The Federal Reserve Bank of Dallas has released a collection of essays — called “After the Boom” — that look at the effects of the oil price decline of the last year on various segments of the economy, including housing and banking.

Bottom line for Dallas is that with Texas’ more diverse economy, and with Dallas less energy-industry dependent than other cities like Houston, today’s relatively low oil prices will likely slow things down a bit but shouldn’t blow up into a full-on bust. Yes, we’ve talked about this before.

Furthermore, much as D CEO argued last year, structural changes that occurred following the painful, oil-collapse-driven banking crisis of the 1980s will prevent that the local financial industry from falling apart:

Arguably, the most important of these involves the ability to conduct business across state lines. In the 1980s, Texas-based institutions could not establish branches outside the state; their counterparts from outside Texas could not open branches here.

These restrictions have since loosened, allowing a level of geographic diversification that did not exist in the 1980s.

Today, 18 percent of deposits in banks headquartered in Texas are held outside the state. The freedom to operate in other states allows area banks to limit their exposure to the Texas economy and its associated energy industry ties. Moreover, only 38 percent of deposits in Texas bank branches belong to institutions headquartered in the state.

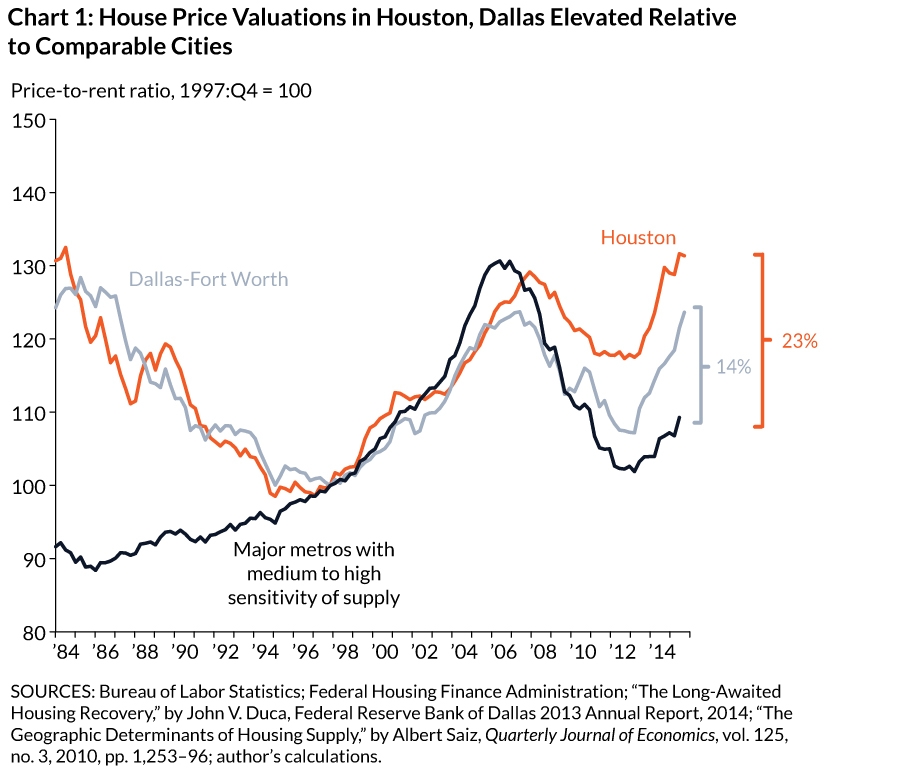

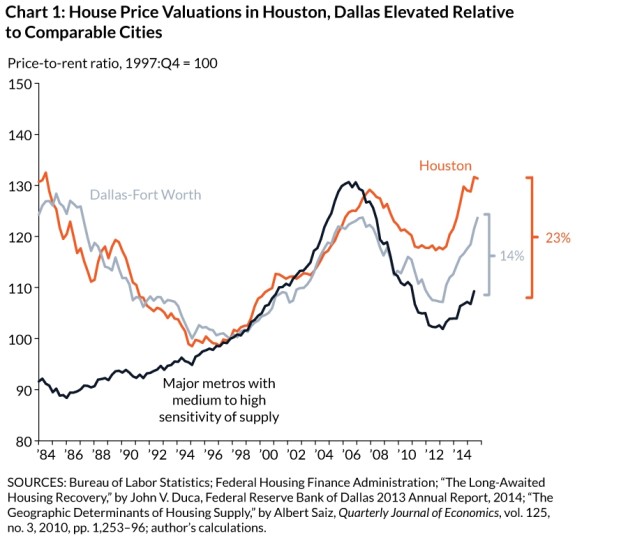

In terms of housing, the Fed anticipates slower growth in prices in Dallas. The price-to-rent ratio in North Texas is now about 14% above what would typically be expected in a major metro area like ours:

Nevertheless, the downside risk to Texas house prices may be less than these measures suggest. Before the bust of the late 1980s to early 1990s, homebuilders created a significant supply overhang fueled by excessive local lending. During the recent oil boom, the housing supply response was much more restrained, limiting overbuilding and inventories of unsold homes that could later depress house prices.

Indicators suggest that Texas cities less exposed to energy, such as Dallas, could see below-normal price growth in coming years before returning to more usual levels, while areas more exposed to energy, such as Houston, face a somewhat greater risk of modest house price declines.

For visual learners:

And — not unrelated to this — job growth for the state as a whole is expected to be only about 1% in 2015.