If you’re like every other homeowner in Texas right now, you’ve looked at your property value assessment and then promptly put it back down just in case the numbers might change if you pretend you never opened the envelope.

I mean, that’s what I did.

You’ll be seeing a lot of talk in the next few weeks about how property taxes are too high. You’ll see people blaming the taxing entities (most notably the one with the biggest line item on your bill—public school districts). You’ll see some calls for wiping out property taxes altogether, too.

But as with most things, this is more nuanced than just “taxes are too damned high because governments are greedy.” And, believe it or not, the numbers bear this out.

For one thing, your local municipalities can actually lower or even freeze their property tax rates, and your property tax bill can still go up because the value of your house and the land it is on continues to increase.

Recent data from real estate data company ATTOM is an apt demonstration of this. You’re looking at your higher-than-the-air-inside-Willie-Nelson’s-tour-bus tax bill, but effective property tax rates actually decreased by an average of 12 percent last year in the Dallas-Fort Worth-Arlington Metropolitan Statistical Area.

Houston’s effective taxes decreased by more than 18 percent, and Austin’s fell by 7.7 percent.

How is that possible?

Simply put, the housing market is so hot that home values are rising faster than taxing entities can assess. Nationally, tax bills were up only 1.6 percent in 2020, markedly down from the 5.4 percent increase the year prior. That resulted in an effective tax rate of less than 1 percent.

“It’s hardly a surprise that property taxes increased in 2021, a year when home prices across the country rose by 16 percent,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “In fact, the real surprise is that the tax increases weren’t higher, which suggests that tax assessments are lagging behind rising property values, and will likely continue to go up in 2022.”

ATTOM provided the historical data for the Dallas-Fort Worth-Arlington MSA, which also yielded a few interesting trends. In 2016, the average estimated home value was $256,565, and the average property tax bill was $5,204, with an effective rate of 2.03 percent. That generated a little more than $8.8 billion in total property taxes. By 2020, the average home value was $310,863, the average property tax bill was $6,625, and the effective rate was 2.13 percent—and brought in about $11.8 billion in property taxes.

But in 2021, the average home value was $427,530, the average bill was $5,817, and the effective rate was 1.36 percent, but that equaled almost $11 billion in property taxes.

Broken down by county, Dallas County’s average home value was $442,492, with an average bill of $6,033, and an effective tax rate of 1.36 percent that equaled almost $3.4 billion in property taxes. Denton County’s average home value was $472,563, with an average tax bill of $6,731, and an effective tax rate of 1.42 percent, equaling almost $1.4 billion in property taxes. Collin County’s average home value was $550,311, with a tax rate of 1.29 percent and a tax bill averaging $7,107, bringing in almost $2 billion in property taxes.

Tarrant County had the largest effective tax rate of the area at 1.48 percent, which means the home worth the average value for the county ($367,501) had an average tax bill of $5,438.

So yes, your property taxes are going to continue to go up, but unless entities raise the rates, it’s mostly a result of the housing market, and not as much (despite what you may hear during an election year) about rates being higher than usual. This is despite ATTOM’s data showing that Texas as a whole has one of the highest effective tax rates in the country. At 1.31 percent, it’s still a good 50 points away from the highest rate, which belongs to Illinois at 1.86 percent.

And it could be much, much worse, according to one group that watches property tax issues in Texas.

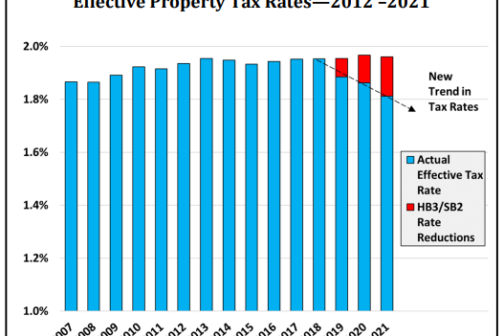

The Texas Taxpayers and Research Association’s April report found that measures the state legislature took in 2019 to create property tax relief actually served as a bit of a throttle on tax bills.

“Based on historical trends, TTARA estimates Texas property tax bills would have been $6 billion, or 8 percent, higher in 2021 had it not been for property tax reforms lawmakers enacted recently,” the report says.

House Bill 3 limited public school tax rate (which is the largest chunk of any property tax bill) growth to 2.5 percent before tax increases must go to voters for approval. Senate Bill 2 capped increases to 3.5 percent.

In 2021, the average school district tax rate was $1.24 per $100 valuation—the lowest since 1991. Dallas ISD’s rate that year was $1.248235, according to figures from the Dallas Central Appraisal District, and will likely remain so in 2022.

Dale Craymer, president of the TTARA, said that while he understands the frustration with high tax bills, voters should be wary of talk of doing away with property taxes altogether in favor of an enhanced sales tax. He called this campaign trail talk “unrealistic.”

He writes in the Houston Chronicle:

“This past year, according to the state comptroller, Texans paid a whopping $73 billion in local property taxes and $46 billion in general sales taxes. Replacing the property tax with an enhanced sales tax, with no changes to the tax base, means the sales tax would about triple to almost a quarter on every dollar you spend. That astronomical rate would drive Texans to go shopping in the 49 states with lower sales tax rates, forcing countless retailers here out of business.”

It would also harm Texans with lower incomes who would find basic necessities even more unaffordable, and smaller towns and areas without a good retail base.

He continues:

“Small towns and rural areas would see their property tax base traded for a non-existent retail base. Larger cities with a broad array of shopping would suck dollars away from their smaller neighbors. To remedy this, we’d need to levy a statewide sales tax and then allocate funds to local governments — the same type of system that kept the state in court over equitable public school funding for decades.”

Most states get funding from three areas—sales taxes, property taxes, and income taxes. Texas only uses two of those. As our tax bills go up, the question may not lie in increasing sales taxes, but in whether having no income tax is really a point of pride when property taxes continue to climb.

State lawmakers have pretty much guaranteed that property tax relief will once again be on the table in the coming legislative session, and Gov. Greg Abbott has put measures on the May ballot that also address property tax relief.

Proposition 1 would allow state lawmakers to reduce the amount of a limitation on the total amount of property taxes imposed by public school districts on homes owned by elderly or disabled persons.

The reduction would “reflect any statutory reduction from the preceding tax year in the maximum compressed rate of the maintenance and operations taxes imposed for those purposes on the homestead.”

Proposition 2 would increase the homestead exemption for the school district portion of your tax bill from $25,000 to $40,000.

Needless to say, none of this will help with that letter from the Dallas Central Appraisal District that currently sits on my kitchen island, still in the envelope. (Fingers crossed.) But like many, we’ll probably protest our valuation this year, knowing that next year, our bill will likely be even higher.

Get the D Brief Newsletter

Author