The good news is that the Federal Reserve finally feels the economy is healthy enough to begin normalizing monetary policy by continuing to slowly raise interest rates. Unfortunately, it promises to be a long, slow climb back to a more palatable yield, and for investors with a need to realize current income from their portfolios, Treasuries just don’t cut it. And moving up the risk scale to high-yield bonds doesn’t make much sense from a risk/reward perspective in this environment. After all, bonds are supposed to be the safe part of your portfolio.

So what’s a risk-averse investor who needs to realize current income to do?

An answer that many investors may fail to give proper consideration to is real estate. Despite the wisdom behind Mark Twain’s famous directive, “Buy land, they’re not making it anymore,” the real value of the asset comes not from the land, but from what we build on it and the regular income it generates.

Unlike some other asset classes that help diversify a portfolio, real estate is backed by something tangible. We can see and touch an office building, apartment building, or self-storage facility, while many other investments represent nothing more than a belief in a piece of paper.

As a hard asset, real estate can also act as a volatility hedge in ways other investments can’t. Barring a catastrophic event, property will survive even if currency or traditional investments lose much of their value. The financial crisis of 2008 was as bad as most of us have seen, yet it showed that real estate can return to its original value—and even grow after a loss.

All Real Estate’s Not Created Equal

So far we’ve been talking in general terms about “real estate,” but real estate isn’t one thing. It’s a broad category that includes everything from single-family homes and townhouses to shopping malls and parking lots, to warehouses and factories. It can refer to residential, commercial, or industrial properties, depending on the context.

There are several ways to invest in real estate, starting with buying individual properties to either rent or flip, but that’s a lot of work and comes with the downside of having to manage those properties as well. Additionally, overweighting your investments with a single new piece of real estate can really skew your risk profile. To avoid that hassle and diversify risk, many investors have put money into real estate investment trusts (REIT), which are similar to mutual funds but their holdings consist of property and mortgages rather than stocks or bonds. Not all REITs trade publicly, but most that do are listed on major stock exchanges. Like stocks they are highly liquid, meaning they are traded most every day, with their prices moving up and down, often mirroring the movement of equities. It wasn’t too long ago that REITs delivered some of the best annualized returns, but overall, lately their shares have been underappreciating.

Working with an investment firm that specializes in private equity is another way to access this asset class. Unlike many other alternative investments, including REITs, the underlying value of private equity real estate does not fluctuate on a daily basis based on the whims of the market.

When it comes to investing in commercial real estate, it’s important to understand that not all properties present the same opportunities. For example, the dynamic growth of online shopping is having the effect of retail commercial space in many markets going empty, meaning a negative return for investors. And the big cities aren’t always the best place to look for the lucrative investments. Big real estate deals in New York, Los Angeles, or San Francisco get a lot of press and attract a lot of suitors, making a market for that deal, which can lead to paying a higher price.

When looking at real estate investments, it is important to look for sectors which are both cash flow positive and recession resilient. A self-storage facility doesn’t have the same cachet as a Fifth Avenue skyscraper. But these facilities do serve a critical function for families needing to store furniture and personal memorabilia they can’t let go of but can’t fit in their homes either, and in the right markets, they are actually among the highest returning, lowest-risk sector of the real estate asset class.

While the self-storage sector has some obvious attractions, many investors, even those with financial advisors, are uncertain about the best way to proceed. Admittedly, it can be difficult because the market is fragmented and deals tend to be small. Beyond that, evaluating transactions requires special expertise—including both broad macro-analysis, regional expertise, and local boots-on-the-ground insight. Many of these facilities are already cash flow positive and can contribute immediately to quarterly payouts. Assets can appreciate after purchase by hands-on management and technology upgrades, but this requires an ongoing commitment. For all these reasons, it makes sense to seek out a seasoned partner with demonstrated expertise in the field.

Investing in private equity real estate, including self-storage facilities, can help investors add a new asset class, or provide additional diversification if they are already into real estate. These assets have historical high rates of return and consistent performance in both good and bad economic climates, potentially making them a valuable addition to any investment portfolio. All of this can contribute to delivering current income well above bonds, backed by hard assets. Financial advisors and investment consultants are taking notice of this.

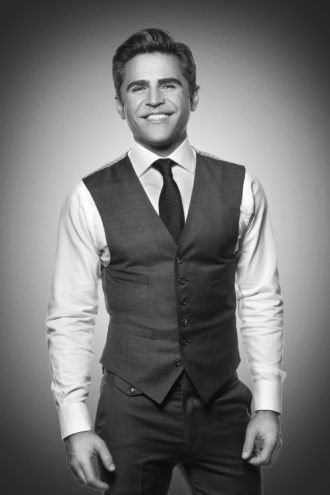

Ari Rastegar is the founder and CEO of Rastegar Equity Partners.