During the go-go 1980s boom, Dallas-Fort Worth earned the reputation as the most overstored market in the country, based on GLA (gross leasable area) per capita. Three decades later, despite nearly 90 million square feet of new retail inventory, that is no longer the case.

There is one big reason why.

The region’s population growth means that the “per capita” part of the equation is growing, while at the same time the “retail space” part of the equations is shrinking.

This is despite the fact that, for DFW, we are tracking the largest number of retail projects under way since the recession hit our market in the late 2000s. But with the market only adding between 2 million to 3 million square feet a year, we are far below what we saw in years like 2000, when that much space would be added in one submarket alone.

This shrinking GLA per capita is one reason why the retail market inventory has nearly doubled since 1990, yet we’ve seen vacancy drastically shrink from nearly 20 percent then to around 8 percent today.

To better understand what has happened to GLA per capita, we reviewed our market reports dating back three decades.

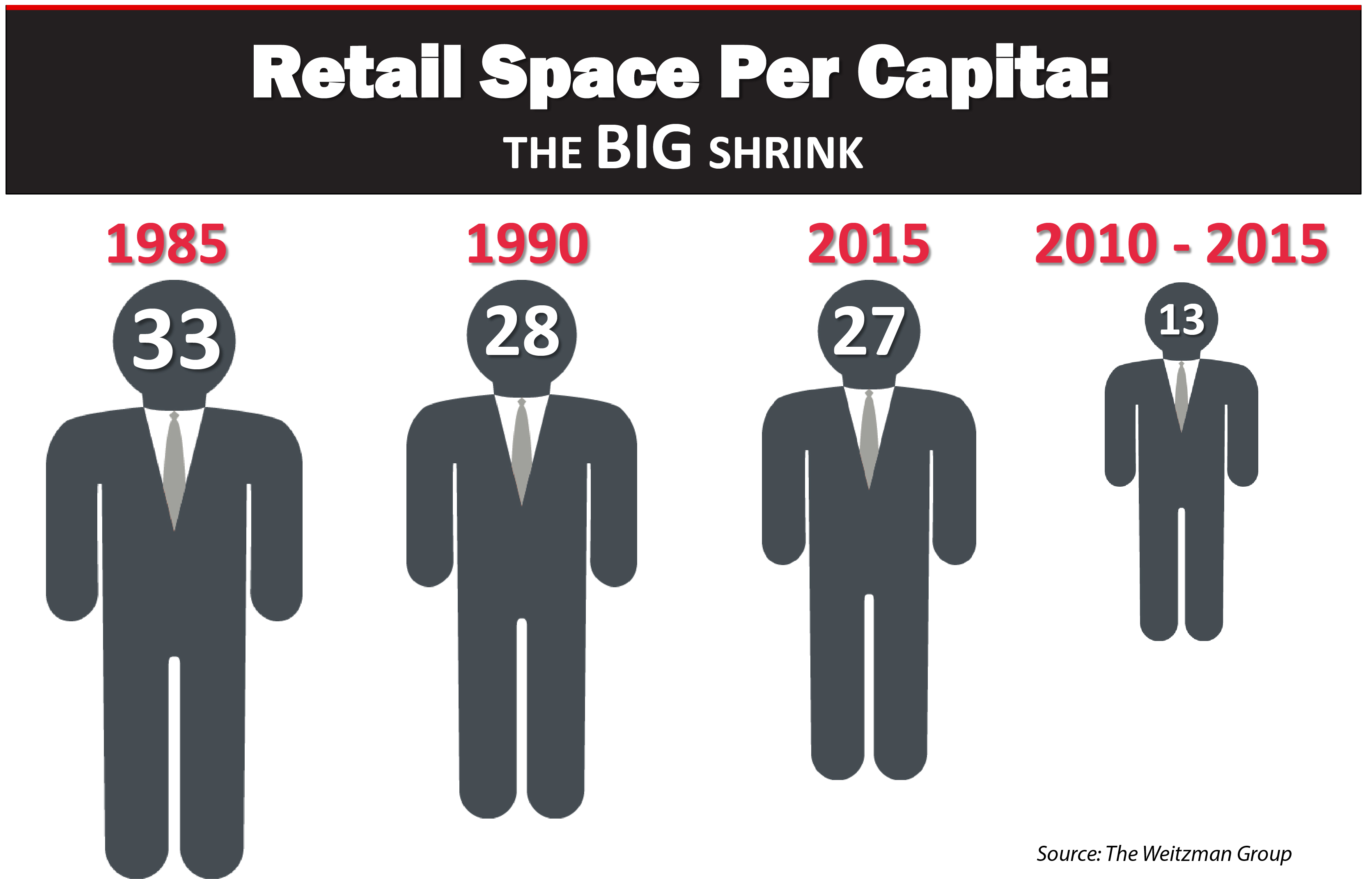

• In 1985, the North Texas market posted 33 square feet of retail space per capita.

• Due to the construction slowdown that resulted because of the ’80s market crash, GLA per capita declined to 28 square feet by 1990.

• Today, DFW market reports GLA per capita of only 27 square feet.

This shrinking per-capita GLA is due to population growth of around 100,000 people a year at a time when retail construction remains at historic lows. The low annual new retail construction is largely due to the trend away from large new projects like malls and toward anchor-store with limited small-shop space.

To give you an idea of what limited construction means for our market, we looked at GLA per capita from the start of 2010 to the end of 2015, a time when DFW added around 700,000 people. During the same six-year period, we added 9.2 million square feet of new retail space—an average of only 1.5 million square feet a year.

The effect of limited retail construction during a time of strong population growth is eye-opening.

We’ve enjoyed one of the nation’s strongest metro economies during the past six years. Yet when you review new retail space compared to new population during the 2010-2015 period, you got only around 13 square feet per capita.

Every previous strong economic cycle for our market has been met with a jump in new retail inventory on a square-foot basis. The fact that that hasn’t happened this go-round (for reasons ranging from retailers’ shrinking footprints to their focus on omni-channel, as opposed to new stores) means that DFW’s current strong retail market promises to be one of balance and longevity.

Ian Pierce is director of corporate communications for Weitzman/Cencor. Contact him at [email protected].