Since the mid-2000s, environmental, social, and corporate governance (ESG) has become a core part of business planning and operations. But what exactly is ESG and how should city planners, commercial real estate developers, and architects and designers, measure impact and progress towards those goals?

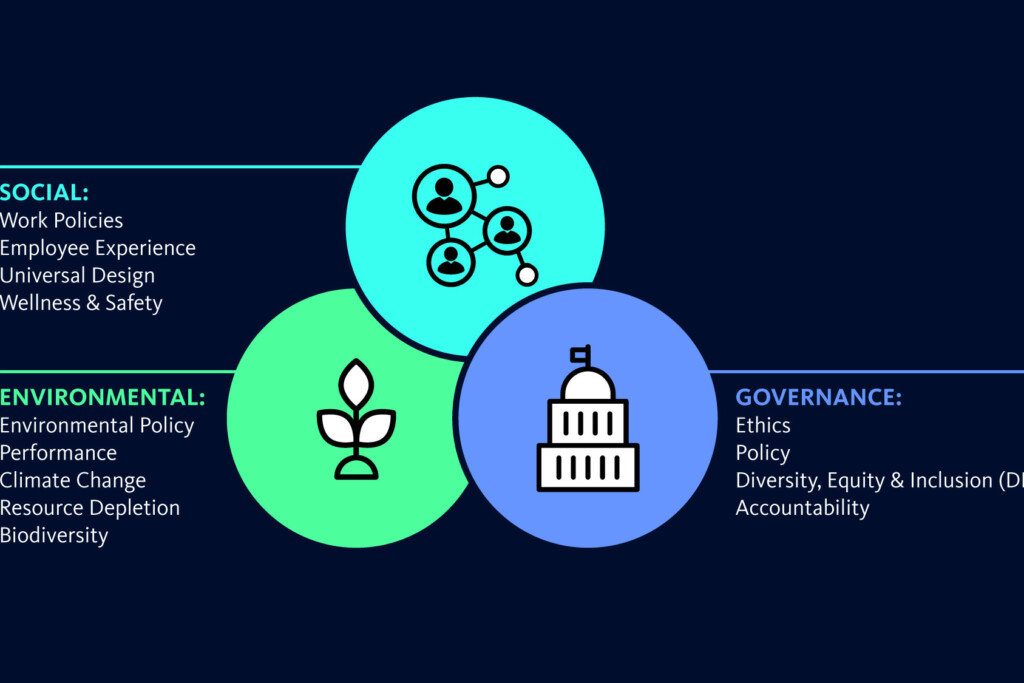

ESG is an approach to evaluating companies and their efforts to achieve goals in three main areas: conservation of natural resources, consideration of people and social issues, and corporate standards and transparency.

Investing in ESG has become more popular with shareholders. EY reports that 90% of investors it surveyed said since the COVID-19 pandemic, they now attach greater importance to a company’s ESG performance when it comes to their investment strategy and decision-making.

Additionally, a 2021 poll by Morning Consult showed nearly 7 of 10 frequent investors categorized ESG investments as “very profitable” or “somewhat profitable”. This helps confirm that companies that are more heavily focused on ESG can expect better returns.

ESG is not only relevant to investors, but also to individual companies. By prioritizing sustainable and socially responsible initiatives, it can improve an organization’s reputation, potentially attracting more investors.

Measuring ESG

Measuring the impact of ESG goals, however, is complicated. Currently, there are no standards for ESG metrics, especially for a building or development. This means organizations are stuck trying to understand how to best score themselves against ambitious ESG objectives.

Gensler is bringing some clarity to the issue by developing an ESG-focused design framework for building types. In the fall of 2021, we began identifying a variety of building features that could be reliably gauged through the “Measurable Impact” tool.

With Measurable Impact, we are reviewing 10 diverse practice areas — from sports and aviation to hospitality and office developers — to identify key ESG features across different industries. We are also using the tool to assess the ESG value of 70 metrics — from the thermal performance of outdoor space, to optimizing how the public uses amenities, to low-carbon construction materials.

These metrics look beyond the building to track how a project can potentially benefit the surrounding neighborhood. Now, we can help our clients strategize on their specific ESG goals and find ways to implement them through design. Ultimately, we will use Measurable Impact to the help forecast the future of design that will shape ESG results.

ESG Moving Forward

ESG is a strategy for sustainable growth and development which goes beyond profits. The other critical metrics include environmental and social aspects such as achieving net-zero emissions, taking care of your employees, and instilling corporate transparency. These elements contribute to a successful organization that not only benefits its people and investors but also supports local communities.

ESG will continue to grow, and a company’s achievements in environmental conservation, and social and governance issues, will be essential benchmarks for access to capital, talent, and an expanded customer base. Below are a few tips to consider:

- Align ESG goals with company values

As a first step, look to your company priorities as a guide. Are you already investing in cleaner operations to help address climate change or funding programs to attract diverse talent? From there, you can begin to chart initial ESG goals.

- Engage with stakeholders

To build a successful ESG strategy, you also need input from your key stakeholders. That includes shareholders, your employees, and even civic or community partners. Identify those groups, study how they are impacted by your operations, and invite their feedback.

- Keep up with regulatory compliance rules

Take time to understand ESG-related regulations and reporting standards. There are several sources that can help you stay up to date on and ensure compliance. Below are two sources:

- The UN Sustainable Development Goals (SDGs) offer ways for greater sustainable solutions.

- The SASB Standards identify ESG issues relevant to financial performance in 77 industries. They are designed to help companies disclose sustainability information to investors.

Ultimately, the goal of ESG is to help companies better integrate their operations with social and environmental responsibilities. ESG can help a company bolster its reputation, attract investors and talent, and be an active contributor to healthy, thriving cities and communities of the future.

Cindy Simpson is the co-regional managing principal of the south central region for Gensler.