The DFW area’s housing prices started rising sharply in 2020, matching or even exceeding the increases in expensive-home hotbeds like Los Angeles, Phoenix, Miami, and New York.

For decades, DFW housing prices increased only moderately—but the sudden spike raised affordability issues. So, how will all the newcomers flocking to North Texas find a place to live at a reasonable price?

Markets for cars, clothing, and the rest of what we buy offer products with a variety of prices and features. There’s usually something for everyone. That’s especially true for the nation’s local housing markets.

With an eye on affordability, we looked at local housing prices, focusing on size and location. These two simple measures create a reasonably coherent portrait of the geography of housing prices in the DFW area. Then, we compared this data with what local homeowners in other metripolitan areas could purchase for the same amount of money.

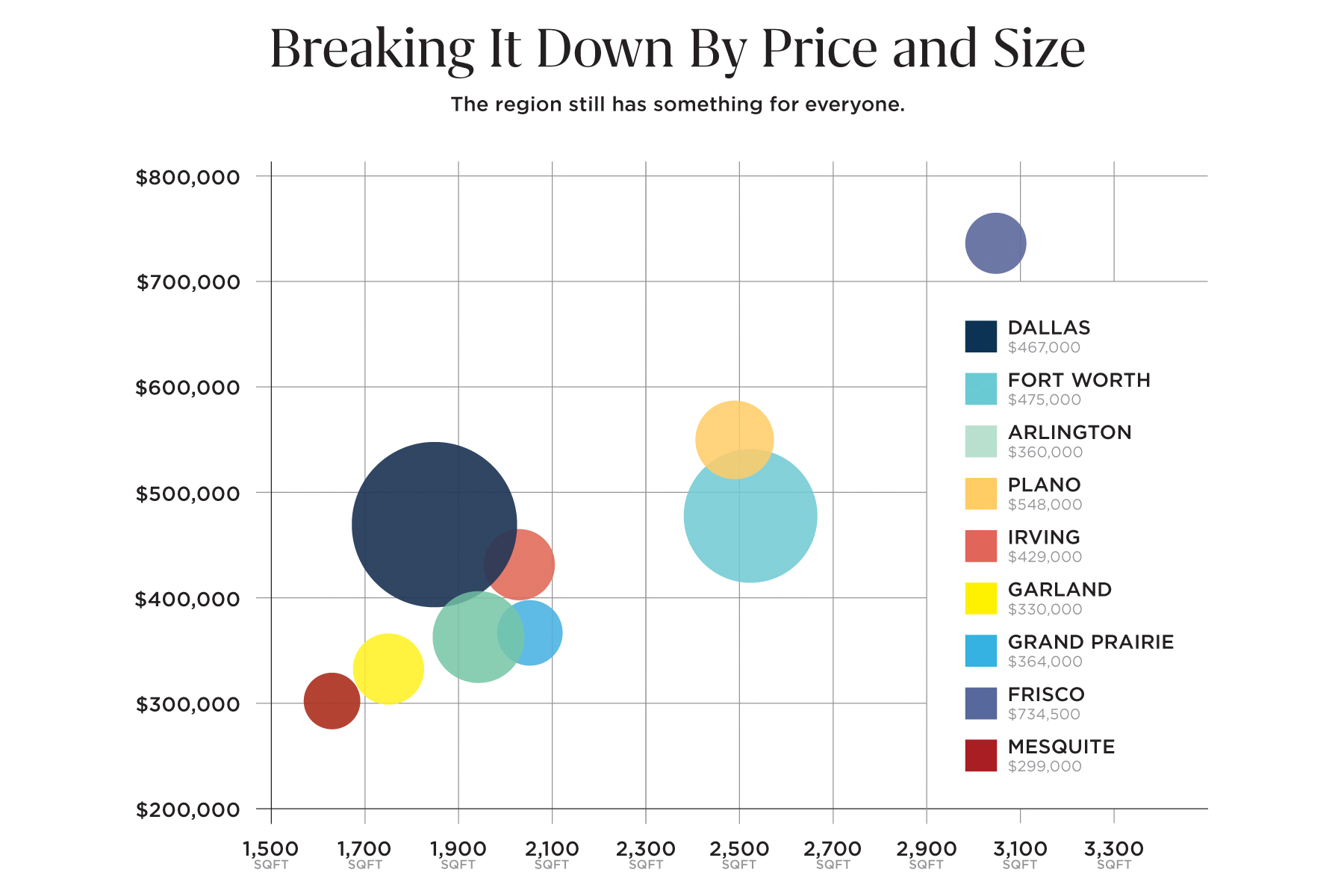

For 50 cities (nine represented in the chart) in DFW, we used Realtor.com’s October listings for median prices and median square footage, combined with census figures on population. We set aside three outliers with big and expensive houses: Highland Park, University Park, and Southlake (see sidebar).

In the chart, DFW cities are represented from places with smaller homes at lower prices to areas with large homes at higher prices.

A Whirlwind Home Tour

A good starting point is Dallas itself—the big dark blue dot. With a median price of $467,000, it’s relatively affordable, but buyers don’t get much room, with a median of 1,853 square feet.

Median prices are lower in Mesquite ($299,000) and Garland ($330,000), but homes are even smaller than in Dallas.

For lower prices with more square footage, good bets include Arlington ($360,000) and Grand Prairie ($364,000) to the west and Duncanville ($335,000) and DeSoto ($367,000) to the south. To the north, Richardson ($460,000) offers a sweet deal: pay $7,000 less for a house with 247 more square feet than in Dallas.

The median Fort Worth house (2,527 square feet) sells for about the same price as one in Dallas with the extra 674 feet costing just $8,000.

If Fort Worth’s too far from work, the east side of the metropolitan area offers similar-sized houses at slightly higher prices in Plano ($548,000) and McKinney ($551,500).

Want even more space? Look farther north and be prepared to pay dearly. Median homes exceed 3,000 square feet in Allen ($570,000) and Prosper ($818,000).

How DFW Compares

Using the city data, we calculated a weighted average median size/median price tradeoff for the overall DFW metropolitan area—1,956 square feet selling at $428,400. We then looked at comparable figures for the country’s 40 largest metropolitan areas.

DFW homes are more expensive than two years ago, but the area is still among six metro areas that offer buyers big homes and low prices. Three of those six are in Texas. In San Antonio, a typical 1,882-square-foot property goes for $320,000; in Houston, a 2,000-square-foot house costs $350,000. Kansas City, Indianapolis, and Charlotte fill out the group.

Small homes and high prices characterize a group of nine coastal cities. All have median square footage between 1,037 for Boston and 1,607 for San Jose. Prices range from $585,000 in Miami and $611,000 in Washington to $1.3 million in both San Francisco and San Jose. The five others are Washington, New York, Seattle, San Diego, and Los Angeles.

Suppose a family sells its median home in Boston or New York and moves to a median home in Prosper. The residences cost the same, but in DFW, the family can afford three times the living space. Smaller but still significant size/price gains are possible in relocating to the DFW area, and the steady stream of newcomers shows that people are still taking advantage of the housing bargains that North Texas offers.

W. Michael Cox is professor of economics in the Bridwell Institute for Economic Freedom at Southern Methodist University’s Cox School of Business. Richard Alm is writer-in-residence at the Bridwell Institute.

Get the D CEO Newsletter

Author