Pay for the CEOs of midsize companies in Dallas-Fort Worth rose sharply last year. That’s the finding of a new study of executive compensation trends among middle-market public companies in North Texas by D CEO magazine and Paradox Compensation Advisors, a Dallas-based consulting firm.

This year marks our third annual study of executive compensation among midsize companies in the DFW area. The first two studies indicated that these companies are likely to be more conservative about CEO pay decisions than are larger companies. As the economy in North Texas continues to out-perform national trends, we wanted to know this time, will CEO compensation increase commensurately?

These midsize companies are also dealing with broader issues which may influence executive pay decisions, specifically the implementation of Dodd-Frank regulation. Dodd-Frank includes the SEC rules implemented in 2011 requiring public companies to conduct a regular “say-on-pay” advisory vote—in essence asking shareholders to cast a vote of support, or not, for a company’s executive pay programs.

Beginning in April of 2011, shareholders also obtained the right to an advisory vote on “golden parachute” agreements, the cash payments, acceleration of equity compensation vesting, and other benefits due an executive under a merger. This year’s study addresses trends in CEO compensation and results of the new SEC say-on-pay requirements.

The 2011 DFW midsize group was selected based on 2011 company revenue of between $50 million and $1 billion. In total, proxy statements for 58 companies were reviewed, versus 45 companies in last year’s study. In that study of 2010 results, annual revenue had climbed by 11 percent and net income increased 33 percent—a substantial change over a clearly dismal year in 2009. In the 2011 group, median total annual revenue again increased, but only by 6 percent, and net income was essentially flat (plus 1 percent).

However, 2011 proved to be a breakthrough year for CEO total direct compensation, which is defined as base salary, annual cash incentives, and the value of long-term equity awards such as stock options and restricted stock. Among these midsize DFW companies, pay for CEOs increased significantly.

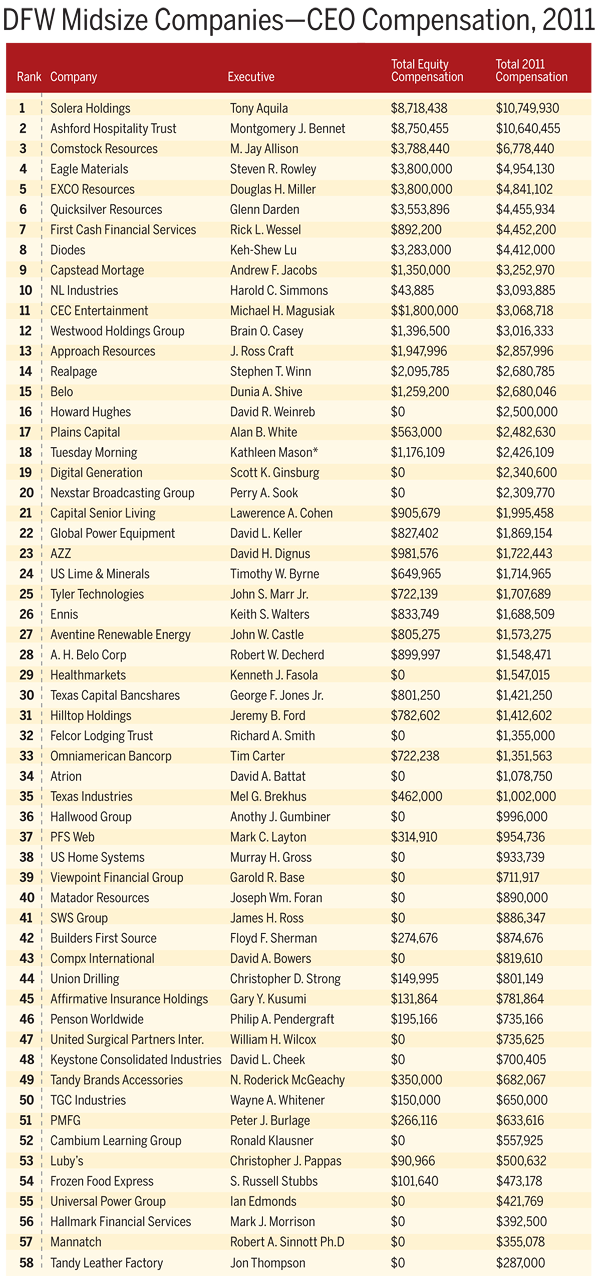

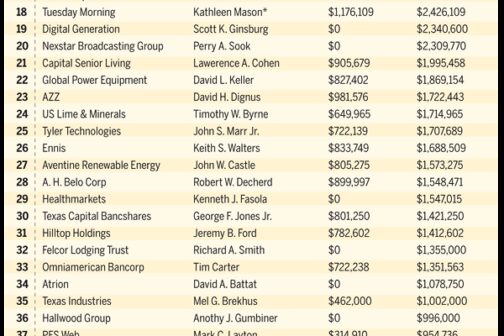

Total direct compensation in 2011 for the DFW midsize group CEOs was $1,484,133 at the median, versus $727,221 in 2010. The chart at right shows total direct compensation for these companies, arrayed from $10,749,930 for Solera Holdings’ CEO Tony Aquila at the top, to $287,000 for Tandy Leather Factory’s Jon Thompson. Considering just the 30 CEOs where 2011 to 2010 comparisons are possible (the “constant population group”), median total direct compensation rose to $1,204,301—14 percent above 2010.

In companies with the same incumbent in both 2010 and 2011, 24 organizations increased the CEO’s total direct compensation, five companies decreased pay, and one made no adjustment. In the constant population group, the range in year-to-year compensation changes varied from minus 38 percent to plus 171 percent. But, in general, increases were higher than in the prior two studies.

The traditionally conservative DFW midsize group has suddenly become more aggressive, says Marsha Cameron, a Paradox senior partner. “The value of ‘variable pay,’ that is, bonuses and long-term incentives, did increase fairly dramatically among these companies in 2011,” she says. “Also, a number of these companies are updating their compensation programs and implementing more sophisticated programs.”

Where base salaries are concerned, the median for this group was $515,000, versus a median of $410,923 in 2010. In the 30 companies where the same incumbent was in place in 2010-2011, 23 companies increased base salary in 2010, while six maintained base salary at the same level, and one decreased base salary for the CEO. The median increase was 4 percent, a typical executive base salary increase prior to recessionary constraints in 2008-2009.

The highest base salary increases were awarded to Approach Resources’ Ross Craft (28 percent) and Affirmative Insurance Holdings’ Gary Kusumi (80 percent). Craft’s adjustment was in response to a competitive analysis specific to the oil exploration and production industry. Kusumi’s increase was made as part of the execution of a new employment agreement.

Sizeable Award Increases

Given that revenue growth and profit metrics remain the two factors most frequently considered when determining bonuses—and that the DFW midsize group demonstrated only a 6 percent uptick in revenue and 1 percent net income growth—fairly flat payouts would be expected. However, the median annual bonus award increased sizeably (median of $379,563 versus $257,700 in 2010), although a wide range in awards was also reported. DFW midsize companies also continue to be willing to withhold bonus payments: 22 percent awarded no bonus, versus 21 percent in last year’s report. The highest bonuses were paid to Rick Wessel at First Cash Financial Services ($2.67 million) and to Jay Allison at Comstock Resources ($2.42 million).

Logically, financial results affect bonus awards. But when results are disappointing, companies sometimes report mitigating factors that convince the board’s compensation committee to award a bonus to the CEO and other executive officers. In the 2011 study, 10 companies with negative net income paid zero or minimal bonuses to the top executive. On the other hand, 12 companies paid bonuses in spite of negative net income. Two of these companies, Nexstar and Comstock Resources, paid bonuses in excess of $1 million.

In the case of Nexstar, though net income was negative, the board’s compensation committee reported that both revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA) exceeded goals. Comstock’s 2011 bonus program was partly “subjective,” i.e., based on the consideration of financial and other strategic factors, but non-formulaic. In 2011, the Comstock compensation committee continued to award one of the highest bonuses in the DFW mid`size group to its CEO, in spite of several years of net income losses. The Comstock committee also reported changes in the bonus program to be implemented for 2012 that are meant to more closely align pay and performance.

Long-term equity awards are a key component of CEO compensation. But, in general, midsize companies have much simpler long-term incentive programs than larger companies, and the 2009-2010 studies indicated that these organizations are less likely to make significant awards. Forty-seven percent of the 2010 companies made no award and, if an award was made, the median value was $305,144.

However, DFW midsize companies appear to have leaped on the long-term incentive bandwagon in 2011. Median award values in 2011 jumped to $830,576, and 66 percent of the 58 companies made awards totaling $58.4 million in value. However, 60 percent of the total value allocated to CEOs by the DFW midsize companies ($34.9 million) was awarded to just eight of the 58 executives: Tony Aquila (Solera Holdings), Montgomery Bennett (Ashford Hospitality Trust), Jay Allison (Comstock Resources), Steven Rowley (Eagle Materials), Douglas Miller (EXCO Resources), Glenn Darden (Quicksilver Resources), Keh-Shew Lu (Diodes), and Stephen Winn (Realpage). Twenty companies made no awards. Thus, wide variations in the value of long-term incentives continue among DFW midsize companies.

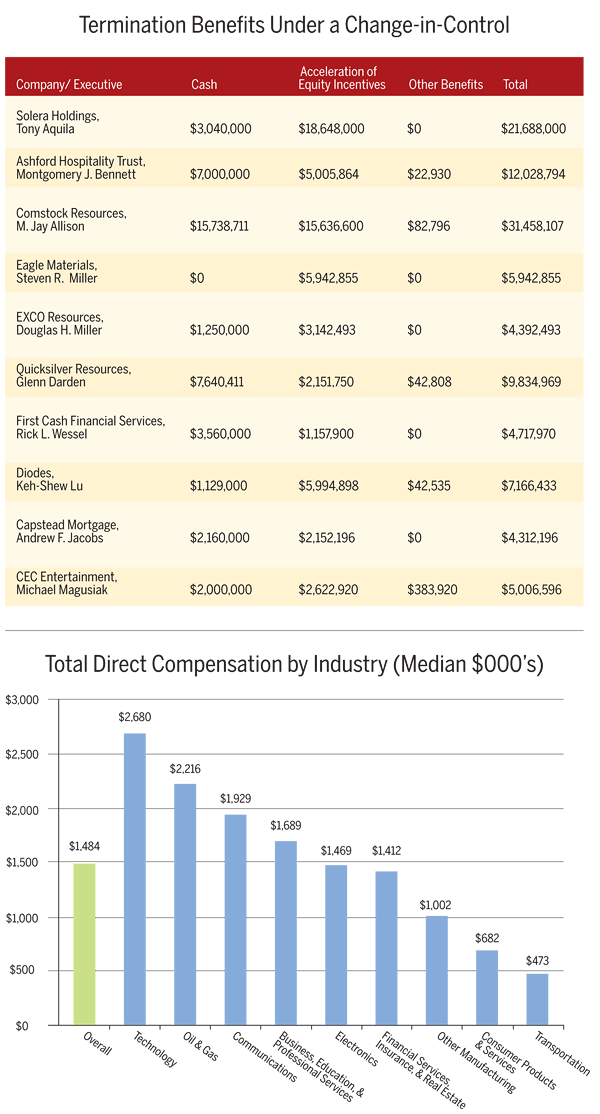

Compensation levels and types of incentive awards are influenced by company size, financial results and company philosophy. There also continues to be a broad range in total direct compensation by industry. The technology industry is currently out-pacing oil and gas and communications as the top-paying industries among midsize companies in North Texas. Consumer products and services companies (which include retail, restaurants, and other consumer services) and transportation companies are ranked the lowest in median total compensation.

Shareholders Get a ‘Say-On-Pay’

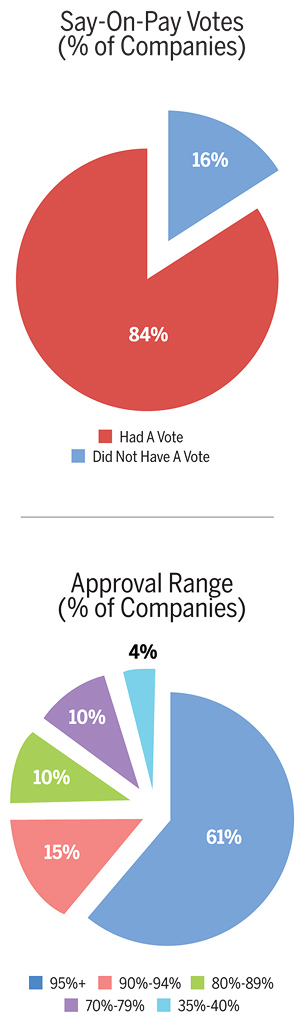

New SEC rules dictate that, beginning with the first annual shareholders’ meeting taking place on or after Jan. 21, 2011, shareholder “say-on-pay” votes must occur at least once every three years. Additionally, at least once every six years, companies are required to hold a “frequency” vote, allowing shareholders to decide how often the company should conduct a say-on-pay vote. Smaller public companies (market capitalization less than $75 million) were granted a temporary exemption until 2013. At the national level, 98 percent of the S&P 500 obtained shareholder support of executive pay in 2011, and the median level of support was 93.2 percent (Workspan, July 2012). 84 percent of the 2011 DFW midsize company group conducted say-on-pay votes. Of these, the median percent approval rate was above 95 percent.

Shareholder advisory groups (e.g., Institutional Shareholder Services) have indicated that they will begin to closely scrutinize companies with low approval (i.e., below 70 percent). In the 2011 DFW midsize company group, only two companies fall into this category: Tuesday Morning (36 percent approval) and Comstock Resources (35 percent approval).

Since 2006, public companies have been required to report the provisions and prospective value of golden parachute agreements. What was new in 2011 was the requirement for companies to disclose change-in-control provisions and amounts in merger agreements and conduct a shareholder advisory vote on these arrangements. The accompanying table shows the last fiscal year-end value of these agreements for the top 10 paid executives in the DFW midsize group companies. (Harold Simmons of NL Industries was excluded due to his high level of company ownership; a golden parachute agreement would be unusual in this case.)

The value of termination benefits under a merger vary considerably based on factors such as corporate culture, industry, executive seniority, and the value of equity incentives. Simply among these 10 executives, benefits range from 0.9 times 2011 total direct compensation (Douglas Miller of EXCO Resources) to 4.6 times 2011 compensation (for Jay Allison at Comstock Resources).

Midsize public companies often find expanding regulation, reporting rules, and shareholder involvement daunting and confusing. Specific initiatives can, in fact, be implemented that are proven to maintain or improve shareholder advisory vote results, including:

– Provide transparent disclosure about executive pay programs.

– Take an objective view of executive pay levels.

– Address potentially problematic pay programs (e.g., excessive severance benefits, tax gross-ups, etc.).

– Improve the relationship between pay and performance.

– Increase communications with shareholders, including direct outreach.