Most of us have been on vacation, drinking too much whiskey and eating too much noodle kugel (I guess I’ll speak for myself). So let’s recap the Dallas Police and Fire Pension System fiasco as we attempt to undertake a healthier and more fiscally solvent new year.

Most of us have been on vacation, drinking too much whiskey and eating too much noodle kugel (I guess I’ll speak for myself). So let’s recap the Dallas Police and Fire Pension System fiasco as we attempt to undertake a healthier and more fiscally solvent new year.

CDK Realty Advisors sued the Dallas Police and Fire Pension System for not paying $139,479 in fees back in February 2016. Yes, that’s right. The lawsuits seemed to start when CDK sued the pension fund. It would take a couple more months for DPFPS to file a counterclaim, alleging that CDK breached its fiduciary duty by encouraging DPFPS to “enter into a variety of real estate investments that were high risk, speculative, and not typically of the type pursued by pension systems. These high-risk investments have resulted in write-downs and losses of more than $320 million … .” That’s about when the FBI served a search warrant at CDK’s offices.

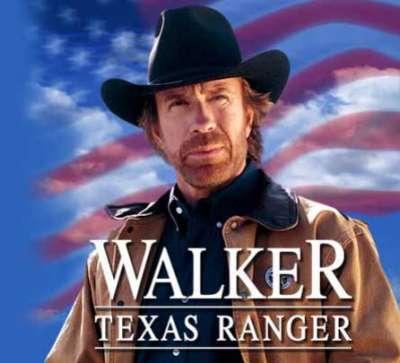

Fast-forward about eight months. Concerned about a run on DROP accounts (which included about $80 million in withdrawals by panicked retirees at the beginning of November alone), Mayor Rawlings sued DPFPS on December 5 to try to stop people from taking all the money. In response, the DPFPS Board stopped lump sum withdrawals a few days later. They amended that position on Thursday to allow certain small, monthly distributions. On Friday, Mayor Rawlings announced that he had also asked the Texas Department of Public Safety to investigate. That’s the Texas Rangers. Philip Kingston told the Texas Tribune he’s concerned that the Texas Rangers investigation may impact the lawsuit against CDK. Because, you know, people may not want to answer questions if they might go to jail. But that’s kind of always true, whether or not the Rangers are involved (again, I guess I’ll speak for myself).

Rawlings had held out some hope that the state of Texas might bail out the pension fund. That looks doubtful. In addition to a scathing letter from Rep. Dan Flynn to Rawlings back in November, the House Committee on Pensions issued a report in early December. It’s pretty clear that they are telling the City of Dallas to stop trying to get someone else to solve the problem, find some paper clips and double-sided tape, and figure out how to MacGyver this situation. Because the cavalry isn’t coming.

It is the Committee’s recommendation that all pension plans work with their respective cities in order to negotiate and come to an agreement that works for both the members of the funds and the taxpaying citizens of those cities while it is still financially feasible to do so. “IOU’s” and “promises” cannot be used in place of assets to determine solvency. It is the Committee’s recommendation that missed payments and contributions can be made up through use of appropriate instruments such as pension obligation bonds and/or one time payments. The Committee will not recommend one time funding increases from the State as a way to boost historic shortfalls as this is both impractical and local considerations and changes need to beenforced before that discussion can take place.It is imperative that cities understand that if they do not act now, the cost to repair plans will be beyond the means of any city (large or small) to sustain any of the current pension plans. If a suitable agreement is unable to be reached, severe actions will need to be taken to ensure the financial sustainability of pension plans. These actions would include some or all of the following measures: Freezing cost of living increases until a time where the plan is actuarially sound, reducing benefits, increasing contributions, eliminating or drastically changing DROP programs, and/or requiring cities to make up missed contributions and freeze all city pay until such a time as the plans are actuarial sound. The Committee does recommend that a combination of pension obligation bonds and excess bonding capacity be used to make up for historic shortfalls in actuarially recommended contributions. It is crucial that shared sacrifice be shared between cities and plans handling pension obligations. The pension plans themselves cannot be fixed by simply changing the type of plans. The problems that were uncovered and addressed during the interim committee hearings do not mean it is suitable or desirable to switch plans from defined benefit to defined contribution without more knowledge and understanding what that would do to current membership, current employees or future generations of employees.

[d-embed]