MOST OFTEN, graduate degrees serve as academic zoom lenses-narrowing, intensifying and focusing knowledge as a camera lens might narrow a wide expanse of sky to a single exotic bird. Graduates of such programs are well-prepared for one vocation and are often well on their ways to becoming experts in their chosen fields.

But the majority of SMU’s MBA grads are hardly specialists. When they finish their Master’s of Business Administration degrees, they’ve completed a broad regimen of courses and have learned to use a particular set of tools such as accounting, management sciences, economics and an ethereal line of study entitled “management of the total enterprise.” These tools are meant to help students think analytically and see the big picture when they encounter problems in business.

The MBA’s tools are meant to smooth the road to success in a student’s chosen field, but the student is left to decide on a specialization. Some find that they have tools but no direction; others choose the standard business disciplines. But SMU’s MBAs are known for taking the road not usually followed. The program encourages young entrepreneurs as well as bankers and corporate executives. At its best, the MBA program helps students manage their ideas and ease the transition from brainstorm to action.

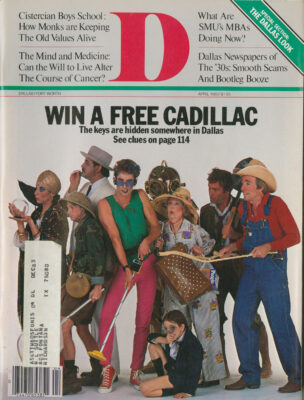

We interviewed an assortment of SMU’s MBAs at several stages of success. We found vitality, variety and-in most instances-sufficient flexibility to weather what business guru Peter Drucker calls “Turbulent Times.”

The Fitness Finance Pro

Lynann Politte, MBA ’81, worried that she’d sound cliche when she described her reasoning for her conduct since graduation. But there seemed to be only one way to say it: “I wanted to expand myself.” So, after beginning college at age 17 at the University of Arizona and after completing her MBA at SMU at age 23, she chose not to go straight into a job. “There were things I wanted to learn. I sold my car and went to Europe. I planned to stay five weeks, but I stayed five months.”

By the time she got home, friends were already beginning to ask her how she planned to fill the gap in her resume, but Politte preferred to think that if a company didn’t understand that gap, then it was more their problem than her own. She decided to look around a little more before being panicked into taking a job she wouldn’t enjoy. She began waitressing at Greenville Avenue Country Club and, since she had gained a little weight while on the road, she joined a fitness center. She did so well at Celebration of Fitness on Skillman that the owner asked her to take over some classes.

The latest news is that Politte is full-time financial manager of Celebration and that the owner is planning to expand her business soon. It’s a job, Politte says, that gives her the flexibility and independence she was looking for; and Celebration has a lot of potential for growth: “We’re even talking about a whole foods store and maybe even a natural-clothing boutique somewhere down the road.”

The Banker

By the time Fred Ball, MBA ’68, finished his undergraduate degree in engineering, he’d at least ruled out one career choice: engineering. He’d taken a few elective business courses his senior year and thought an MBA might be an interesting course of study. If his current position is any indication, his decision to get an MBA was a wise choice. Ball is executive vice president of multilending at Mercantile Bank, a job he says is very diverse and full of pressures to perform.

The 38-year-old father of two boys and part-time baseball coach says he’d like to have some spare time someday to become proficient in Spanish; but a long, leisurely retirement isn’t in the picture: “I’d like to still be active in the business after I’m 65.”

The Go-Getter

Steve Mastor has the sort of face that always seems to be smiling. And since he’s had his MBA less than a year and since he’s only 24, he has reason to grin. He’s vice president of acquisitions of the young investment search firm he interned with a year ago. He expects to earn more than $30,000 by the end of his first year.

InveQuest Incorporated, the investment search company, was founded in 1981 and is run by the family of another SMU MBA graduate, Cooper Stuart. Mastor has been on the ground floor since the beginning, helping to organize and “putting my 2 cents’ worth in on everything,” learning from Stuart and the other partners. One of the advantages about being with such a young company, Mastor says, is that he doesn’t have to just talk about doing something -he’s able to go out and do it and talk later. That’s perfect for him, he says, because one of his major faults is that he’s not much of a planner.

But Mastor’s record says quite a bit about success and the MBA. He says he has a feeling that he would have been successful anywhere, but that if it hadn’t been for his time in SMU’s MBA program, he wouldn’t have been in the same circumstances and he wouldn’t have met Cooper Stuart. “The things I learned at SMU are more valuable than what I learned in all the other four years of college. But I think some people feel that once they have the initials SMU MBA after their name they’re going to be successful. It takes more than that. That program isn’t going to turn your life around.”

“A lot of my friends think I’m just lucky,” he says, “which I am; but after the luck wears off, you still have to buckle down and prove yourself.”

The Shop Owner

Wayne Lovell, owner of The Ole Moon, a funky sort of book and gift shop on Greenville Avenue, had a shot at the gilded lifestyle and turned it down to clean swimming pools and live in the back room of the tiny store in which he eventually hoped to make his livelihood. Three years later, he still hasn’t matched the salary he gave up when he quit his job as director of personnel for the 5,000 employees of Mare-mont Corporation. But now he has control over his life, he says, and “nobody is going to transfer me but me.”

The Ole Moon was a dream of his from a long time ago. Lovell had always wanted to open a book and record store. He prowled a lot of used bookstores for an eclectic, suitably dusty collection; he still says those shopping trips are the closest he gets to real peace and tranquility.

While he was at Maremont, Lovell says he began to realize that people go through life dreaming of all kinds of things they want to do but then end up pushing those hopes aside. Since he had acquired an MBA (SMU ’73), he knew he had what it takes to open a shop. “I don’t think the degree is essential to run a small business,” he says, “but the added knowledge is like frosting on the cake.”

“One thing you catch in business school is that you’re always looking ahead. You’re always finding a means to an end, looking to the top of the mountain instead of enjoying the climb. There are faster approaches to the top than this shop, but none I enjoy as much. I could go out and find a job that would make me a lot more money, but you don’t find many humanistic top execs. This way I can stop at a ledge and enjoy the view.”

The Company President

Howard Hallam’s desk top is very, very shiny. On one corner is a tin of needle-sharp pencils; behind the desk is a ceramic eagle, a copy of Watership Down and an open dictionary. There’s also a globe. It’s a new office, and Hallam isn’t quite comfortable yet. But he’s trying.

He was already headed toward the presidency of Ben E. Keith Company, the local Budweiser distributor, when he enrolled in SMU’s EMBA program. With the EMBA (Executive Master’s of Business Administration), a student attends class every other week all day Friday and Saturday. The class is limited to those nominated by their companies to participate – those with more than five years of management experience. EMBA students learn from one another, as well as from lectures. Hallam’s class included students from a variety of fields: banking, oil and gas and technology, as well as entrepreneurs. He probably would have become president of his company, anyway (his father was president before him), but he wanted the added education. “The higher I went in the company, the more 1 realized how little I knew about business,” Hallam says.

Hallam received his undergraduate degree from the Plan II program at The University of Texas at Austin. He went on to law school but decided he didn’t want to be a lawyer. He went to work in 1968 in the warehouse of Ben E. Keith. Just before he received his EMBA in 1980, he was made president of the company.

“1 thought many times that if I were just a student, much of what I was learning would be practically meaningless because I wouldn’t be able to apply it. 1 think it almost ought to be required that students work before they come back for their MBA. I don’t know how you could learn that sort of knowledge in a vacuum.” The Trainee and the Unemployed

Tom McCasland takes the bus every morning from The Village down Central, down Ross to St. Paul. He gets out at the stop right in front of RepublicBank, where he works in the credit training department. He says he’s beginning to feel more comfortable wearing bank duds, and in his gray suit, blue oxford-cloth shirt and not-too-daring red tie, he looks all of his 23 years. He received his MBA from SMU in 1982, and, like one-third of his class, he chose to go into finance and banking.

But the thing that makes McCasland and a classmate of his, Sarah Hogg, different is that this year they discovered that they weren’t the hot commodity most MBAs of years gone by had been. The economy, they say, made things tough for their class; McCasland looked for four months after graduating before he found his job at RepublicBank. “With the economy the way it is, you really do have to know somebody to get a job. (The only way to circumvent that,’ he later said, ’is lots of on-campus interviews.’) I didn’t think it would be this bad,” McCasland says, “but I know that even some of those in our credit department aren’t really happy. They went into banking because other fields of business were too crowded.”

The panic began even before McCas-land and Hogg and others in the class of ’82 graduated, says Dan Weston, dean of SMU’s office of external affairs. “The students were paranoid about the economy, and many didn’t start looking until after they got out of school.” But nationwide reports (which Weston says SMU can at least equal) show that in 1982, 50 percent of student MBAs had jobs by the time they graduated. Within the next two months, another 45 percent found positions.

Still, Hogg does not have a job. It’s true that she didn’t begin looking before graduation, and it’s true she didn’t queue up at 4 a.m.-as others in her class did-to sign up for on-campus interviews. But since she graduated, she’s had at least 35 interviews, has sent out 50 letters and has made more than 100 “cold calls” (dialing a company’s number and making an inquiry). She hasn’t been dumb about it, either; she knows about strategy: “I’ve learned to be creative, persistent – even obnoxious. I know how to embellish on my small achievements. I avoid personnel departments. I go through friends in other parts of the companies.” But still no job.

Hogg is a little choosy. She turned down a couple of jobs. One or two places wanted her to be an assistant apartment manager, and that would have been in her chosen field of real estate. But sitting in a leasing office weekdays and weekends, listening to residents complain about stopped-up toilets while drawing a paycheck of $800 a month didn’t seem appropriate. Neither did another company’s offer to make her the owner’s wife’s social secretary. “It was like a slap in the face,” she says.

Parties keep Hogg and McCasland and others from their class in touch. There have been more than five parties since they graduated, plus weekly happy hours and an unofficial unemployment party. Hogg says she avoids some of the parties because “Once people find out you don’t have a job, they know you don’t have anything to talk about. I get so depressed. It’s hard not to take it personally after awhile. People say, ’Just try harder, be more aggressive,’ and still they think that if you’re not employed, you just aren’t looking. There have been afternoons when I’ve prayed I’d just be run over by a truck so I wouldn’t have to get up the next morning and look for a job.”

The High-Rise Veep

Most boys from Vernon, Texas, don’t get a view like the one that Thomas S. Wright has from his 17th-floor office in the Diamond Shamrock Building until they’re strumming a harp on a cloud somewhere. But Wright didn’t come straight from Vernon; he got his bachelor’s degree in economics at Yale in 1964 and spent a few summers on Wall Street.

Some of his Yale classmates thought he was crazy when he decided to return to Texas, but he was convinced that “the quality of life was better and that free enterprise was still alive.” He got his MBA at SMU in 1968.

“One difference between SMU and Harvard and Yale,” he says, “is that those schools try to make their people fit into large corporations. SMU strives to make people more entrepreneurial, and I know that if I’d stayed back East, I never would have had the same kind of opportunities.” Wright’s first job as a securities analyst was at what is now InterFirst Bank. Finding the job was a result of contacts he had made at SMU, he says. That position led to his present job as a vice president of Alliance Capital Management, an investment management firm for domestic and foreign capital markets.

“I didn’t learn the answers at SMU,” he says, “but I became better at posing the questions. An MBA should be able to adapt to the world 20 years from now.”

Since Wright’s graduation, the Dallas business community has begun to back the school more wholeheartedly. “When I was an MBA, the program was still in its infancy. Now the program is really on the map. Fund-raising drives have given the school the second- or third-highest number of endowed chairs in the country.”

And thanks to Wright, SMU also has an enthusiastic group of alumni who will continue to help get more recognition for SMU.

The Boat Salesman

Bob Williams is on his fourth career. This time he’s calling it retirement, but he says that from a “career standpoint,” he feels 18. Now he’s owner of a yacht shop: Anchor Bay Marine. He was previously director of human resources for Blue Cross and Blue Shield, a personnel man for Zale Corporation and an administrator of pilots and air crewmen in the U.S. Navy.

He graduated from SMU’s night school after 14 consecutive years of classes with a bachelor’s degree (’56) and an MBA (’63).

“The length of my schooling helped me to see what I was learning,” he says. “The difference between a kennel dog and a junkyard dog is like the difference between an MBA who got to practice what he learned as he learned it and the one who has to store up all those treasures for the future. When they get into a scrap, it’s easy to guess which kind of dog will win.”

Williams wasn’t the only one benefiting from his MBA training as he learned. While he was in school, he organized the first of the Navy’s management assessment centers designed to help identify leadership qualities. Later, he did the same for Zale and Blue Cross.

Through his MBA, he says he learned that there is an answer to every problem: “I learned to persevere. I learned to see the big picture, and I found out early that if you act like you know what to do, people will fall in behind you. He who hesitates is bossed.

“I’d say a lot of my success is because of my nature. I never wanted a consultant to come into my company and tell my boss what was wrong. But I needed the academic trappings of an MBA to live up to my self-image. My dad used to keep a $100 bill in his wallet just for the feeling it gave him. You don’t see the trappings of the MBA around me, but with it I feel I’m as big as the guys who come to buy my boats. I can call any of them Al or whatever – my MBA is a symbol that I’ve overcome a set of obstacles and that whatever others come along, I’m ready to take them on.” The Husband-and-Wife Team

David and Tegwin Pulley weren’t born yesterday. While they’re hardly over the hill (he’s 43 and she’s 39), they do have the chutzpah that comes with experience. David is president of his own businesses, Environmental Components, Inc., and David Pulley and Associates, both small manufacturers’ representatives companies. Tegwin is financial-planning manager for the equipment group at Texas Instruments (TI).

They’ve both been through some hard times and have worked continually to improve their performances. David knew very little about running a company when he began, and while he could hire accountants, personnel managers and investment counselors, he soon found that he still needed to keep tabs on their jobs. He found cash flow to be the biggest problem in running a company.

Similarly, Tegwin climbed the ranks at TI during a period when women were just beginning to excel in business. She gradually learned which methods worked in personnel management and other areas, but the learning was hit-and-miss.

David and Tegwin were perfect candidates for SMU’s EMBA program. Tegwin completed her degree in 1981. David is currently enrolled in SMU’s program. He says he’s learning as much through the other students as he is from the instructor. “There’s lots of camaraderie through the case studies. The beauty of the EMBA is that you spend two years with the same group and study group.” He says he expects to become better at sizing up problems and looking at entire situations. The degree, Tegwin and David say, makes a person better able to cut to the core of a problem. David says he sees a definite need for business knowledge regardless of what field of work a person enters. That type of knowledge is necessary, he says, in order to manage ideas.

Related Articles

Hot Properties

Hot Property: An Architectural Gem You’ve Probably Driven By But Didn’t Know Was There

It's hidden in plain sight.

By Jessica Otte

Local News

Wherein We Ask: WTF Is Going on With DCAD’s Property Valuations?

Property tax valuations have increased by hundreds of thousands for some Dallas homeowners, providing quite a shock. What's up with that?

Commercial Real Estate

Former Mayor Tom Leppert: Let’s Get Back on Track, Dallas

The city has an opportunity to lead the charge in becoming a more connected and efficient America, writes the former public official and construction company CEO.

By Tom Leppert