Small to midsize employers often are standard-bearers for qualities like independence and gritty self-reliance. That’s probably ideal for managing tasks like IT infrastructure or corporate communications.

However, when it comes to managing healthcare benefits, independence and self-reliance could have a cost.

These employers may be able to capitalize on several innovations in health-benefit design and plan management— if they’re willing to be flexible. This flexibility can produce savings In excess of $850 per employee per year in health and benefits cost.

Today, there are new opportunities to control costs, improve quality of care, expand options and simplify benefit administration. It will require a change in mindset, giving up some autonomy to purchase collectively with other employers and possibly partnering with emerging healthcare players that can help integrate different pieces of the benefit puzzle. This flexibility and collective purchasing mindset allows small to midsize employers to purchase benefits and plan management, which historically were the exclusive purview of jumbo employers.

Focus on strategy

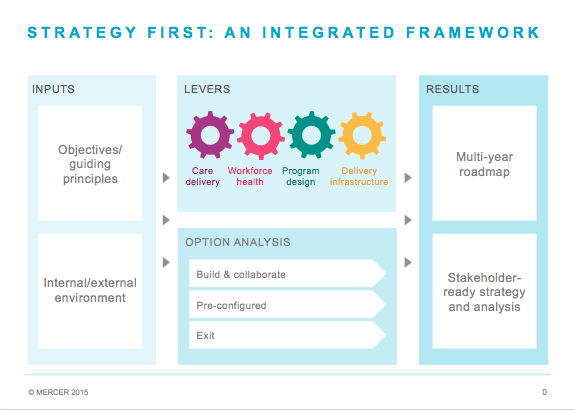

The key to managing health benefits like a big league company is to have a strategy. Haphazardly trying to piecemeal benefits for a small employer is inefficient and costly. Instead, build guiding principles for your health benefits plan that link to your overall business objectives. It will protect the value you’ve promised your employees when you recruited them, while consistently managing to the objectives that support your business.

These guiding principles should consider macro issues like regulatory changes, emerging developments in the healthcare payer and provider market, trends in consumer accountability and shifts in multi-generational behaviors and needs.

When you have identified your path, you then have the structure and guidelines to take advantage of some remarkable new solutions and tactics. Some of the benefit management approaches are staples for large companies, but are now available to small and midsize companies.

Collective purchasing

The simplest approach is to buy collectively with other companies, particularly in the area of pharmaceuticals. Collective purchasing coalitions have become increasingly popular among smaller companies. It’s a strategy larger companies routinely employ. In a Mercer survey of more than 2,800 employers, only 16 percent of employers with more than 500 workers said they collectively purchase pharmaceutical benefits. Ten percent of this same employer population purchases collectively for all benefits. Of that number, the employers, on average, reported a significant savings from collective purchasing. With the relatively small penetration of collective purchasing, early adopters are gaining a significant competitive advantage.

Market insight

Small to midsize employers should be utilizing analytic cost and qualitative data across different geographic healthcare markets. At the local level, networks and carriers vary dramatically. Understanding the local dynamics of cost and network mix is the key to solving this puzzle. Capitalizing on these differences was the historic domain of large employers but it is now available to small and midsize employers.

Accountable care organizations at the local level, spurred by increased consolidation among physician practice groups, can heighten the potential for savings. Many midsize employers feel they can’t access multiple plans by geography because of the administrative burden and lack of negotiating leverage. That’s not true. New purchasing avenues with administrative support are available to lift the burden of accessing multiple plans while taking advantage of the cost differences.

One move smaller employers are taking advantage of moreso than jumbo employers is the use of private exchanges. Small to midsize employers like private exchanges because it allows them to take advantage of collective purchasing and provides access to the innovations built by large employers. It also provides an administrative platform that allows small to midsize companies to take advantage of the regional differences in networks and carriers.

Our three-year experience in this area has delivered average annual savings of $850,000 for a 1,000-employee company. That savings was reached accessing collectives and purchasing locally while expanding employee choice, which is a growing demand of the multi-generational workforce.

By taking advantage of large-employer innovations through collective purchasing and private exchanges, small to midsize employers can dramatically lower cost, improve quality of care and offer broader choice. Finally new innovative players are emerging that provide platforms to link the program components, deliver information efficiently to employees and their families, while steering patients to the highest quality and most efficient providers.

Innovative quality and cost improvement strategies are within reach. Developing the road map to get there is the first step and capitalizing on collective purchasing can give you the toys used in the big leagues. Finally, linking everything together in a consumer-friendly manner delivers the results.

Eric Bassett is a senior partner and leader of Mercer’s Health and Benefits business in the Central market, based in Dallas.