Mike Hoque’s office on the 56th floor of the Comerica Bank tower in downtown Dallas looks out onto a patchwork of parking lots, crumbling brick buildings, and empty streets and concrete sidewalks that have long served as a kind of symbolic border between the city’s thriving north and forgotten south. About a decade ago, Hoque began buying up the no man’s land, small parcel by small parcel. It seemed like an easy bet. The fortunes of land adjacent to the downtown of a major American city would inevitably reverse. The only question was when.

Hoque’s gamble nearly paid off when executives from Amazon came to town looking for a location for a second headquarters. The corporation shortlisted his property but eventually passed on Dallas. In the meantime, though, Hoque had caught another break. After the passage of President Donald Trump’s tax bill, most of the media attention focused on its steep tax cuts. But a somewhat arcane provision slipped into the legislation caught Hoque’s interest. It provided for the creation of something called “Opportunity Zones.” Although the details of the provision are somewhat baroque, its intention is relatively simple. Opportunity Zones attempt to steer investment into challenged urban neighborhoods and blighted rural areas by offering investors huge reduction in capital gains tax. Hoque believed that if he could get his land holdings included in one of these new zones, the math might pencil out on his deal downtown.

As Hoque began to lobby Gov. Greg Abbott’s office, which was charged with designating the new Opportunity Zones in Texas, he drew up plans for a new innovation district. The development would include mixed-use towers with hundreds of thousands of office square footage, thousands of new residential units, a new community college campus, public green space, and street-level shops and restaurants. Adding his land to an Opportunity Zone would essentially mean a new downtown would sprout up next to the existing one.

Hoque’s plans to capture the scale and potential new tax incentives would have implications that extended far beyond downtown. For generations, attempts to drive investment in southern Dallas have met with little success. Opportunity Zones, however, looked like a game-changer. Not only did the provision create an incentive to tap new sources of investment, it incentivized the kind of patient investment—plays of 10 years or longer—that many believe is necessary to tip southern Dallas in a new direction. Other developers soon took notice. Had southern Dallas finally found its economic salvation?

Making Good Deals, Better Deals

Opportunity Zones may have been new to Dallas investors, but the idea has been bouncing around policy wonk circles in Washington, D.C., for the better part of the last decade. At the center of the conversation is an organization called the Economic Innovation Group, a think tank funded by Napster founder and former Facebook president Sean Parker. EIG managed to build rare bipartisan support for the incentive that promised to tap into what it estimates as trillions of unrealized capital gains and direct it to economically challenged areas. It worked by allowing investors to defer taxes on capital gains that are reinvested in qualifying opportunity funds and getting reduced rates on the return from that new investment. The longer an investor keeps his or her investment in a fund invested in an Opportunity Zone, the more potential long-range upside.

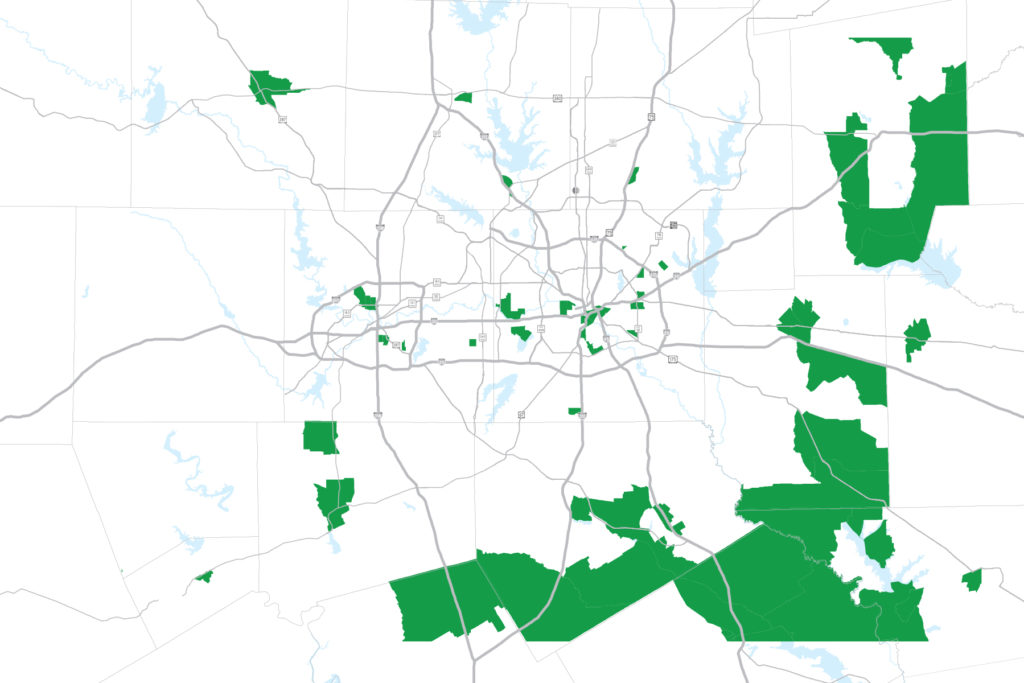

At first, however, the Opportunity Zone provision in the 2017 tax bill didn’t create a windfall of new investment. The provision was instead mired in ambiguity around its implementation. How would the zones be created? What were the timelines for making investments? What kinds of investments would qualify for the tax benefits? Over the next two years, the IRS drafted two sets of regulations clarifying the new measure. More confusion was generated by the process of designating the new Opportunity Zones. The federal government left the decision to the states, and different states took different approaches. In Texas, Gov. Greg Abbott’s office drew out a map with zones scattered around metro areas and throughout rural parts of the state. It was a process that some believe was driven more by lobbying than by data and research around which areas could be best impacted.

“Government programs usually make bad deals good deals. This one makes good deals better deals.”

Jack Matthews | Matthews Southwest

“If you compare Dallas and Houston, unfortunately Dallas didn’t get the same level of allocation,” says Linda McMahon, president of The Real Estate Council. “For example, Red Bird Mall wasn’t chosen nor, was the area with the Forest Theater; but the area across I-45–near Fair Park was.”

Designated Opportunity Zones in Dallas wrap around the southern edge of downtown, including areas north and south of Interstate 30 and the Cedars. A portion of South Dallas near Fair Park is an Opportunity Zone, as are sections of East Oak Cliff. Hoque’s land made it into an Opportunity Zone—as did many of the other large holdings that were in play for the Amazon bid. In fact, as the Opportunity Zones were implemented, the areas that seemed most poised for potential impact where those where real estate developers had already acquired land and the fundamental economics were in place. The zones promised to simply direct more capital to the projects, potentially speeding up their development timeline.

In addition to Hoque’s land, Jack Matthews’ extensive holdings in the Cedars, Ray Washburne’s newly purchased Dallas Morning News site in southwest downtown, and Cienda Partners’ development of the former Oak Farms Dairy in North Oak Cliff are all expected to come online sooner because of their presence in Opportunity Zones. The zones may have been intended to spur investment in disenfranchised neighborhoods, but in Dallas, the investors best positioned to take advantage of the new incentive were those who were already well on their way brining projects out of the ground.

“Government programs usually make bad deals good deals,” says Matthews, president of Matthews Southwest. “This one makes good deals better deals.”

Flipping the Economic Narrative

McMahon has long looked for deals in South Dallas. As part of former-Mayor Mike Rawlings’ Grow South initiative, she managed a capital fund that was raised to invest in developments and businesses in the southern half of the city. That experience taught her that capital wasn’t enough to flip the economic narrative on some areas of southern Dallas, which is why she isn’t sure that Opportunity Zones will have the same community impact on Dallas as they might elsewhere.

“The perfect execution, based on everything I’ve been reading, is the relocation of a businesses to a low-income area—say investing in a building that could be turned into small manufacturing,” McMahon says. “But there are just not small manufacturers that someone would take over [in southern Dallas].”

That perfect execution also doesn’t appear to be happening in many other cities. As the New York Times reported in August, Opportunity Zones are primarily benefiting wealthy financiers who are steering untaxed capital gains into high-end apartment buildings and hotels in already transitioning neighborhoods.

Opportunity Zones may not have the intended effect of generating job growth in southern Dallas, but there are some examples of urban revitalization projects that could get a boost from the measure. In addition to the opportunity fund he has created to invest in the Dallas Morning News headquarters site, Washburne says he has created an opportunity fund to invest in a shopping center in West Dallas he recently purchased.

The center looks like a picture-perfect Opportunity Zone deal. It sits amidst an economically depressed area on the far western edge of the burgeoning Trinity Groves neighborhood. Apartment developments are marching westward down Singleton, but the center recently lost its anchor grocery tenant. Washburne plans to attract a new grocer to the project but admits that it will take time to lease the property back up. Had it not been for the Opportunity Zone, it would not have made sense to make such a long-range play in West Dallas.

“Do I put a dollar in West Dallas or a dollar in Frisco?” Washburne says. “I’d go to Frisco all day long. But what if we let you keep 35 percent of what you had for 10 years and then pay us for 10 years, but whatever appreciation you have you get to capture tax free. All of a sudden, the scales balance out.”

Washburne can roll his capital gains from other investments into the West Dallas shopping center and defer paying capital gains tax for 10 years. That effectively frees up the capital he would have paid in taxes to invest. A decade down the road, the appreciation of the property will likely offset whatever capital gains he eventual pays on the initial investment.

“The way you have to look at it is the way you look at the present value of your money. If you put your capital into it and not pay tax today, it gives an extra 35 percent to invest,” says Washburne, reiterating the terms. “It allows you to put more value in today that you can harvest and sell 10 years from now. That’s exactly a middle fairway deal—an example of why Opportunity Zones were set up.”

The economics are starting to drive increased investor interest into Opportunity Zones, and developers who have already been active in the designated areas are seeing a surge of investor interest. Amanda Moreno Lake and her husband Jim Lake have been investing in southern Dallas for decades, most notably in the Bishop Arts District in Oak Cliff and, more recently, in downtown Waxahachie. For a development site acquisition in a part of Dallas County that sits in an Opportunity Zone, Moreno Lake set up an opportunity fund. Shares sold out within 24 hours.

‘Promise and Peril’

The uptick in investor interest is already impacting the market. A report by commercial real estate research firm Reonomy found that since the passage of the tax reform bill, the average sales price of commercial investments in Opportunity Zones in Dallas has increased from 19 percent to as much as 117 percent. However, as more investors look to offload the capital gains in Opportunity Zone investments, some market watchers fear that the incentive won’t fuel the turnaround of struggling neighborhoods but simply supercharge the processes of gentrification.

Emily Perlmeter, community development advisor with the Dallas Federal Reserve, wrote a paper analyzing the “promise and peril” of Opportunity Zones in Texas. She says that Opportunity Zone investment is targeting areas that were already undergoing the process of transformation.

“It is a likely outcome that in those currently gentrifying neighborhoods, it will speed that up,” Perlmeter says. “If people are aware and mindful, there is a way to not stop that from happening but to be able to mitigate the impact.”

If Opportunity Zones are intended to spark neighborhood rejuvenation, the best potential results, Perlmeter says, are in areas where Opportunity Zones are layered over existing plans for community revitalization. Some communities around the country have created additional incentives that can help steer Opportunity Zone investments to the areas that most need a jump-start, rather than parts of town that have already begun to see investor interest.

But as the New York Times has reported, nationwide, investments in Opportunity Zones are being drawn to those already-transitioning neighborhoods that offer the lowest-risk, highest-return environment.

“This is market-driven,” Perlmeter says. “Other communities recognized that we’re competing with every Opportunity Zone across the entire country, so we need to be able to offer extra tax credits. Sometimes they are able to play with policy—‘Okay, well, we want to see this kind of development, so we are only going to offer incentives for that kind of a project. Texas has not done that.”

Washburne sees another potential pitfall: funds set up by inexperienced investors looking for their cut of a surge of investment capital. At the end of the day, Opportunity Zone investments work when the fundamental economics of the deal pencil out. But if there are investors simply looking to park their money in a fund to offset tax expenses, they could be steered toward bad deals that hurt—rather than help—communities in the long-run.

“I think you have to be cautious about these things,” Washburne says. “There are going to be a lot of funds set up that don’t have properties or experience. I see it in oil deals, and I saw it in the dot-com boom. People run out after deals and they might not have the expertise. There are a lot of alligators in that swamp.”

Deadline Looms

Another provision in the bill that created Opportunity Zones may lead to hasty deals—or communities missing out on potentially impactful projects. If investments aren’t made by Dec. 31, 2019, investors won’t realize the full tax benefit of the program. The deadline poses a challenge to real estate developers who often need a longer timeframe to piece together deals.

“When Amazon went away, [other Dallas developers] went to sleep. I woke up.”

Mike Hoque | Hoque Global

But not Hoque. He has been working to maximize the potential impact of Opportunity Zones on his investments from the get-go. He hired lobbyists to ensure his land holdings were included in the governor’s office’s Opportunity Zone maps. He hired lawyers to parse the federal legislation and figure out how it could best be suited to serve his investment. Hoque says he believes Dallas lost the Amazon bid because the city didn’t do enough homework. So, after the e-commerce giant chose the East Coast, Hoque hired architects to dream up a new vision for his corner of downtown, and he worked with the city to create a Municipal Management District for the area. “When Amazon went away, [other Dallas developers] went to sleep,” he says. “I woke up.”

Hoque recognized early on that Opportunity Zones aren’t a magic bullet. The fundamental economics of the deal still need to work, and developer expertise is still necessary. Opportunity Zones will have the most positive impact on both an investor and a community, he says, when there is a strong plan already in place. “It is another extra level of icing,” Hoque says. “It is not the cake.”