The COVID-19 pandemic is an unprecedented global challenge that is severely impacting the commercial real estate community. Last year, the industry contributed $50 billion to the state’s economy, making a recovery in this industry essential for Texas’ long-term vitality.

While the North Texas commercial real estate market experienced relatively fast recoveries from past economic downturns, the severity and issues associated with this pandemic pose an entirely new set of challenges. Long-term recovery will require us to rethink how people are going to use various spaces in a time when they want to be around fewer people who are spaced farther apart. It also means that companies are considering new site options as they become more protective of their manufacturing and supply chain capabilities.

There is not a one-size-fits-all solution for commercial real estate market recovery. Each asset type and class have distinctive challenges. Below are some of the issues and post-COVID-19 opportunities associated with various property types in North Texas.

Retail and Hospitality Sector

It is no surprise that the most highly impacted real estate sector is retail and hospitality. One out of every four people in Texas were employed by the retail industry, which has a $6 trillion economic impact on the U.S. economy. The majority of the two-million Texas residents filing for unemployment in March and April represent the retail and hospitality industry.

Although restaurants and shops are among the first to reopen under the state’s guidelines, the prolonged shut down, and limited reopening capacities make it difficult for these businesses to recover.

It is hard to operate at 50 percent capacity when you still must pay 100 percent overhead and expenses. Another complication for retail and restaurant establishments is regaining patrons.

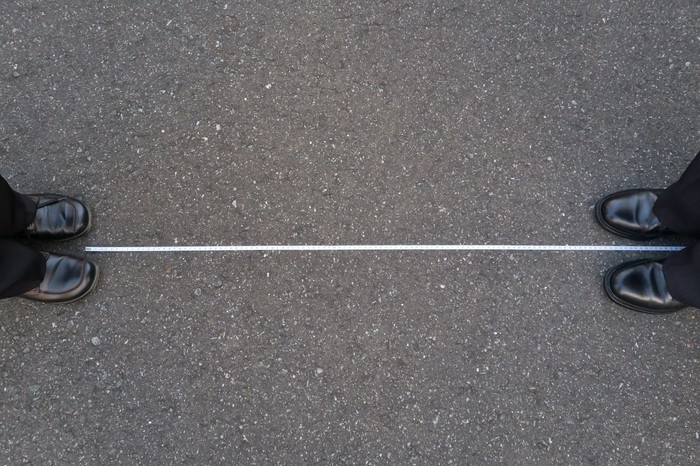

People are changing their habits during this prolonged period of social distancing, and restaurants will need to make adjustments that cater to the “new normal.” This means smaller spaces to reduce overhead expenses and changing their operations to build on the take-out and curbside delivery options that became a mainstay during the pandemic. They will also need to adopt touchless technology like automatic doors and motion-activated lights and water faucets. Ultimately, cities will need to work with restaurant owners to create zoning requirements that will help these establishments thrive, especially in underserved neighborhoods.

While residents will likely support restaurants and retail stores during the recovery period, hotels face an uphill battle due to an uncertain future. It will be a long time before people will be comfortable traveling, and when they do, it will be important for hotels to outline the steps they are taking to protect the health of all guests.

Office Sector

So far, the office market is not experiencing a major slowdown due to COVID-19.

While not robust, there is activity taking place as rents are being paid at 80 percent, and leases are still being signed. Most of the discussion among real estate and corporate professionals is now focusing on how offices will function in the future.

In recent years, co-working was one of the biggest office trends. Companies like WeWork offer low-cost, open workspace along with access to conference rooms and other amenities. Demand will likely decrease as more people who utilized co-working space may decide to work from home or will be looking for options providing more individual space.

Another trend we expect to see is the return of private office space in corporate settings.

Private corporate offices went away in favor of open workspaces that accommodate as many workstations as possible in the least amount of space. In the new era of social distancing, private offices and larger workspaces are expected to make a comeback. Touchless technology, like automatic doors, bio scanners, or voice-activated devices, will also be integrated throughout office spaces to minimize public touchpoints.

One of the biggest questions impacting the office market is whether more companies will adopt remote working.

The shelter-in-place experience helped many companies realize that virtual conferencing, online presentations, and other technology tools are viable ways of conducting business. At the same time, employees seem reluctant to give up additional family time for long commutes on overcrowded roadways.

The nationwide work from home concept has been successful for many companies, and more employees may adopt remote working options in the post-COVID-19 environment. However, working from home does not eliminate the need for corporate office space. Employees need daily interactions to feel connected to coworkers within the company. Without those relationships, remote employees might as well be independent contractors. Additionally, creating a corporate culture cannot be accomplished if employees are not working in the same space. Culture is essential for a brand’s identity since a dynamic culture supports talent recruitment and inspires loyalty among employees, customers, and other stakeholders.

Industrial Sector

The industrial sector remains the bright spot in North Texas’ real estate market and is expected to pull Texas through the economic challenges brought on by COVID-19. The state was already attracting new industrial and manufacturing opportunities, so the pandemic is accelerating a trend that was already taking place.

COVID-19 spotlighted the nation’s supply chain challenges, especially in terms of manufacturing and distribution from the East and West Coasts–areas that were severely affected by the virus.

In the coming years, many of these companies will be looking to protect their supply chains by moving to a more central geographic location, and Texas is ideally positioned to attract new opportunities from American manufacturers. The state has long been an ideal destination due to the business-friendly environment, lack of a state income tax, and temperate climate.

North Texas, in particular, remains an attractive destination for manufacturing and logistics as it offers a large and highly trained workforce, shovel ready sites, and access to multimodal infrastructure that includes major interstates and DFW International Airport, one of the most frequently visited superhub airports in the world. The region is already a preferred destination for e-commerce fulfillment and distribution centers, with two Amazon facilities and the nation’s first Amazon air sorting hub.

Once again, the North Texas commercial real estate community has an opportunity to set the tone for economic recovery across the nation. Focusing on how the pandemic is changing the way we use technology and space and offering creative solutions for the post-COVID-19 environment are necessary for us to return to our economic peak.

Linda McMahon is the president and CEO of The Real Estate Council (TREC)