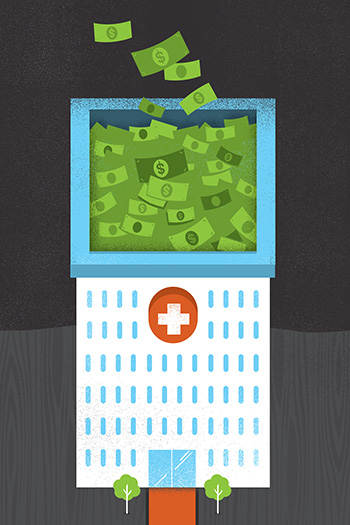

In a world where there just aren’t enough healthcare dollars to go around, big hospital chains have certainly grabbed their share. But federal healthcare reform is changing the equation.

Obamacare promises to bring millions of uninsured Americans into the healthcare system, with the hope that they will stay out of high-priced emergency rooms. Meanwhile, the law’s Robin Hood approach seeks to limit reimbursements to providers and shift money to fund care for more people. The result: hospitals stays are starting to decline and profits are coming under pressure. Moody’s recently cast a negative outlook on the U.S. hospital industry, while Standard & Poor’s said it expects revenues to come under pressure over the next two years.

In North Texas, however, the prognosis is brighter. The area’s two big hospital systems—Arlington-based Texas Health Resources and Dallas-based Baylor Health Care System—have taken steps to get ahead of the curve, in part, by turning attention away from hospitals to clinics and day surgeries. These are very profitable not-for-profit systems.

In 2012, the 25-hospital THR system—formed in the 1997 merger of the Presbyterian and Harris Methodist hospital chain—logged operating income of $288.7 million. Although profits dropped off in the first six months of 2013, THR had about $450 million in cash at year-end and was one of just 11 systems (among 143 nationwide) given a “positive” outlook, S&P reported in August.

“I will tell you that our results are not representative of the industry,” says Ron Long, THR’s chief financial officer, who credited the success to strategic planning and a shift in resources towards outpatient services.

Meanwhile Baylor, which logged operating income of $264.5 million in its last fiscal year, is becoming a Goliath. The system recently completed a merger with Temple-based Scott & White, a combination that stretches its reach as far south as Pflugerville and creates the nation’s 12th largest system based on assets.

Fred Savelsbergh, Baylor’s chief financial officer, says slightly more than half of his company’s nearly $4 billion in revenues last year came from outpatient services, such as imaging or surgery centers. And while Scott & White will add a dozen hospitals, it will also bring 650 doctors and a health insurance plan.

“Investments in brick and mortar are becoming less and less important” relative to adding doctors or computer equipment for electronic medical records, Savelsbergh says. After a building boom that saw a wave of expansions and new doctor-owned hospitals added to North Texas, “this market is over-bedded,” he says.

Although consolidation has allowed hospital systems to trim costs and expand into other healthcare services, it has also concentrated market power, says Allen Baumgarten, an independent healthcare analyst in Minnesota and author of the Texas Health Market Review.

“In most cases, these expanding hospital systems are using that leverage not to reduce costs to consumers or employers but to improve their profitability,” he says.

Savelsbergh begs to differ. He says merging to get bigger is not about gaining leverage, but about taking care of patients. With the industry in upheaval, size gives a hospital network the “bandwidth” to handle the turbulent industry changes underway.

THR’s Long says the trend in healthcare is to hold down costs, not boost prices. In that environment, size has helped hospital systems create a “healthy tension” with insurers.

“I would say that consolidation allows us to get price increases that are needed to continue our financial stability,” Long says. “When you look at operating margins at 4 to 6 percent, we’re not hitting the ball out of the park in comparison to other industries.”

Even so, both THR and Baylor make a lot of money, which leads to a philosophical question: Do not-for-profit hospital systems have a special responsibility to hold down costs for the community?

Both Long and Savelsbergh unequivocally say yes, pointing to a history of indigent care and community involvement.

Baumgarten is skeptical, saying that for-profit and not-for-profit chains seem to have similar business models and both have their share of highly paid executives. At THR, for example, eight executives made more than $1 million in 2011.

But I see one huge difference. As big as their cash balances might get, not-for-profits can’t give that money to shareholders or private equity owners. Rather, that money must be reinvested back into healthcare. And that’s a plus for North Texas.