then he gets to take his sweet 30 days after that to get me my money. But, no, not all my money. Turns out he gets to hold back 10 percent, without interest, until after the year-end audit. Which gets done in, oh, April, right? May? So, anyway, I sent him my notice in February last year. You with me? Here it is, almost a year and a half later, and I’m still waiting for my 10 percent. Can you believe it? Of course, even at zero interest, he’s doing a better job than I am with those Titanic stocks that my idiot brother-in-law recommended.”

It’s like the manly one-upmanship of a nasty hangover. We tut-tut about how prodigiously we drank the night before, but there’s pride in the prodigy and only sham in the shame. We’re competitively broke.

“I’ve had a deposit on a Ferrari for two years now,” confided a former dot-com millionaire. “I threw a fit when Risi told me it would be April, at the earliest, before my car would come in. Truth be told, I’m secretly glad.”

“How much is the deposit?” I asked. “Fifteen thou,” he said. “You could still cancel and get your money back, right?” This was, you understand, not a rhetorical question but a knee-high fastball right over the plate. As a fellow club member, I could have lip-synced right along with him as he bellowed, “Are you insane? I’ve waited two years, and I’m going to give up the car now?!”

You see, we’re broke all right. But like the hung-over penitent, the fervent vows of reform are only a way to mark time until the pain subsides. Because this is Dallas. We know there will come another party. And this time, it will be different.

While D Magazine’s policy is not to run anonymously written stories, it is the author’s policy to maintain appearances and not embarrass himself more than is absolutely necessary.

We’re nothing if not realistic. When times get tough, we tighten our belts. Roll up our sleeves. Economize.

$$$BUBBLE$$$ | $$BROKE$$ |

PRESTON HOLLOW | HIGHLAND PARK |

CALVIN KLEIN | TOMMY HILFIGER |

THE MANSION | AL BIERNAT’S |

MERCEDES S-CLASS | MERCEDES C-CLASS |

THE AU PAIR GIRL | THE MAID |

CRISTAL | VEUVE CLICQUOT |

MARK CUBAN | SID BASS |

CARTIER | TIFFANY & CO. |

AMERICAN EXPRESS BLACK | CITI PLATINUM SELECT AADVANTAGE VISA |

KOBE BEEF | PRIME RIB |

FOUR SEASONS, NEVIS | RITZ-CARLTON, CANCUN |

RON KIRK | LAURA MILLER |

BOOB JOB | BOTOX |

PARTAGAS 150 | FUENTES HEMINGWAY |

FLYING FIRST CLASS | FLYING FIRST CLASS (NO ONE’S THAT BROKE) |