On March 8, Ukraine President Volodymyr Zelensky addressed the United Kingdom Parliament from his bunker in Kyiv, just two weeks after Russia had invaded his country. He invoked Winston Churchill’s famous speech during World War II, saying, “We will fight for our land, whatever the costs. We will fight in the forests, in the fields, on the shores, in the streets.”

Zelensky’s address asking for additional aid in battling Russia was preceded by a presentation to Parliament from George Yates, CEO of Dallas-based HEYCO Energy. He was part of a group of U.K. shale gas industry leaders who were there to convince lawmakers to give them access to untapped shale gas on the island nation.

Yates believes the timing was a turning point. Many forces are coalescing to illustrate how he—a typically under-the-radar, third-generation industry veteran with experience in the Permian Basin, Spain, and the Bowland Shale in the U.K.—is the right man to play a constructive, practical role in Europe’s much-needed energy continuity. “The dominoes are falling,” he says.

The world is awakening to the realities of an energy transition that is driven by numerous competing factions. In an era where social media creates quick visceral reactions and narratives spin, piercing the veil of truth is a challenge. Yates brings a measured and balanced perspective. “We have to outline our objectives clearly: What is an energy system supposed to do?” he says. “You have to think big. Energy systems are fundamental to human lives.”

A fundamental need that’s ever-increasing. Globally, energy needs are expected increase 50 percent by 2050. “Net zero—as an absolute—will not deliver; you have to be flexible,” says Yates, an entrepreneur with a deep vein of geology informing his perspectives and actions. Climate science is complex and not perfectly understood. Low carbon cannot exist in isolation without energy security, he suggests. “Adequate supplies that are affordable and reliable are key,” he says.

The energy crisis in Europe began before the Russian invasion of Ukraine, revealing its bite in the winter of 2021. Yates notes that in Spain, as of late July, gas was selling for $50 mmbtu (a measurement that represents 1 million British thermal units). Dutch gas futures, called “TTF,” in mid-September for year-end delivery are approximately $64 mmbtu.

In Europe, electricity prices are high owing to its deregulated market; effectively, the most expensive and least efficient megawatt influences the direction of price—usually upward—when there are energy shortfalls. “At the margin, natural gas prices all electricity, which is why Europe’s natural gas prices are six to 10 times that of the U.S.’s,” says Jay Hatfield, CEO and founder of New York-based InfraCap Ltd., a firm that focuses on energy infrastructure investment funds. He expects upward pressure on prices through the winter with some convergence in the future. Large-scale infrastructure projects are a form of capital stock lock-in. As such, Hatfield believes that natural gas has a 30-to 40-year run, oil slightly less, even while addressing decarbonization.

Human necessity and welfare are the compounding factors, more so than any other time in the energy industry’s cyclical history. It’s not driven by boom and busts, shortages and surpluses—as is typical of oil and gas markets—but the necessity of what energy does, including lifting people out of poverty, Yates says. As a top global powerhouse, the United States is being called to action for a role in Europe’s energy security. “We are entering a cycle like no other in a cyclical business because of such different characteristics, underpinned by geopolitics and undercapitalization,” says Yates, whose impact and lifelong achievements in the industry are being recognized by D CEO with the top honor in its 2022 Energy Awards program.

Artesian Wells

Yates’ European ventures have their roots in the innovation of America’s shale revolution. In 2013, the Permian Basin, one of the most prolific oil fields in the world, achieved more recognition than its initial discovery, a sort of 21st-century oilfield breakout. It began to change the dynamics of oil markets that had been at the mercy of OPEC since the 1970s. The Permian continues to give the world more than just oil.

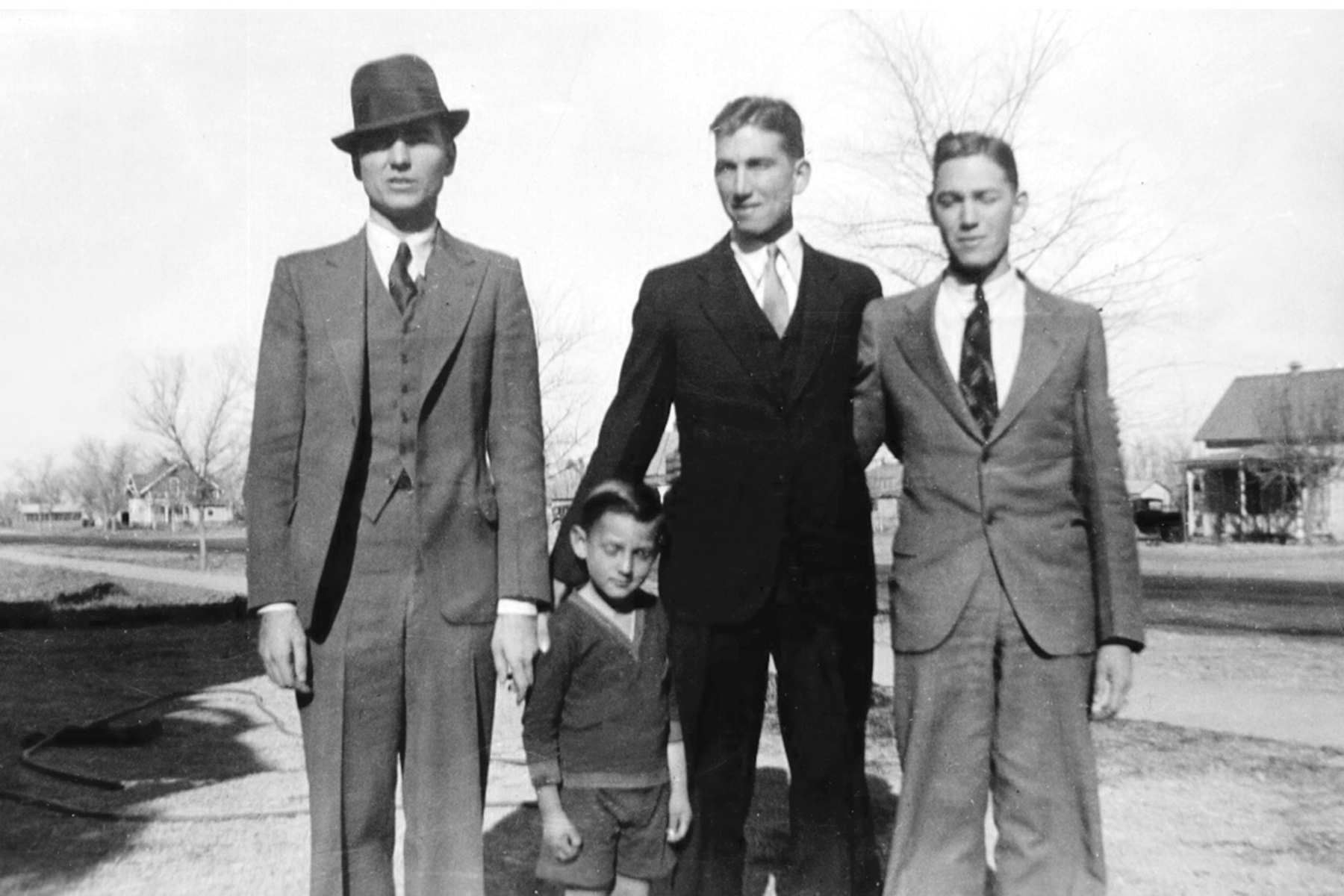

Within the Permian’s borders sits the Delaware Basin, where George’s grandfather, Martin Yates Jr., discovered the first commercial oil well on state lands in southeastern New Mexico in 1924. He had moved to Artesia, New Mexico, from Missouri in 1907, looking for adventure and believing that oil would be found in the Pecos Valley, where many artesian water wells had traces of oil. Today, he’s considered the “father of the New Mexico oil business.”

In 1969, George’s father, pioneer oilman and wildcatter Harvey Yates, founded Harvey E. Yates Co., the predecessor of HEYCO Energy Group. Today, building on work by his grandfather and father, George Yates is driving significant developments globally and redrawing energy lines.

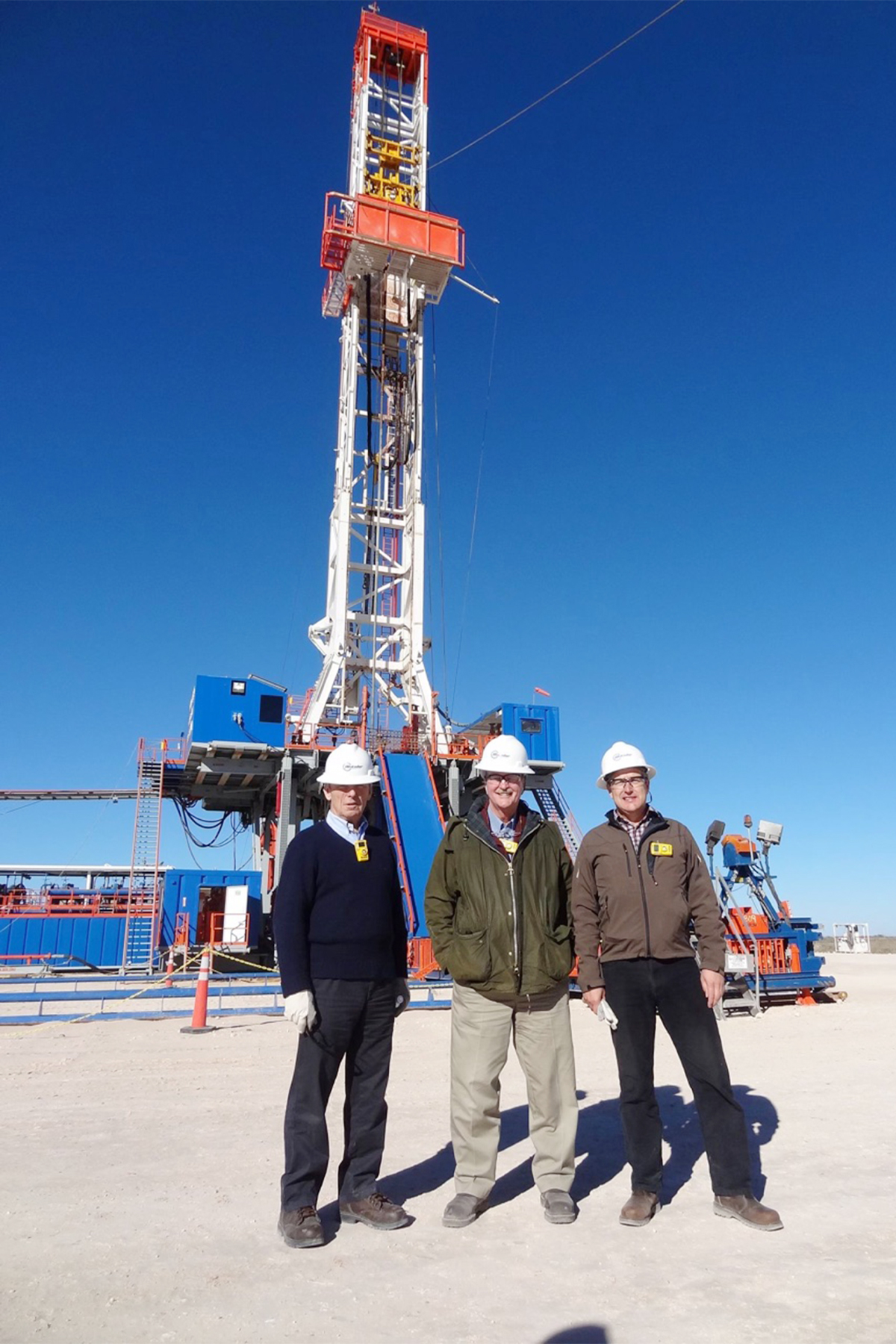

HEYCO had lease positions in all the headline horizontal plays and pioneered the Bone Springs Sands as a conventional play in the 1980s. (The Bone Springs intervals correspond in Texas to the resource-rich Spraberry of Midland.) HEYCO developed the sand as a vertical play before multi-stage hydraulic fracturing. “We worked with some brilliant scientists from Sandia Labs to better understand the reservoir and drilled the first horizontal well in the second sand with their help,” Yates says. “It has, of course, grown into one of the best horizontal plays in the best basin in the country.”

In the U.S., HEYCO has focused on non-operated projects in New Mexico, Louisiana, Wyoming, and East Texas’ Haynesville Shale. (Some holdings were sold in 2015 to Dallas-based Matador Resources in a cash-and-stock deal.) In 1987, HEYCO went global, with subsidiaries involved in exploration in England, Spain, and Morocco. In 1995, HEYCO and partners were granted permits in Spain; in 2007, they discovered the Avington Field in southern England. Yates’ international activity has been more of a non-operated nature—until now. While pushing against the headwinds in Europe opposing oil and gas development, Putin’s invasion of Ukraine reversed the tide.

Energy Revolution 2.0

Some 15 years ago, Yates, along with partners, the Basque National Oil Co. and True Oil, obtained licenses over what they named the Gran Enara Field in Basque Country—a community in northern Spain. Third-party estimates of gas in place are some 200 trillion cubic feet. In comparison, the Texas Railroad Commission says the Delaware Basin in the Permian has the potential to produce 281 trillion cubic feet of natural gas, based on a 2018 survey.

Earlier this year, Yates bought a majority interest in a producing gas field with substantial proven undeveloped reserves in a conventional reservoir located in Spain’s Rioja wine country. Several years ago, he also helped engineer the passage of a bill that gave surface owners a royalty interest. “It’s the first field in Spain where surface owners have an economic interest in production,” Yates said. The field is very popular locally, particularly among landowners. When asked why HEYCO was chosen to operate, Yates modestly offers, “You go to your friends. It’s a relationship business.”

Based out of a new office in Madrid, HEYCO’s Iberia team now operates the field. This required Spanish government approval, which finally happened in mid-July. “We are running 3 million cubic feet (cf) a day through our gas plant, but the plant is capable of 30 million cf per day,” Yates says. “Incredibly, we now produce 85 percent of the indigenous gas in Spain from one well.”

He and his team hope to build capacity after drilling up to three development wells next spring. Spain currently relies almost exclusively on imports—roughly 1 trillion cf per year.

The opportunity in Spain compelled Yates to come off the sidelines: “Maybe it’s the old dog and old tricks,” he says. “We will have conventional and unconventional operational capabilities in Europe that no other independent has. We are in the technology transfer business.”

The same reversal of fortunes is happening now in the U.K. HEYCO has a very large footprint in the Bowland Shale, specifically in the Gainesborough Trough of the East Midlands. The Bowland Shale is just north of Birmingham; it edges to Britain’s West Coast include Liverpool and Blackpool, and to its east, north of York into the Moors. Yates enthusiastically explains that the in-place reserves there “have wonderful looking rock, full of gas.” The IP reserves are 650 billion cf per section, which is more than the Marcellus and Haynesville, and all above 10,000 feet.

According to a report in Britain’s national daily, The Telegraph, if 10 percent of the estimated in-place resource were recovered, the U.K. would be self-sufficient in natural gas for 50 years. Former Prime Minister Boris Johnson imposed a moratorium on large-scale drilling and hydraulic fracturing in 2019. But, due to the European energy crisis, it was lifted on Sept. 8 by former Prime Minister Liz Truss. (See sidebar on p. 39.)

An Energy Evangelist

At a December 2021 conference in Washington, D.C., Yates discussed Europe’s energy crisis, as defined by supply shortfalls and record-high prices. He said that Russia was using its “swing producer dominance in Europe to maximum economic and geopolitical advance, missed by planners in Brussels and London.” He added that Europe, an industrial bloc, needs resources if its economies are to grow.

Natural gas prices were already escalating last winter—before Russia’s invasion of Ukraine.

InfraCap’s Jay Hatfield attributes this to the failure to procure a secure supply. “The U.K. even shut down a 3 billion cf storage facility owing to their energy transition plans,” he says. In addition, the German government has begun to bail out firms impacted by the energy crisis post-invasion. “Europe doesn’t need any speeches from the United States about failed policies now,” Hatfield says. “They’re living them.”

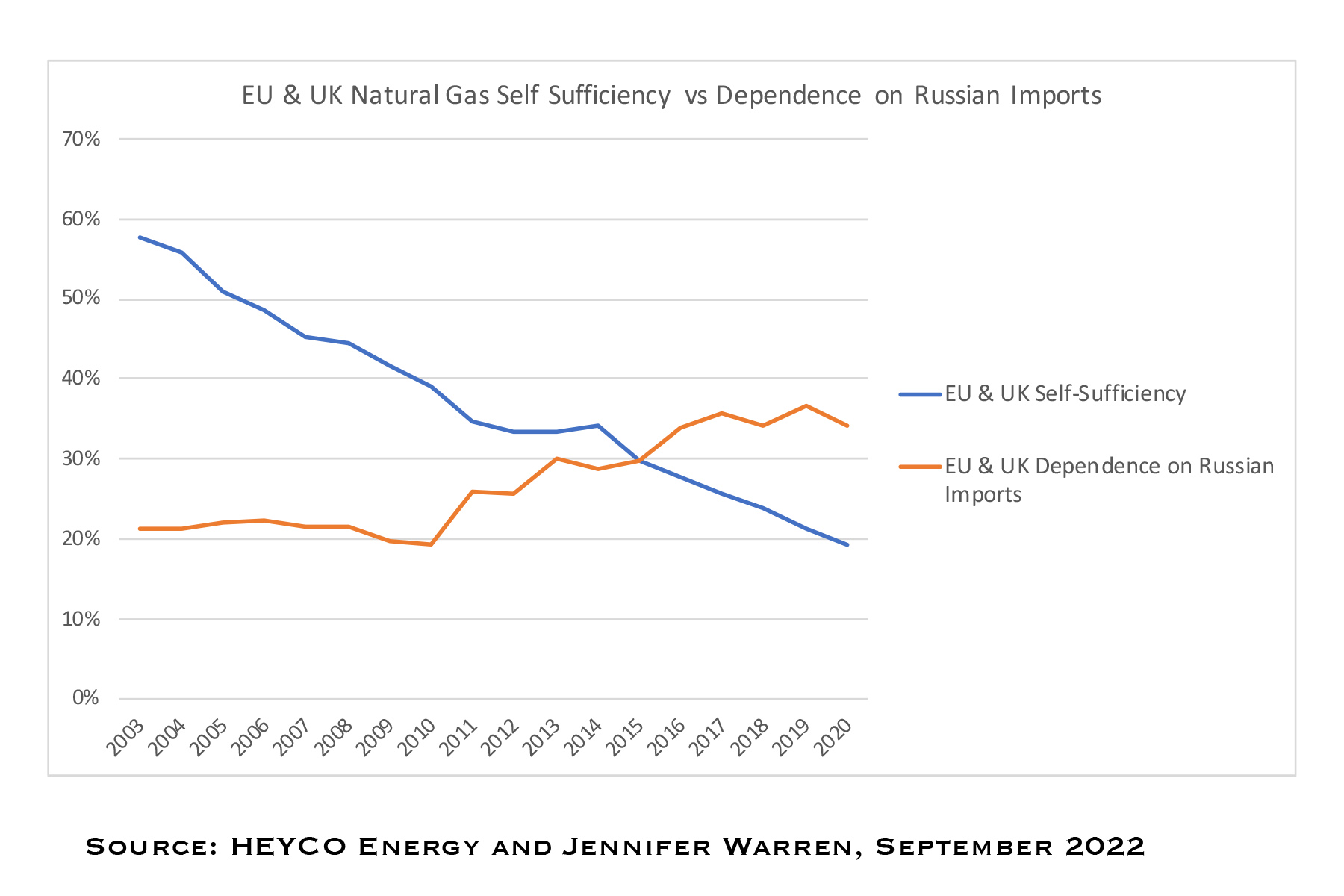

The U.K. sits atop world-class resources, as does Spain. At the D.C. conference, Yates warned that energy was of national security importance and said NATO members should develop their resources. As an example, he said natural gas status was hotly debated in Brussels but is now accepted as a cleaner fuel. The U.K.’s dependency on Russian gas and imports had grown well north of 50 percent. According to shale industry experts, 100 new wells could cut that to 10 percent.

A natural gas advocate, Yates offers facts about the impact of developing indigenous resources: surface use is very limited, carbon is a fraction compared to importing it, and no rare earth minerals from China or child labor are involved.

What’s happening in Europe is reminiscent of America’s experience about 15 years ago, when green ambitions and fossil fuel use collided. Then came the Great Recession. Things changed. Shale gas was taking off, then oil.

We’re here again. This time, we aren’t faced with Putin’s direct war machine but remnants of his longtime and well-documented anti-shale disinformation campaign.

Getting the Gas Flowing

On Sept. 8, Britain’s short-lived Prime Minister Liz Truss lifted the moratorium for large-scale hydraulic fracturing, with the goal of easing the energy crisis in the short term and for the future. The ban had been in place since 2019. Upon lifting the ban, Truss said she expects more than 100 licenses to be awarded for tapping into the country’s “huge reserves,” which “could get gas flowing in as soon as six months.” Showing the U.K. their path to self-sufficiency is what Yates pushed for when presenting to the U.K.’s parliament this past March. Lifting the ban is the first step toward energy independence, he says. HEYCO and its British partner stand ready, with a substantial footprint in England’s Bowland Shale. “The only way the U.K. attains self-sufficiency is through the development of shale resources,” he says.

Given the backdrop of the energy transition and Europe’s energy crisis, Yates calls the decision countries face between importing gas from Russia or developing their own “truly a binary choice.” Putin’s regime has been playing geopolitical chess for many years, and Yates says the Russian president understands energy systems better than most policymakers in Europe. “They assumed Russian gas was reliable and that renewables would work, but intermittency issues have revealed shortcomings,” he says.

In the past decade or so, seven European countries banned fracking, pressed to do so by environmental organizations. But an energy crisis has stunned Europe. The situation was exacerbated by an unprecedented summer heatwave—and winter looms large. And the war waged by Putin is in Europe’s backyard. “It’s the equivalent of tanks rolling into West Texas,” says Yates. While Europe was focused on going green, Putin dreamed of taking advantage of the moment through land coups.

A Catalyst for Change

A vast fissure is opening between the use of fossil fuels as a majority fuel source and electrification. The reality is that approximately 80 percent of global energy is sourced from fossil fuels, including coal. The electrification of advanced economies has many headwinds—critical minerals’ supply chains for electric vehicles, issues surrounding grid capacity, renewables intermittency, major transmission gaps, and NIMBY (not in my backyard). Many energy experts say natural gas and nuclear are the way forward, given the need to burn less carbon and continue reliable power generation. Natural gas with carbon sequestration helps. In choosing a country’s optimal energy mix, leaning on its own resources first is Yates’ answer.

U.S. oil and gas firms are decarbonizing, and fewer imports also mean less carbon. Then there’s the net-zero quest and the influence of environmental, social, and governance factors. They are two very different but overlapping drivers of capital flows.

According to Yates, net zero is a pseudo-scientific approach to reducing carbon emissions. “We have to recognize our place in geologic time,” he says. “We are in an interglacial period, which gets warmer.” In the quest to combat climate change, “there are at least 16 different variables that go into climate, and we have focused on one, without knowing their relative weightings. It is the one variable with the connection to man’s burning of fossil fuels.”

A Shift in Power

In the past 20 years, the EU has dramatically cut its own energy production and increasingly relied on imports from Russia.

It may be that decarbonization is an insurance policy for now. Yates says the U.S. will continue to build oil supply this year and next but in the context of being short oil around the world. OPEC doesn’t have the additional barrels. “They cut down investment in 2020 and are suffering the same problems as the world market,” he assesses. “The only excess capacity is in the UAE and Saudi Arabia, and it’s marginal from what I understand.” I ask if we’re calling their bluff. “Yes, we’re calling their bluff; the market is calling their bluff,” Yates says. “We’ve not been in a situation where we’ve run out of oil physically—it has never happened.” The market needs 2 percent excess capacity to function well, about 2 million barrels per day at minimum, he adds.

Until more oil is developed, we’re operating on the edge of supply and demand. “Price signals are there for development but think how long it’s going to take us to return to a 2018–2019 market set up with the right capacity, sand, pipe people—everything,” Yates warns. “When you lack capacity, how do you make up for a spike in demand, an outage, or a pipeline problem? In a few months, we may be draining inventories worldwide.”

Yates has lived through deregulation, price controls, profound technological advancements, and many embargoes. “When I started in the industry, continental drift was not a universally-accepted theory,” he recalls. The two most momentous events in his career—the U.S. unconventional revolution and the globalization of the gas market—are happening right now and are complementary. “I knew it would happen, but I did not know we would be so compressed in time,” Yates says. “Russia was the catalyst?” I ask. “Yes, Russia was the catalyst,” he says.

Massive Opportunity

Estimated gas in place per square mile in the U.K.’s Bowland Shale, where Dallas-based HEYCO and its British partner have a significant stake, exceeds the most successful U.S. natural gas shale plays. Here’s a look at how estimates break down per section by billion cubic feet (bcf).

- 80 bcf

- 150 bcf

- 300 bcf

- 650 bcf

Haynesville Shale – Spans Northern Louisiana and Eastern Texas

Barnett Shale – Spans 25 counties in North Texas

Marcellus Shale – Spans parts of five states in the Appalachian Basin

Bowland Shale – Spans Coast to Coast in Central Britain

HEYCO Milestones

Martin Yates Jr. and his partners complete the first commercial oil well on state lands in New Mexico.

One of Martin’s four sons, Harvey, forms the Harvey E. Yates Co., which goes on to become a cornerstone of HEYCO Energy Group.

HEYCO pioneers the Delaware Basin’s Bone Springs as a conventional play.

Led by Harvey’s

son, George, HEYCO expands to Europe.

HEYCO opens a HQ office in Dallas.

HEYCO is part of a group that discovers the Avington Field in southern England.

HEYCO subsidiary, Harvey E. Yates Co., is acquired by Matador Resources in a cash-and-stock deal.

CEO George Yates joins other industry leaders in successfully pushing the U.K. to lift its fracking ban.

Get the D CEO Newsletter

Author