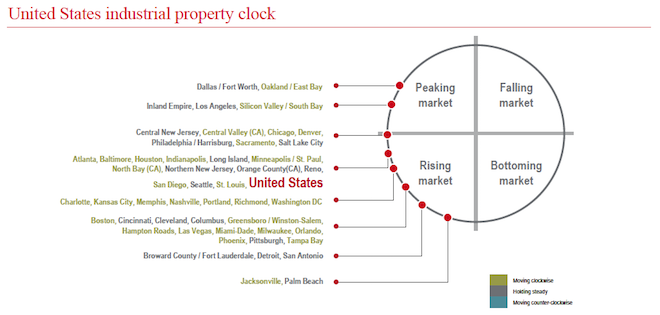

North Texas is firmly in the “peaking market” category, according to JLL’s latest industrial outlook report. The firm’s signature property clock chart, which illustrates where U.S. markets sit within a real estate cycle, has DFW joining Oakland/East Bay midway through the peaking market quadrant. (Click on the image at the end of this story for a larger view.)

All major U.S. industrial markets are performing well, either in the rising market or peaking market realms.

Dallas-Fort Worth is among the top five national markets when it comes to inventory, year-over-year rent changes, and 2014 net absorption. The region’s current vacancy rate of 5.3 percent is about half of its historic average (10 percent).

According to JLL, the following factors are primary current market drivers: a surge in construction activity, strong population and job growth, residential home construction, low vacancy rates, healthy demand for industrial space, and an abundance of land for future development. Here are other notes from the report:

MARKET CONDITIONS

• Market fundamentals remain favorable, with a record low total vacancy rate (5.3 percent) and upward pressure on rates—7.4 percent, year over year.

• Over the past year, sales volume of investment-grade industrial product in Dallas-Fort Worth has fallen by about 10 percent. This is largely attributed to a shortage of product on the market, and not a decrease in demand.

• The average sales price per square foot currently stands at $65, while the average cap rate is 6.5 percent.

OUTLOOK

• With about 17.5 million square feet of industrial space under construction, the vacancy rate is expected to increase over the next few quarters, as spec construction begins to hit the market.

• Of the new construction, about 25 percent is build to suit and 75 percent is speculative development. This is in line with historic norms for the market.

• Until the new space comes online, the upward pressure on lease rates is expected to continue.

• The largest growth submarkets are South Dallas, DFW Airport, North Fort Worth, and Great Southwest/Arlington. All four have shown healthy demand and have a significant amount of new construction underway.

Here’s the property clock chart: