The retail market in Dallas-Fort Worth ended 2019 with an occupancy rate of 93 percent–the highest recorded since 1981, according to the Weitzman 2020 Retail Forecast. The data marks the seventh consecutive year of near-record occupancy in DFW.

Weitzman Executive Managing Director Bob Young delivered the company’s annual retail forecast Tuesday morning to a crowded auditorium at the George W. Bush Presidential Center.

“Our strong occupancy is not a fluke,” he said. “This is the most geographically balanced retail market we’ve seen in our history. Almost every single one of our submarkets is healthy.”

And from a numbers perspective, occupancy would look even better without the hit from the massive Sears stores that closed, which hit Class A retail, like Stonebriar and North East Mall.

To compile the report, each year, Weitzman completes a comprehensive review of DFW’s total retail market inventory of about 200.5 million square feet in projects with 25,000 square feet or more. Young said other lessons learned analyzing the data include the affirmation that restaurants are the most valuable player of retail leasing; the low construction market is here to stay for the foreseeable future; and the convergence of physical and digital retail is paying off.

“And all of our indicators point that 2020 will be the eighth year in a row,” Young said.

In the past, DFW has traditionally seen a bifurcated market, meaning we’ve seen booming areas in Collin County or North Fort Worth (where occupancy was at 95 percent) while at the same time, some long-established urban markets with limited growth were lucky to break 85 percent.

“But now, our retail stability is shared throughout DFW,” Young said.

To explain, Weitzman divides DFW into 42 retail submarkets. In 2019, a record of 35 submarkets reported strong occupancy above 90 percent. A decade ago, only 17 submarkets reported that occupancy that reached or exceeded that level.

Young said that today DFW leads the country in new multi-family units with nearly 140,000 new units since 2010. “That market-wide residential growth has created retail demand and boosted existing retail centers,” he added. “For the first time in our survey’s 45-year history, every single category reported occupancy above 90 percent–even struggling Redbird Mall in Dallas saw a boost.”

The data shows that malls climbed to 90.6 percent with several new tranche anchors like fitness, medical, and grocery.

“This past year proved that malls are good real estate, just not necessarily good retail real estate,” Young said.

Additionally, for the second year in a row, small strip centers (or neighborhood centers) reported occupancy above 90 percent. The multi-family boom is responsible (new residential drives retail demand, and developers like Weitzman are taking note, renovating older centers. Weitzman, for example, is renovating 14 centers with a program they call “life-styling the strip center,” where they add pedestrian-friendly elements like greenspace, patios, seating areas, and arbors.

Power centers, which reported nearly 60,000 square feet of net new leasing (more than any category), had occupancy of 95,1, according to the data.

“When Toys R Us failed in 2018 and left 700,000 square feet vacant in the market, we predicted that that would be short-lived. That proved to be the case as you can see,” Young said.

Mixed-use, the smallest category with 9.2 million square feet of retail space, is currently at 94 percent occupancy.

Community Centers (like grocery stores) sit at 94 percent occupancy. Young said occupancy was high in 2019 thanks to net leasing of 482,000 square feet that year. Remodeling has been a huge driver. Dallas no. 1 grocer, Walmart, saw total market share jump last year from 27.4 percent to 28.6 percent thanks to its store remodeling program. The remodels incorporate essential customer amenities like curbside grocery pickup and delivery.

“Community centers also benefit from a tenant mix transition from soft goods to categories like restaurants,” Young said. “Restaurants like community retail because they can benefit from the Monday through Friday traffic driven by the grocer.”

Today’s larger community centers can have as many as 10 restaurants, compared to two, at best, a decade ago. Young said 481 community centers in DFW report an average of four restaurants per center. “Those restaurants drive a lot of traffic, cross-shopping, and sales. This is why we call restaurants our leasing MVPs.”

As for numbers that have ticked down, there’s only one: construction.

“During 2019, despite our tight retail market amid the country’s best economy, we actually saw a decline in new space,” Young said.

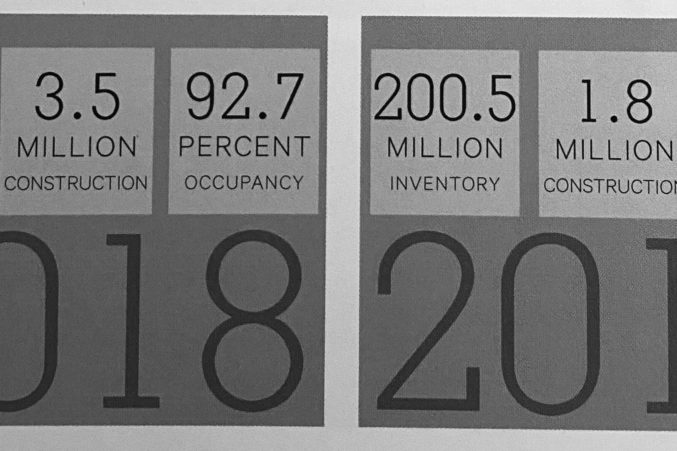

New and expanding retail centers totaled only 1.8 million square feet last year, compared to 3.5 million square feet in 2018. Young said the decline reflects a trend of limited anchor expansions, existing project renovations and redevelopments, diligent lending standards and the rise of construction costs, and smaller retail projects.

That smaller-center trend is reflective in Weitzman’s numbers. In 2019, the average size for a new retail project was 64,000 square feet. A decade earlier, it was almost twice as large with 124,300 square feet.

“This low construction environment means that a lot of retail demand is driven to existing retail centers,” Young said. “That’s a big reason why net leasing absorbed more than 1.8 million square feet last year.”

With all that said, Weitzman delivered the following forecast for 2020.

- Retail occupancy will reach 95 percent. “The disruption of retail is basically over, and now our retailers have transitioned to what we call ‘Customer. Convenience. Convergence,'” Young said. That means the customer is commanding what retailers do. “They want convenience, and retailers respond by seamlessly blending the physical with the digital.”

- 2020 will be another year of low construction. With today’s land and construction costs, rents would have to be way above market to justify new space, “which is a non-starter for most retailers,” Young said.

- Vacancy=Opportunity. “Today, if a store fails, it means the customer has rejected it,” Young said. “But vacancy in a well-located center allows the landlord to re-merchandise and re-energize the center.” Meaning, the customer tells them what will work, and digital and analytics give them the tools to listen.

- We’ll see a bifurcated investment market. The value of existing small-shop retail will continue to rise because this is where the leasing demand is. “But even fully leased power centers at strong intersections can see cap rates go up, not down, due to perceived risk,” Young said. Why? “There’s a fear in the investment market that, if a box tenant goes vacant, it can be difficult and costly to release at market rents.”

- Digital marketing rules. “The customer today literally has retail’s future in their hands,” Young said, adding that smartphones have reached a tipping point, accounting for half or more of all purchase decisions. Every online search implies intent, and digital puts centers and retailers at the forefront of search results. “So if your center and its retailers are winning at search, they are winning the customers.”