What is “alignment,” and why should you, as a C-suite resident or aspirant, care about it?

Fundamentally, “alignment” recognizes that there are multiple routes along which information flows to key company audiences such as employees, customers, regulators, the public, and investors. Instead of concentrating only on what the company formally controls—such as brochures, annual reports, web pages, and advertising—the CEO needs to be equally concerned with what’s flowing along all the informal routes.

This used to be referred to as “water-cooler” talk—all those encounters and interactions that make up the vast majority of communications among employees.

But, how can the CEO possibly pay attention to hundreds of thousands of such encounters? You can begin by creating a comprehensive standard or model with set expectations and definitions. While explicating such an approach is beyond the scope of this column, the starting point is extremely simple—and might have saved UBS, for example, intense embarrassment, significant damage to its reputation, and $35 million.

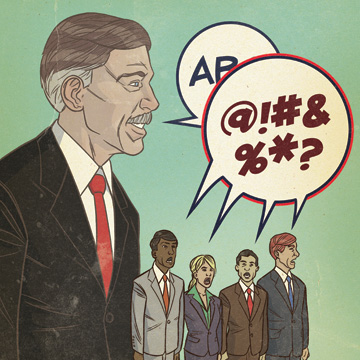

Communication starts with the very words chosen to represent a company’s mission, products, services, values, and people. Two decades ago we coined the term, “good words,” to describe the words you want people to latch on to and repeat. “Bad words” are the words you don’t want repeated. It couldn’t be simpler.

UBS sold hedge-fund customer Pursuit Partners collateralized debt obligations that UBS represented as “investment-grade” securities. However, in internal e-mails, UBS traders referred to the same products as “vomit” and “crap.” (CDOs are considered risky. The debate over the past year has been whether the structure of the investments conceals, rather than spreads out, the underlying credit risk.) In this instance, UBS customer Pursuit Partners charged that UBS knew the rating services were about to downgrade the securities and then rushed to unload them.

A judge in Connecticut ruled that UBS would have to set $35 million aside as a prejudgment precaution. The judge’s written decision is both hilarious and sobering, pointing out that no one could mistake “investment grade” for “vomit” and “crap.”

UBS continues to insist it “will prevail on the merits,” and it may well be able to argue that Pursuit Partners should have known CDOs were risky. However, the damage has already been done. There are almost 41,000 web entries linking UBS with the words “vomit” and “crap.” The bloggers on this issue are highly sophisticated individuals in financial services. Their general tone is illustrated in a post by Felix Salmon titled, “When UBS sells crap and vomit.”

“Even if it does prevail, UBS has been revealed as being extremely sleazy at best,” Salmon writes in the post. “And it would be fair for anybody dealing with the UBS fixed-income desk to assume that they’re being ripped off, and treat any proffered paper with extreme prejudice.”

Would this have happened if UBS leadership had understood that the words associated with the company–integrity, trust, investment-grade—were sacred, and not just marketing throwaways? We believe someone might have stepped forward to point out the disconnect. UBS is making the mistake of treating this as a minor legal matter. It’s not. It’s about the soul of the company, and whether future customers will follow Salmon’s advice or regard UBS as a trusted partner.

This is what we mean when we refer to “alignment.” No doubt, it’s a strategic matter worthy of attention from the top.

Spaeth is one of the country’s leading communications strategists. After serving as President Ronald Reagan’s director of media relations, she founded Dallas-based Spaeth Communications in 1987. She is also a lecturer at Southern Methodist University’s Cox School of Business.

Caught in a Trap

Many other companies besides UBS have been caught in the alignment—or the “misalignment”—trap.

Consider, for example, the situation where a firm’s customer calls a “24-hour customer-service” number printed on a credit card, only to be dumped into a voicemail system with complicated prompts and no way to reach a real person. Sound familiar?

In 2006, Fort Worth-based RadioShack fired 400 employees via e-mail—a move that called into question its claim that every employee was an individual, and that the company cared about its employees.

A few months ago, the Tribune Co., which had filed for bankruptcy protection, circulated an internal memo asking all of its employees to commit to “shared sacrifice.” At the same time, Tribune management was asking the bankruptcy court to approve $66 million in bonuses, saying they were needed to “incentivize” top managers.

That case recalled a similar situation at Fort Worth-based American Airlines, which several years ago awarded generous bonuses to executives after asking pilots and other employees to accept “concessions” including cuts in pay and benefits. —Rebecca Shaw