Richardson-based MetroPCS doesn’t have the biggest wireless network, the most subscribers, the latest cutting-edge phones, or a bundle of pay TV or other services to sell you. Instead, the genius of MetroPCS is that it lives and dies by a stunningly simple promise to consumers, and it embraces change to keep up with and satisfy its market.

MetroPCS offers voice and data service at a monthly flat rate—$40, with all taxes included. It allows customers unlimited usage of voice and data with no contract whatsoever. A service that easy to understand is a rarity in the tech world. That’s why MetroPCS has more than 8 million subscribers nationwide now, up from around 6 million in the summer of 2009.

But in a world where increasingly powerful smartphones and mobile data usage are changing everything else about the Internet and the way we use technology, will the company change its core value proposition?

To argue that MetroPCS is on the right track, you can start with its network. In late 2010, MetroPCS became the first service provider in the nation to launch a wireless network based on Long-Term Evolution (LTE), a technology standard for building the latest generation of mobile broadband networks.

The peak data rates called for in the LTE standard are a screaming 100Mbit/s downstream and 50Mbit/s upstream. As the standard evolves, the data rates will keep going up and network upgrades will be relatively straightforward. But MetroPCS wasn’t aiming for a faster network per se, and it hasn’t tapped the full power of its network yet.

As the fifth-largest wireless carrier in the United States, MetroPCS does not own as much wireless spectrum as its bigger competitors, so it had to find a way to handle more customers on its existing spectrum.

Shashi Kavi, vice president of the MetroPCS account at telecom gear-maker Ericsson, says MetroPCS skipped a couple of possible technology upgrades because LTE “is more spectral efficiency and it improves latency.” he says. “If you look at applications like video, which have more stringent latency requirements, LTE becomes the obvious choice.”

So MetroPCS, it seems, is emphasizing economics, not speed, with its new network. What’s more, it took things slow by making some significant technology tradeoffs that helped it avoid a mobile data deluge. Instead of building a nationwide LTE network, like the one Verizon switched on in December, MetroPCS initially targeted Dallas and eight other cities for LTE service in 2010. The company says it will add LTE service in all of its core markets early this year. Customers in LTE cities get a fast network connection. When they roam outside the city limits, video-based services become more challenging. Also, MetroPCS doesn’t offer tablets, dongles (a small piece of hardware that attaches to computers), or data cards on its network, so that keeps even the most aggressive video usage down to a screen less than 4 inches wide.

The Not-So-Smart Phone

Another tech tradeoff MetroPCS made was its first LTE-enabled phone, the Samsung Craft. The phone is not a true smartphone; it isn’t based on the more data-friendly mobile operating systems like Google’s Android. In his PC World review, telecom analyst Paul Kapustka observed that even on a new network, the Craft “seemed to respond to web requests on a par with most other smartphones, and a little slower than 3G-based iPhones and Android units I’ve used recently.”

To keep costs down, the Samsung Craft handset uses just two of the more than 40 available frequency bands for LTE. It also hands off to MetroPCS’s older CDMA (code division multiple access) network for voice calls and text messages. Also, CNET’s review of the device confirmed that it “doesn’t do push e-mail, or calendar syncing,” two necessities for anyone weighing the phone against a BlackBerry or an iPhone.

The less-than-comprehensive LTE coverage and the feature-constrained handset turns off corporate customers, tech enthusiasts, and frequent travelers, who tend to be early tech adopters and among the most voracious consumers of mobile data. Indeed, MetroPCS embraces its “Wireless for All” slogan with unlimited data plans and a simple pricing menu. But its first two moves into the mobile broadband future seem to add to the slogan in a whisper, “unless you want iPhone-like features on a nationwide network.”

Then again, MetroPCS argues that converting its customer base to smartphone-toting data addicts is a gradual process. “It’s not like we’re flipping the switch tomorrow and 40 percent of our base is going to have an Android LTE 4G smart phone,” the company’s CFO, Braxton Carter, told investors last November. “This is going to be a transformation that happens over upcoming quarters as the ecosystem develops, as the price curve on smart phones comes down over time.”

Fair enough, but any transformation involving mobile data happens fast. MetroPCS has said the majority of its customers use their handset as their primary access to the Web. If a good number of those customers switch to smartphones, MetroPCS may have to lose its identity as the friendly, neighborhood unlimited use, flat-rate provider to make money in a mobile data avalanche.

Keeping up with demand would be enough of a challenge for most mobile operators (AT&T, my iPhone and I are looking at you). But what has vexed mobile operators in the years leading up to LTE networks coming online is that the cost of keeping the data spigot turned on—and wide open—is not lining up with the amount of money consumers are paying for the privilege.

Conspicuous Consumption

Networking vendor Cisco Systems Inc., in its annual index that measures Internet traffic growth, says that between 2009 and 2014, mobile data traffic will grow at a compound annual growth rate (CAGR) of 108 percent. If Cisco’s right, worldwide mobile data traffic will double every year through 2014, increasing 39 times between 2009 and 2014.

But telecom analytics firm Pyramid Research says revenue from mobile data usage isn’t growing nearly as fast. That firm expects mobile data revenue to increase at a CAGR of 14.5 percent between 2010 and 2014. “Despite the fact that data will account for the vast majority of traffic on mobile networks by 2014, it will still constitute only 37 percent of total revenue,” writes Pyramid associate analyst Ewa Romaniuk-Calkowska, in a recent report.

The numbers still impress. Pyramid Research predicts that mobile data revenue will climb from $56 billion in 2010 to $107 billion in 2015. By 2014, the firm expects mobile broadband services to take in more revenue than fixed broadband service worldwide.

In an unlimited usage, flat-rate pricing structure, a mobile operator reaches a point where data revenue hits a ceiling, but consumer data usage keeps skyrocketing. Analysts say tier-pricing structures, like the kind used by AT&T and Verizon, are the way to go. As a newly minted smartphone consumer changes her behavior—begins watching shows streamed via Netflix, instead of reading magazines, at the salon, the doctor’s office, and anywhere else there’s a queue—mobile operators want to make a few more bucks to offset their costs.

Having a network like MetroPCS’s LTE network will help mitigate those concerns. But we are wading into uncharted waters here. Smartphones have never been more available, more affordable, and given us access to as many bandwidth-hungry applications. In fact, a month or so after the Samsung Craft debuted, MetroPCS offered a couple of real smartphones, based on Google’s Android operating system, on its LTE network.

It’s too soon to tell what effect those new phones will have. The Android distinction is noteworthy because there are more than 100,000 applications consumers can download from the Android Marketplace, making it a beehive of data usage. The SlingPlayer Mobile, which allows you to watch your home TV from your Android phone, is among the marketplace’s most popular apps.

MetroPCS executives declined to be interviewed for this column, but via a PR firm the company didn’t rule out pricing changes: “At this time, unlimited 4G LTE service is an introductory offer,” writes a spokeswoman. “Since this is a new service, we will want to evaluate how our customers are using it and therefore will be in a continuous evaluation mode as we continue to expand our markets.”

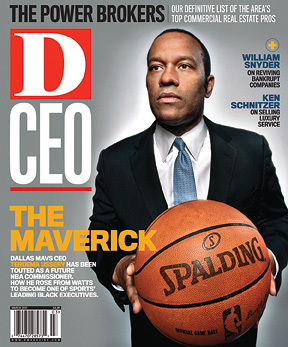

Phil Harvey is the editor-in-chief of Light Reading, a UBM TechWeb publication covering the telecom industry.