This piece has been updated with a response from Baylor and as well as Baumgarten in regards to financial discrepancies.

If you sit and listen to health provider executives, they will tell you about how they want to improve the quality of care while cutting costs. They have noble goals, but the numbers show that the North Texas healthcare market is raking in the cash with middling quality results. Almost all of North Texas’ health systems have yearly 10 percent profit margins, and the most lucrative health systems have margins nearing 20 percent with yearly net incomes over $1 billion. According to the American Hospital Association’s Hospital Statistics report, hospitals’ average overall operating margin was 7.7% in 2016.

According the Texas Health Market Review and CMS data, Texans spent $7,000 per person on healthcare in 2014, with hospital spending accounting for 38.6 percent of the total. The review looked at 2017 data for almost 400 acute care hospitals statewide, excluding VA hospitals. The review pulls information from the Texas Department of State Health Services and the American Hospital Association.

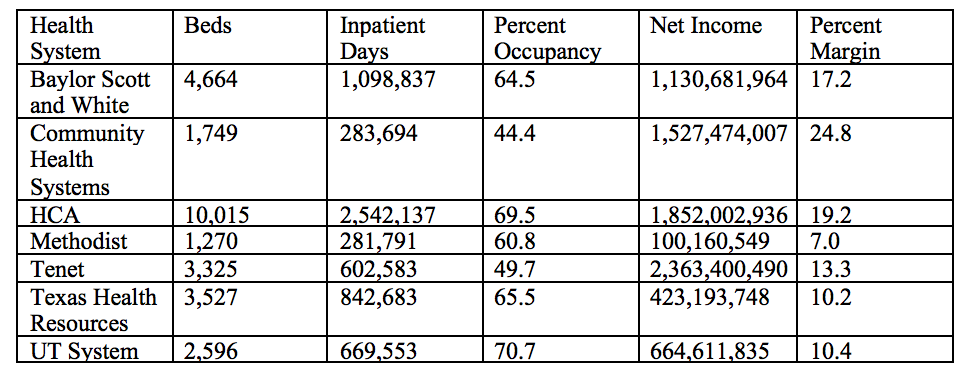

In 2017, the local systems that are income standouts are nonprofit system Baylor Scott and White and for-profit HCA (who runs the Medical City hospitals). Baylor, the system with the most beds in North Texas, posted a net income from 2017 of over $1 billion with a margin of 17.2 percent (which Baylor disputes, see below). HCA’s profits, which include its hospitals all over the state, were $1.8 billion with a 19.2 percent profit margin in 2017. The Texas Health Resources and UT systems were no slouches either, both making around 10 percent margins. Community Health Systems, which owns mostly rural and small town hospitals all over Texas, including in Hillsboro and Granbury, cleared an impressive 24.8 percent margin despite just a 44.4 percent occupancy rate. Methodist Health System, which also came in the lowest-priced knee replacement surgeries in the region, showed the lowest profit margin of the major systems at just 7 percent, according to the review. The review’s numbers are limited to inpatient and outpatient revenue for the hospitals, not including ambulatory centers, clinics, or other services owned by the larger hospital systems.

The provider market continues to expand and merge, looking for new ways to engage potential and current patients. Billions of dollars in new construction have kept up with the population influx all over the state, achieving economies of scale for technology like electronic medical records along the way. The largest networks are also expanding their reach outside of the large hospital, with freestanding emergency rooms, urgent care facilities and other retail clinics proliferating in DFW. Review author Allan Baumgarten also notes that the provider expansion is an attempt to combat increased market power of health insurers.

But despite all the expansion, money, and growth, Texas’ hospital quality standards are nothing to write home about. According to Medicare’s hospital rating system, Texas has 26 hospitals that earned the highest rating of five stars. While that may seem great, Wisconsin, with one fifth the number of hospitals as Texas, has 28 hospitals with the highest rating.

Check out complete numbers for regional hospital systems in the table below. Note that these totals are for hospital inpatient and outpatient services only, and not non-hospital services.

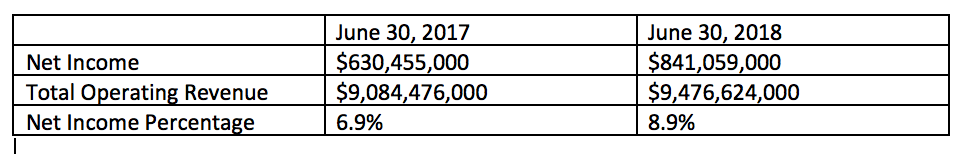

Baylor Scott and White released the following numbers from their bond disclosure and audit, including their net income as a percentage of total operating revenue for their entire system, which includes more than just hospital revenue, including the system’s health plan, research, pharmacies, clinics, and other operations.

One reason there might be discrepancy between the numbers is that the sources for the Texas Health Market Review are limited to inpatient and outpatient revenues and expenses at the hospitals, but don’t include other facilities such as physician clinics, skilled nursing facilities or other locations. These other clinics are usually less profitable than hospitals and have at times reported losses.