When former Austin entrepreneur Jason Story and veteran Dallas investor Jeff Williams linked up to launch Dallas venture capital firm Hangar Ventures in 2015, they hoped to build a collaborative investing environment and increase momentum for the Dallas startup community. Fast-forward two and half years later and the firm, now called Interlock Partners, has made three investments, doubled the size of its team, upped its fund by $15 million, and broadened its geographic reach and expertise.

“I’ve been in this market a long time, and what we’re seeing right now is pretty encouraging,” says Williams, formerly of Covera Ventures on the 16th floor of Two Galleria Tower, once a hub for Dallas investors. Family offices, which supplement venture capital deals, are starting to become more forward-thinking, he adds: “We now have that third generation in the room. That generation grew up with technology, so they’re not averse to investing in it.”

The current pipeline for investment is strong, with Interlock estimating about 100 deals worth vetting. Interlock has already invested in Dallas-based real estate startup Rechat, New York-based video editing marketplace VidMob, and New York-based early childhood education software company BEGiN. Each investment ranged between $1 million and $3 million, with the possibility of follow-on cash.

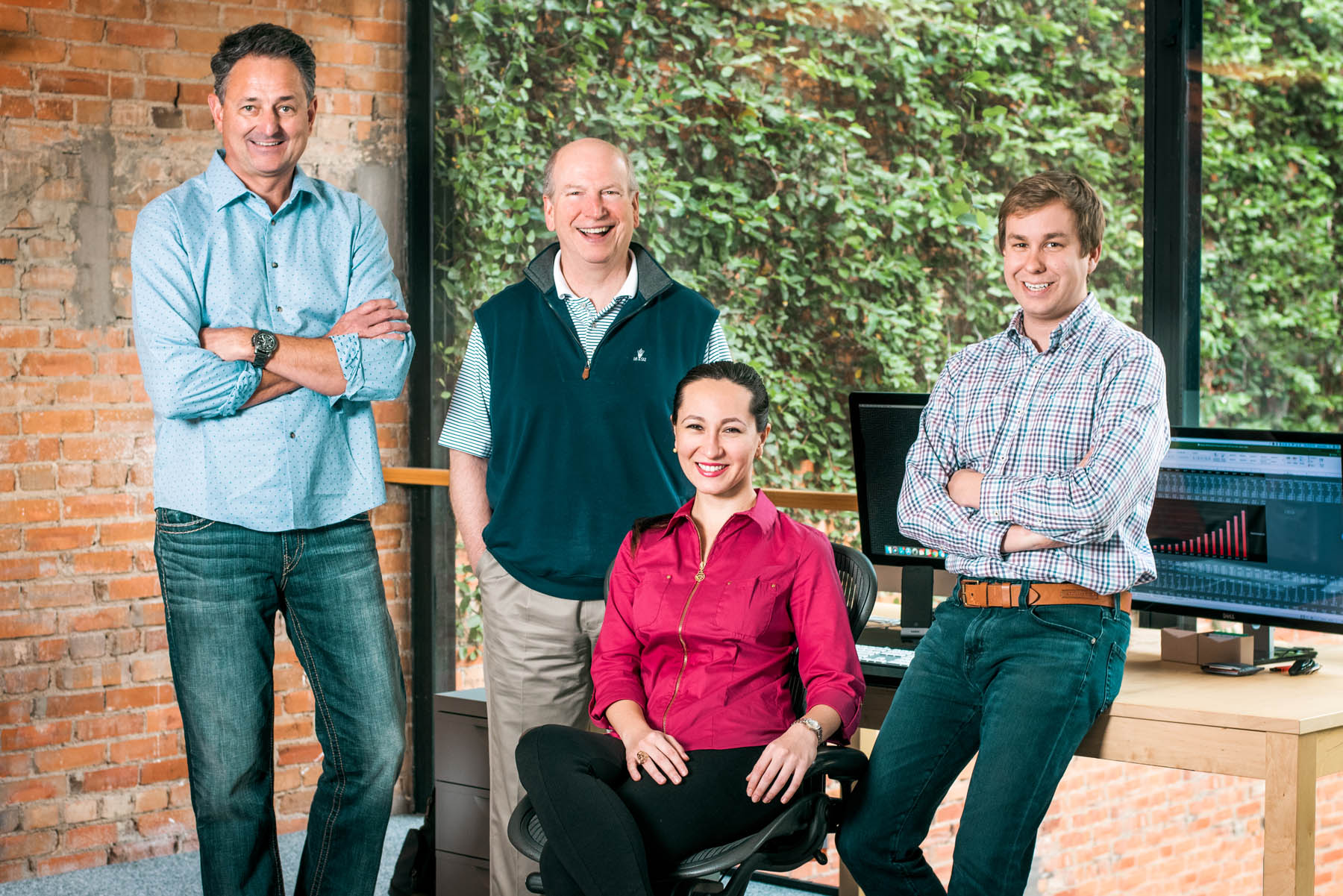

Story and Williams now have two new partners with specialty expertise of their own. Harry Hawks, a serial entrepreneur and former chief financial officer of Hearst Television, joined the team in January. And Inobat Igamberdieva, an Uzbekistan native who started college at age 14 and later worked in the private banking industry in the Czech Republic, came on board a year before. With the new partners, the firm increased its fund size from $50 million to $75 million and anticipates doing about 15 deals.

Together, Interlock is a team of entrepreneurs, operators, and investors aiming to fund innovative business-to-business startups with experienced teams that are disrupting their industries. Sectors they plan to focus on are real estate technology, digital media, educational technology, and the convergence of artificial intelligence, robotics, and drones. Their investments will mostly be in Series A rounds, the partners say. And they’re taking a hands-on approach, helping portfolio companies with operations. “We are the operator … we get it,” Hawks says. “Our little, young shop is doing really cool stuff with highly respected investors and entrepreneurs across the country.”

Interlock’s pipeline ranges from companies in business intelligence and cybersecurity to logistics, augmented and virtual reality, and human resources tech, with about half coming from Texas. It’s just a matter of finding the right deals and funneling the rest to other investors, the team says. “We can build one of the leading venture firms in the state, because there’s no dominate player,” Hawks says. “The motivation was, let’s build something … that will live long.”