For five of the last seven years, I snuck in under the bar and was lucky enough to participate in the annual SMU Cox Economic Outlook Panel led by Dean Al Niemi Jr. This is a very learned and august group of faculty members at Cox; each has a very experienced eye on various sectors of the economy: oil/gas, retail, banking, and the stock market. Because Joseph Cahoon (director of the Folsom Institute For Real Estate) had a conflict, I stood in and talked about all things real estate here in Dallas-Fort Worth.

I did this last in 2011 and 2012: both times I titled my presentation: “The Real Estate Market: All Things Considered, It’s Good to be in DFW.” In 2012, absent anything more creative, I simply added “Part Deux” to the title. That seemed reasonable to me: the real estate market here, relative to the rest of the country, was on a roll then. So, now I am back, with an outlook for 2016. Absent any more creative and innovative ideas, my recent presentation was titled— you guessed it—“Part Trois”.

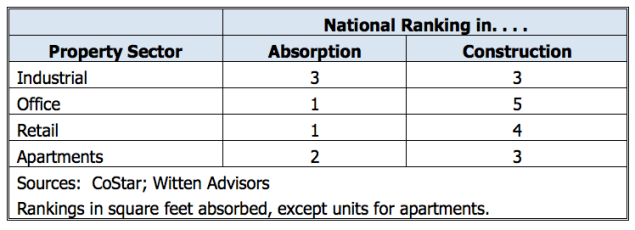

Why nothing more creative? Simple: It is really, really good to be here in DFW if you are part of the real estate economy. Take a quick look at some statistical rankings on how the region is doing in the four main property sectors (as of 3Q 2015):

(Note to the file: It is good to rank high in absorption—it simply means users are using the space. Waste not, want not. However, one’s ranking at the top of the “under construction” scale can be good, but it can also be bad. Being ranked No. 3-No. 5 is a reasonable place for DFW to sit, as long as we keep eating up space at this rate.)

I also made two quick observations on our local housing market: It’s affordable, and relative to places like, say, Torrance, California, we are over the top affordable. In just about every MSA in Texas, the median sale price of an existing home does not exceed approximately 4x the median household income. (Austin is the exception at about 5x, but that metric is skewed because of the large student population.)

In Collin County, where Toyota is relocating from Torrance, the County has the highest median home price (as tracked by MLS) in Texas of $284,000, but its estimated median household income is an impressive $82,000. That results in a multiple of only 3.5x.

Now here is better news, especially for our new neighbors moving from Torrance: The median household income there is just over $76,000, but the median home price is a whopping (compared to Texas) $580,000. That results in a multiple of 7.6x—more than twice what they are buying into in Plano. Home sweet home.

My last point relates to my little “HOTI” that I created as a tongue-in-cheek talking point more than 20 years ago. My “HOTI” is an acronym for “Housing Opportunity Targeted Index.” It is based upon my long-standing observation that no matter how rich you are, if you are employed and you have a low mortgage interest rate on your personal home, you are, in relative terms, happy.

I have tracked my HOTI back to 1972 and have opined on many public occasions that a “10” on a HOTI scale is close to perfection. That would be an unemployment rate of, say, 5.5 percent and a 30-year fixed rate mortgage rate of around 4.5 percent. Well, in 2014, my little HOTI broke below 10 percent for the first time in more than 40 years and as of now, it is the lowest on record (my record, that is).

Good things should happen (in the housing market) when my HOTI gets down.

All in all, it is good to be here, for all my real estate reasons. You readers should comment as to why you agree; there are certainly many other reasons to choose from.